OIO 18 ADC 2012 - Central Excise

advertisement

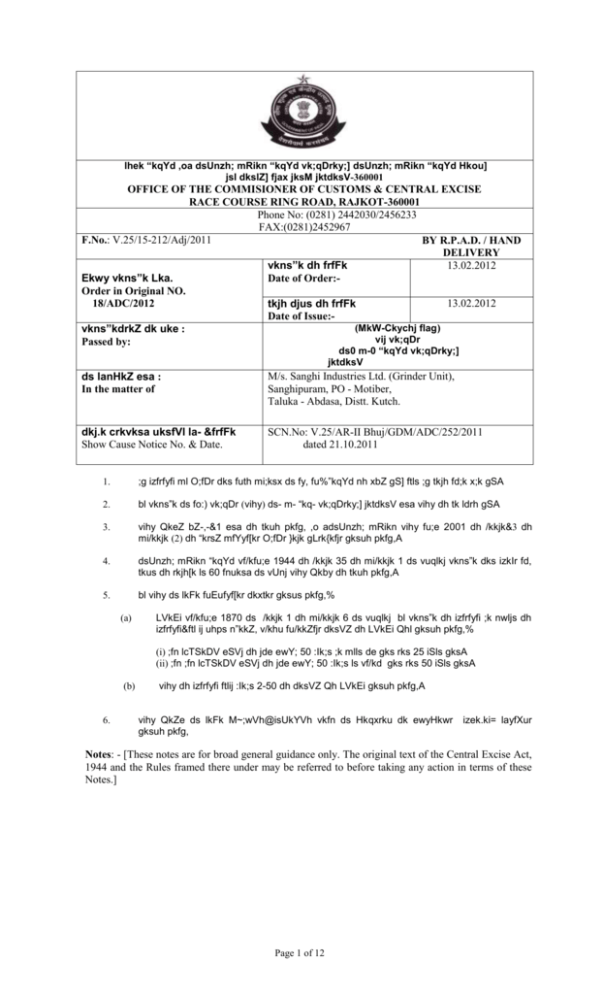

lhek “kqYd ,oa dsUnzh; mRikn “kqYd vk;qDrky;] dsUnzh; mRikn “kqYd Hkou]

jsl dkslZ] fjax jksM jktdksV-360001

OFFICE OF THE COMMISIONER OF CUSTOMS & CENTRAL EXCISE

RACE COURSE RING ROAD, RAJKOT-360001

Phone No: (0281) 2442030/2456233

FAX:(0281)2452967

F.No.: V.25/15-212/Adj/2011

BY R.P.A.D. / HAND

DELIVERY

13.02.2012

vkns”k dh frfFk

Ekwy vkns”k Lka.

Date of Order:Order in Original NO.

18/ADC/2012

13.02.2012

tkjh djus dh frfFk

Date of Issue:(MkW-Ckychj flag)

vkns”kdrkZ dk uke :

vij vk;qDr

Passed by:

ds0 m-0 “kqYd vk;qDrky;]

jktdksV

ds lanHkZ esa :

In the matter of

M/s. Sanghi Industries Ltd. (Grinder Unit),

Sanghipuram, PO - Motiber,

Taluka - Abdasa, Distt. Kutch.

dkj.k crkvksa uksfVl la- &frfFk

Show Cause Notice No. & Date.

SCN.No: V.25/AR-II Bhuj/GDM/ADC/252/2011

dated 21.10.2011

1.

;g izfrfyfi ml O;fDr dks futh mi;ksx ds fy, fu%”kqYd nh xbZ gS] ftls ;g tkjh fd;k x;k gSA

2.

bl vkns”k ds fo:) vk;qDr (vihy) ds- m- “kq- vk;qDrky;] jktdksV esa vihy dh tk ldrh gSA

3.

vihy QkeZ bZ-,-&1 esa dh tkuh pkfg, ,o adsUnzh; mRikn vihy fu;e 2001 dh /kkjk&3 dh

mi/kkjk (2) dh “krsZ mfYyf[kr O;fDr }kjk gLrk{kfjr gksuh pkfg,A

4.

dsUnzh; mRikn “kqYd vf/kfu;e 1944 dh /kkjk 35 dh mi/kkjk 1 ds vuqlkj vkns”k dks izkIr fd,

tkus dh rkjh[k ls 60 fnuksa ds vUnj vihy Qkby dh tkuh pkfg,A

5.

bl vihy ds lkFk fuEufyf[kr dkxtkr gksus pkfg,%

(a)

LVkEi vf/kfu;e 1870 ds /kkjk 1 dh mi/kkjk 6 ds vuqlkj bl vkns”k dh izfrfyfi ;k nwljs dh

izfrfyfi&ftl ij uhps n”kkZ, v/khu fu/kkZfjr dksVZ dh LVkEi Qhl gksuh pkfg,%

(i) ;fn lcTSkDV eSVj dh jde ewY; 50 :Ik;s ;k mlls de gks rks 25 iSls gksA

(ii) ;fn ;fn lcTSkDV eSVj dh jde ewY; 50 :Ik;s ls vf/kd gks rks 50 iSls gksA

(b)

6.

vihy dh izfrfyfi ftlij :Ik;s 2-50 dh dksVZ Qh LVkEi gksuh pkfg,A

vihy QkZe ds lkFk M~;wVh@isUkYVh vkfn ds Hkqxrku dk ewyHkwr

gksuh pkfg,

izek.ki= layfXur

Notes: - [These notes are for broad general guidance only. The original text of the Central Excise Act,

1944 and the Rules framed there under may be referred to before taking any action in terms of these

Notes.]

Page 1 of 12

BRIEF FACTS:

M/s. Sanghi Industries Ltd. (Grinding Unit), Sanghipuram, PO Motiber,

Taluka Abdasa, Distt. Kutch (hereinafter referred to as "the noticee") are

engaged in the manufacture of excisable goods viz. Grinding falling under CETSH

No. 25232910 of the Schedule to the Central Excise Tariff Act 1985 and are

holding Central Excise Registration No AAECS5510QXM004.

2.

The SCN No. V.25/AR-II BHUJ/GDM/ADC/252/2011 dated 21.10.2011 was

issued to the noticee on the following grounds:

(i)

On scrutiny of ER-1 Returns of the noticee for the months of October2010 to June-2011 by the Central Excise officers of AR-II, Bhuj, it was

observed that the noticee had wrongly availed the Cenvat Credit on

inputs in full in respect of certain goods received by them such as M.S.

Channel/ M.S. Beam/N.B. Pipe/M.S. Flats/M.S. Angle/ M.S. Chequered

Plate etc and it appeared that these items are being used for civil

construction purposes or repairs.

(ii)

Whereas it appeared that the said items used for civil construction

purposes or repairs, neither fall under the definition of inputs nor

Capital goods as per Rule 2 of the Cenvat Credit Rules, 2004.

Therefore, the Cenvat credit availed by the noticee on above mentioned

items to the tune of 6,10,421/- was inadmissible and was required to

be recovered from the noticee along with interest.

(iii)

From the facts, stated in preceding paragraphs it appeared that the

noticee had wrongly availed Cenvat Credit, on the items, which were

neither inputs nor capital goods, in contravention of Rule 2 of the

Cenvat Credit Rules, 2004. Therefore this credit was required to be

recovered from the noticee under Rule 14 of the Cenvat Credit Rules,

2004 read with Section 11 A (l) of the Central Excise Act, 1944, along

with interest. The noticee had also rendered itself liable to penalty

under Rule 15 of the Cenvat credit Rules, 2004.

(iv)

Therefore show cause notices as mentioned in the table above were

issued to the noticee requiring them to show cause as to why:

(a) The Cenvat Credit amounting to Rs. 6,10,421/-(Rupees Six Lac Ten

Thousand Four Hundred Twenty One Only) availed and utilized during the

months of October-2010 to June-2011 should not be disallowed and

recovered from them under Rule 14 of the Cenvat Credit Rules 2004 read

with section 11A of the Central Excise Act 1944;

(b) Interest at appropriate rate should not be recovered under Rule 14 of

Cenvat Credit Rules, 2004 read with Section 11AB of Central Excise Act,

1944;

(c) Penalty should not be imposed upon them under Rule 15 of the Cenvat

Credit Rules, 2004;

Page 2 of 12

3.

The noticee submitted replies to the SCN vide their various letters and

inter alia, contended that:

(i)

They had utilized the items for repair and maintenance of machineries

producing Clinker. The contention of the department that the said

items were used in civil construction purpose can not be sustained in

the absence of any evidence tendered or verification of use of the items

were done by the department. Therefore, the allegation in the notice is

only on assumption that the disputed items could be used for civil

construction purpose and hence can not be sustained.

(ii)

They had utilized the said items in works for the repair and

maintenance of machineries such as belt conveyor used to feed raw

material to kiln, chute used to feed limestone into kiln, reclaimer,

blower repairing,

coal mill bag house repairing, hopper repairing,

pipes were used to carry water as well as to carry electrical wires for

safety purpose to various machinery, etc as per submitted alongwith

defense reply, to optimize the life of the said equipment. Therefore, the

said items were used with machineries falling under the definition of

capital goods which were further used in the manufacturing process. As

such, the credit availed on the said items was in order and in line with

judicial pronouncement. They relied upon the following decision in

support of their contention :

(a) Commissioner of C. Excise V/s. Rashtriya Ispat Nigam Ltd;

2011 (267) E.L.T. 311 (A.P.)

(b) U.O.I. V/s. Associated Cement Company Ltd

2011 (267) E.L.T. 55 (Chhattisgarh.)

(iii)

Explanation-2 to Rule 2 (k) of Cenvat credit Rules, 2004 specifically

provide that input include goods used in the manufacture of capital

goods which are further used in the factory of manufacturer. Therefore,

the credit availed on the above items which were used alongwith

capital goods in their factory could not be demanded back. Hence the

notice requires to be vacated on merit. They relied upon the decision of

Hon. Tribunal in the case of in K.C.P.Ltd. V/s. Commissioner - 2009

(237) E.L.T. 500 (Tri.) which was approved by honorable Karnataka

High Court as reported in 2010-250-ELT-326 (Kar.).

(iv)

The credit availed on the items during relevant period was not covered

under the amendment made on 07.07.2009, in the explanation 2 of

Rule 2(k) of Cenvat credit Rules 2004, since the items were not used

for construction of factory shed, building or lying of foundation or

making of structure for support of capital goods. Therefore the

allegation of the department, on assumption and presumption that the

Page 3 of 12

items are used for construction, without any evidence, could not be

sustained.

(v)

The notice propose to deny the Cenvat credit referring to the

explanation 2 of the definition of “input”. The said explanation is

clarificatory and cannot be interpreted so as to exclude anything that is

otherwise provided by the main definition. The definition of “inputs” has

a wide coverage to all goods with certain exceptions. The inputs are

defined to mean those goods used in or in relation to manufacture of

final products, whether or not contained in the final products, including

those cleared alongwith final products. The definition of ‘inputs’ covers

all the goods used in or in relation to the manufacture of the final

product, whether directly or indirectly. Similarly, iron and steel item

used in manufacture of capital goods, are also used in or in relation to

manufacture of final product since without capital goods, it is

impossible for the noticee to function in any manner. Hence, these are

also used in or in relation to the manufacture of final product. The

above submission is supported by various judgments consistently

holding that the expression “in relation to” employed in the definition of

“inputs” is of wide connotation:

(a) JK Cotton Spg & Wvg Vs. STO – 1997 (91) ELT 34 (SC)

(b) Indian Farmers Fertiliser Vs. CCE – 1996 (86) ELT 177 (SC)

(c) CCE Vs. Ballarpur Industries Ltd. – 1989 (43) ELT 804 (SC)

(d) Singh Alloys & Steel Ltd. Vs. ACCE – 1993 (66) ELT 594 (Cal)

(e) Ponds (India) Ltd. Vs. CCE – 1983 (63) ELT 3 (SC)

(f) Sirpur Paper Mills Ltd. Vs. CCE – 2003 (159) ELT 17 (AP)

(g) Union Carbide India Vs. CCE – 1996 (86) ELT 613 (T-LB)

(h) Shri Ramakrishna Steel Industries Vs. CCE – 1996 (82) ELT 575 (TLB)

(i) CCE Vs. Escorts Mahle Ltd. – 2003 (154) ELT 321 (SC)

(j) CCE Vs. Steel Strips Alloys – 2008 (232) ELT 598 (HP)

(k) CCE Vs. Steel Strips Alloys – 2008 (232) ELT 395 (HP)

(l) Shimoga Steels Ltd. Vs. CCE – 2002 (142) ELT 304 (Kar)

(m) CCE Vs. Hindustan Sanitaryware – 2002 (145) ELT 3 (SC)

(n) Oswal Steel Vs. CCE – 2006 (193) ELT 403 (P&H)

(o) CCE Vs. Zenith Papers – 2002 (146) ELT 518 (P&H)

(vi)

In the case of Union Carbide India Ltd., the Tribunal held that the

words “in or in relation to manufacture” used in the definition of inputs

widen the scope so as to include all the goods entering the

manufacturing stream directly or indirectly and on this reasoning, the

Tribunal allowed modvat credit on the spares of machinery as “inputs”.

In view of the above, iron and steel items are to be considered as used

in or in relation to the manufacture of the final products on which duty

was paid by them and hence they are “inputs” for the purpose of

availing Cenvat credit.

Therefore the proposal to deny the credit is

liable to be set aside on this ground.

(vii)

The Iron and steel items are used in repair and fabrication of capital

goods which are in turn used in manufacture of Clinker.

Page 4 of 12

A detailed

write-up regarding the use of the said capital goods and their role in

the process of manufacture was enclosed as with defense reply. They

relied upon the appellate decision in case of Commissioner of C.Excise

V/s. Madras Aluminium Co. - 2010 (259) E.L.T. 738 (Tri-Chennai).

Larger bench in Vandana Global[2010 (235) E.L.T. 440(Tribunal-LB]

though disallows credit on cement and steel items used for laying

foundation and for building supporting structures but not deny credit on

steel items used for fabricating parts and machinery-Department

appeal fails-Rule 2(k) of Cenvat Credit Rules, 2004.

(viii) The decision of the Larger Bench in the case of Vandana Global Ltd. is

per incuriam and not reliable as inasmuch as the decision taken by the

Tribunal is contrary to the intention of the legislature and well settled

legal position in this regard. The decision of the Tribunal holding that

the amendment carried out in the explanation to the definition of inputs

is retrospective is also ex-facie perverse and erroneous.

Hence, the

entire basis of the demand proposed in the show cause notices is not

correct. The finding of the Larger Bench regarding the amendment to

the explanation being retrospective has been reiterated by the Board

vide its Instructions dated 8.7.2010 wherein it has been clarified that

the amendment carried out by Notification No. 16/2009-CE(NT) dated

7.7.2009 is clarificatory in nature hence retrospective. The finding of

the Larger Bench holding that the amendment dated 7.7.2009 is

retrospective and the instructions issued by the Board on this basis are

clearly erroneous. The submission made by the department in the

counter affidavit before the Hon'ble High Court that the issue of

retrospectivity was not considered or decided by the Larger Bench of

the Hon'ble Tribunal in the case of Vandana Global is ex-facie

erroneous and contrary to facts on record as evident from the order of

the Tribunal and the clarification issued by the Board. The averment to

this effect in the sworn affidavit is erroneous. Mere styling a provision

as Explanation, does not mean that it is clarificatory and hence

retrospective in nature.

It is well settled that merely styling the

provision as explanation is not decisive of its character. If it excepts,

excludes or restricts, it is not an explanation but a proviso & should be

considered as operative only form the date of its insertion. They refer:

(a) Krishna Iyer Vs. State of Kerala - 1962 (13) STC 838 (Ker – FB)

(b) CIT Vs. Kerala Electric Lamp Works Ltd. - 2003 (261) ITR 721

(Ker)

(c) CIT Vs. Rajasthan Mercantile Co. Ltd. - 1995 (211) ITR 400 (Del.)

(d) Mahindra & Mahindra Ltd. Vs. CCE - 2007 (211) ELT 481 (T)

(ix)

Prior to 7.7.2009, credit on iron and steel items used in making capital

goods was allowed as credit.

The amendment introduced w.e.f.

7.7.2009 took away this valuable right of the assessees and hence it is

Page 5 of 12

not correct to style this amendment as clarificatory and hence

retrospective. The Tribunal in Vandana Global did not consider this

legal position into account. The decision of the Tribunal in the case of

Vandana Global Ltd. is also not sustainable for another reason,

inasmuch as the same is per incuriam and has failed to take into

consideration a series of judgments as detailed below passed by the

various High Courts on this very issue wherein it has been consistently

held that credit on iron and steel items used for fabrication of

structures or capital goods which are part of the immovable goods were

eligible for credit.

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(x)

CCE Vs. Gujarat Ambuja Cement Ltd.-2008 (230) ELT 221(HP)

CCE Vs. Madras Aluminum Ltd. - 2008 (226) ELT 342 (Mad.)

Oswal Steel Vs. CCE - 2006 (193) ELT 403 (P&H)

CCE Vs. Zenith Papers - 2002 (146) ELT 518 (P&H)

CCE Vs. India Glycols Ltd. - 2008 (229) ELT 516 (Utt)

CCE Vs. Prism Cement Ltd. - 2006 (199) ELT 777 (MP).

The

items

in

question

are

to

be

considered

as

essential

parts/accessories to the capital goods as held by the Hon'ble High

Court of Rajasthan in the case of Grasim Cement reported in 2008

(223) ELT 583 (Raj). Further, the Punjab and Haryana High Court in

the case of CCE, Jalandhar Vs. Pioneer Agro Extracts Ltd. - 2008 (230)

ELT 597 (P&H) held that channels, angles, joints, square and equal

angles of iron and steel used for installing batch vessel which is part of

machine, are admissible to credit under Rule 2(b) of the CENVAT Credit

Rules, 2002. They also relied on the judgment of Rajasthan High Court

in the case of Hindustan Zinc Ltd. reported in 2007 (214) ELT 510 (Raj)

which was affirmed by the Hon'ble Supreme Court wherein credit was

allowed on plates etc. used for repair and maintenance of machines.

They also placed reliance on the decision of the Hon'ble Tribunal case

of Ispat Industries Ltd. Vs Commissioner of Central Excise reported in

2006 (195) ELT 164 (T). This decision of the Hon'ble Tribunal has since

been affirmed by the Hon'ble High Court of Bombay in Central Excise

Appeal No. 187 of 2006 whereby by order dated 19th July 2007 the

Hon'ble High Court has dismissed Revenue’s appeal.

(xi)

As is evident from the decision of the Larger Bench, even though the

judgments of various High Courts were pointed out, the same have not

been taken into consideration by the Tribunal. This clearly shows that

the decision rendered by the Larger Bench is per incuriam and contrary

to well settled law.

(xii)

The amendment made vide Notification No.16/2009 dated 7.7.2009

denying Cenvat credit on cement, angles, channel, TMT bar and CTD

bar used in building, structure, factory shed or laying foundation for

capital goods can not be equated with repair and maintenance or

Page 6 of 12

fabrication of accessories of capital goods so as to deny eligible Cenvat

credit.

(xiii) The Central Board of Excise & Customs vide chapter 5-Cenvat credit,

sr.no.2 –Definition -clarified that components, spares and accessories

may fall under any chapter but they should be components, spares and

accessories of capital goods. Therefore, the above items used for repair

and maintenance of capital goods are accessories of the machineries

and hence eligible for the Cenvat.

(xiv) Moreover Rule 2 (vi) of Cenvat Credit Rules 2004 specifically includes

tubes and pipes and fitting thereof in the definition of capital goods and

the only condition imposed to avail the credit is that the items are used

in the factory of the manufacturer. The notice does not dispute the fact

of usage of the pipes in their factory and therefore, the demand of

credit availed on pipes is contrary to the definition of capital goods

itself and can not be sustained. Hence the credit availed on pipes can

not be sustained on merit and requires to be vacated. They relied upon

the following case laws:

(a)

Commissioner of C. Excise V/s. Rajastan Spinning & Wvg. Mills

Ltd - 2010 (255) E.L.T. 481 (S.C.).

(b)

(c)

Commissioner of C. Excise V/s. Bharat Aluminium Co.Ltd. - 2009

(246) E.L.T. 388 (Tri. Del.).

Commissioner of C. Excise V/s. APP Mills Ltd - 2011-TIOL-1378CESTAT-BANG.

(xv)

Further the Madras High Court in their latest decision reported in 2011TIOL-558-HC-MAD-CX held that goods used for supporting structures of

machineries are capital. Further, the Commissioner allowed Cenvat

credit availed on the disputed M.S. items on verification of actual usage

of the same on the ground that the said goods/items used for

fabrication and repair and maintenance of capital goods are eligible for

Cenvat credit vide Order In Original. No. 01/Commr./2010.

(xvi) Rule 15 is invokable only where the Cenvat credit in respect of input

has been taken or utilised wrongly with the intention to evade the

payment of excise duty. The entire demand is within the period of

limitation. Further the Department was well aware about the fact that

they were availing the Cenvat credit on above inputs. Therefore, the

proposal in the notice to impose a penalty under Rules 15 of the Cenvat

credit Rules, 2004 is not legally tenable since the Rule ibid can not be

made applicable to the case in hand as there is no suppression of fact,

fraud etc involved with willful intention to evade payment of duty. The

notice itself rely upon the statutory return submitted to demand back

the credit availed hence no ingredient of Section 11AC of Central Excise

Act, 1944 read with Rule 15 of Cenvat Credit Rules, 2004 has been

mentioned in the notice so as to impose a penalty under the said

Page 7 of 12

section. They relied on the judgment in the case of Davangere Sugar

Company reported at 2011 (267) E.L.T. 384 (Tri. - Bang.).

(xvii) Further, in the aforesaid Show Cause Notice a penalty has been

proposed under Rule 15 of the CENVAT Credit Rules, 2004. The said

Rule consists of four sub-rules prescribing different circumstance under

each of the said sub-rule. However, in the said Show Cause Notice it

has not been proposed under which sub-rule penalty is proposed to be

imposed. It has been held by the Hon’ble Apex Court in the case of

Amit Foods Vs. Collector of Central Excise, UP 2005 (190) ELT 433(SC)

and followed various High Courts and Tribunal that in absence of

mention of specific provision under which penalty is proposed to be

imposed on the assessee, the said action on the part of the Department

is bad in law and penalty imposed in such cases has been held to be

not sustainable in law.

(xviii) They were of the bona fide belief and view that the Cenvat credit

availed was correct and in-accordance with the provisions of the Rules

and the Act. The judicial pronouncement of Supreme Court, High Court

and Tribunal support the belief. In the light of the above, neither did

they indulge in evasion of any kind nor did they entertain any intention

to commit any wrong. Therefore, on merits of the matter imposition of

penalty and demand of interest is not sustainable.

4.

Personal hearing in the matter was held on 25.01.2012, which was

attended by the representative of the noticee. He reiterated the written

submissions made in this regard, earlier. He requested that the usage of these

items may be got verified and also submitted that the availability of credit in

pipes is not at all disputed, and thus, should be allowed.

DISCUSSION AND FINDINGS:

5.

I have carefully gone through the entire case records, SCN issued, defence

put forth by the noticee in written as well as contentions raised during personal

hearing. I find that the limited issue to be decided in the present case is whether

the noticee is eligible for Cenvat credit of M.S. Channel/ M.S. Beam/N.B.

Pipe/M.S. Flats/M.S. Angle/ M.S. Chequered Plate etc., which is alleged to be

neither capital goods nor input for the noticee.

6.

It is contended by the noticee that since the goods in question were used

in repair of various machineries, which are their capital goods, they had rightly

availed the credit. They have also relied upon the decision of Hon. High Court in

the case of Rashtriya Ispat Nigam Ltd. and Associated Cement Co. Ltd. I have

gone through the case laws cited by the noticee. In case of Rashtriya Ispat

Nigam Ltd., it was held that the goods used in repair of capital goods are also

Page 8 of 12

capital goods, as the definition of capital goods does not only cover the goods

falling within specified chapters but also components and spares of such capital

goods. It is seen that the case law is based on earlier definition of capital goods,

when the goods used for fabrication of capital goods were not covered as “input”

in the definition of “input” given under Rule 2(k) of the Cenvat Credit Rules,

2004. Here, in the present case, the noticee has contended that the goods, viz.

M.S. angle/channel/bar etc. would fall under the definition of “input”. Therefore,

the case law cited by the noticee is not relevant. Further, in the case of M/s.

Associated Cement Co. Ltd., it was held, based on Supreme Court judgment, that

the items used for fabrication of capital goods would qualify for credit. In the

present case, it is not disputed that credit of duty paid on goods used for

fabrication of capital goods would be available as input credit. The present case

involves repair of capital goods, therefore, the facts being different from the cited

case law, the case law is not applicable here.

7.

The definition of “input” as given under Rule 2(k) of the Cenvat Credit

Rules, 2004 has two explanations appended to it. Explanation – 2 reads as –

“Input include goods used in the manufacture of capital goods which are further

used in the factory of the manufacturer but shall not include cement, angles,

channels, Centrally Twisted Deform bar (CTD) or Thermo Mechanically Treated

bar (TMT) and other items used for construction of factory shed, building or

laying of foundation or making of structures for support of capital goods”. Here

the last portion “used for construction of factory shed…..” is applicable only to

“other items” and not to all the items mentioned before that. Therefore, other

items like cement, angles, channels, CTD and TMT cannot be treated as “input”

irrespective of their use. Therefore, the contention of the noticee that since the

items were not used for construction and therefore they are eligible for the credit

on the same, is not tenable.

8.

It is also contended by the noticee that the definition of input has a wide

coverage and therefore, all the goods used in or in relation to the manufacture of

final product would qualify as input. They have also relied upon several case laws

to support this contention. It is true that the definition of input has vide coverage

and it includes all the items used in or in relation to manufacture of final product.

There is no denial that there are several case laws where it is held that the

definition of input includes many items and has wide coverage but so far as specific

goods covered in the present proceedings are concerned, the same are clearly

excluded from the definition, vide explanation – 2 appended to the said definition.

It is clear from the aforesaid Explanation that the goods used for manufacture of

capital goods only are to be treated as ‘input’ and not the goods used for repair of

any machinery. In the present case, there is no dispute that the MS items were

used for repair of plant and machinery and not for fabrication/manufacture of new

capital goods. Therefore, such MS items are not covered by the explanation given

Page 9 of 12

above. In view thereof, I find that credit on this count is not admissible to the

noticee. This view is also supported by Board’s circular No. 267/11/2010-CX dated

08.07.2010, wherein it is stated that credit shall also not be admissible on inputs

used for repair and maintenance of capital goods.

Regarding case laws cited by the noticee, I find that the Board’s circular

referred above is based on various recent judgments of CESTAT (LB) and Hon.

Supreme Court. Therefore, the case-laws cited by the noticee, being prior to the

date of such various judgments and circular, cannot be relied upon in the present

case. Regarding Order-in-Original No. 13/Commr/2009 dated 09.02.2009, I find

that in that case, it was proved by the noticee that they had used such MS items

in fabrication of fresh capital goods, therefore the same is not applicable to the

present case, where such MS items were used for repair of capital goods.

9.

The noticee has further contended that in view of case laws of Madras

Aluminum Co. and Vandana Global, credit on iron and steel items used in repair

and fabrication of capital goods is admissible. I have gone through both the case

laws. I find that in both the cases credit pertaining to fabrication of capital goods

is allowed. However, it is to be noted that this allowance is limited to fabrication

of new capital goods only and not for repair of worn out machinery/capital goods.

In the present case, it is contended by the noticee that all the M.S. items were

used for repair of capital goods. It is undisputed that credit on account of M.S.

items used for fabrication of capital goods is admissible, as per explanation – 2

to the definition of input given under Rule 2(k) of the Cenvat Credit Rules, 2004.

However, since in the present case it is contended that the M.S. items were used

for repair of capital goods, the case laws cited are not applicable.

10.

The noticee, after relying upon the larger bench judgment of CESTAT in

Vandana Global case, has contended that this judgment is per incuriam. It is

contended that the amendment made in the definition of “input”, with effect from

07.07.2009 cannot be retrospective and that Board’s circular issued based on

this judgment is also erroneous. In this regard, I find that the period covered in

concerned SCN is after 07.07.2009. Therefore, whether the amendment to Rule

2(k) of the Cenvat Credit Rules, 2004 is retrospective or otherwise, has no

relevance to the present case. Therefore, the case laws cited by the noticee have

no relevance to the present case.

11.

It is also contended by the noticee that as per Rule 2(vi) of the Cenvat

Credit Rules, 2004, tubes and pipes and fittings thereof are included in the

definition of capital goods and therefore, they are eligible for the Cenvat credit

availed on such tubes and pipes. They have also relied upon various case laws in

this regard. I agree with this contention of the noticee. Since tubes and pipes are

squarely covered in the definition of capital goods, Cenvat credit on such tubes

Page 10 of 12

and pipes cannot be denied. The SCN demand pertaining to such tubes and pipes

is as under:

Sr.

No.

SCN No. and date

1

V.25/AR-II

BHUJ/GDM/ADC/252/2011

dated 21.10.2011

Amount

demand

(Rs.)

of Cenvat

credit

admissible

on Pipes and

tubes (Rs.)

6,10,421/-

2,54,826/-

Cenvat

credit

not

admissible

(Rs.)

3,55,595/-

In view of the above, I find that out of total demand of wrongly availed

Cenvat credit Rs. 6,10,421/-, Cenvat credit of Rs. 2,54,826/- is admissible and

credit of Rs. 3,55,595/- is inadmissible.

12.

So far as the question of payment of interest under Rule 14 of the Cenvat

Credit Rules, 2004 is concerned, the noticee has argued that no interest is payable

by them since all the amounts taken as Cenvat credit are admissible and as per

rule. As discussed and concluded hereinbefore, Cenvat credit to the tune of Rs.

3,55,595/- has been wrongly taken and availed by the noticee. Further, Rule 14 of

Cenvat Credit Rules, 2004 is also very clear. It provides for levy of interest in case

of wrongly taken credit and utilization thereof is not necessary. A recent circular

issued by the Board, also clarified that – “Rule 14 of the CENVAT Credit Rules,

2004, is clear and unambiguous in the position that interest would be recoverable

when CENVAT credit is taken or utilized wrongly, it is clarified that the interest

shall be recoverable when credit has been wrongly taken, even if it has not been

utilized, in terms of the wordings of the present Rule 14”. [Circular No.

897/17/2009-CX, dated 3-9-2009]. Thus, interest is required to be recovered on

the amount of Cenvat credit wrongly taken by the noticee.

13.

With regard to the proposition for imposition of penalty under Rule 15 of

Cenvat Credit Rules, 2004, it is contended by the noticee that since they have

rightly availed the credit and not violated any provision of Central Excise Act and

Cenvat Credit Rules and there is no fraud or collusion of any willful misstatement or suppression of facts, no penalty can be imposed upon them. In this

regard, I cull out and note the following in the present case:

(1) All the data based on which the SCN is issued, has been provided by the

noticee himself, as part of the monthly ER-1 returns and hence there is no

suppression of facts.

(2) The SCN is issued for normal period of limitation, i.e., within one year of

availment of credit.

In my considered view, these are relevant extenuating factors in the case

and have to be duly factored in while considering the quantum of penalty to be

Page 11 of 12

imposed on the noticee. It is also pertinent to observe that though such facts do

constitute extenuating factors in the matter of their acts and omissions resulting

in breach of law as concluded above, these do not absolve them from the

consequences thereof. It is all the more so when viewed with the fact that the

noticee has been following the system of self assessment.

However, Rule 15 of the Cenvat Credit Rules, 2004 provides for penal

action even in those cases also where there is no suppression of facts or other

ingredients mentioned in section 11AC are absent. I find that there is wrong

availment of credit. To that extent and, therefore, the noticee is liable to penal

action under Rule 15 of the Cenvat Credit Rules, 2004.

14.

In view thereof, I pass the following order:

(i)

I confirm the demand of wrongly availed Cenvat credit of Rs.

3,55,595/- (Rupees Three Lac Fifty Five Thousand Five Hundred

Ninety Five Only) on the noticee, under Rule 14 of the Cenvat

Credit Rules, 2004 read with section 11A of the Central Excise

Act, 1944:

(ii)

The demand confirmed at (i) above should be paid with interest

as due and payable under Rule 14 of the Cenvat Credit Rules,

2004 read with section 11AB of the Central Excise Act, 1944.

(iii)

I impose penalty of Rs. 1.00 Lac (Rupees One Lac Only) upon

the noticee, under Rule 15 of the Cenvat Credit Rules, 2004.

(Dr. Balbir Singh)

Additional Commissioner,

Central Excise, Rajkot.

F.No.: V.25/15-212/Adj./2011.

Date: 13.02.2012

BY RPAD/H.D.

To:

M/s. Sanghi Industries Ltd. (Grinder Unit),

Sanghipuram, PO - Motiber, Taluka - Abdasa, Distt. Kutch.

Copy to:

1.

2.

3.

4.

The Commissioner, Central Excise, Rajkot.

The Assistant Commissioner, Central Excise, Gandhidham.

The Superintendent of Central Excise, AR-II Bhuj.

Guard File.

Page 12 of 12