BANK INTERVENTION and RESOLUTION: Part 2

advertisement

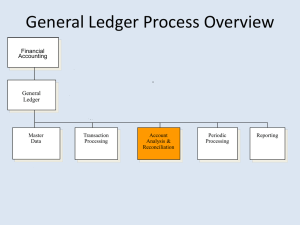

BANK INTERVENTION and RESOLUTION: Part 2 United States Department of the Treasury Office of Technical Assistance Banking & Financial Services Bank Intervention and Resolution Advance Preparation • Effective preliminary preparation and execution of the action plan can make the Intervention and Resolution much easier. • Intervention and Resolution are not separate—much overlap Advance Preparation Intervention • • • • Intervention Action Plan Management and Legal Information Packages Function Areas Advance Preparation Advance Preparation Intervention • Both bank intervention and resolution advance preparation should be conducted concurrently. Legal – Advance Preparation • Prepare notices and other legal documents regarding appointment of the Conservator or Receiver • File at the appropriate court Conservator or Receiver • Failed bank employee retention strategy • Appropriate Delegations of Authority and • Powers of Attorney have been issued Bank Intervention Manager • Main function is managing and coordinating all intervention team members to assure that the intervention goes as smoothly as possible. • He can delegate many of the functions to others; however, the BIM bears ultimate responsibility to assure completion of intervention activities as required. Intervention Action Plan • A checklist for planned actions and assignments (who, what, when, where, why, how). • Ensures that all areas of risk will be controlled without delay Management and Legal • Management - meeting with the bank’s General Director and his key staff to be held at the bank immediately before the date and time of Intervention Management and Legal • Legal - drafting corrective measures, transactional documents as applicable (i.e., P&A), any required notices, any required Powers of Attorney for the Conservator or Receiver and providing legal assistance to a Liquidator on broad matters Intervention Preparation • The Bank Intervention Manager should begin preparing an Intervention Action Plan. • The Intervention Action Plan is a checklist for planned actions and assignments (who, what, when, where, why, how). • It is designed to ensure that all areas of risk are addressed. Intervention Team • Bank closings are best carried out using a team approach. Team members may be drawn from the Supervisory Authority and Deposit Guarantee Fund. Intervention preparation • The Bank Intervention Manager must designate Function area managers and begin advance preparation for the intervention. • All Function managers should: • review the Information Package for items in the functional area; and • determine staffing, supplies, equipment and security needs. Function Areas Advance Preparation • • • • • • • • Accounting Team Asset Team Branch Operations Team Deposit Operations Team Facilities and Security Team Information Technology Team Legal Team: Personnel Team Intervention preparation • Accounting: • Review P&A for asset and liabilities splits with Assuming Bank. • Review bank’s financial reports. Intervention preparation • Asset Team • Review bank’s financial reports to determine types and amounts of assets • Work with Accounting for asset splits with Assuming Bank Intervention preparation • Branch Operations • Identify the number of branches and the contact person at each branch. • For any branches located abroad, contact Legal to secure the services of an experienced banking attorney in each country prior to the intervention. Intervention preparation • Deposit Operations Team (under the DGF) • Perform a preliminary insurance determination according to governing deposit insurance law. • Work with Accounting for deposit liability splits with Assuming Bank Intervention preparation • Facilities • Ensure necessary supplies, forms and documents are available. • Arrange for an official seal, tape or other means to control drawers, and use labels for inventory, etc. • Determine if the bank’s existing facilities has the capacity to accommodate the intervention team. Arrange for additional work space if necessary (e.g. hotel conference rooms). Intervention preparation • Security • Meet with contracted Security Guard firm or police to provide instructions, determine locations and assignments. Intervention preparation • Information Technology • If possible, the IT Manager should visit the failing institution to help prepare data files, equipment, and information needed for the intervention. • Determine capability of stopping accruals, when to expect the download files, report generation capability, delivery logistics, and staffing. Legal • The Supervisory Authority’s Legal department will be involved throughout the process, drafting: • Corrective measures, • P&A transactional documents, • Any required legal notices (for registering with court, posting on premises, publishing, etc.), • Powers of Attorney for the Administrator or Receiver, and, • Providing legal assistance to a Administrator or Receiver on broad matters Intervention preparation Legal Team • Review the bank inspection report • Prepare the proper legal order (i.e., Administration or Receivership) as required by law Intervention preparation Legal Team • Review major contracts and agreements as requested by the Administrator/Receiver or the Bank Intervention manager (including letters of credit, open credit lines, unfunded and partially funded commitments, etc.). Intervention preparation Legal Team • Accompany the Administrator/Receiver, the Bank Intervention Manager, and the representative from the applicable Supervisory Authority when the proper legal notice (i.e., Administration or Receivership) is served on the bank. • Make sure that the notice is published in accordance with the Law Advance Preparation - Resolution • • • • • • • • Resolution preparation Marketing strategy Legal documents Potential acquirers Marketing presentation Due diligence Bid acceptance Contract signing Resolution preparation • Compiling Initial Information about the bank • Asset Valuation • Completion of a financial information package (Bid Package) • Marketing Meeting Logistics Initial Information • • • • • Number of offices Location of main offices and branch locations Loans Deposits Borrowings – secured or unsecured Initial Information • • • • • • Subsidiaries Trust Department or activities Ownership structure Enforcement actions pending Litigation Other – leases, etc. Asset Valuation • Statistical sampling of asset categories • Liquidation value is derived from the future cash flows and the expenses likely to be incurred during the collection of the asset Asset Valuation • Adjustments - discount future cash flows; account for liquidation expenses • Loss factors are aggregated and extrapolated to the bank as a whole • Loss factor, or cost of liquidation, which will be used in assessing bids from potential acquirers Bid Package Builds on Initial Information: • Demographic information, • Balance sheet schedules: • • • • Cash and equivalents Investment securities s Loans Fixed assets Bid Package Builds on Initial Information: • Other real estate • Subsidiaries • Other assets • Deposit base • Borrowings • Guaranties Bid Package Builds on Initial Information: • Other liabilities • Contingent liabilities • Capital accounts • Detailed description of the Data Processing (in-house or outsourced, applications, etc.) • Employees • Contracts • Litigation Marketing Meeting Logistics • Date, time, and place for the Marketing Presentation Least Cost Analysis • The calculation to determine the problem bank resolution method that is the least costly • A typical formula to calculate least cost is: (Loss on assets – equity capital- unsecured creditors’ loss) x (insured deposits/total deposits) P&A • Financially healthier bank will purchase certain “good” assets and assume insured deposit liabilities P&A Some benefits of a P&A include: • • • • Customers suffer no loss in service Acquiring bank can increase market share Usually less expensive than a payoff Depending on transaction, can keep assets in private sector P&A • Assets of the failed bank help offset the deposit liabilities transferred to the assuming bank • Reduces impact on deposit insurance fund (if there are not enough “good” assets to balance the amount of insured deposits, the DGF must advance the cash to balance the transaction--assets must equal liabilities) Types of P&A • Whole Bank - where the authorities pay an acquirer to take all assets and liabilities of a failed bank (negative bid). • Clean Bank – some good assets are sold to an acquirer who also assumes insured deposit liabilities. • “Bridge” Bank – where a temporary financial institution, owned and operated by the government, is established to receive the deposits and good assets of one or several failed institutions. Bank Resolution An effective failing bank resolution plan can help avoid disruption of orderly economic activity such as: • Loss of a bank in an isolated area • Severe reduction in credit availability for an industry or region • Considerable government ownership of a failed bank’s assets Branch Break-ups Branch Break-up (i.e., offering branch offices individually, or in clusters, to multiple bidders): • Pros: • Provides for more potential bidders (especially smaller banks), which may increase the premiums received. • Increases the resolutions options available to the bidders. Branch Break-ups Branch Break-up (i.e., offering branch offices individually, or in clusters, to multiple bidders): • Cons: • Information technology and conversion costs are usually higher. • A quick and smooth transaction is more difficult. • One acquirer must be the “lead” acquirer (an often onerous role), in processing and allocating transactions and costs. • Some branches may be undesirable, resulting in liquidated payoff. Legal documents • • • • • Confidentiality Agreement Purchase and Assumption Agreement Interim Asset Servicing Agreement Escrow Agreement Bid Agreement Form Potential acquirers • Opportunity for an acquiring bank to either increase market share or to expand. • Paying a premium for deposits and options on banking premises is more cost-effective. (In the U.S., estimates are that the acquirers in these types of transactions retain approximately 70% of deposits.) Potential Acquirers • Additionally, the efficiency of the P&A transaction: • limits financial disruption to a community, • maintains public confidence and stability in the banking system. Potential acquirers • Maintain a database of approved banks and investors that are interested in establishing bank operations in the country. Potential acquirers • When evaluating investor groups for approval, the Supervisory Authority must consider, among other factors: • The length of time required for licensing a new bank • Whether the investor group can raise sufficient capital • Whether the investor group can provide competent management Potential acquirers • The Supervisory Authority must be confident that those parties on the list are strong enough to acquire a failed bank and sustain profitable operations. • The Supervisory Authority should keep track of any seriously interested bank or investor group Potential acquirers • Contact all strong, healthy banks in the country to solicit their interest in acquiring the failing bank. • Additionally, solicit the interest of foreign banks attempting to obtain licenses in the country Marketing Presentation • • • • • • Financial data on the bank P&A transaction summary Legal summary. Regulatory requirements Due diligence scheduling Bid process Due Diligence • Due diligence is the potential acquirers’ on-site inspection of the premises, records, and operations of the failing bank. It allows the potential acquirers’ to assess the franchise value and calculate a knowledgeable bid amount. • Note: The resolution preparation process can be shortened by not allowing due diligence. Due Diligence • Approved potential acquirers will have the opportunity to go on-site and examine the relevant records of the failing bank. • The potential acquirer must have completed a Confidentiality Agreement, which is a legally binding document and violations are subject to criminal penalties. Due Diligence • Maintaining the “level playing field concept,” all potential acquirers conducting due diligence should have access to the same information. • Potential acquirers should be granted adequate review time, keeping in mind the urgency of the resolution process. Due Diligence • Small bank, simple transaction - maybe a day or less. • Larger bank, complex transaction - may require a week or more. Due Diligence • When potential acquirers have the opportunity to conduct due diligence, they can put their own value on assets they may purchase and therefore those assets can be sold “as is.” Due Diligence • When due diligence is not used, assets can be sold to the assuming bank with putback options. That is, if an asset is not of the quality that has been represented, the assuming bank can sell it back at the purchase price, within a limited time period (usually 90 days). Bid Acceptance • After all potential acquirers have finished due diligence, they will submit their bids. • The bid amount (or Premium) is the price a potential acquirer puts on the value of the transaction (asset purchase options, deposit base, branch network, etc.) Bid Acceptance • The winning bidder should be notified and a meeting to sign contracts should be scheduled. A reminder of the confidentiality of the process is appropriate at this point. • Losing bidders should also be notified; however, the identity of the winning bidder should not be disclosed. The winning bidder is referred to as the “Assuming” Bank Contract Signing • To provide a comfort level to both parties to the transaction, the P&A contracts are signed several days prior to the actual closing of the bank. This eliminates last minute conditions or demands by either party. • Authorized representatives from the Authorities and the Assuming Bank will sign the Purchase and Assumption Agreements. Both parties will also sign the Escrow Agreement. Contract Signing • The Escrow Agreement merely states that the aforementioned documents were signed and put into escrow until the stipulated date. • The Assuming Bank receives only a copy of the Escrow Agreement. The other signed Agreements will be delivered to the Assuming Bank at the time of the bank closing.