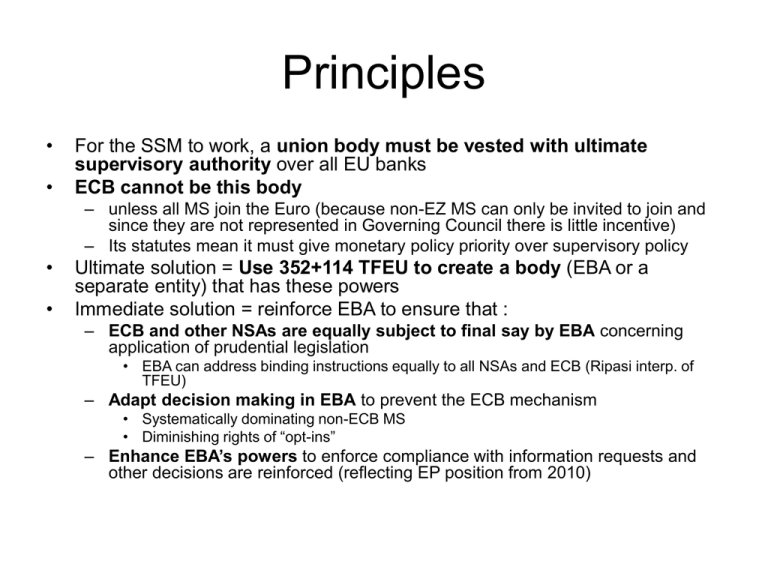

EBA as Supreme Supervisory Authority

advertisement

Principles • • For the SSM to work, a union body must be vested with ultimate supervisory authority over all EU banks ECB cannot be this body – unless all MS join the Euro (because non-EZ MS can only be invited to join and since they are not represented in Governing Council there is little incentive) – Its statutes mean it must give monetary policy priority over supervisory policy • • Ultimate solution = Use 352+114 TFEU to create a body (EBA or a separate entity) that has these powers Immediate solution = reinforce EBA to ensure that : – ECB and other NSAs are equally subject to final say by EBA concerning application of prudential legislation • EBA can address binding instructions equally to all NSAs and ECB (Ripasi interp. of TFEU) – Adapt decision making in EBA to prevent the ECB mechanism • Systematically dominating non-ECB MS • Diminishing rights of “opt-ins” – Enhance EBA’s powers to enforce compliance with information requests and other decisions are reinforced (reflecting EP position from 2010) EBA as Supreme Supervisory Authority +Enhanced powers. Decision Making EBA Binding Instructions Board of Supervisors 27 NCA with separate votes Binding Instructions Extra Panel for ECB-mechanism Members (to boost voice of “opt-ins”) Planning & Execution Only ECB Supervisory board Permanent College – enhance uniformity of supervision Non-ECB NSAs Fully harmonised execution Individial = agents of ECB NSAs Red = proposed changes Explanations • Enhanced powers of EBA – – – – • Full investigatory powers over institutions & supervisors Issuing Single Supervisory Handbook (Enria) Direct intervention in case of non-compliance + EP position on EBA 2009 Binding instructions – ECB (non-)action can be corrected by binding EBA decision (no independence for supervisory tasks) – Just as in the case of National Supervisory Auths. (NSA) • Special Panel for ECB comp. auths. – Possibility of challenging (via EBA) ECB decision affecting an “opt-in” – Means that ECB decision (based on power of Gov. Council with no “opt-ins”) can be overruled by EBA decision (proposed by panel including “opt-ins”) • Changed EBA voting system for Binding Mediation – “3+3” only where a dispute is between ECB and non-ECB – Simple majority otherwise Detail on proposed Voting Mechanisms Motivation: to counterbalance inevitable weight of EZ Member States in supervisory decision making in the light of the proposed ECB mechanism QM = majority including 3 EZ members and 3 non-ECB members Panel 1 = chair + 1 ECB member + 1 non-ECB Panel 2 = 17 EZ + "opt-ins" Dispute between ... Decision applies to ... Decision proposed by ECB and non- ECB ECB Non-ECB ECB or "opt-in" MS Panel 1 Panel 1 Panel 2 ECB and "opt-in" MS Decision adopted by Board of Supervisors unless rejected by QM Simple majority Simple Majority Consequences: 1 Its harder to block a decision directed at the ECB than at non-ECB - this is fair given the inbuilt majority of ECB participants "opt-ins" who have no vote on the ECB Governing Council, have a (slightly1) better chance of defending themselves via EBA, where they disagree with an ECB decision The more opt-ins there are, the higher this chance.