What will CRD IV change?

advertisement

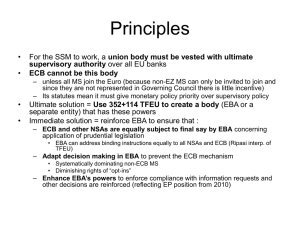

ECB-PUBLIC Aurel Schubert* Director General Statistics, ECB State of the European supervisory framework at the ECB Conference “Preparing for CRD IV reporting” London, 17 June 2013 * The views expressed are those of the author and do not necessarily reflect the position of the ECB. Rubric ECB-PUBLIC Outline 1 Banking Union - overall framework 2 Single Supervisory Mechanism 3 Implementation of Basel III in Europe 4 EBA Implementing Technical Standards 5 XBRL view by the European institutions 6 ECB efforts to alleviate reporting burden 2 www.ecb.europa.eu © Rubric ECB-PUBLIC Banking Union - overall framework Euro area summit statement (29 June 2012): • “The Commission will present Proposals on the basis of Article 127(6) for a single supervisory mechanism shortly. We ask the Council to consider these Proposals as a matter of urgency by the end of 2012. • When an effective single supervisory mechanism is established, involving the ECB, for banks in the euro area the [European Stability Mechanism] could, following a regular decision, have the possibility to recapitalize banks directly.” => Council Regulation will soon be adopted (based on Art. 127.6 of the Treaty) => Start of SSM one year after adoption 3 www.ecb.europa.eu © Rubric ECB-PUBLIC Banking Union - overall framework • It has become critical to “break the vicious circle between banks and sovereigns” Euro area summit statement (29 June 2012) • Three components to the Euro area Banking Union: Banking supervision (on- and off-site) – high priority Resolution mechanism – high priority Deposit guarantee scheme – lower priority 4 www.ecb.europa.eu © Rubric ECB-PUBLIC Why the Single Supervisory Mechanism (SSM)? Two main objectives in establishing the SSM • Address the “financial trilemma”: financial stability, financial integration and national financial supervision cannot really be made fully compatible. • Contribute to break negative feedback loops between sovereigns and banks Why the central role of ECB in the SSM • conduct of monetary policy creates an intrinsic and deep interest in a stable financial system • close link between micro-supervision and assessment of macro risks • information-related synergies exist between the supervision of banks and other central banking functions 5 www.ecb.europa.eu © Rubric ECB-PUBLIC SSM: institutional setting • The ECB's monetary and supervisory tasks will be strictly separated • Important role given to the Supervisory Board vis-à-vis the Governing Council: – actual supervisory decision-making power rests within the Supervisory Board – Governing Council would be empowered to reject the decisions agreed upon – decision-making process should mitigate any risk of supervisory forbearance • Decisions of the Supervisory Board shall be taken by a simple majority of its members - the participating non-euro area countries will have full and equal voting rights 6 www.ecb.europa.eu © Rubric ECB-PUBLIC SSM information requirements: legal provisions Final compromise text from 16 April 2013 Scope – article 5(4) The ECB shall be responsible for the supervision of significant banking groups, stand-alone banks and branches, which on a consolidated basis meet any of the following conditions: Total assets > €30 bn Ratio total assets/GDP > 20% (unless total assets < €5 bn) Significance is notified by NSA and confirmed by ECB Upon ECB initiative, significant cross-border activity (subsidiaries in more than one country, etc.) Public assistance requested or received directly from EFSF or ESM The three most significant banks in each country 7 www.ecb.europa.eu © Rubric Single Supervisory Mechanism as one system • The SSM will operate as one system: national supervisors and a strong decision making centre • Supervisory Board to prepare ECB Governing Council decisions on supervisory matters • Appropriate decentralisation procedures while preserving the unity of the supervisory system • Assisted by national supervisors, the ECB will ultimately be responsible for the conduct of its supervisory function 8 www.ecb.europa.eu © Rubric Preliminary assessment • ECB to conduct direct supervision of ca. 130-140 banking groups representing around 80% of the banking sectors’ total assets in the euro area • The other, “less significant” banks will be directly supervised locally • ECB is still the Competent Authority for all banks in the euro area with SSM members in close cooperation • Non-euro area countries can – voluntarily – join the SSM • Accurate, timely and high quality data will be key for the performance of these tasks • Balance sheet review before the ECB takes over the SSM (conducted together with national supervisory authorities) • Need for a backstop (national budgets and where needed the ESM) 9 www.ecb.europa.eu © Rubric ECB-PUBLIC Legal power to request information The ECB may require legal or natural persons (see list below) to provide all information that is necessary in order to carry out the SSM tasks. INVESTIGATORY POWERS Article 9: Requests for information Information can be requested from credit institutions financial holding companies mixed financial holding companies mixed-activity holding companies persons belonging to such entities or 3rd parties to whom entities have outsourced functions or activities …. in compliance with single rule book (by European Banking Authority)! 10 www.ecb.europa.eu © Rubric ECB-PUBLIC Scope – some important articles on data related issues Art. 5: Both the ECB and national competent authorities shall be subject to a duty of cooperation in good faith, and an obligation to exchange information. Art. 9: ECB empowered to require […] including information to be provided at recurring intervals and in specified formats for supervisory and related statistical purposes. Art. 18: Separation from monetary policy function; […] the ECB shall adopt and make public any necessary internal rules, including rules regarding professional secrecy and information exchanges between the two functional areas. 11 www.ecb.europa.eu © Rubric ECB-PUBLIC Implementation of Basel III in Europe Key issues: Directive (CRD IV) and Regulation (CRR) Single rule book will support the effectiveness of the SSM and consistent reporting (under Pillar 1) with other EU countries. − Set out reporting requirements related to the Basel III ratios related to large exposures, asset encumbrance, financial reporting, etc. − Aim to establish a single rulebook for credit institutions in the EU Ensure level playing field Mitigate regulatory arbitrage opportunities Reduce compliance costs Support financial integration Enhance the single market for financial services The SSM may have additional data requirements. 12 www.ecb.europa.eu © Rubric ECB-PUBLIC Main elements • Capital requirements – Enhancing the quality of the capital base with focus common equity – Increasing the quantity of capital (minimum + buffers) – Ensuring harmonisation and consistent application of requirements • Leverage ratio – Supplementary, non-risk-based measure – Calibration subject to observation and revision • Liquidity ratios – Liquidity Coverage Ratio establishes a minimum level of high-quality liquid assets to withstand an acute stress scenario lasting one month – Net Stable Funding Ratio aims to ensure a closer alignment of the funding of longer-term assets or activities 13 www.ecb.europa.eu © Rubric ECB-PUBLIC Implementing Technical Standards (ITS) Scope • COREP, FINREP, Large Exposures, Leverage, Liquidity, Asset encumbrance • For FINREP (only at consolidated level), 3 main cases: 1. IFRS banks 2. Non-IFRS banks subject to Art. 21(2) CRR 3. Other non-IFRS banks • Competent authorities to decide on cases 2 and 3 • Competent authority in the SSM countries = ECB Out of scope • reporting of Pillar 2 information, e.g. interest rate risk data, credit register data, statistical reporting, FINREP at solo level (incl. for stand-alone institutions) 14 www.ecb.europa.eu © Rubric ECB-PUBLIC ITS proportionality principles • Implicit proportionality in line with banks business models (e.g. no reporting of securitisation data where not relevant) • Reduced frequency of certain templates • Reporting of certain templates subject to % thresholds 15 www.ecb.europa.eu © Rubric ECB-PUBLIC XBRL viewed by the European institutions • ECB closely coordinates with EBA and NSAs in framework of XBRL reporting, also to minimise impact on reporters and compilers • XBRL will help – set out reporting requirements in a business-friendly language – foster greater harmonisation via XBRL taxonomies • EBA supporting XBRL reporting – mandatory from national competent authorities to EBA – optional for primary reporting: from banks to national supervisors • XBRL taxonomy for ITS includes validation rules, good for data quality! 16 www.ecb.europa.eu © Rubric ECB efforts to alleviate reporting burden • Close coordination with EBA • Participation in relevant EBA committees (SCARA, etc.) • On-going cooperation on defining ECB/ESRB user requirements, the data point model, the validation rules, etc. 17 www.ecb.europa.eu © Rubric ECB-PUBLIC ECB efforts to alleviate reporting burden II Reconciliation of statistical and supervisory information: • ESCB/EBA Joint Expert Group on Reconciliation (JEGR) (achievements since 2008) – Bridging Manual - links ECB’s monetary and financial statistics with EBA’s supervisory reporting templates, including pocket manual and FAQ questions – Relational Database – mirrors the manual, identifies similarities/differences between datasets – Manuals, FAQ, Database published in the ECB and EBA websites. Link: www.ecb.europa.eu/press/pr/date/2012/html/pr120323.en.html 18 www.ecb.europa.eu © Rubric ECB-PUBLIC • JEGR (cont’d): Goals for the near future (by end-2013) – Update and expand coverage of the Bridging Manual and – Investigate viability to approach the reconciliation from input side – (Continue to) Involve the industry 19 www.ecb.europa.eu © Rubric ECB-PUBLIC Thank you for your attention! Questions? 20 www.ecb.europa.eu ©