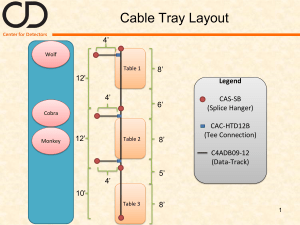

Operational Support Services

advertisement

Corporate Presentation NASDAQ: UTSI December 2011 Disclosure & Forward Looking Statements This investor presentation contains forward-looking statements, including statements regarding the Company's strategy to reduce operating expenses, ability to achieve profitability, investment in selective products and certain geographic regions, diversification of business and customer base, transition to a new business model and anticipated or assumed future financial results. Forwardlooking statements are based on current expectations, estimates, forecasts and projections about the Company, the Company’s future performance and the industries in which the Company operates as well as on the Company management's assumptions and beliefs. These forward-looking statements are only predictions and are subject to risks and uncertainties related to, among other things, the ability of the Company to realize anticipated results of operational improvements, increase bookings, successfully transition to a new management team and headquarters location and execute on its business plan, as well as risk factors identified in its latest Annual Report on Form 10-K, as amended, Quarterly Reports on Form 6K and 10-Q and Current Reports on Form 8-K, as filed with the Securities and Exchange Commission. Therefore, actual results could differ materially and adversely from the Company's current expectations. We undertake no obligation to update these forward-looking statements to reflect events or circumstances occurring after the date of this investor presentation. The Company is in a period of significant transition and in the conduct of its business is exposed to additional risks as a result. This investor presentation also includes financial guidance and information about the Company previously disclosed during the Company's 2009, 2010 and 2011 earnings conference calls, restructuring announcements on December 18, 2008 and November 9, 2009 and other filings with the Securities and Exchange Commission. Such guidance and information reflects the Company’s information and expectations as of those dates and this presentation is not intended to confirm or update that information and expectations. 2 Agenda 1 Corporate Overview 2 Market Dynamics & Growth Strategy 3 Financial Overview and Outlook 3 CORPORATE OVERVIEW Company Introduction A leading provider of interactive, IP-based network solutions in iDTV, IPTV, Internet TV and Broadband for cable and telecom operators Technology and services expand and help modernize communications networks, giving operator customers the capability to provide their subscribers with interactive communications experiences while opening up increased revenue opportunities for operator clients The new service business represents a “business model innovation” that leverages UTStarcom’s current core technology and management background to generate more recurring, higher margin returns. Share Price: Shares Outstanding: Market Cap: Legal Counsel: Auditors: $1.37 (as of December 9, 2011) 155.4 m $212.9 m (as of December 9, 2011) Wilson Sonsini Goodrich & Rosati Price Waterhouse 5 Investment Highlights Focused on achieving breakeven in 2011 Strong existing relationships with leading telecom, cable and media players in China and across the rest of Asia Well positioned to benefit from China’s Three Network Convergence policy and development Diversifying business model into high-margin new service business (“Operation Support Business”) with recurring revenues Diversifying customer base to broaden profit opportunities Strong cash position and no debt 6 Our Positioning and Growth Strategy A leading provider of interactive, IP-based network solutions in iDTV, IPTV, Internet TV and Broadband to cable and telecom operators Strategy 1: Return to China Strategy 2: Telecom and Cable in Parallel Strategy 3: Equipment AND Service • Enables focus on Chinese and Asian markets • Leverage Three Network Convergence (TNC) policy in China • Senior management close to client decision-makers • Improved internal communication & lower costs • Core IP technology applied across different networks • Strong competitive edge and opportunity with both telecom and cable operator • Demand for interactive services creates opportunity for equipment AND services revenues with higher margin earnings • New service business model moves UTStarcom up the value chain and closer to interactive TV operators Our existing telecommunication equipment products, RollingStream technology and sales channels are the foundation of new service business, which taps a major opportunity in video content services over the broadband network and internet. 7 RollingStream Technology SOLUTION AND VALUE TO CUSTOMER PRODUCTS OR SERVICE PROVIDED TARGET CUSTOMERS RollingStream® Technology: provides customers market leading interactive TV solutions RollingStream enables operators to 1.Telecom provide IPTV, iDTV, Internet TV, mobileTV, operators video information and other industrial applications. Hardware includes: 2. Cable operators Infrastructure Components: 3. TV stations and content Video Storage and OSS license holders Streaming Servers who, in China, run broadcast Terminals: control IP STB Dual-mode STB platforms 8 Broadband and NGN Solutions SOLUTION AND VALUE TO CUSTOMER PRODUCTS OR SERVICE PROVIDED TARGET CUSTOMER Broadband Solution: provides high bandwidth network infrastructure for communications networks • PTN 1.Telecom operators TN725 2. Cable operators • MSTP NetRing 4K NetRing2500 • G/E-PON BBS 4000 NGN Solution: Provides a multiservice IP-based soft switch system for voice, data, mobile and multimedia operations TN705 ONU 1.Telecom operators 2. Cable operators Call server Media Gateway 9 Leading Market Position China Focus Area UTStarcom’s Achievements Interactive Television (including IPTV, iDTV & Internet TV) Currently leading IPTV market share in China Contracts won from both cable and telecom operators in Zhejiang, Fujian, Anhui and Shenzhen to expand IPTV system Won 10 contracts with city level cable operators for iDTV Built 6 IPTV Broadcast Control Platforms out of 12 TNC pilot cities Will launch Internet TV platform through Stage Smart acquisition in the first half of 2011 TNC Broadband Infrastructure Launched EPON fiber access projects in 10 regional cable markets Won China’s first PTN contract for Cable MSO in Sichuan province Smart Grid Approved as a qualified EPON supplier for China State Grid Company The first EPON supplier to China’s electricity grid companies and supply EPON product to the provincial Electricity Grid Company in Ningxia 10 Leading Positioning on APAC Market (I) Market & Focus Area UTStarcom’s Achievements South Asia: IPTV: Cooperate with MTNL, BSNL, Bharti, SLT and other leading South Asia operators to secure our market leading position Exploring a joint venture with local partner in India with better government relations and local market support to retain and extend leading position in IPTV sector Successfully launched GEPON project with BSNL Received the first Purchase Order of IPTV systems from TOT in Thailand in the fourth quarter of 2010 Focused on IPTV and Broadband Broadband: Currently have more than 30% market share UTStarcom Confidential Leading Positioning on APAC Market (II) Market & Focus Area UTStarcom’s Achievements Japan: 50% of SoftBank Broadband (SBB)’s MSTP transmissions. SBB is currently Japan’s 3rd largest telecom operator Preferred PTN supplier of next generation IP transmission equipment for SBB Continue to receive sizable orders of PTN product in year 2011 Focused on Broadband Taiwan: Won sizable MSTP and PTN contracts from Chunghwa Telecom Focused on Broadband UTStarcom Confidential Market Dynamics & Growth Strategy China’s Three Network Convergence: a growth catalyst for UTStarcom Equipment Spending & Network Buildout Media Platform Spending 16% Set Top Box Sales 28% Telecom Network Buildout 42% Cable Network Buildout 14% Three Network Convergence (TNC) is the Chinese government policy dedicated to integration of telecom, broadband and cable TV networks Three Network Convergence related market will reach RMB 688B over the next three years, including RMB 249B on equipment and network buildout and RMB 439B from interactive media user demand Pilots concluded and expansion drives ahead Focused on cable / teleco two-way entrance National Implementation Policy Launched 2010 Pilots Conducted 2010—2012 2013—2015 Source: iChina Research Center, 2010.4, “Analysis of Market Size, Industry and Region for Three-Network Convergence” and policy directives issued by China’s State Council. 14 Strategy 2: Parallel Growth Opportunities Service • • TNC will increase opportunities with cable and telecom operators because of infrastructure investment Our Broadband, RollingStream video platform and mSwitch NGN solutions help meet the TNC needs of both sectors Cable Telco Interactive video services 4million (iDTV) 6.7million (IPTV) Broadband service <5million >100million Bi-directional network percentage <25% 100% Voice services none >1 billion 187 million 88 million none TV and Digital TV service Source: SARFT Report January 2011 and UTStarcom 15 New Business Model of Cable Operators Traditional TV Channel Basic Service (1) Revenue Structure of Cable Operators 58% Subscribed Channel 90% 42% 10% Information Channel US China Value-Add HD Channel Basic ARPU Comparison among Countries USD Video on Demand Service of Cable Operators Value-Added Service Time Shifting Over Cable Online Gaming & Shopping Broadband Network Service Data Service GDP per Person Private Network Service UTStarcom Confidential 16 16 Strategy 3: Our Operational Support Services RollingStream platform allows our clients to provide end-to-end solutions including, video content service and other value added services like on-line gaming, on-line shopping and video phone service through their networks Cable network operators need partners that can provide continued technological and operational support services for these platforms Operational Support Services (OSS) expands our revenue stream with higher margin, recurring revenues Enterprise Operators TV and Cable Operators iDTV Platforms Equipment Sales Related Service Business Telecom Operators IPTV, Internet TV Platforms IP Signage Platforms 17 An Overview of the New Service or “Operational Support Services” Business Content Producers /Providers VAS Solutions RollingStream Video Platform Ad Management Solutions Content Distribution Internet TV Platform by Stage Smart Acquisition Mobile TV Subscriber Base IPTV/iDTV Subscriber Base Internet TV Subscriber Base 18 Recent Business Development Successfully completed the construction of first Internet TV platform to support a cable TV network customer Launched DOCSIS-EOC application (“EOC application”), Packet Transport Network 735 (“PTN 735”), MS 3005 server and several Wi-FI products at PT/EXPO COMM CHINA 2011 Won IPTV integrated broadcasting control platform contract in Tianjin and Zhejiang Province Won MSTP and PTN contracts from Taiwan’s Chunghwa Telecom, the largest integrated telecom operator in Taiwan Entered into strategic revenue-sharing partnership agreement with Wasu Digital TV Media Group, one of the largest digital TV content providers in China Won E-Town 12 square kilometers affordable housing area telecommunication network project 19 iTV.cn: Internet TV for Chinese outside China Q3 2011 Q4 2011 Commercial launch in North America on October 1st Provides Chinese language content targeting the Chinese-speaking population located in North America Integrated multi-screen viewing from a single managed platform Education Shopping Social Time and location shifting Reliable HD streaming Gaming Radio Multi-language programming Value-added interactive service, such as distance-learning, gaming and ecommerce 20 Financial Overview and Outlook Third Quarter 2011 Highlights Net Income of $8.0 million, or basic earnings per share of 5 cents; Revenues of $83.3 million, a 35.7% or $21.9 million increase, compared to the same period of 2010; Gross profit margin of 38.4%, compared to 19.7% in same period of 2010, 37.6% in Q2 2011 and 31.1% in Q1 2011; Operating income of $14.2 million; Cash balance of US$305.9 million in cash, cash equivalents, and short-term investments. 22 Revenue Trend $83.3 million in Q3 2011, 35.7% or $21.9 million increase, compared to $61.4 million in Q3 2010. Nine months ended 2011 total revenue was $237.1 million, 10.1% or $21.7 million increase, compared to $215.4 million in the nine months ended 2010. Quarterly Booking Amount US$ (mm) 70 60 50 Booking 40 30 20 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 23 Gross Margin Improvement Gross margin for the third quarter of 2011 was 38.4% as compared to 19.7% in the third quarter of 2010. Gross margin for the nine month ended 2011 was 36.2% as compared to 28.9% for the nine months ended 2010. US$ (mm) 45% 40 34.8 40% 35% 32.1 30 27.2 30% 35 23 25 25% 19 20 20% 15 12 15% 8 10% Gross Profit Gross Margin 10 5 5% 0% 0 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 24 Continued Progress in Cost Cutting US$ (mm) 60% 50 55% 45 50% 40 45% 35 40% 30 One Time Gain on Divesture 35% 25 OPEX 46 30% 25% 20% 35.4 28 34.7 4.2 30 20 15 25 17.8 OPEX/Sales 10 15% 5 10% 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2010 2010 2010 2010 2011 2011 2011 Total OPEX of Q3 2011 included $4.2 million one time net gain on divestitures. 25 Quarterly Profit Achieved Quarterly Operating Income of $14.2 million… US$ (mm) 17 14.2 12 9.7 7 2 -3 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 -5.1 -8 -11.1 -13 -18 -18.8 -23 -23.3 -26.6 -28 Quarterly Net Income of $8.0 million… 17 US$ (mm) 11.6 12 8.0 7 2 -3 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 -8 -9 -13 -18 -23 -28 -16 -10.3 -17.2 -23 26 Balance Sheet & Deposits Strong cash balance of $305.9 million in cash, cash equivalents, and short-term investment Zero debt Cash Balance by Region Cash Balance by Currency China , 43% USD 32% Other INR 2% 6% JPY 20% Int'l, 57% RMB 40% 27 Reiterating 2011 Financial Outlook Total revenue to be within the range of $300 – $320 million (includes PAS deferred revenue) Annualized operating expenses of less than $100 million Breakeven in 2011 on a full year basis OSS business comprising 10% of total sales in 2011 will be difficult due to the rigorous due diligence process, detail terms and condition negotiation with acquisition targets and revenue sharing partners 28 Investor Relations Contacts UTStarcom, Investor Relations Jing Ou-Yang T: + 8610 8520 5153 E: jouyang@utstar.com Ogilvy Financial In China: Agustin Bautista Tel: +86-10-8520-6166 Email: utsi@ogilvy.com In the U.S.: Jessica Barist Cohen Tel: +1-646-460-9989 Email: utsi@ogilvy.com 29