Labour laws – Courts` interpretations

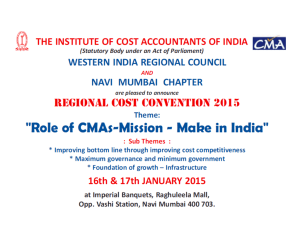

advertisement

Industrial Disputes Act, 1947 • Applicability – In case of appointment on job contract basis, reference under I.D. Act is not maintainable. E.C.I. Ltd. v. E.C.I. Service Engineers Union, AIR 2006 SC 2996 • S. 2(j) Industry Bihar Khadi Gramodyog Sangh is an industry. Gopalji Jha Shastri v. State of Bihar, (1983) 2 SCC 4: 1983 SCC (L&S) 262 Bangalore Water Supply & Sewerage Board v. A. Rajappa, (1978) 2 SCC 213: 1978 SCC (L&S) 215 – (a) Where (i) systematic activity, (ii) organized by co-operation between employer and employee (iii) for the production and/or distribution of goods and services calculated to satisfy human wants and wishes, prima facie, there is an ‘industry’ in that enterprise. (b) Absence of profit motive or gainful objective is irrelevant, be the venture in the public, joint, private or other sector. (c) The true focus is functional and the decisive test is the nature of the activity with special emphasis on the employer-employee relations. (d) If the organization is a trade or business it does not cease to be one because of philanthropy animating the undertaking. All organized activity possessing the triple elements, although not trade or business, may still be ‘industry’ provided the nature of the activity, viz. the employer-employee basis, bears resemblance to what we find in trade or business. The consequences are (i) professions, (ii) clubs, (iii) educational institutions, (iv) co-operatives, (v) research institutes, (vi) charitable projects, and (vii) other kindred adventures, if they fulfil the above triple tests, cannot be exempted from the scope of Section 2(j). Real estate company is an industry. Karnani Properties Ltd. v. State of W.B., (1990) 4 SCC 472 • S. 2 (k) – Industrial dispute The dispute arising out of breach of certified standing orders (last come first go) is an industrial dispute and Civil court has no jurisdiction. Chief Engineer, Hydel Project v. Ravinder Nath, (2008) 2 SCC 350 An industrial dispute must be supported by a number of workmen; or sponsored or espoused by the Union. There is no particular form prescribed to effect such espousal. Proof of support by the union may also be available aliunde. J.H. Jadhav v. Forbes Gokak Ltd., (2005) 3 SCC 202 Even an outside Union may espouse the case of a workman. Workmen v. Indian Express (P) Ltd., (1969) 1 SCC 228 : AIR 1970 SC 737 Employment and non-employment Under the concept of employment the employee agrees to serve the employer subject to his control and supervision. On the other hand, non-employment being negative of the expression “employment” would ordinarily mean a dispute when the workman is out of service. When non-employment is referable to an employment which at one point of time was existing would be a matter required to be dealt with differently than a situation where non-employment would mean a contemplated employment. Workmen of Nilgiri Coop. Mkt. Society Ltd. v. State of T.N., (2004) 3 SCC 514 Any person “Any person” cannot be read without limitation and a person in respect of which the employer-employee relationship never existed and can never possibly exist cannot be the subject-matter of dispute between employers and workmen. Bongaigaon Refinery & Petrochemicals Ltd. v. Samijuddin Ahmed, (2001) 9 SCC 557 S. 2 (Ka) – Industrial establishment Since there was no functional integrity in the sixty factories of the Company, the units had to be taken as one. Monthly Rated Workmen v. Indian Hume Pipe Co. Ltd., 1986 Supp SCC 79 • S. 2 (l) – Lock-out • The true test to determine whether it is closure or lock out is whether the closure was a device or pretence to terminate services of workmen or whether it is bona fide and for reasons beyond the control of the employer. The duration of the closure may be a significant fact to determine the intention and bona fides of the employer at the time of closure but is not decisive of the matter. If a rigid view is taken that in case of a lockout there is only closure of the place of business whereas in case of a closure there is a closure of the business itself permanent and irrevocable the if an employer who has resorted to closure, bona fide wants to reopen, revive and re-start the industrial activity he cannot do so on the pain that the closure would be adjudged a device or pretence. General Labour Union (Red Flag), Bombay v. B.V. Chavan, AIR 1985 SC 297: 1985 SCC (L & S) 253 • S. 2(oo) – Retrenchment S. 2(oo)(bb) Termination of a workman having not completed 240 days is not retrenchment. Bhogpur Co-op. Sugar Mills Ltd. v. Harmesh Kumar, AIR 2007 SC 288. Onus of proving that the workman had worked for 240 days in 12 calendar months is on the workman, not the employer. Batala Co-op. Sugar Mills Ltd. v. Sowaran Singh, AIR 2005 SC 56 Termination of service of contract workers for specific period on completion of contract period is not retrenchment. Punjab State Electricity Board v. Sudesh Kumar Puri, AIR 2007 (Supp) 647 When a workman is terminated after 89 days on a regular basis and re-appointed after a gap of one or two days, it is unfair labour practice and in such cases provision of S. 2(oo)(bb) is not attracted. Haryana State Electronics Devpt Corpn v. Mamni, AIR 2006 SC 2427 : (2006) 9 SCC 434. Plea that termination of employment of workers employed against particular Scheme falls under S. 2(oo)(bb) cannot be raised for first time in appeal before Supreme Court. Executive Engineer ZP Engg. Divn. V. Digambara Rao, AIR 2004 SC 4839 • Retrenchment means the termination by the employer of the service of a workman for any reason whatsoever except those expressly excluded in the section. Section 2(oo)(bb) should be harmoniously construed with Sections 25-F, 25-G and 25-H. Punjab Land Development and Reclamation Corpn. Ltd. v. Presiding Officer, (1990) 3 SCC 682 • S. 2(p) – Settlement The bipartite agreement authorized the Bank to stop the stagnation increment of the employee who is reverted on his own request after one year of his promotion. Thus when the employee requested for his reversion after one year of promotion, it was held that the Bank was right in stopping stagnation increment. However, it was held that the Bank cold not stop the employee’s promotion for all times to come because of his request reversion. C. V. Satheeshchandran v. General Manager, UCO Bank, AIR 2008 SC (Supp) 1371 When a settlement applies to employees as on a cut-off date, it also applies to all employees appointed thereafter. Ceat Ltd. v. Murphy India Employees Union, AIR 2006 SC 2412 When employment was given to widow of a worker dying in harness on contract basis but at the instance of the Union, it was held that the contract was not a settlement. Indian Drugs and Pharmaceuticals Ltd. v. Devki Devi, AIR 2006 SC 2691 Settlement can only be in writing. No oral agreement or pleading can vary, modify or supersede a written settlement. Fabril Gasosa, M/s v. Labour Commissioner, AIR 1997 SC 954 Settlement in course of conciliation proceeding is binding on all parties to industrial dispute, i.e. in case of employer, on his heirs, successors, or assigns and in case of workmen, all persons employed in establishment. Settlement by agreement between employer and workmen otherwise than in course of conciliation proceeding is not binding on workmen not parties to it . General Manager, Security Paper Mill, Hoshangabad v. R.S. Sharma, AIR 1988 SC 954 • S. 2(q) – Strike Unless the strike is legal and justified, workmen are not entitled to wages. Syndicate Bank v. Umesh Nayak, AIR 1995 SC 319 Pendown strike is strike. Punjab National Bank Ltd. v. All India Punjab National Bank Employees’ Federation, AIR 1960 SC 160 • S. 2(ra) – Unfair labour practices • S. 2(s) A workman employed on a part time basis but under the control and supervision of an employer is a workman in term of Section 2(s) of the Act, and is entitled to claim the protection of Section 25F. Divisional Manager, New India Assurance Co. Ltd. v. A. Sankaralingam, AIR 2009 SC 309: (2008) 10 SCC 698 An employee appointed as Industrial Relations Executive has to draft management enquiry and to hold conferences with the advocates in relation to the company's acts. Being in the category of management staff Gr. II, his conditions of service were different than those provided for the workers of the Company. Leave given to him were not applicable under the settlement. He was covered under the Pension Scheme which did not apply under the settlement with employees. It was held therefore that he was not a workman. C. Gupta v. Galaxosmithklin Pharmaceutical Ltd., AIR 2007 SC (Supp) 1244 Duty of a Legal Assistant is to supervise Court cases and whenever necessary to prepare draft reply of matters pending in Court. Such employees are professionals and cannot be termed as workman under any law. Muir Mills Unit of N. T. C. (U. P.) Ltd. v. Swayam Prakash Srivastava, AIR 2007 SC 519 : (2007) 1 SCC 491 Professional job involves creativity and is not stereotype. Professionals cannot be workmen. Management of M/s. Sonepat Co-op. Sugar Mills Ltd. v. Ajit Singh, AIR 2005 SC 1050 : (2005) 3 SCC 232 Housing Co-operating Society is not an industry. Its employees cannot be treated to be workmen as defined in S. 2(s). Md. Manjur v. Shyam Kunj Occupants’ Society, AIR 2005 SC 1501 An apprentice under the 1961 Act is not a workman. U.P. State Electricity Board v. Shiv Mohan Singh, AIR 2004 SC 5009 Employees of the Canteen maintained by NTPC as per statutory obligation under S. 46 of Factories Act are workmen of NTPC. National Thermal Power Corporation v. Karri Pothuraju, AIR 2003 SC 3647 Whether an Area Sales Executive is a workman has to be adjudicated by the Labour Court/ Industrial Tribunal. Government cannot decide the issue and refuse to make a reference. Sharad Kumar v. Govt of NCT of Delhi, AIR 2002 SC 1724 Commission amount received by Deposit Collectors was 'wage' linked to productivity. Deposit Collectors of Bank are therefore 'workmen‘. Indian Banks Association v. Workmen of Syndicate Bank, AIR 2001 SC 946 Medical representatives are not workmen. Rhone-Poulenc (India) Ltd. v. State of U.P., AIR 2000 SC 3182 : (2000) 7 SCC 675 R.B. I. is neither legally obliged to run canteen nor has effective control to supervise the work done by canteen employees. Such employees are not workmen of the R.B.I. Employees in relation to the Management of Reserve Bank of India v. Their Workmen, AIR 1996 SC 1241 : (1996) 3 SCC 267 Bank employee in clerical grade is a workman. Syed Azam Hussaini v Andhra Bank Ltd., AIR 1995 SC 1352 Shop Manager/In-charge of a local shop of a big company discharging duties of administrative and managerial nature. He is not a workman though either incidentally he is required to do some clerical work or is not vested with power to appoint or discharge employees under him. S.K. Maini v. Carona Sahu Co. Ltd., AIR 1994 SC 1824 Appraiser engaged by bank to appraise quality, purity and value of ornaments offered for pledging to bank is not a workman. Management of M/s Puri Urban Co-operative Bank v. Madhusudan Sahu, AIR 1992 SC 1452 A person performing duties requiring imaginative and creative mind and involving suggesting of ways and means to improve sales of company's product and publicity in markets and melas; advertisements including need for posters, holders and cinema slides is not a workman. T.P. Srivastava v. M/s National Tobacco Co. of India Ltd., AIR 1991 SC 2294 Internal Auditor in company, only checking up on behalf of employer and having no independent right or authority to take decision, not doing supervisory work – is a "workman”. National Engineering Industries Ltd. v. Kishen Bhageria, AIR 1988 SC 329 Maintenance Engineer having power to grant leave, initiate disciplinary proceedings and make temporary appointments is not a workman. Vimal Kumar Jain v. Labour Court, Kanpur, AIR 1988 SC 384. Though school is industry, teacher employed in school is not workman. A. Sundarambal . Govt. of Goa, Daman and Diu, AIR 1988 SC 1700 Primary and basic duties and not incidental duties constitute the criterion for determining whether a person is a workman. Arkal Govind Raj Rao v. Ciba Geigy of India Ltd., AIR 1985 SC 985 Piece rated Tailors working in big tailoring establishment are workmen. Shining Tailors v. Industrial Tribunal II, U.P., AIR 1984 SC 23 Development Officer in Life Insurance Corporation is workman. S.K. Verma v. Mahesh Chandra, AIR 1984 SC 1462 Blending Supervisors in Burma Shell Oil Storage and Distributing Co. of India, Ltd. - Some are workmen and some are not. Burma Shell Oil Storage and Distributing Co. of India, Ltd. v. Burma Shell Management Staff Asscn., AIR 1971 SC 922. • S. 2-A In enacting Section 2A the intention of the legislature was that a individual workman who was discharged, dismissed or retrenched or whose services were otherwise terminated should be given relief without its being necessary for the relationship between the employer and the whole body of employees and attracted to that dispute and the dispute becoming a generalised one between labour on the one hand and the employer on the other. Chemicals and Fibres of India Ltd. v. D.G. Bhoir, AIR 1975 SC 1660 • S. 10 – Reference of industrial dispute A reference u/S. 10(1) cannot be used to circumvent or by pass the statutory scheme provided u/S. 25-N. Empire Industries Ltd., M/s. v. State of Maharashtra, AIR 2010 SC 1389 Badli workers have no protection under the Act. Bangalore Metropolitan Transport Corporation v. T.V. Anandappa, AIR 2009 SC (Supp) 1058 The Industrial dispute should be existing or apprehended at the time of reference. When the matter was sought to be raised seeking reference after seven years, it was held to be stale because at that time there was no industrial dispute. However when a matter can be said to be stale or delayed depends on the facts of the case, but a matter which has attained finality cannot be reopened. Haryana Land Reclamation and Development Corpn. Ltd. v. Nirmal Kumar, AIR 2008 SC (Supp) 390; Manager (now Regional Director), R. B. I. v. Gopinath Sharma, AIR 2006 SC 2614 Although the only dispute was with regard to the regularization of the services of the contractual employees, it was open to the Industrial Tribunal to determine the nature of the employment as to whether the employees were employees of the contractor or the principal employer. G. M., O. N. G. C., Shilchar v. O. N. G. C. Contractual Workers Union, AIR 2008 SC (Supp) 1994 When the principal question under reference was as to whether the termination of services of the seasonal worker was justified; the Labour Court could not go into the question as to whether the Company was bound to take the services of the worker in all subsequent seasons or not. Bhogpur Co-op. Sugar Mills Ltd. v. Harmesh Kumar, AIR 2007 SC 288 A settlement was reached between the Bank and Association of majority of employees, not signed by Employees Federation representing minority of employees. Bank extended benefit under settlement to employees who were not members of Association on accepting the settlement in writing. Federation disputed the clause in settlement giving benefit only to members of the Association and action of Bank extending benefit to other employees on giving individual acceptance of the settlement. Such dispute was not industrial dispute. Reference of dispute by Govt. to Industrial Tribunal, was held not proper. Government order making reference can be challenged in writ petition if futility of the reference can be shown. ANZ Grindlays Bank Ltd. v. Union of India, AIR 2006 SC 296. Reference can be made only if a employer-employee relationship exists. ECI Ltd. v. ECI Service Engineers Union, AIR 2006 SC 2996 Question as to whether contract labour should be abolished or not cannot be the subject matter of reference. Steel Authority of India Ltd. v. Union of India, AIR 2006 SC 3229 Dispute with respect to bonus payable or with respect to application of Bonus Act in public sector, is deemed to be an industrial dispute. Reference can be made for adjudication. A.P. Foods v. S. Samuel, AIR 2006 SC 3622. Tribunal cannot decide disputes relating to non-workmen. Mukand Ltd. v. Mukand Staff and Officers’ Association, AIR 2004 SC 3905 Termination without payment of retrenchment compensation gives rise to industrial dispute. Range Forest Officer v. S.T. Hadimani, AIR 2002 SC 1147 Question whether Area Sales Manager falls within definition of "workman" or not is an industrial dispute. Sharad Kumar v. Govt. of NCT of Delhi, AIR 2002 SC 1724 Industrial Tribunal is the creation statute and it gets jurisdiction on the basis of reference. Therefore it cannot go into the question on validity of the reference. National Engineering Industries Ltd. v. State of Rajasthan, AIR 2000 SC 469 • S. 11 and 11-A – Powers of Labour Courts etc. When a reference is made under Section 10 of the Act, all incidental questions arising thereto can be determined by the Tribunal. State Bank of India v. Ram Chandra Dubey, (2001) 1 SCC 73 Labour Court can consider the evidence already considered by the domestic tribunal and arrive at a conclusion different from the one arrived at by the domestic tribunal. Workmen v. Balmadies Estates, (2008) 4 SCC 517 Tribunal is duty-bound to consider whether back wages have to be awarded and if so, to what extent. P.V.K. Distillery Ltd. v. Mahendra Ram, (2009) 5 SCC 705 Grant of relief must depend on the fact situation. Therefore the Industrial Tribunal is not bound to grant some relief only because it will be lawful to do so. Manager, Reserve Bank of India v. S. Mani, (2005) 5 SCC 100 The Tribunal must attempt to strike a balance between the claim of the worker and situation f the employer. Laxmi Rattan Cotton Mills Ltd. v. State of U.P., (2009) 1 SCC 695 While doing so, it is necessary for the Industrial Courts also to consider as to whether the industry has been sick or not. If it is found that the industry is not in a position to bear the financial burden, an appropriate award, as a result whereof the equities between the parties can be adjusted, should be passed. Talwara Coop. Credit and Service Society Ltd. v. Sushil Kumar, (2008) 9 SCC 486 It is not proper for the Tribunal to make an award as if appointing an incumbent to the post. Entitlement to a post can be determined only on the touchstone of relevant rules or on the basis that he is discharging such functions. When the findings are not clear as if the employee was functioning in the post to which claim is made, no relief could have been given. U.P. SEB v. Hydro-Electric Employees Union, (2002) 10 SCC 417 The Tribunal while deciding the issue of termination of the workers can go into the cause thereof to find out whether there was a closure and whether such closure was bona fide. J.K. Synthetics v. Rajasthan Trade Union Kendra, (2001) 2 SCC 87 Material on record in terms of Section 11-A of the Industrial Disputes Act will include enquiry report as well as further evidence led before the Tribunal. The Industrial Tribunal cannot act as an Appellate Tribunal. West Bokaro Colliery (TISCO Ltd.) v. Ram Pravesh Singh, (2008) 3 SCC 729 It is open to the Labour Court/Industrial Tribunal to interfere with the quantum of punishment for good and valid reasons where the workman concerned is found guilty of misconduct. L.K. Verma v. HMT Ltd., (2006) 2 SCC 269 • S. 17, 17-A and 17-B Provisions of S. 17(1) are directory. Publication of award beyond fixed time does not invalidate the award. Remington Rand of India Ltd. v. The Workmen, AIR 1968 SC 224 A Tribunal ordinarily makes its award operative from the date of reference; but, in exceptional circumstances it gives retroactive operation to some of its proposals. Hindustan Antibiotics Ltd. v. The Workmen, AIR 1967 SC 948 S. 17(2) gives finality to an award. However Rule 28 (31 ?) provides for correction therein. It is only a clerical mistake or error which can be corrected, and the clerical mistake or error must arise from an accidental slip or omission in the award. It must be a mistake or error amenable to clerical correction only. It must not be a mistake or error which calls for rectification by modification of the conscious adjudication on the issues involved. Tata Consulting Engineers v. Workmen employed under them, AIR 1981 SC 599 Under S. 17-A of the Act, an award becomes enforceable on the expiry of 30 days from the date of its publication under S. 17. The proceedings with regard to a reference under Section 10 of the Act are therefore, not deemed to be concluded until the expiry of 30 days from the publication of the award. Till then the Tribunal retains jurisdiction over the dispute referred to it for adjudication and up to that date it has the power to entertain an application in connection with such dispute. Radhakrishna Mani Tripathi v. L. H. Patel, AIR 2008 SC (Supp) 928 • Section 17-B has been enacted by Parliament with a view to give relief to a workman who has been ordered to be reinstated under the award of a Labour Court or the Industrial Tribunal during the pendency of proceedings in which the said award is under challenge before the High Court or the Supreme Court. The object underlying the provision is to relieve to a certain extent the hardship that is caused to the workman due to delay in the implementation of the award. The payment which is required to be made by the employer to the workman is in the nature of subsistence allowance which would not be refundable or recoverable from the workman even if the award is set aside by the High Court or Supreme Court. Therefore the words "full wages last drawn“ are used. Therefore, the words "full wages last drawn" must be given their plain and material meaning and they cannot be given the extended meaning. Dena Bank v. Kiritikumar T. Patel, AIR 1998 SC 511 • S. 22-24 – Prohibition of strikes and lock-outs Workman went on illegal strike. Although strike was subsequently called off, workman continued to disrupt working in the factory from within factory premises. Company declared Lock out. It was held that the lock out must be regarded as in consequence of the illegal strike and cannot be regarded as illegal even if provisions of S. 22 were not complied with. Workmen were held not entitled to wages for the lock out period. H. M. T. Ltd. v. H. M. T. Head Office Employees' Assocn., AIR 1997 SC 585 The strength of a trade union depends on its membership. The right to demonstrate and, therefore, the right to strike is an important weapon in the armoury of the workers. But the right to strike is not absolute under our industrial jurisprudence and restrictions have been placed on it under sections 22 and 23 of the I.D. Act, 1947. Where no proceedings were pending before conciliation board, labour court or arbitration tribunal nor any settlement or award touching the striking workmen was in operation during the strike period, it was held that the strike was not illegal. B.R. Singh v. Union of India, AIR 1990 SC 1 Strike commenced within four days of conclusion of conciliation proceedings was held illegal. India General Navigation and Railway Co. Ltd. v. Their Workmen, AIR 1960 SC 219 If a conciliation proceeding is pending between one union and the employer and it relates to matters concerning all the employees of the employer, the pendency of the conciliation proceeding would be a bar against all the employees of the employer to go on a strike during the pendency of the said proceedings under S. 22 (1) (d). Ramnagar Cane and Sugar Co. Ltd. v. Jatin Chakravorty, AIR 1960 SC 1012 Pendency of a dispute between an individual workman as such and the employer does not attract the provisions of Section 23. It means that pendency of a dispute relating to an individual workman under Section 2A will not debar the other workers from going on strike. Chemicals and Fibres of India Ltd. v. D.G. Bhoir, AIR 1975 SC 1660 • Mere breach of a Standing Order could not render the strike illegal under Sections 23 and 24. Ballarpur Collieries Co. v. Presiding Officer, C. G. I. T. Dhanbad, AIR 1972 SC 1216 Strike called by the union ignoring conciliation proceedings, management’s offer and request for deferring the strike for even one day was held illegal. Management of the Fertilizer Corporation of India Ltd. v. Workmen, AIR 1970 SC 867 S. 25-B – Continuous service Service rendered under two different establishments, although under one central management, cannot be clubbed to reckon continues service of 240 days in a calendar year. Haryana State Co-operative Supply Marketing Federation Ltd. v. Sanjay, AIR 2009 SC 3155 Completion of 240 days' work does not confer right of regularisation. Hindustan Aeronautics Ltd. v. Dan Bahadur Singh, AIR 2007 SC 2733 The expression "actually worked under the employer" cannot mean those days only when the workman worked with hammer, sickle or pen, but must necessarily comprehend all those days during which he was in the employment of the employer and for which he had been paid wages. Thus Sundays and other paid holidays should be taken into account for the purpose of reckoning the total number of days on which the workman could be said to have actually worked. Workmen of A. E. I. B. Corpn. v. Management A. E. I. B. Corpn., AIR 1986 SC 458 However period of illegal strike has to be excluded. Management of Standard Motor Products of India Limited v. A. Parthasarathy, AIR 1986 SC 462 Section 25-B (2) comprehends a situation where a workman is not in employment for a period of 12 calendar months, but has rendered service for a period of 240 days within the period 12 calendar months commencing and counting backwards from the relevant date, i.e., the date of retrenchment. If he has, he would be deemed to be in continuous service for a period of one year for the purpose of Section 25-B and Chapter V-A. • S. 25-C – Compensation for lay-off • S. 25-F – Conditions precedent for retrenchment (less than 1 year) • S. 25-FF – Compensation for transfer of undertaking • S. 25-FFF – Compensation for closing down of undertaking – Badli worker • S. 25-G – Procedure for retrenchment • S. 25-N – Condition precedent for retrenchment (not less than 1 year) • S. 25-T – Unfair labour practice • S. 33 –Conditions of service – not to change • S. 33-A – Adjudication • S. 36 – Representation in departmental proceedings Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959 • S. 3 – Applicability • S. 4 – Notification of vacancies • S. 5 – Returns Employee’s Compensation Act, 1923 • S. 3 – Employer’s liability for compensation • S. 4 – Amount of compensation • S. 4-A – Payment of compensation • S. 5 – Method of calculating wages Payment of wages Act,1936 • Sections 12 to 17 and 22 Payment of Bonus Act, 1965 • Sections 4 to 9, 15 and 25 Factories Act, 1948 • Section 41B,41C, 41H, 46, 67, 71, 85, 86, 93, 96A, 97 and 101 Payment of Gratuity Act, 1972 • Sections 2, 2A, 4A, 7 and 10 Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 • S. 7A • S. 7C