IBM Global Financing

advertisement

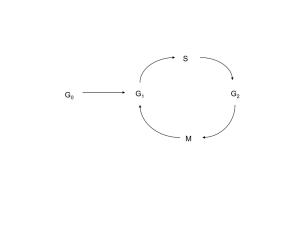

® Diamond In The Rough Leverage IBM Global Financing To Improve Business Performance IBM and Ingram Micro Confidential IBM Global Financing ® Agenda Who is IGF? Value to you, our Partners A compelling client funding alternative What you can expect from IGF Best Practices 2 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® IBM Global Financing portfolio IBM Global Financing Client Financing Provides financing (leases and loans) for the acquisition of solutions and technology 3 Commercial Financing (flooring) •Credit Lines from $300K • 30 day terms on IBM SW and non-IBM products Asset Recovery Services Offers comprehensive services for used IT assets, including resale, buyback and recycling •45 day terms on IBM X IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® IGF Client Financing Channel Program Attributes Preferred sales model is to team with our partners to deliver a total solution Lease and finance total IT solutions, hardware, software, services, IBM and non-IBM $5K minimum, 12-60 month terms, deferrals, step structures IGF Finance Associates qualify for fees 4 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® IGF Value to Our Partners Relieve credit and cash flow constraints When your client finances with IGF, Ingram will provide you virtually unlimited credit IGF pays in in 5-7 from delivery of product/services Enhance profitability By delivering a compelling payment structure (solving budgetary and financial related metrics) you relieve purchase price pressure Improved DSO IGF fee payments Strengthen Client Value Team with a trusted, financing consultant Differentiated, total solution Positioned for long term, incremental client IT 5 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® Financing for your Software and Services Project Match payment timing and structure with anticipated benefits » Costs are heaviest at the front end of the project, while benefits do not fully accrue until the project is implemented » When the project is financed, replacing up-front costs with payments over time, costs and benefits track much more closely • Cost of the project • Benefits of using the new solution (ROI) • Financed payments $ Time 6 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® Current IBM Software Financing Offering 0% Software Financing – No interest for 12 months on new IBM Software licenses – Simple and fast to propose: divide purchase price 12 to calculate monthly payment – Competitive rates are also available for 24 – 60 month payment terms IBM Global Financing offerings are provided through IBM Credit LLC in the United States and other IBM subsidiaries and divisions worldwide to qualified commercial and government customers. Rates are based on a customer's credit rating, financing terms, offering type, equipment type and options, and may vary by country. Other restrictions may apply. Rates and offerings are subject to change, extension or withdrawal without notice. 7 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® What can you expect The sales rep requests a financing offer from IBM Global Financing IBM Global Financing performs a credit review If client is approved, contract is created and sent to the reseller or client The client signs the contract and returns it to IBM Global Financing IBM Global Financing pays supplier invoices IGF/Ingram Micro Support Team Ingram Micro, Bill Papaj, Ingram Micro IGF Market Development Manager, william.papaj@ingrammicro.com, (716) 633-3600, Ext. 66994 IGF, Steve Slayton, IGF IBM SW Client Exec. sslayton@us.ibm.com, (864) 363-5333 mobile IGF Channel Inside Sales Team 888-780-4110, e-mail: leasing@financingadv.com 8 IBM & Ingram Micro Confidential © 2009 IBM Corporation IBM Global Financing ® Best Practices for Selling SW Financing 9 Request credit review for all opportunities early in the sales cycle Differentiate your solution from other resellers with financing – Provides real business value in a total solution approach – Minimize discounting Understand how to handle objections – “Our company does not finance”. Every company borrows money (stock, bonds, loans through local bank, etc..). We need to talk to the decision makers in the Accounting/Purchasing/Finance department. – “We have the cash/budget to pay for this today”. That cash could be put towards other capital expenditures planned for the company. With 0% financing, the client takes advantage of time value of money. – Engage IGF to help with these conversations with clients IBM & Ingram Micro Confidential © 2009 IBM Corporation