ECB

Presentation of the

ECB Framework Regulation

Organisational aspects

Tallinn, 26 February 2014

Timeline

SSM

Regulation enters into force

Submission to the

European

Parliament

Public hearing Publication on the ECB’s website

SSM takes over banking supervision

3 Nov. 2013

30 Jan. 2014

4 Feb.

7 Feb.

19 Feb.

7 March by 4 May

May

4 Nov.

End of public consultation

Publication in

Official Journal

Supervisory Board endorses draft

Framework Regulation at its first meeting

Launch of public consultation

2

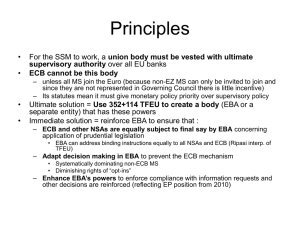

Legal basis

Articles 6 and

33(1) SSMR

ECB shall adopt and make public (by 4 May 2014) a framework to organise the practical arrangements for the implementation of the cooperation between the ECB and NCAs within the SSM.

Article 33(2)

SSMR

ECB shall publish by means of regulations and decisions the detailed operational arrangements for the implementation of its supervisory tasks.

Article 4(3)

SSMR

ECB may adopt regulations for the carrying out of its supervisory tasks.

The framework will be an ECB regulation.

3

Structure of the draft Framework Regulation

Part I – General provisions

Part II – Organisation of the SSM

Part III – Operation of the SSM

Part IV – Methodology for assessing significance

Part V – Common procedures

Part VI – Significant credit institutions

Part VII – Less significant credit institutions

Part VIII – Macro-prudential supervision

Part IX – Close cooperation

Part X – Administrative Penalties

Part XI – Access to information, reporting, investigations and on-site inspections

Part XII – Transitional and final provisions

4

ECB as a banking supervisor – institutional impact

Shared Services (IT, Legal, HR, Statistics)

5

Functioning of the SSM

SSM

ECB oversees the system

JST

(ECB/

NCAs staff)

Grants/withdraws authorisations, assesses qualifying holdings

Direct supervision

Significant banks

NCAs

Direct supervision

Grants/withdraws authorisations, assesses qualifying holdings

May “call-up” direct supervision

Less significant banks

6

Banking supervision by the SSM

Direct supervision by the ECB Direct supervision by the NCAs

Significant banks as defined under the SSMR by:

• size

• importance for EU or domestic economy

• significant cross-border activities

Less significant banks

Less significant banks when necessary to ensure consistent application of high supervisory standards

Banks that have requested or received ESM or EFSF public financial assistance

Three most significant banks in each participating Member

State

7

Methodology for assessing significance

Procedures

• assessment and ongoing review of a bank’s significance

• determination of the date on which a change of status/supervisor takes effect and its impact on pending procedures

• ECB takes decisions on changes in status

Size

• main criterion

• Framework Regulation specifies how the total value of

assets is determined

• significance is determined at highest level of consolidation

ECB lists

• of significant banks

• of less significant banks and their respective NCAs

• published on the ECB’s website and updated regularly

8

Supervision of Significant Banks

Supervisory Tasks conferred to the SSM:

• Authorization, withdrawal and assesment of qualifying holdings

• Passport

• Ensure compliance with requirements on capital, leverage, liquidity, and governance

• Supervisory review and Supervisory powers (Pillar 2)

• Consolidated supervision and supervision of conglomerates

• On-site inspection

• Early intervention where a bank breaches requirements

(coordinating with resolution authorities)

• Sanctions

• Macroprudential tasks

9

Micro-prudential tasks

Colleges of

Supervisors

• ECB will chair colleges for any significant groups with branches/subsidiaries outside the SSM and in non-EU countries

• ECB will participate in the colleges for non-SSM groups with branches/subsidiaries that are significant within the SSM

Passport issues

• CRD IV procedures no longer apply for the establishment of branches within the SSM

• for banks within the SSM wishing to establish a branch

outside the SSM, the ECB will be the home authority for significant banks and the NCA for less significant banks

Financial conglomerates

• ECB will act as coordinator if the bank belonging to the

financial conglomerate is significant

• supervision of insurance firms is excluded

10

Supervision of significant banks

ECB is the entry point for requests

(unless expressly provided otherwise)

JST analyses and prepares a draft decision

Decision-making

Supervisory Board submits draft decisions to Governing Council

NCAs

• assist the ECB by preparing a draft decision upon request or on their own initiative

• follow the ECB’s instructions

11

Close cooperation

General principles

• ECB’s position will be comparable to the one it holds in respect of supervised entities and groups established in euro area countries

• ECB may not act directly vis-à-vis banks but through

instructions, requests or guidelines addressed to NCAs

Significant institutions

• establishment of JST for each institution

• ECB will be consolidating supervisor

• NCAs adopt decisions in respect of significant supervised entities only upon the ECB’s instructions

Less significant institutions

• ECB may issue general instructions, guidelines or

requests to the NCA under close cooperation

12

ECB’s supervisory powers

Request for information

• ECB may require information that it considers necessary from any person referred to in Article 10(1) SSMR

• before making a request, the ECB will take into account the

information available to NCAs

Supervisory

Reporting

• ECB is the competent authority for supervisory reporting by

significant banks and NCAs for that by less significant banks

• NCAs are the single entry point and perform initial data checks

On-site inspections draft Framework Regulation sets out the procedures for:

• the decision to conduct an on-site inspection

• the establishment of an on-site inspection team

• the notification of an on-site inspection

13

Transitional provisions

Start of the

ECB supervision

• ECB sends a decision to significant banks of their status two months prior to start of supervision

• bank has the right to be heard

Continuity of existing procedures

• supervisory procedures initiated by NCAs will generally

continue after the ECB starts supervision

Countries adopting the euro

• transitional provisions will apply to countries that join the euro area after the start of the SSM

• comprehensive assessment of banks established in countries that join the euro area

Continuity of cooperation agreements

• MoUs and other cooperation agreements will continue to apply

• ECB may decide to participate

14

Thank you for your attention

Jean-Christophe Cabotte jean-christophe.cabotte@ecb.europa.eu

15