The push factors - Housing Studies Association

advertisement

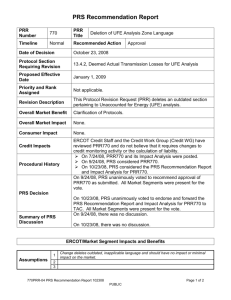

Diversifying into private rental investments: Organisational strategies of English Housing Associations Dr Nicky Morrison Department of Land Economy University of Cambridge Housing Studies Association conference April 2014 Why are housing associations diversifying into PRS? The push factors • Welfare reform & housing benefit cuts • Affordable rent model = less certain rental income/cash flows • Reduced grant funding • Reliance on bank finance less certain – look to capital markets > organisations’ risk profile changing The pull factors • Generate extra surpluses & cross subsidisation “robin-hood” principle • Fill a gap in the housing market – pent-up demand from ‘Generation rent’ • Montague Report (2012) ‘natural complement to existing activities/HAs are potentially key players’ • Government support ‘Get Britain building’ - £1b ‘Build-to-rent’ / PRS taskforce • YET HCA(2014) Regulations - Need assurances social housing assets not put at risk Housing Associations’ diversification into PRS General needs Private rented PRS as % of total total 2006 154390 36573 1.75 2079515 2007 1620476 38573 1.77 2178223 2008 1713124 40767 1.77 2296368 2009 1776095 45208 1.89 2379728 2010 1825510 50318 2.06 2437005 2011 1896853 56683 2.24 2526639 2012 1949565 47881 1.85 2586115 2013 1979874 48701 1.84 2634917 Source: HCA Statistical data returns Research Questions • What were HA’s reasons for diversifying into PRS investment? • What is the business model adopted? • What are the key risk exposures and how are they mitigated? • How does HA manage the tension between social and commercial goals? Conceptual framework: Institutional logics • How organisations reconcile competing logics – commercial and social goals (Mullins 2006, Mullins et al 2012, Morrison 2014) • Organisations face similar institutional pressures but negotiate logics in different ways • How organisations make strategic decisions in relation to business ethos • Organisational archetypes (Gruis 2008, Czischke et al 2002, Nieboer & Gruis 2014) Research methods • Case study research - to examine organisations’ decisions: why taken/how implemented/what results (Yin 2012) • Purposive sampling • Criteria: - Operating in same market = London chosen Focus on `prospectors’ – the front-runners • Distinguish between: (Neiboer & Gruis 2014) (i) Societal innovator: enlarge activity and use financial surplus in interest of society - social returns (ii) Societal real-estate investor: focus on achieving real estate portfolio to provide good financial return – take into account social objectives Organisational strategies Societal innovator: Notting Hill Societal RE investor: Thames Valley Company model Established 1963 Owns 27,170 units (57% SH) Registered profit-making PRS subsidiary. Borrow against SH assets. All profits gift aided to charitable parent group. Established 1966 Owns 14,900 units (34% SH) 2009 Company restructure: - Parent non-charitable - Non-registered profit-making PRS subsidiary. Ring fence investment. All profits gift aid to charitable subsidiary (TVC) When entered PRS & portfolio size 2004 – loss making ‘novice’. Today : 700 PRS units 2012 - set up ‘Fizzy Living’ brand. Today: 313 PRS units Funding - Used £100m own reserves & traditional bank borrowing at historically low rates - 2013 - £45m loan from HCA ‘Get Britain Building’ - 2013 - £18.3m HCA Round 1 ‘Build to rent’ 2012 - £34m seed capital from parent 2013 - £40m debt funding from Macquarie Capital investment bank 2013 - £200m Silver Arrow subsidiary of Abu Dhabi Investment Authority (ADIA) State-owned investment Fund Target market Social mission: To help same group Commercial mission: client group who access shared ownership i.e. lower end of market/working poor -Ideally would provide; - discounted rents at £1000pcm but little return - 5-10 years time limited tenancies young professionals – lifestyle choice -Market rents - 1 year AST - Provide add-on services e.g concierge/gyms/underground car parking Societal innovator: Notting Hill Societal RE investor: Thames Valley Rates of return 3% rental income 3% capital appreciation minus costs and borrowing at 4.5% N.B will sell off if little return 5% rental income Capital appreciation not factored ADIA terms are ‘gold dust’ N.B would not sell - hold over long term -considers PRS a ‘tradable asset’ in future PRS Portfolio (i) (ii) Buy tenanted existing properties Acquire off-plan from developer at discounted price (iii) Government ‘Get Britain Building’ – HCA bought homes from developer/HA manage (iv) HCA Round 1 ‘Build to rent’ N.B To focus on cheaper outer London locations (i)Acquire off-plan from developers at discounted price (ii) Plan to build PRS Did not enter Government’s ‘Build to rent’ Rounds as have investor injection of cash -Need a clear brand/marketing -Difficulties in letting – need right product to reduce void period/churn -Maintenance & repair less than anticipated -Need strong track record for investors -PRS returns less than property sales as way to generate surpluses (2013 market sale profits £21.1m versus market rent profits £3.7m) -Build on Brand reputation – customer loyalty - ‘rentysomethings’ -Income threshold – what are tenants willing to pay? - Operating costs relatively high -- Need strong track record for investors -Make sure AH business continues at same trajectory -(TV parent group plans 500 AH p.a next 10 years) Key risks N.B To focus in and around London and extend beyond once built Brand Notting Hill: Societal innovator Canning Town HCA ’Get Britain Building’ Fizzy Living: Real Estate investor Canning Town Epsom Popular Stepney Green Lessons learnt from ‘front-runners’ • Uncertain cash flows and reduced grants so need to generate own profits • Diversification allows cross subsidisation to core business – yet need assurances social housing assets not at risk • PRS risks versus AH risks are different • Nature extension of business – yet adoption of different business models in relation to organisation’s ethos • Fills a gap in housing market – especially in London where ‘market risk’ is relatively minimal • Need to focus on a defined market segment and strong branding – “cannot be all things to all people” (TVH) – “Fizzy living winning the brand war” (NH) • Manage the tensions – commercial v social goals.. Key risks in HAs sustaining PRS business • Investors’ appetite growing but complex deals YET like HAs’ asset management skills & professional management services - ‘safe pair of hands’ (TVH) • Funds secured against portfolio of completed and income producing PRS (ring fenced) or SH assets – risks & assurances • PRS returns realised versus selling in open market “sales greater returns and quicker in short run so would consider flogging off PRS” (NH) • Acquiring properties off-plan from developers at discounted prices – unlikely now in TODAY’s market • Build to rent: difficult to obtain land in London – escalating land prices/building costs & fierce competition from other organisations Public sector land owners reluctant to negotiate reduced price for HAs’ PRS – “best consideration rules” • Purposive exploratory sampling framework: a final point.. To see if fits theoretical model Choose variations to capture insights of ‘phenomenon’ from different angles To illustrate how decisions taken & results If have same problems then likely all will experience these issues – logical generalisations to help identify cases subsequently select and guide future research…