Private Retirement Schemes (PRS) Terms Explained Private R

advertisement

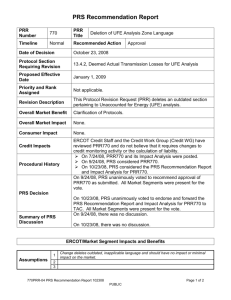

Private Retirement Schemes (PRS) Terms Explained Private Retirement Schemes (PRS) are becoming increasingly popular in Malaysia. If you are looking to sign up for one right now, here are the common terms you’ll need to get accustomed to: PRS This refers to the Private Retirement Schemes. They are voluntary private pension funds similar to EPF. PRS Provider This refers to a company which has been authorized by the Securities Commission (SC) to offer PRS. As at 5 April 2012, there are 8 approved PRS Providers: AmInvestment Management Sdn Bhd American International Assurance Bhd CIMB-Principal Asset Management Bhd Hwang Investment Management Berhad ING Funds Bhd Manulife Unit Trust Bhd Public Mutual Bhd RHB Investment Management Sdn Bhd PRS Consultant This is an individual that is licensed to sell PRS products. A PRS Consultant has to fulfill the following criteria: Be at least 21 years of age Possesses no criminal record Be registered with the Federation of Investment Managers Malaysia (FIMM) Has passed the PRS examination offered by FIMM PPA This refers to the Private Pension Administrator, which is regulated by the SC and acts as a record-keeping, resource and research center for all things related to PRS. You can manage all your PRS accounts with different PRS Providers with the PPA. Securities Commission SC is a regulatory body empowered by the law to supervise the PRS sector. SC also regulates other investment-related products and providers in Malaysia. Fund Options / Fund Plans These are the investment options offered to you by the PRS Providers. These options differ based on your tolerance to investment risk. Unit Price The unit price of PRS works in the same way as a share price. It is a reflection of the worth of the PRS fund you’re investing in, and could fluctuate from time to time. For the record: the Unit Price for PRS changes daily. Scheme Trustee This refers to an independent party that protects investors by ensuring that the PRS funds are operated according to the original objectives and requirements. A Scheme Trustee also holds the assets that the funds invest in on behalf of the investors. Distributions This refers to the income component of a PRS. In the simplest terms, Distributions are like dividends you receive from shares. And just like dividends, Distributions are NOT guaranteed. *** This article is brought to you by iMoney- website helping Malaysians to find and compare the best credit cards, loans, mortgages, and other financial products. iMoney.my aims to empower all Malaysians to manage their personal finance more intelligently by giving them the one thing that’ll truly benefit people for life – knowledge.