Imtech shifting emphasis to operational and financial recovery

advertisement

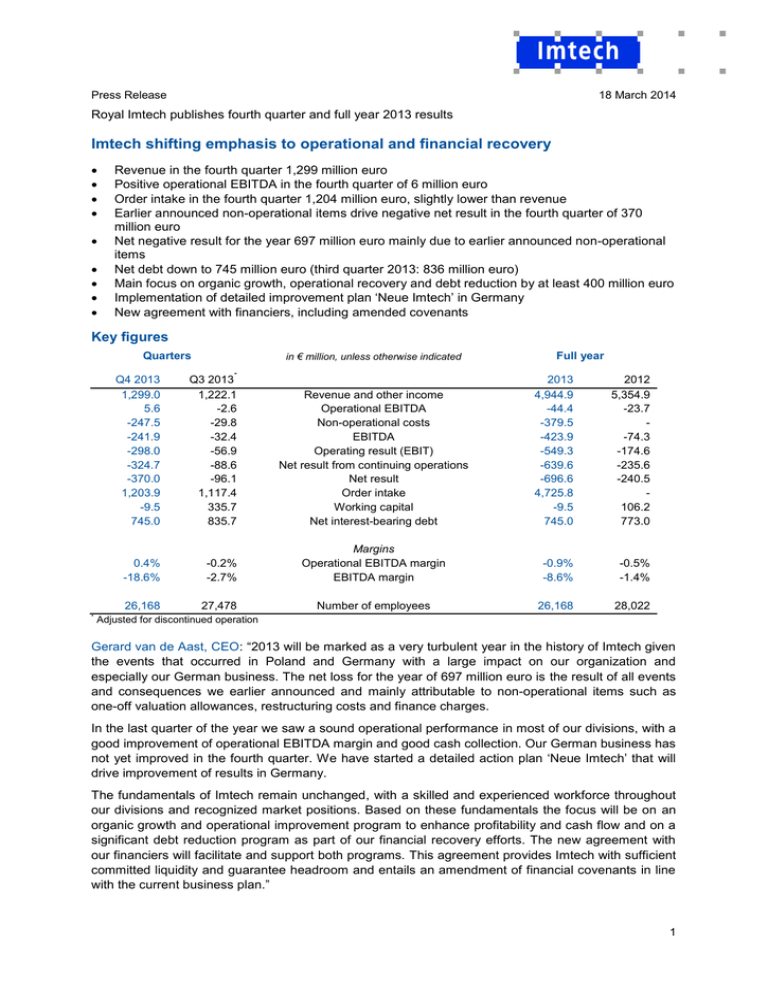

Press Release 18 March 2014 Royal Imtech publishes fourth quarter and full year 2013 results Imtech shifting emphasis to operational and financial recovery Revenue in the fourth quarter 1,299 million euro Positive operational EBITDA in the fourth quarter of 6 million euro Order intake in the fourth quarter 1,204 million euro, slightly lower than revenue Earlier announced non-operational items drive negative net result in the fourth quarter of 370 million euro Net negative result for the year 697 million euro mainly due to earlier announced non-operational items Net debt down to 745 million euro (third quarter 2013: 836 million euro) Main focus on organic growth, operational recovery and debt reduction by at least 400 million euro Implementation of detailed improvement plan ‘Neue Imtech’ in Germany New agreement with financiers, including amended covenants Key figures in € million, unless otherwise indicated Quarters * Q4 2013 1,299.0 5.6 -247.5 -241.9 -298.0 -324.7 -370.0 1,203.9 -9.5 745.0 Q3 2013* 1,222.1 -2.6 -29.8 -32.4 -56.9 -88.6 -96.1 1,117.4 335.7 835.7 0.4% -18.6% -0.2% -2.7% 26,168 27,478 Full year 2013 4,944.9 -44.4 -379.5 -423.9 -549.3 -639.6 -696.6 4,725.8 -9.5 745.0 2012 5,354.9 -23.7 -74.3 -174.6 -235.6 -240.5 106.2 773.0 Margins Operational EBITDA margin EBITDA margin -0.9% -8.6% -0.5% -1.4% Number of employees 26,168 28,022 Revenue and other income Operational EBITDA Non-operational costs EBITDA Operating result (EBIT) Net result from continuing operations Net result Order intake Working capital Net interest-bearing debt Adjusted for discontinued operation Gerard van de Aast, CEO: “2013 will be marked as a very turbulent year in the history of Imtech given the events that occurred in Poland and Germany with a large impact on our organization and especially our German business. The net loss for the year of 697 million euro is the result of all events and consequences we earlier announced and mainly attributable to non-operational items such as one-off valuation allowances, restructuring costs and finance charges. In the last quarter of the year we saw a sound operational performance in most of our divisions, with a good improvement of operational EBITDA margin and good cash collection. Our German business has not yet improved in the fourth quarter. We have started a detailed action plan ‘Neue Imtech’ that will drive improvement of results in Germany. The fundamentals of Imtech remain unchanged, with a skilled and experienced workforce throughout our divisions and recognized market positions. Based on these fundamentals the focus will be on an organic growth and operational improvement program to enhance profitability and cash flow and on a significant debt reduction program as part of our financial recovery efforts. The new agreement with our financiers will facilitate and support both programs. This agreement provides Imtech with sufficient committed liquidity and guarantee headroom and entails an amendment of financial covenants in line with the current business plan.” 1 2013 was a year of transition and resolving legacy items As communicated before, beginning 2013 we were confronted with irregularities in Poland and Germany, requiring deep investigations and an extended auditing and reviewing process of our company. The investigation resulted in a comprehensive Report to Shareholders, that we published on 18 June 2013. In the first quarter, we introduced a company wide operational excellence program with a strong focus on improving the profitability and cash generation and strengthening the business controls. In April, a headcount reduction plan of 1,300 FTEs was announced to improve the profitability. During the year, this program was extended to 2,300 FTEs and implemented. In the summer, we strengthened the balance sheet by an equity issue with net proceeds of 487 million euro. Management was strengthened throughout the company. Non-operational items in 2013 drive negative result of 697 million euro The net loss for the year of 696.6 million euro includes an operational EBITDA loss of 44.4 million euro, of which 107.7 million euro is attributable to Germany & Eastern Europe. This means, the rest of the group realised a positive operational EBITDA of 63.3 million euro. Previously announced one-off items are the non-operational costs for 379.5 million euro. Legacy items account for in total 230.0 million euro of which 195.9 million euro is included in the aforementioned non-operational costs, 29.3 million euro relates to impairment of (in)tangibles assets and 4.8 million euro is included in share results of associates, joint ventures and other investments. The net finance costs amounted to 105.0 million euro, mainly driven by higher cost of debt (67.5 million euro) and refinancing costs (23.9 million euro). The sale of the Turkish operating company AE Arma-Elektropanç resulted in a net loss of 40.8 million euro, included in result from discontinued operations. The restructuring program 2013 has been finalised with a total costs of 103.8 million euro, of which 33.1 million euro in the fourth quarter. Operational and financial recovery going forward We now enter the next phase of recovery with focus on enhancing our organic growth, operational performance and regaining Imtech’s financial health. We have concluded that a further significant debt reduction is required for our financial recovery efforts. We are committed to reduce debt by at least 400 million euro. To realise this, we will review all options in order to intensify the debt reduction program in 2014. Good progress on operational recovery plan In the second half of the year, we intensified our recovery plan, including the implementation of the operational excellence program. Towards the end of the year, this resulted in a good improvement of operational EBITDA margin, excluding Germany & Eastern Europe, also helped by the impact of management upgrades and the completed headcount reduction programs. Our focus on working capital management and cash management resulted in a good net debt reduction of 91 million euro in the fourth quarter to 745 million euro. All businesses, including Germany & Eastern Europe, contributed to this good result. We can conclude that Imtech’s strong foundations are intact. Every day, our committed employees serve thousands of customers with technical solutions all over the world. The order intake during 2013 was satisfactorily and in line with revenue. As previously communicated, the results in our businesses provide a platform for recovery. In Germany we accelerated and intensified our recovery plan, named ‘Neue Imtech’. German action plan: ‘Neue Imtech’ Management has launched a comprehensive recovery plan to rebuild the German organisation, named ‘Neue Imtech’. This program prioritizes healthy project margins over volume and is based on a detailed action plan consisting of eight building blocks: project execution excellence, procurement, improving sales processes, prudent spending, streamlining organisation and staff, modern cash 2 management, closure of unprofitable branches in Eastern Europe, and establish a sustainable strategy. An important element of the recovery program is the closure of the legacy items which resulted in a total valuation allowances of 197.9 million euro as already announced in February 2014. New agreement with financiers including amended covenants Imtech has reached agreement with its main lenders and guarantee providers on a comprehensive financing solution that creates a foundation to stabilize operations and implement the operational and financial recovery referred to above. The agreement provides Imtech with access to 1.3 billion euro of committed credit facilities (including senior notes) and 843 million euro of committed guarantee facilities (including 50 million euro from drawings under the credit facilities). The agreement provides Imtech with sufficient liquidity and guarantee headroom and entails an amendment of financial covenants in line with the current business plan. The agreement is structured to harmonise the maturity of the cash and guarantee facilities to 1 November 2015. Imtech and its main lenders have committed to extend the maturity until July 2017. However, this extension is not yet finalised as one of the financiers under the RCF has not agreed to the financing solution. However all financiers are bound by it at least until 1 November 2015 under the terms of the RCF. The new agreement includes: - Replacement of existing financial covenants by a minimum EBITDA level and a minimum operational cash flow level over the last twelve months from 30 September 2014 to 30 September 2016 and (if facilities are extended) a minimum operational cash flow level, an interest cover ratio, a senior leverage and a total leverage ratio from 31 December 2016 to 30 June 2017. The minimum EBITDA level increases over time. The minimum operational cash flow varies in line with the company's business plan. All covenants are in line with the company’s business plan plus headroom. - A commitment to delever with 250 million euro by 30 June 2015 and a best effort obligation to further delever with in total at least 400 million euro by the same date but a reduction with a substantially higher amount is not excluded. If the company has not achieved its deleveraging target in full by 30 June 2015, non-cash fees of an estimated 25 million euro will accrue on both 30 June and 30 September 2015 and semi-annually thereafter for as long as the deleveraging target is not met. Also, if the deleveraging target has not been achieved in full by 30 June 2015, the company will be required to issue warrants to its financiers up to 10% of the company's then outstanding share capital at an exercise price equal to the nominal value at the time of issue. The granting of warrants requires approval of the shareholders. If shareholders’ approval is not obtained a synthetic fee will be paid. - Revised interest arrangements resulting in a margin of 7.5% (of which 3.75% non-cash interest) on RCF and bilateral credit facilities and interest of 9.8% on senior notes (of which 2.00% non-cash interest). Guarantee fees range from 3.75-4.5% (of which 1.25-1.50% noncash). The margin on the RCF and bilateral credit facilities and the guarantee fees are subject to reduction based on a leverage ratio grid. - One-off fees and make-whole amounts payable to financiers aggregating 53 million euro of which circa 10 million euro in cash and 32 million euro is contractual make-whole added to the principal of the senior notes. Imtech continues to be focused on achieving a long term sustainable capital structure and is committed to reduce indebtedness by at least 400 million euro. To realize this debt reduction Imtech will review all options in order to intensify the debt reduction program in 2014. 3 Confirmation of medium term targets We maintain our medium term targets to achieve an operational EBITDA margin of 4-6%, a cash conversion of 90% and a maximum leverage ratio of 2.0. To achieve these targets we will continue to focus on organic growth, improvement of our operational performance by implementing operational excellence programs and debt reduction. Comparative figures 2012 Imtech has adopted the revised IAS 19 Employee benefits as per the financial year 2013. IAS 19 must be applied retrospectively with a restatement of comparative figures for 2012. For further details reference is made to note 3 of the 2013 financial statements. The company has decided to dispose its 80% shareholding in AE Arma-Elektropanç (Arma). As a result, these activities are classified as discontinued operations. The comparative consolidated profit and loss account 2012 has been restated to show the discontinued operations separately from continuing operations. In the balance sheet the related assets and liabilities are classified as held for sale as per 31 December 2013. Reference is made to note 13 of the 2013 financial statements. Financial performance Income statement in € million Quarters * Q4 2013 1,299.0 5.6 -247.5 -241.9 -11.1 -45.0 -298.0 -23.5 Q3 2013* 1,222.1 -2.6 -29.8 -32.4 -9.9 -14.6 -56.9 -25.8 -2.1 -1.1 -324.7 -45.3 -370.0 -3.9 -2.0 -88.6 -7.4 -96.1 Revenue and other income Operational EBITDA Non-operational costs EBITDA Depreciation Amortisation & impairment Operating result (EBIT) Net finance result Share of results of associates, joint ventures and other investments Income tax expense Net result from continuing operations Result from discontinued operations Net result Full year 2013 4,944.9 -44.4 -379.5 -423.9 -40.5 -84.9 -549.3 -105.0 2012 5,354.9 -23.7 -74.3 -39.6 -60.7 -174.6 -62.0 -5.7 20.4 -639.6 -57.0 -696.6 2.8 -1.8 -235.6 -4.9 -240.5 Adjusted for discontinued operation Fourth quarter 2013 The last quarter of the year is seasonally a better quarter. Revenue came in at 1,299 million euro, in line with previous quarters of 2013. Almost all divisions contributed to the revenue increase in the quarter, particularly ICT (+48%) and Traffic & Infra (+32%). Exceptions are Germany & Eastern Europe (-31%) and to a lesser extent UK & Ireland (-7%). The operational EBITDA ended at 5.6 million euro in Q4, including an operational EBITDA loss of Germany & Eastern Europe of 32.8 million euro. Operational EBITDA excluding Germany & Eastern Europe improved markedly in the quarter from 17.1 million euro to 41.7 million euro in Q4 2013 as a result of the benefits of restructuring the businesses of Benelux, Marine and Traffic & Infra, and a strong fourth quarter of ICT. In UK & Ireland and Nordic, operational EBITDA was lower than in Q3 2013. The non-operational costs in Q4 2013 amounted to 247.5 million euro and include previously announced costs made for restructuring for 33.1 million euro (mainly in Germany), 5.5 million euro for 4 financial restructuring, valuation allowances of 195.9 million euro, mainly related to Germany & Eastern Europe and 13.0 million euro for several other non-operational overhead costs such as advisory and legal. Depreciation in Q4 2014 was 11.1 million euro. Amortisation and impairment was 45.0 million euro, including an impairment of 29.4 million euro as part of the valuation allowances of in total 230.0 million euro. The accelerated amortisation of the brand name NVS in Nordic, as our business in Nordic is implementing the Imtech brand name, counts for 4.2 million euro in Q4 2013. In Q4 2013, the net finance result is -23.5 million euro. The net finance result includes amongst other net interest expenses (Q4 2013: 18.8 million euro, first nine months 2013: 48.7 million euro) and earlier announced financing costs (Q4 2013: 0.9 million euro, first nine months 2013: 27.4 million euro). The share of results of associates, joint ventures and other investments amounted to -2.1 million euro (first nine months 2013: -3.6 million euro), including 4.8 million euro related to the valuation allowances. The effective tax rate for Q4 2013 was 0.3% negative (first nine months 2013: 5.7% positive). The effective tax rate is significantly impacted by losses made in 2013. Part of these losses do not result in a direct tax credit, particularly for businesses located in the Netherlands, Germany and Eastern Europe. Full year 2013 Revenue for the year 2013 came in at 4,945 million euro, a decrease of 8% primarily due to Germany & Eastern Europe. Also Benelux, Marine, Spain and UK & Ireland reported a decrease of revenue. The revenue decrease was partly offset by an increase in Nordic, ICT and Traffic & Infra. The operational EBITDA resulted in a loss of 44.4 million euro. Germany & Eastern Europe was the main contributor of this loss, also Benelux, Marine and Spain reported a loss. Positive operational EBITDA was realised in ICT, UK & Ireland, Nordic and Traffic & Infra. The non-operational costs of 379.5 million euro include amongst other as previously announced costs made for restructuring for 103.8 million euro (mainly Benelux, Germany and Marine), 22.3 million euro for financial restructuring and the valuation allowances in Benelux and Marine for 40.0 million euro, the valuation allowances in the fourth quarter of 195.9 million euro and 17.5 million euro for several other non-operational overhead costs such as advisory, legal and rebranding. Depreciation was 40.5 million euro. Amortisation and impairment amounted to 84.9 million euro, including an impairment of 29.3 million euro as part of the valuation allowances in the fourth quarter and 14.2 million euro for the accelerated amortisation of the brand name NVS in Nordic. The net finance result is 105.0 million euro. The net finance result includes amongst other net interest expenses (67.5 million euro) and earlier announced financing costs (28.5 million euro). The share of results of associates, joint ventures and other investments amounted to -5.7 million euro, including 4.8 million euro related to the valuation allowances. The effective tax rate for the year was 3.1%. The effective tax rate is significantly impacted by losses made in 2013. Part of these losses do not result in a direct tax credit, particularly for businesses located in the Netherlands, Germany and Eastern Europe. Result for discontinued operations (net of tax) amounted to -45.3 million euro in Q4 2013 and -57.0 million euro for the full year, and are related to the divestment of the Turkish business AE ArmaElektropanç as announced on 17 January 2014. 5 Result for the period, result per share in € million, unless otherwise indicated Quarters Q4 2013 -370.0 1.1 -371.1 45.0 -326.1 Q3 2013 -96.1 0.8 -96.8 14.6 -82.3 Full year 2013 -696.6 4.6 -701.2 84.9 -616.3 2012 -240.5 6.7 -247.2 60.7 -186.5 Basic result per share from continuing operations Diluted result per share from continuing operations -2.15 -2.15 -1.26 -1.26 Basic result per share Diluted result per share -2.34 -2.34 -1.29 -1.29 Net result Non-controlling interests Net result for shareholders Amortisation & impairment Adjusted net result for shareholders Balance sheet Selected balance sheet items in € million, unless otherwise indicated 31 Dec 2013 161.0 1,181.8 44.3 1,387.1 -9.5 79.9 1,457.5 30 Sep 2013 158.0 1,266.1 75.2 1,499.3 335.7 25.3 1,860.3 31 Dec 2012 170.8 1,299.7 66.5 1,537.0 106.2 27.6 1,670.8 313.3 745.0 11.8 30.9 296.7 59.8 1,457.5 678.4 835.7 19.7 28.4 273.0 25.1 1,860.3 524.5 773.0 24.8 24.0 299.4 25.1 1,670.8 31 Dec 2013 168.7 859.3 215.7 1,243.7 30 Sep 2013 382.0 938.1 265.7 1,585.8 31 Dec 2012 264.8 1,132.1 283.8 1,680.7 756.5 496.7 1,253.2 708.7 541.4 1,250.1 890.8 683.7 1,574.5 Working capital As % of LTM revenue -9.5 -0.2% 335.7 6.4% 106.2 2.0% Working capital excluding remaining legacy items As % of LTM revenue -85.2 -1.7% - - Property, plant and equipment Goodwill & other intangible assets Other non-current assets Non-current assets Working capital Assets held for sale Capital employed Equity Net interest-bearing debt Other (non-interest bearing) LT liabilities Restructuring provisions Other liabilities Liabilities held for sale Funding Working capital in € million, unless otherwise indicated Work in progress Trade receivables Other current assets Trade payables Other current liabilities 6 Net amount trade receivables (aging) in € million, unless otherwise indicated Not past due Past due <180 days Past due >180 days Total Past due > 180 days excluding remaining legacy items 31 Dec 2013 635.5 136.5 87.3 859.3 30 Sep 2013 668.5 140.6 129.0 938.1 31 Dec 2012 767.8 228.8 135.5 1,132.1 33.6 - - Remaining legacy items As announced on 3 February 2014, there are remaining legacy items on the balance sheet. A dedicated team at Imtech will resolve these remaining legacy items in a pragmatic and optimized manner. The vast majority of these remaining legacy items does not have a direct relation to current operations. At year-end the total amount of remaining legacy items on the balance sheet amounts to 82.5 million euro. The company will report separately and quarterly on these remaining legacy items going forward. Fourth quarter 2013 Capital employed declined by 402.8 million euro to 1,457.5 million euro per end Q4 2013 as a result of increased focus on cash and working capital management as well as valuation allowances of 230 million euro, of which 175.7 million euro is related to working capital, 54.3 million euro to other balance sheet items, mainly non-current items. Goodwill and other intangibles decreased by 84.3 million euro to 1,181.8 million euro primarily due to the disposal of AE Arma-Elektropanç in Turkey and a movement in exchange rates. Working capital declined by 345.2 million euro to -9.5 million euro per end of Q4 2013. Within working capital, the decline is primarily related to the previously announced valuation allowances of 193.9 million euro as well as an increased focus on working capital reductions. Most important elements of valuation allowances in working capital are for work in progress 110.5 million euro and receivables 66.8 million euro. Assets and liabilities held for sale both increased in the quarter as a result of the conclusion of the strategic review to dispose our 80% shareholding in AE Arma-Elektropanç. The previously reported amounts of assets and liabilities held for sale (a data centre in Germany) have been reclassified to property, plant and equipment and interest-bearing debt as these assets will remain in use. The equity decreased in Q4 by 365.1 million euro to 313.3 million euro due to the net loss realized in Q4 2013. The net interest-bearing debt decreased by 90.7 million euro to 745.0 million euro as a result of the positive cash flow from operational activities (133.3 million euro) in Q4 2013, pay-out of severance related to the 2013 restructuring plans (30.7 million euro), costs associated with the financial restructuring (5.4 million euro), paid interest, paid tax and reclassification of liabilities held for sale. Full year 2013 Capital employed decreased by 213.3 million euro to 1,457.5 million euro in 2013 as a result of increased focus on cash and working capital management as well as valuation allowances. Goodwill and other intangibles decreased by 117.9 million euro to 1,181.8 million euro primarily due to the disposal of AE Arma-Elektropanç in Turkey, accelerated amortisation of the brand name NVS in Nordic (14.2 million euro) and a movement in exchange rates (-28.0 million euro). Working capital decreased by 115.7 million euro to -9.5 million euro per end of Q4 2013. The equity decreased during the year by 211.2 million euro to 313.3 million euro is due to the net loss realized in 2013 offset by net proceeds of the equity increase during the summer of 487.1 million euro. The net interest-bearing debt decreased by 28.0 million euro to 745.0 million euro as a result of the negative EBITDA in 2013, pay-out of severance related to the 2013 restructuring plans (73.8 million euro), costs associated with the financial restructuring (110.6 million euro), paid interest, paid tax, capital expenditure offset by the gross proceeds of the equity increase. 7 Cash flow statement Fourth quarter 2013 The net cash flow from operating activities in Q4 2013 amounts to 149.6 million euro positive. The cash flow was impacted by a net loss of 370.0 million euro in the quarter and good cash collection from working capital of 101.9 million euro. The net cash flow from investing activities in Q4 2013 was 0.9 million euro positive. During Q4 2013 2.5 million euro of earn-outs were paid for previous acquisitions. Net capital expenditure in Q4 2013 for property, plant & equipment and intangible assets amounted to 17.7 million euro. Full year 2013 The net cash flow from operating activities in 2013 amounts to 327.5 million euro negative. The cash flow was impacted by the net loss of 696.6 million euro. The net cash flow from investing activities in 2013 was 57.8 million euro negative. During 2013 27.7 million euro were paid for the acquisitions in Finland and earn-outs of previous acquisitions. Net capital expenditure in 2013 for property, plant & equipment and intangible assets amounted to 39.5 million euro. Performance by division Benelux Quarters Q4 2013 186.2 1.3 0.7% -8.8 125.9 4,120 Q3 2013 167.7 -1.1 -0.7% -5.0 203.5 4,284 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 682.8 -17.6 -2.6% -63.4 625.5 4,120 2012 766.1 -19.1 -2.5% -51.2 4,859 Markets in Benelux remain challenging, especially the Dutch buildings market. The industrial businesses remain stable, with opportunities in the international oil and gas business. The Belgian market shows first signs of improvement. Revenue increase of 11% to 186 million euro in Q4 2013 was driven by year-end closing of projects. Operational EBITDA turned into a positive result of 1.3 million euro after previous loss making quarters as consequence of year-end closings of projects as well as the benefits of the restructurings in previous quarters. The building services unit in the Netherlands is continuing to address operational efficiency issues and has to deal with a weak building market. The industrial businesses delivered a good performance in the fourth quarter. Order intake during the quarter was lower than revenue, reflecting decreasing volumes in the buildings market. Interesting projects awarded in Q4 are the upgrading of 21 operating rooms at the University Medical Centre in Utrecht and the design and implementation of new security systems and power supplies at NXP Semiconductors. For the full year, revenue was 683 million euro reflecting the challenging market conditions. Operational EBITDA for the year was a loss of 17.6 million euro due to a negative results in the Dutch buildings services business which could not be fully offset by good performance in the industrial businesses. Order intake for the year was slightly below revenue. The number of employees decreased by 739 FTEs to 4,120 FTEs and is primarily the result of the restructurings in the Dutch buildings business. 8 Germany & Eastern Europe Quarters Q4 2013 185.8 -32.8 -17.6% -239.7 161.6 4,740 Q3 2013 269.3 -19.7 -7.3% -26.8 187.0 5,304 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 968.6 -107.7 -11.1% -327.7 800.6 4,740 2012 1,372.1 -131.2 -9.6% -131.2 5,479 The market conditions in Germany remain favourable and our market position based on our strong technical competences continues to be solid. Fourth quarter revenue decreased to 186 million euro as a result of prioritizing margin over volume and the impact of valuation allowances for 66.2 million euro. Operational EBITDA was a loss of 32.8 million euro as a result of the high cost structure and several weak project results. The headcount restructuring program 2013 has resulted in a reduction of 564 FTEs. The order intake for the quarter was lower than revenue and arrives at 161.6 million euro. Good orders included in the Q4 order book are the electric, ventilation and sprinkler solutions for the new headquarter of the German automotive component supplier ZF and the ventilation systems at the new build hospital of SLK Kliniken Heilbronn. Revenue for the year amounted to 969 million euro. Operational EBITDA was a loss of 107.7 million euro. Order intake for the year was lower than revenue, which is based on the new market approach of prioritizing margin over volume. The number of employees decreased by 739 FTEs to 4,740 FTEs and is the impact of downsizing our businesses in Germany and Eastern Europe. UK & Ireland Quarters Q4 2013 174.7 6.7 3.8% 5.8 207.0 3,396 Q3 2013 188.6 9.3 4.9% 7.8 127.6 3,504 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 738.0 30.7 4.2% 28.2 673.7 3,396 2012 750.6 44.6 5.9% 44.2 3,598 The UK engineering services market is characterised by tough market conditions resulting in very tight margins in the marketplace. In the fourth quarter, some improvements were becoming apparent. In the fourth quarter, revenue was down 7% to 175 million euro reflecting a downturn in the UK engineering services market as well as the primary project in Kazakhstan is coming to conclusion. The operational EBITDA of 6.7 million euro was 28% lower than Q3 2014 reflecting the margin pressure in UK engineering services business. This margin pressure was partly offset by other technical maintenance, system integration and waste, water & energy. Order intake increased in the quarter to 207.0 million euro and was higher than revenue. Interesting orders awarded in the Q4 are for the international dairy food company Glanbia Foods for the installation of HVAC power, fire alarms and emergency lighting and for the new to be build Kensington and Chelsea Leisure Centre the design and build of the combined heating and power generation and ventilation systems. The reduction of 108 FTEs in the fourth quarter to 3,396 FTE is the result of streamlining the business, particularly for UK engineering services business. 9 In 2013, the business environment was considerable tougher than 2012. Revenue for the year remained stable at 738 million euro, including a negative currency impact of 27.9 million euro. Operational EBITDA of 30.7 million euro was impacted by margin pressure in the UK engineering services business and a currency impact of 1.0 million euro negative. Order intake ended somewhat below revenue at 673.7 million euro for the year. The continued focus on streamlining the business to market conditions and order intake resulted in a decrease of 202 FTEs. Total number of employees at year-end amounted to 3,396 FTEs. Nordic Quarters Q4 2013 237.6 7.5 3.2% 7.1 218.6 5,406 Q3 2013 202.2 6.6 3.3% 6.3 161.9 5,549 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 891.6 29.8 3.3% 25.0 888.1 5,406 2012 804.9 59.6 7.4% 60.4 4,937 Market environment in both Sweden and Finland is difficult with lower volumes and margin pressure. Towards the end of the year, first signs of a market recovery became visible. The Norwegian market shows some slowdown. In the quarter, revenue was 18% higher at 238 million euro. The operational EBITDA increased to 7.5 million euro, though negatively impacted by inefficiencies on projects in Sweden and Finland. The NKS project in Sweden realised a significant loss in 2013. Order intake in the quarter was 35% up to 217.9 million euro. New orders included in the order book are the upgrading of the ventilation systems and medical gas supply systems in the University Hospital Linköping and the modernisation of the heating, sanitation and cooling system at the Lund Institute of Technology. The reduction of 143 FTEs in the fourth quarter is related to the integration process of previous acquisitions. In 2013, revenue increased to 892 million euro as a result of the consolidation of the Finnish company EMC with 101.8 million euro revenue. Operational EBITDA amounted to 29.8 million euro due to weak project results and some margin pressure in the market. Order intake was in line with revenue and amounted to 888.1 million euro. The increase of the number of employees by 469 FTEs in 2013 is the result of the acquisition of EMC. Spain Quarters Q4 2013 34.6 -0.5 -1.4% -0.8 59.8 1,560 Q3 2013 27.9 -0.7 -2.5% -0.7 12.0 1,733 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 126.9 -2.3 -1.8% -3.0 122.6 1,560 2012 156.1 -0.8 -0.5% -5.3 1,809 It looks like that the Spanish markets have now reached the bottom, but competition is still fierce. For the maintenance market, conditions improved slightly in the fourth quarter. Revenue in the quarter is up 24% to 35 million euro due to higher production levels in the Spanish building projects business. Operational EBITDA improvement is related to the benefits of the restructuring as executed during the year. Good order intake in Q4 is also due to securing the 10 maintenance business for 2014. Interesting new orders are the renewal of the five year maintenance contract at Cepsa’s fuel and chemical plants in Huelva and the three year maintenance contract at the MSC Terminal in the Port of Valencia. The reduction of 173 FTEs in Q4 is a combination of restructuring and expiring of labour agreements related to the closure of specific contracted work. In 2013, revenue decreased by 19% to 127 million euro due to challenging economic conditions in the markets for both building projects as well as industry projects. Operational EBITDA was a loss of 2.3 million euro. Order intake for the year was in line with revenue and amounted to 122.6 million euro. The number of employees decreased by 249 FTEs to 1,560 FTEs. ICT Quarters Q4 2013 260.8 18.3 7.0% 16.6 283.6 2,380 Q3 2013 176.5 6.3 3.6% 4.4 181.2 2,432 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 740.1 36.9 5.0% 32.7 777.6 2,380 2012 667.0 43.8 6.6% 43.8 2,422 The fourth quarter is traditionally a strong quarter for the ICT business. Revenue in Q4 showed a considerable increase to 261 million euro, strongly driven by one-off deals initiated by some of our strategic partners at the end of the quarter. Operational EBITDA increased to 18.3 million euro and correspondingly margin improved to 7.0%. The higher quarter order intake of 283.6 million euro is mainly related to the partner deals. Interesting new contracts are the management and implementation of a flexible data centre infrastructure of the Dutch certification company Kiwa and the three years IT outsourcing contract for the Swedish staffing company Lernia. The number of employees decreased to 2,380 FTEs and is related of the continuous streamlining of the ICT portfolio which include also in two small non-strategic asset disposals in UK and Austria with no financial impact. Revenue for the year was 11% up to 740 million euro, particularly due to a good last quarter. Operational EBITDA was 36.9 million euro. Order intake at 777.6 million euro was higher than revenue for the year. The number of employees was slightly lower than a year ago and amounted to 2,380 FTE. Traffic & Infra Quarters Q4 2013 111.1 5.9 5.3% 5.0 75.6 2,072 Q3 2013 84.3 3.9 4.6% 5.2 74.1 2,042 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 384.6 12.0 3.1% -8.4 361.5 2,072 2012 346.0 11.6 3.4% 5.8 2,315 Revenue in the quarter amounted to 111 million euro, an increase of 31.8% compared to previous quarter driven by closing of projects. Operational EBITDA was up 51% to 5.9 million euro, also reflecting the benefits of the restructuring program in the Netherlands earlier in the year. Good new orders are the contract of the design and implementation of a new traffic control centre in the south of the Netherlands and the installation and maintenance of the intelligent travel information system at Utrecht Central Station. The increase of the number of employees is related to some quality upgrade of the organisation. 11 Revenue for the year improved by 11% to 385 million euro due to good performance of the businesses in Belgium and Nordic, partly offset by the Dutch business. Operational EBITDA was 12.0 million euro. Order intake for the year amounted to 361.5 million euro and was slightly below revenue. The number of employees decreased by 243 FTEs due to restructuring of the Dutch infra business in the first halfyear. Marine Quarters Q4 2013 111.8 1.0 0.9% -15.3 91.1 2,410 Q3 2013 111.4 -1.6 -1.4% -13.3 170.1 2,541 in € million, unless otherwise indicated Revenue Operational EBITDA Operational EBITDA margin EBITDA Order intake Number of employees Full year 2013 415.9 -9.9 -2.4% -61.5 476.2 2,410 2012 491.7 -0.5 -0.1% -9.3 2,528 Revenue for the quarter remained stable at 112 million euro. The operational EBITDA turned in to a positive result and amounted 1.0 million euro, for the first time benefiting from restructuring of previous quarters. Order intake of 91.1 million euro for the quarter is satisfactorily. Good new orders are the contract for the engineering and installation of electrical power generation and distribution systems and electrical distribution systems for a new heavy construction vessel for the offshore energy contractor Subsea 7. Another project is the design and commissioning of the electrical installation, automation and electrical propulsion systems for a river pusher, out of a series of 8, for the Brazil operator Hidrovias. Reduction of 131 FTEs in the quarter is the result of the restructuring program. The full-year revenue of 416 million euro was 15% down due to low order intake in 2012. Operational EBITDA was a loss of 9.9 million euro due to weak project results and inefficiencies. Order intake amounted to 476.2 million euro and was higher than revenue for the year. The number of employees decreased by 118 FTEs to 2,410 FTEs as a result of the restructuring. Group management Quarters Q4 2013 -3.6 -1.8 -11.8 84 Q3 2013 -5.8 -5.5 -10.3 89 in € million, unless otherwise indicated Revenue Operational EBITDA EBITDA Number of employees Full year 2013 -3.6 -16.3 -45.8 84 2012 0.4 -31.7 -31.5 75 Operational EBITDA in Q4 amounted to -1.8 million euro. The reported EBITDA was -11.8 million, primarily due to costs for the financial restructuring. The number of employees at the end of the quarter was 84 FTEs. For the full year, the operational EBITDA was -16.3 million euro divided in -12.5 million euro for holding and -3.8 million euro for other corporate staff functions. The reported EBITDA for year was -45.8 million euro, strongly influenced by the financial restructuring charges of 22.3 million euro. Outlook 2014 is a year of further recovery where we enter the next phase with focus on organic growth, enhancing our operational performance and recovery of Imtech’s financial health. Given the size of this transition and the challenging market circumstances, no specific forecasts are being made regarding 2014. 12 Risks and uncertainties In our Annual Report 2013, dated 17 March 2014, we have described our risk management systems and our major risk factors. Furthermore, we refer to the notes of the consolidated financial statements 2013, particularly note 2 and 29. Gouda, 18 March 2014 Board of Management Royal Imtech N.V. Financial calendar 2014 15 May 2014: first quarter results 22 May 2014: Annual General Meeting of shareholders 26 August 2014: second quarter and half-year results 18 November 2014: third quarter results Press conference Today at 9.00 hours (CET) Imtech will organize a press conference in the Novotel, Europaboulevard 10 in Amsterdam. Analyst meeting Today at 11.00 hours (CET) Imtech will organize a sell-side analyst meeting in the Novotel, Europaboulevard 10 in Amsterdam. This meeting will be transmitted live via the internet (www.imtech.com) and will afterwards also be available on the website as a replay. More information Media: Dorien Wietsma Director Corporate Communication & CSR T: +31 182 54 35 53 E: dorien.wietsma@imtech.com www.imtech.com Analysts & investors: Jeroen Leenaers Director Investor Relations T: +31 182 543 504 E: jeroen.leenaers@imtech.com www.imtech.com Imtech profile Royal Imtech N.V. is a European technical services provider in the fields of electrical solutions, ICT and mechanical solutions. With approximately 26,000 employees, Imtech is active attractive positions in the buildings and industry markets in the Netherlands, Belgium, Luxembourg, Germany, Austria, Eastern Europe, Sweden, Norway, Finland, the UK, Ireland and Spain, the European markets of ICT and Traffic as well as in the global marine market. In total Imtech serves 24,000 customers. Imtech offers integrated and multidisciplinary total solutions that lead to better business processes and more efficiency for customers and the customers they, in their turn, serve. Imtech also offers solutions that contribute towards a sustainable society - for example, in the areas of energy, the environment, water and traffic. Imtech shares are listed on the NYSE Euronext Amsterdam. 13 Appendix 1. Condensed consolidated profit and loss account .......................................................................... 15 2. Condensed consolidated balance sheet ........................................................................................ 16 3. Condensed consolidated statement of changes in equity .............................................................. 17 4. Condensed consolidated statement of cash flows ......................................................................... 18 5. Operating segments ....................................................................................................................... 19 6. Discontinued operations ................................................................................................................. 20 7. Net finance result ........................................................................................................................... 21 8. Financial glossary........................................................................................................................... 22 14 1. Condensed consolidated profit and loss account in € million, unless otherwise indicated Fourth quarter * 2013 2012 Full year 2013 2012 * Continuing operations Revenue Other income 1,296.1 2.9 1,485.0 7.3 4,936.3 8.6 5,336.3 18.6 Total revenue and other income 1,299.0 1,492.3 4,944.9 5,354.9 549.5 311.5 450.9 11.1 45.0 229.0 485.8 346.1 478.9 11.1 30.1 155.6 1,815.9 1,166.7 1,772.0 40.5 84.9 614.2 1,820.8 1,312.7 1,707.8 39.6 60.7 587.9 Total operating expenses 1,597.0 1,507.6 5,494.2 5,529.5 Result from operating activities (298.0) (15.3) (549.3) (174.6) (23.5) (18.7) (105.0) (62.0) (2.1) 1.9 (5.7) 2.8 (323.6) (32.1) (660.0) (233.8) (1.1) (7.6) 20.4 (1.8) (324.7) (39.7) (639.6) (235.6) (45.3) 1.3 (57.0) (4.9) Result for the period (net result) (370.0) (38.4) (696.6) (240.5) Attributable to: Shareholders of Royal Imtech N.V. Non-controlling interests (371.1) 1.1 (40.6) 2.2 (701.2) 4.6 (247.2) 6.7 Result for the period (net result) (370.0) (38.4) (696.6) (240.5) Basic earnings per share from continuing and discontinued operation From continuing operations (euro) From discontinued operation (euro) (2.15) (0.19) (1.26) (0.03) From result for the year (2.34) (1.29) Diluted earnings per share from continuing and discontinued operation From continuing operations (euro) From discontinued operation (euro) (2.15) (0.19) (1.26) (0.03) From result for the year (2.34) (1.29) (44.4) (23.7) Raw and auxiliary materials and trade goods Work by third parties and other external expenses Personnel expenses Depreciation of property, plant and equipment Amortisation and impairments Other expenses Net finance result Share in results of associates, joint ventures and other investments (net of tax) Result before income tax Income tax benefit / expense (-) Result from continuing operations Discontinued operation Result from discontinued operation (net of tax) Operational EBITDA * ** ** 5.6 76.5 Restated (based on continuing operations and change in accounting policy, IAS 19 Employee benefits (2011)). Non IFRS measure. 15 2. Condensed consolidated balance sheet in € million * 31 Dec 2013 31 Dec 2012 Property, plant and equipment Goodwill Other intangible assets Investments in associated companies and joint ventures Non-current receivables and other investments Deferred tax assets 161.0 1,032.8 149.0 2.5 21.9 19.9 170.8 1,081.6 218.1 3.7 28.8 34.0 Total non-current assets 1,387.1 1,537.0 72.8 443.9 859.3 134.0 8.9 296.4 80.0 572.8 1,132.1 190.5 13.3 385.1 1,815.3 2,373.8 Inventories Due from customers Trade receivables Other receivables Income tax receivables Cash and cash equivalents Assets held for sale 79.9 27.6 Total current assets 1,895.2 2,401.4 Total assets 3,282.3 3,938.4 Equity attributable to shareholders of Royal Imtech N.V. Non-controlling interests 304.6 8.7 514.8 9.7 Total equity 313.3 524.5 Loans and borrowings Employee benefits Provisions Deferred tax liabilities 907.3 207.1 35.8 45.9 42.7 209.8 13.0 62.9 1,196.1 328.4 106.2 39.7 275.2 756.5 476.4 20.3 38.8 314.3 825.9 308.0 890.8 652.9 30.8 37.7 1,713.1 3,060.4 59.8 25.1 Total current liabilities 1,772.9 3,085.5 Total liabilities 2,969.0 3,413.9 Total equity and liabilities 3,282.3 3,938.4 745.0 773.0 Total non-current liabilities Bank overdrafts Loans and borrowings Due to customers Trade payables Other payables Income tax payables Provisions Liabilities held for sale Net interest bearing debt * ** ** Restated (change in accounting policy, IAS 19 Employee benefits (2011)). Non IFRS measure. 16 3. Condensed consolidated statement of changes in equity Equity attributable to shareholders of Royal Imtech N.V. Total Noncontrolling interests Total equity 95.8 816.8 6.3 823.1 22.7 - 22.7 - 22.7 (88.8) 555.9 95.8 839.5 6.3 845.8 (4.8) - 23.5 (311.3) (283.7) 6.5 (277.2) - - - - (31.7) (31.7) (2.5) (34.2) - - - (24.7) - - (24.7) - (24.7) - - - - 10.5 - - 10.5 - 10.5 - - - - 1.9 3.9 - 5.8 - 5.8 - - - - - (0.9) - (0.9) (0.6) (1.5) 75.2 208.6 7.3 (10.4) (101.1) 582.4 (247.2) 514.8 9.7 524.5 75.2 208.6 7.3 (10.4) (101.1) 582.4 (247.2) 514.8 9.7 524.5 - - (9.8) 6.2 - (242.5) (454.0) (700.1) 4.2 (695.9) Share capital Share premium reserve Translation reserve Hedging reserve Reserve for own shares 74.2 209.6 (1.6) (5.6) (88.8) 533.2 - - - - - 74.2 209.6 (1.6) (5.6) - - 8.9 1.0 (1.0) Repurchase of own shares - Share options exercised Share-based payments in € million As at 1 January 2012, as previously reported Impact of change in accounting policy Restated as at 1 January 2012 Total comprehensive income for the year (restated) Dividends to shareholders Acquisition of noncontrolling interests without change in control Restated as at 31 December 2012 Restated as at 1 January 2013 Total comprehensive income for the year UnapRetained propriaearnings ted result 298.6 188.5 - - - - - 487.1 - 487.1 Dividends to shareholders - - - - - - - - (5.2) (5.2) Repurchase of own shares - - - - 0.4 - - 0.4 - 0.4 Share-based payments Acquisition of noncontrolling interests without change in control - - - - - 2.4 - 2.4 - 2.4 - - - - - - - - - - 373.8 397.1 (2.5) (4.2) (100.7) 342.3 (701.2) 304.6 8.7 313.3 Issue of shares As at 31 December 2013 17 4. Condensed consolidated statement of cash flows Fourth quarter 2013 Full year 2013 (370.0) (696.6) 11.5 46.7 66.0 18.0 2.1 0.3 40.8 (0.1) 0.8 41.1 92.1 78.0 105.0 5.7 (1.1) 40.8 2.4 (20.4) (183.9) (353.0) 5.4 179.2 30.6 70.6 31.4 7.7 67.9 241.7 (254.9) 20.5 133.3 (270.1) 1.8 14.5 (69.9) 12.5 Net cash flow from operating activities 149.6 (327.5) Cash flow from investing activities Proceeds from the sale of property, plant and equipment and other non-current assets Interest received Dividends received Disposal of discontinued operation (net of cash disposed of) Acquisition of subsidiaries (net of cash acquired) Acquisition of property, plant and equipment Acquisition of intangible assets (Purchase) sale of associates, joint ventures and other investments Issue less repayment of non-current receivables 3.3 1.7 1.8 9.6 (2.5) (17.3) (3.7) (5.0) 13.0 17.9 2.0 1.8 9.6 (27.7) (40.7) (16.7) (6.9) 2.9 0.9 (57.8) Cash flow from financing activities Proceeds from issue of share capital Proceeds from loans and borrowings Transaction costs related to loans and borrowings Sale (repurchase) of own shares Repayment of loans and borrowings Payments of finance lease liabilities Dividend paid (0.5) 30.1 (51.0) 0.1 (0.8) 487.1 528.5 (51.0) 0.4 (449.7) (2.0) (5.2) Net cash flow from financing activities (22.1) 508.1 Net change in cash, cash equivalents and bank overdrafts 128.4 122.8 64.8 (3.0) 70.8 (3.4) 190.2 190.2 in € million Cash flow from operating activities Result for the period Adjustments for: Depreciation of property, plant and equipment Amortisation and impairment of property, plant and equipment and intangible assets Impairment loss on trade receivables Net finance result Share in results of associates, joint ventures and other investments Result on disposal of non-current assets Loss on sale of discontinued operation (net of tax) Share-based payments Income tax expense Operating cash flow before changes in working capital and provisions Change in inventories Change in amounts due from/to customers Change in trade and other receivables Change in trade and other payables Change in provisions and employee benefits Cash flow from operating activities Interest paid Income tax paid Net cash flow from investing activities Cash, cash equivalents and bank overdrafts beginning of period Effect of exchange rate fluctuations on cash, cash equivalents and bank overdrafts Cash, cash equivalents and bank overdrafts at the end of the period 18 5. Operating segments in € million, unless otherwise indicated Fourth quarter * 2013 2012 Full year * 2013 2012 Revenue Benelux Germany & Eastern Europe UK & Ireland Nordic Spain ICT Traffic & Infra Marine Group management Revenue 186.2 185.8 174.7 237.6 34.6 260.8 111.1 111.8 (3.6) 1,299.0 155.1 436.3 200.9 227.0 31.0 207.3 105.9 128.6 0.2 1,492.3 682.8 968.6 738.0 891.6 126.9 740.1 384.6 415.9 (3.6) 4,944.9 766.1 1,372.1 750.6 804.9 156.1 667.0 346.0 491.7 0.4 5,354.9 Operational EBITDA Benelux Germany & Eastern Europe UK & Ireland Nordic Spain ICT Traffic & Infra Marine Group management Operational EBITDA 1.3 (32.8) 6.7 7.5 (0.5) 18.3 5.9 1.0 (1.8) 5.6 5.6 (4.5) 14.0 20.1 (0.4) 22.6 9.9 11.1 (1.9) 76.5 (17.6) (107.7) 30.7 29.8 (2.3) 36.9 12.0 (9.9) (16.3) (44.4) (19.1) (131.2) 44.6 59.6 (0.8) 43.8 11.6 (0.5) (31.7) (23.7) Operational EBITDA margin Benelux Germany & Eastern Europe UK & Ireland Nordic Spain ICT Traffic & Infra Marine Operational EBITDA margin 0.7% (17.7%) 3.8% 3.2% (1.4%) 7.0% 5.3% 0.9% 0.4% 3.6% (1.0%) 7.0% 8.9% (1.3%) 10.9% 9.3% 8.6% 5.1% (2.6%) (11.1%) 4.2% 3.3% (1.8%) 5.0% 3.1% (2.4%) (0.9%) (2.5%) (9.6%) 5.9% 7.4% (0.5%) 6.6% 3.4% (0.1%) (0.4%) Reported EBITDA Benelux Germany & Eastern Europe UK & Ireland Nordic Spain ICT Traffic & Infra Marine Group management Reported EBITDA (8.8) (239.7) 5.8 7.1 (0.8) 16.6 5.0 (15.3) (11.8) (241.9) (26.5) (4.5) 13.6 20.9 (4.9) 22.6 4.1 2.3 (1.7) 25.9 (63.4) (327.7) 28.2 25.0 (3.0) 32.7 (8.4) (61.5) (45.8) (423.9) (51.2) (131.2) 44.2 60.4 (5.3) 43.8 5.8 (9.3) (31.5) (74.3) * Restated (based on continuing operations and change in accounting policy, IAS 19 Employee benefits (2011)). 19 Operating segments (continuing operations) (continued) Order intake Order book Employees (FTE) in € million, unless otherwise indicated Fourth quarter 2013 Full year 2013 31 Dec 2013 31 Dec 2013 125.9 161.6 207.0 218.6 59.8 283.6 75.6 71.8 - 625.5 800.6 673.7 888.1 122.6 777.6 361.5 476.2 - 845.5 1,521.2 526.4 822.1 190.8 218.8 427.3 814.5 - 4,120 4,740 3,396 5,406 1,560 2,380 2,072 2,410 84 1,203.9 4,725.8 5,366.6 26,168 Benelux Germany & Eastern Europe UK & Ireland Nordic Spain ICT Traffic & Infra Marine Group management Total 6. Discontinued operations On 17 January 2014, we announced the conclusion of the strategic review of the Turkish business AE Arma-Elekropanç (Arma). It was concluded that the profile of Arma is not in line with the Group’s revised strategic framework and to sell our 80% shareholding to the previous owners and management of Arma. The operations in Turkey were included in the reporting segment Spain & Turkey in the condensed consolidated interim financial statements 30 June 2013 and were not previously reported as a held-for-sale or discontinued operations. The comparative consolidated statement of profit and loss account and consolidated statement of comprehensive income have been restated to show the discontinued operations separately from continuing operations. in € million Fourth quarter 2013 2012 2013 Full year 2012 Revenue Expenses Result before income tax Income tax Results from operation activities (net of tax) Loss on sale of discontinued operation 28.9 34.6 (5.7) 1.2 (4.5) (40.8) 34.7 34.6 0.1 1.2 1.3 - 124.3 141.4 (17.1) 0.9 (16.2) (40.8) 78.1 84.1 (6.0) 1.1 (4.9) - Result from discontinued operation (net of tax) (45.3) 1.3 (57.0) (4.9) 20 7. Net finance result in € million Interest income Interest expense on financial liabilities measured at amortised cost Net change in fair value of cash flow hedges transferred from equity Fourth quarter * 2013 2012 2013 Full year * 2012 1.4 1.6 1.4 1.6 (18.9) (10.2) (67.5) (38.8) (1.3) (0.9) (1.4) (5.2) (18.8) (9.5) (67.5) (42.4) Interest income on plan assets Interest cost on defined benefit obligation 0.9 (2.5) 1.7 (3.5) 2.6 (9.5) 8.1 (15.1) Net employee benefits financing component (1.6) (1.8) (6.9) (7.0) Change in fair value of contingent consideration Other finance income Net currency exchange loss Other finance expenses Other 4.4 0.7 1.2 (9.4) (3.1) 2.4 3.6 (0.7) (12.7) (7.4) 14.3 1.9 (4.4) (42.4) (30.6) 6.1 4.2 (2.9) (20.0) (12.6) (23.5) (18.7) (105.0) (62.0) Net interest expense Net finance result * Restated (based on continuing operations and change in accounting policy, IAS 19 Employee benefits (2011)). 21 8. Financial glossary Adjusted earnings per share Adjusted net result divided by the weighted average number of ordinary shares outstanding during the period. Adjusted net result Net result for shareholders before amortisation and impairment on intangible assets. Basic earnings per share Net result for shareholders divided by the weighted average number of ordinary shares outstanding during the period. Capital employed Non-current assets plus working capital plus assets held for sale. Capital expenditure (Capex) Sum of expenditure on property, plant, and equipment, and other intangible assets (e.g. software and technology). Part of cash flow from investing activities. Cash conversion Operating cash flow divided by EBITA. Diluted earnings per share Net result for shareholders divided by the weighted average number of ordinary shares outstanding during the period, diluted. Ordinary shares with dilutive potential arise from share-based payment arrangements. EBIT See operating result. EBITA EBITA is operating result plus amortisation and impairment on intangible assets. EBITDA EBITDA is EBITA plus depreciation on property, plant and equipment. EBITDA margin EBITDA as a percentage of total revenue. EBITDA growth Growth of EBITDA over a period with respect to the previous comparable period (including the impact of organic growth, acquisitions and divestments of operations, discontinued operations and, where applicable, currency effects). Interest coverage Calculated as the ratio between operational EBIT and net interest result (including net change in fair value of cash flow hedges transferred from equity). In the loan documentation, this ratio will be included as covenant from 31 December 2016 onwards. Leverage ratio Net interest-bearing debt plus restricted cash divided by operational EBITDA. In the loan documentation, this ratio will be included as covenant from 31 December 2016 onwards. 22 Net interest-bearing debt Sum of loans, borrowings and bank overdrafts minus derivatives at fair value, payment in kind reserve, contingent considerations (deferred acquisition payments) and cash and cash equivalents. Net interest result Interest received or receivable from third parties (interest income) less interest paid or due to third parties (interest expense). Net result Result for the period Net result for shareholders Result for the period attributable to the holders of ordinary shares of Royal Imtech N.V. Non-operational items Non-operational items relate to expenses arising that, given their size or nature, are clearly distinct from the ordinary activities of Imtech, such as restructuring costs, acquisition expenses, some refinancing costs, write offs legacy items, and results from divestments of operations. Operating result Result from operating activities. Operating cash flow Operational EBITDA plus or minus operational movements in working capital minus capex and plus or minus changes to operational provisions and accruals. Operational EBIT EBIT adjusted for non-operational items in EBIT. Operational EBITDA EBITDA adjusted for non-operational items in EBITDA. Operational EBITDA margin Operational EBITDA as a percentage of total revenue. Solvency Total equity as a percentage of the balance sheet total (total non-current assets plus total current assets). Working capital Current assets, excluding cash and cash equivalents and assets held for sale, less current liabilities, excluding bank overdrafts, loans and borrowings, provisions and liabilities held for sale. 23