The Single Supervisory Mechanism (SSM)

advertisement

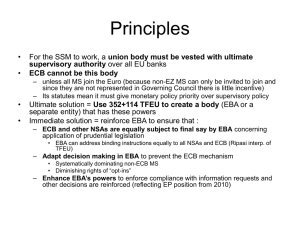

Current challenges for the ECB Benoît Cœuré Member of the Executive Board European Central Bank Association des journalistes économiques et financiers Paris, 5 April 2013 1 1 Conjunctural developments 2 Euro area real GDP and survey data (A) quarter-on-quarter growth rate, contributions (B) year-on-year growth rate, diffusion index, percentage balance) Sources: Markit, DG-ECFIN and Eurostat. Latest data: 2012Q4 for GDP, March 2013 for the ESI and the PMI. 3 Euro area divergence Real GDP Economic Sentiment Index (index: 2009Q2 = 100) (index: March 2009 = 100) Sources: DG-ECFIN, Eurostat and ECB calculations. Latest data: 2012Q4 for GDP, March 2013 for the ESI. Note: Stressed countries refer to GR, ES, IE, IT, PT, CY & SI. 4 Developments in euro area labour markets Euro area employment, PMI employment expectations and unemployment (q-o-q % growth; index; % of labour force) Sources: Eurostat and Markit. Note:The PMI is expressed as deviations from 50 divided by 10. Latest data: 2012Q4 for employment, February 2013 for unemployment and March 2013 for the PMI. 5 Latest euro area real GDP growth forecasts (annual percentage change) Date 2013 2014 2015 -0.9 - -0.1 0.0 - 2.0 - ECB staff macroeconomic projections 07 March 2013 OECD 27 November 2012 -0.1 1.3 - IMF 23 January 2013 -0.2 1.0 1.5 ECB Survey of Professional Forecasters 31 January 2013 0.0 1.1 1.6 European Commission 22 February 2013 -0.3 1.4 - Euro Zone Barometer 11 March 2013 -0.1 1.2 1.6 Consensus Economics 14 March 2013 -0.3 1.0 1.6 6 HICP and HICP excluding food, energy and taxes (annual percentage changes) 4.5 Mar 2013 MPE Range HICP HICP excluding food and energy HICP excluding food, energy and taxes 4.5 4.0 4.0 3.5 3.5 3.0 Mar: 1.7% 3.0 2014 -1.0 2013 -1.0 2012 -0.5 2011 -0.5 2010 0.0 2009 0.0 2008 0.5 2007 0.5 2006 1.0 2005 1.0 2004 1.5 2003 1.5 2002 2.0 2001 2.0 2000 2.5 1999 2.5 Sources: Eurostat and ECB calculations. Note: Latest observations: March 2013 for HICP and HICP excluding food and energy (Flash estimates). January 2013 for HICP excluding food, energy and taxes. Projection ranges for 2013 and 2014 refer to the March 2013 MPE . Projections for HICP excluding energy, food and taxes are not available. 7 The price of deflation and inflation protection remain below the 5-year average Price of floor and caps (year-on-year) on euro area HICP inflation – 5Y maturity Sources: Bloomberg. Latest observation: 03 April 13 Note: The market for inflation-linked options is relatively illiquid and often heavily influenced by specific demand and supply patterns. Developments should therefore be interpreted with caution. The underlying instruments are for the inflation protection: year-on-year cap of 4% with 5 year maturity; for deflation protection: year-on-year floor of 0% with 5 year maturity. 8 Latest euro area HICP forecasts (annual percentage change) Date 2013 2014 2015 1.2 - 2.0 0.6 - 2.0 - ECB staff macroeconomic projections 07 March 2013 OECD 27 November 2012 1.6 1.2 - IMF 23 January 2013 1.6 1.4 1.5 ECB Survey of Professional Forecasters 31 January 2013 1.8 1.8 1.9 European Commission 22 February 2013 1.8 1.5 - Euro Zone Barometer 11 March 2013 1.8 1.7 1.9 Consensus Economics 14 March 2013 1.7 1.7 1.8 9 The ECB monetary policy 10 Overview of the ECB’s monetary policy in the crisis In exceptional circumstances, the ECB took exceptional monetary policy measures, with a separation between: 1. Standard measures: Reduction in all key ECB interest rates 2. Non-standard measures: to support the effective transmission of interest rate decisions to the wider euro area economy, in a context of dysfunctions in the financial market Price stability objective has retained primacy in all these measures 11 ECB’s interest rate decisions and implementation: steering money market conditions As a result of the monetary policy operations, the overnight interest rates evolve in relation to the key ECB interest rates deposit rate main refinancing / minimum bid rate overnight interest rate (EONIA) marginal lending rate 6 5 4 3 2 1 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 Sources: ECB Last observations: 2 April 2013. 12 Overview of non-standard monetary policy actions I. Measures to improve bank funding and liquidity conditions • Fixed-rate full allotment mode in refinancing operations (since October 2008) • Lengthening the maturity of the refinancing operations (1, 3, 6, 12 and 36 months) • Extending the list of eligible collateral • Liquidity provision directly in foreign currencies (USD and CHF) • Reducing reserve requirements (from 2% to 1%) II. Measures to provide depth and liquidity in malfunctioning markets A. Covered bond markets • Covered Bond Purchase Programmes (July 2009 - July 2010; Nov. 2011-Oct. 2012) B. Sovereign bond markets • Securities Markets Programme (May 2010 to 6 September 2012) • Outright Monetary Transactions (modalities announced on 6 September 2012) 13 How non-standard measures are reflected in the ECB’s balance sheet… Billion € Eurosystem monetary policy operations in euro 1600 1400 1200 1000 800 600 400 200 0 -200 -400 -600 -800 -1000 -1200 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 main refinancing operations 1-maintenance period refinancing operations 3-month longer-term refinancing operations 6-month longer-term refinancing operations 12-month longer-term refinancing operations CBPPs and SMP fine tuning providing operations 3-year longer-term refinancing operations fine tuning absorbing operations net recourse to deposit facility daily reserve surplus under zero deposit rate liquidity needs (autonomous factors + reserve requirements) Source: ECB. Last observation: 2 April 2013. 14 Relationship between EONIA and excess liquidity 1.4 EONIA - Deposit Rate spread 1.2 1 0.8 0.6 0.4 0.2 0 0 200 400 600 Excess liquidity (€ billions) 800 1000 Source: ECB. Sample period: May 2009 to April 2013 15 Indicator of cost of borrowing for non-financial corporations Short-term Long-term (percentages per annum; three-month moving average; March 2003 to January 2013) (percentages per annum; three-month moving average; March 2003 to January 2013) euro area Germany euro area Germany France Italy France Italy Spain The Netherlands Spain The Netherlands 8 8 6 6 4 4 2 2 0 2003 0 2003 2005 2007 2009 2011 Sources: ECB, ECB calculations. Notes: The indicator is computed using lending rates on loans with a maturity of up to one year and interest rates on overdrafts, aggregated on the basis of amounts outstanding. The weight applied to lending rates on loans with a maturity of up to one year accounts for the share of long-term loans issued at a floating rate. 2005 2007 2009 2011 Sources: ECB, ECB calculations. Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. 16 Indicator of cost of borrowing for households Short-term Long-term (percentages per annum; three-month moving average; March 2003 to January 2013) (percentages per annum; three-month moving average; March 2003 to January 2013) euro area Germany France euro area Germany France Italy Spain The Netherlands Italy Spain The Netherlands 8 8 6 6 4 4 2 2 0 2003 2005 2007 2009 2011 Sources: ECB, ECB calculations. Notes: Lending rate to households for house purchase, up to one year maturity. Aggregation is based on new business volumes. 0 2003 2005 2007 2009 2011 Sources: ECB, ECB calculations. Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. 17 Risk control measures 18 Risks in Eurosystem credit operations • The risk management framework enables the central banks to provide support to the economy by optimising the relationship between policy efficiency and risk taking • Risks are constantly monitored and assessed against available financial buffers at the Eurosystem level 19 Non-standard monetary policy measures (purchases) Monetary policy portfolios SMP (as of 31 December 2012) Outstanding amounts Issuer country Ireland Greece Spain Italy Portugal Total Nominal amount Book value (EUR billion) (EUR billion) 14.2 33.9 44.3 102.8 22.8 218 Average remaining maturity (in years) 13.6 30.8 43.7 99 21.6 208.7 4.6 3.6 4.1 4.5 3.9 4.3 CBPP (EUR 47.3 billion as of 2 April 2013 – settled amount) CBPP2 (EUR 16.2 billion as of 2 April 2013 – settled amount) The financial risks are closely monitored and measured 20 Non-standard monetary policy measures (credit operations) • Provision of unlimited liquidity at various maturities • Measures to increase collateral availability Key principles of the risk control framework – Risk protection – Consistency – Simplicity and transparency – Risk equivalence (residual risk of assets - after valuation and haircuts - same for all collateral types) 21 Changes to the risk control framework following non-standard measures The Eurosystem reviewed its risk control measures together with decisions to preserve collateral availability for counterparties during 2012: • when euro area NCBs have been allowed on 9 February to accept as collateral additional performing credit claims; • when reducing the rating threshold and amending the eligibility requirements for certain ABSs on 29 June; • on 6 September when the marketable debt instruments denominated in currencies other than the euro (USD, GBP, JPY) issued and held in the EA became eligible; • on 19 December when eligibility of debt instruments issued or guaranteed by the Hellenic Republic was reinstated (the application of the minimum credit rating threshold was suspended on 6 September in the case of assets issued or guaranteed by OMT or EU/IMF programme-complying countries); 22 Collateral put forward in Eurosystem credit operations by asset group central government securities regional government securities uncovered bank bonds covered bank bonds corporate bonds asset-backed securities other marketable assets non-marketable assets 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2004 2005 2006 2007 2008 2009 2010 2011 2012 (percentages; annual averages) 23 Risk mitigation framework for Eurosystem credit operations (1) • Counterparties must be financially sound; • According to Article 18.1 of the Statute of the ESCB, all credit shall be based on adequate collateral; • Collateral alone cannot eliminate or even sufficiently mitigate financial risks; there are two possibilities of loss, once a counterparty defaults: – A “double default event”: Very small probability as long as: (a) collateral satisfies high credit standards; and (b) close financial links between counterparty and collateral issuer are prohibited; – Losses incurred in realising collateral in illiquid market conditions: Use correct valuation and risk control measures to keep probability of such losses small. 24 Risk mitigation framework for Eurosystem credit operations (2) To guarantee that the quality and quantity of collateral provide adequate protection to the Eurosystem, three risk mitigation tools are required: Risk mitigation within the collateral framework Eurosystem Credit Assessment Framework (ECAF) Collateral valuation Risk control measures 25 The Single Supervisory Mechanism 26 The Single Supervisory Mechanism (SSM) Establishment of the SSM • Need to speed up strengthening of Economic and Monetary Union (EMU) because of: • Sovereign debt crisis • Contagion in the banking sector • Milestones of the process in 2012 and in 2013 • 29 June: Euro area Summit – Request to set up a single supervisory mechanism (SSM) • 12 September: European Commission proposal for a Council Regulation • 18 October: European Council conclusions on completing EMU • 13 December: European Council agreement on SSM • 19 March 2013: Provisional agreement on SSM between European Council and European Parliament 27 The Single Supervisory Mechanism (SSM) Two main advantages and goals of establishing the SSM • Will address the so-called “financial trilemma” • Impossibility of achieving financial stability, financial integration and maintaining national financial policies in a globalised financial market • Together with a single resolution mechanism, will help to break the negative feedback loops between sovereigns and banks • Increasing debt levels of sovereigns that provided financial support to struggling banks • Losses for banks from exposures to sovereigns under stress • Break the correlation between the cost of funding of euro area banks and that of their respective sovereigns • Need for a common resolution mechanism 28 The Single Supervisory Mechanism (SSM) Main features of the SSM • Single system of supervision • The ECB will take all decisions regarding the banks, banking groups and respective components categorised as “significant” (around 150 banks in the euro area countries) • Banks with more than €30 billion in total assets • Banks representing more than 20% of domestic GDP (unless <€5 billion in assets) • 3 most significant banks in each country (unless justified by particular circumstances) • Banks receiving direct assistance from the EFSF/ESM • The ECB can decide to exercise direct supervision of other banks 29 The Single Supervisory Mechanism (SSM) Main features of the SSM (cont.) • The national supervisors will take the decisions regarding “non-significant” banks subject to regulations, guidelines or general instructions • Close cooperation with non-euro area Member States • The ECB can conduct supervision in a non-euro area EU Member State, following a request for close cooperation • Transition • The SSM will start supervision one year after the entry into force of the regulation • ECB may choose to postpone the start if it deems that it is not ready 30 The Single Supervisory Mechanism (SSM) ECB’s guiding principles for establishing the SSM • Comprehensiveness and strong institutional framework • Independence • Clear separation of monetary policy and supervisory responsibilities • Decentralisation • Consistency with the single market • Accountability 31 The Single Supervisory Mechanism (SSM) Establishment of a banking union • “Towards a genuine Economic and Monetary Union” Final Report by the President of the European Council (December 2012) • Core elements of a banking union: • A Single Supervisory Mechanism (SSM) consisting of the ECB and national supervisors • A single bank resolution mechanism, including an independent resolution authority and a European resolution fund • More harmonised and sufficiently robust deposit-guarantee mechanisms in the EU 32 Thank you for your attention 33