BUILDING TOMORROW ™

Innovation in Banking

Tony Clegg & Tom Macdonald

24th February 2012

rbs.com/gts

Cards in Public Sector

Tony Clegg - Business Development Manager

RBS00000

1

GPC III

RBS only dual scheme issuer in GPCIII i.e. MasterCard and Visa

MasterCard OneCard preferred solution with Integrated MI package

Comprehensive reporting system – Smart Data Online

Solutions encompass both Travel & Entertainment and Purchasing style spend

Tiered rebate structure available, based on annual spend and settlement period

RBS00000

2

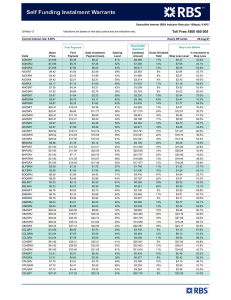

Rebate matrix

Size of customer

% Rebate

(annual value of transactions)

Standard terms - 14 days

Up to £499,999 per annum

0.00% Up to £499,999 per annum

Size of customer

(annual value of transactions)

For delayed settlement - 28

days

0.000% Up to £499,999 per annum

£500,000 to

0.10% £500,000 to

0.175% £500,000 to

£999,999

Size of customer

% Rebate

(annual value of transactions)

For early settlement - 7 days

£999,999

£999,999

% Rebate

0.000%

0.000%

£1,000,000 to £2,999,999

0.15% £1,000,000 to £2,999,999

0.225% £1,000,000 to £2,999,999

0.000%

£3,000,000 to £4,999,999

0.20% £3,000,000 to £4,999,999

0.275% £3,000,000 to £4,999,999

0.050%

£5,000,000 to £9,999,999

0.35% £5,000,000 to £9,999,999

0.425% £5,000,000 to £9,999,999

0.150%

£10,000,000 to £29,999,999

0.40% £10,000,000 to £29,999,999

0.475% £10,000,000 to £29,999,999

0.200%

£30,000,000 to £49,999,999

0.45% £30,000,000 to £49,999,999

0.525% £30,000,000 to £49,999,999

0.225%

£50,000,000 to £74,999,999

0.50% £50,000,000 to £74,999,999

0.575% £50,000,000 to £74,999,999

0.275%

£75,000,000 to £99,999,999

0.60% £75,000,000 to £99,999,999

0.675% £75,000,000 to £99,999,999

0.325%

In excess of £100,000,000

0.65% In excess of £100,000,000

0.725% In excess of £100,000,000

0.375%

RBS00000

3

Comprehensive Controls

Individual transaction limit

Cardholder monthly limit

Corporate monthly limit

Merchant Category Group Blocking (inc option to prohibit cash withdrawals)

Preferred Vendor

‘Approved’ Supplier lists

‘Hosted’/Virtual cards

Smart Data On-Line (SDOL)

Corporate Liability Waiver/ Lost or Stolen Card Liability

£50k per c/holder

£1.5 Million per programme

RBS00000

4

Declining Balance Cards - Uses and Benefits

Declining balance cards are an ideal solution for any programme where there is a

need for a set budget or a fixed spending amount.

Examples of Declining Balance usage would be…

- Incentives

and Per Diem

Meetings & Events

Projects

Travel and Expense

-

Consulting Projects

-

Board Meeting Arrangements

- Recruiting and Relocation

- Disaster Recovery Projects

- Conferences & Conventions

- Rewards and Recognition

- Educational Grants

- Parties

- Temporary Workers Expenses

- Government Grants

- Sales / Team Meetings

- Training Budgets

- Pilot / Test Programmes

- Trade Shows & Events

- Allowances

- Short-Term Projects

- Product Launches

RBS00000

5

Virtual Cards

A rapidly growing area for cards use

No Cards issued

Virtual cards can be set up in any name as not constrained by Chip & Pin regs

Usually set up in name of Department or key supplier

If with key supplier, card number is lodged with supplier

Purchases made and charged to card

Data supplied is usually level 3 compliant removing requirement for VAT receipts

Card details held securely

Coding can be added as part of transactions to assist cost allocation

RBS00000

6

Reporting options

Functionality Includes :

Integrated MI systems or 3rd Party solutions available

Large variety of reporting options, allowing you to compile, track and manage

transactions.

VAT reports accredited by Customs and Excise as evidence for VAT reclaim.

Manipulate raw data to produce your own bespoke reports.

Web based services that enable you to access management information reports,

helps analyse your cardholder’s spending, ensure internal policies are being

adhered to.

Create your hierarchy for reporting purposes.

Cardholder logon

Assignment of GL Codes

Download data to your General Ledger/Account software systems

RBS00000

7

Summary benefits

RBS Commercial Cards through GPC, can offer increased value to both internal and end

user customers through ;

Reducing the need for cash - Global Acceptance

Cash flow management – Free up cash flow of upto 45 days from date of purchases

Process efficiency – Reduce cost of invoice processing by approximately £33 (manual

versus electronic)

Cost control - Card transaction limits and monthly card limits – Tight Control on Spending

On line Management Information – 24/7 visibility of Purchases

RBS00000

8

Innovation in Banking

Tom Macdonald - Cash Management

RBS00000

9

Banking Innovation

Backdrop

Banking landscape more regulated to ensure greater future stability

Liquidity and cash flow management increasingly important

European initiatives driving efficient business interaction across the single market

Technology continues to transform how we pay and interact

Growing expectations for mobility, speed and interoperability

Online is moving to Mobile as smart phone and tablet use increases

Consumers are changing faster than businesses but what does this mean in the way they

pay businesses?

RBS00000

10

Regulation – Stability and Compliance

The New Landscape

Europe Basel III

1) International Agreement on the amount of capital held

by banks

– Goes live from 2013

Prudential Regulatory Authority

US Dodd Frank Act

1) Promotes the stability of the US financial system

– Improves accountability and transparency

– Protects American taxpayer by ending bailouts

– Protects consumers from abusive financial services

practices

3) FCA supervises the individual organisations

1) New entity that will sit alongside the Financial Conduct

Authority

2) PRA works with Bank of England to ensure market

stability

Payment Services Oversight

1) Banking Act 2009 gives the BoE responsibility in the UK

for ensuring that critical payment schemes operate

prudently

– More banks will join schemes in their own right

UK independent Commission on Banking

1) Ring fences UK retail operations

2) Improves loss absorbency, e.g. equity/leverage

3) Sets higher UK capital requirements for systemically

important FIs

– Bacs payments will move to a £20m value cap from

May 2012

2) UK Payments Council tasked to oversee and drive

these changes

RBS00000

11

UK Payments Council

Key Objectives

Innovation – research, enhance, facilitate

Inclusion – improve access & inclusion

Integrity – robust and secure systems

RBS00000

12

Payments Council – National Payments Plan

Activity

Innovation

Mobile Payments Service development of a ‘proxy’ database to

route payments to a bank account

using a linked mobile phone number

Multiple Authorisation for all business

online channels to support small

business demand for online banking

services

Investigating solutions to ensure

electronic payments are made to the

right payee

Inclusion

Integrity

Linked closely to innovation

•

Working closely with the Charities &

Voluntary sectors to ensure that

payment services meet the needs

Frameworks/concepts easy to

recycle

Payment system resilience e.g. Bacs

transaction value cap of £20m from end

May 2012

•

Develop minimum standards for customer

authentication on internet and telephone

banking

•

New best practice guidance on Payment

Referencing for Billers and Payers in late

2010

Recent research on how older people

interact with the service sector for

payments

RBS00000

13

UK Payments Trends 2010 - 2020

Winners and Losers

100%

40%

41%

24%

22%

17%

All Payments

(Non Cash)

Debit Cards Credit Cards Direct Debits Auto Credits Standing Orders

ATM

3%

CHAPS

Cash

Cheques

9%

35%

100%

Source: Payments Council UK Payment Markets 2011

RBS00000

14

Wider Innovation

Business Efficiency

Worldwide Government initiatives driving business and citizen e-enablement and

activity

Across Europe, mandatory B2Gov e-invoicing is spreading - Denmark, Finland,

Italy, Spain and Sweden have done and other countries are expected to follow

e-invoicing generally is experiencing 30-40% annual market growth

In turn it supports better cash flow management and accounts payable/ receivable

process efficiency,

The SEPA project aims by end 2014 to deliver across participant countries

mandated use of SEPA credits and direct debits

For consumers UK drive to get more people on line and extend broadband reach/

speed

So what might the future look like?

RBS00000

15

Fast growing expectations – consumers and businesses

Customers today demand payment methods that :

Conform to the highest standards

Don’t have onerous identification methods

Are completed within hours

Use devices that exist for other reasons

Are 100% accurate and reliable

Are widely accepted by businesses

Are globally usable

Are value for money

Use data to enhance the bank’s offer, but not

intrude

Do you agree?

16

RBS00000

16

And what might this mean?

Mobile, globally

accepted and secure

Cash is dead

Possible Consumer

Scenario

x

Efficient*

Replaced by mobile phones

and contactless cards

Or by biometric identification

and verification which brings

up a list of cards/accounts to

choose from stored on ‘the

cloud’

Networked*

Paper is dead: all

payments are initiated

electronically

Possible Corporate

Scenario

Networked*

Flexible*

Insightful*

Most are straight-through,

enabled by....

Efficient*

Freeing people to

provide insights and

build relationships

With transparent pricing

17

17

RBS00000

*Source: characteristics of a Bank of the Future

And data is used to improve

tailoring and support

Insightful*

And approval

on the go

...E-invoicing

Flexible*

Innovation Activity

PayAway-IP Direct Mobile App

Intelligent Deposit Safes

• Mobile app for iPhone & iPad

• Service piloted in live customer premises

• View BACS reports and file submissions

‘on the move’

• Proposition under assessment for potential

full delivery

• Secure solution for cash takings

• Mobile app for iPhone and iPad - File

authorisation

• Technology counts cash reducing errors

and saving time

PayAway-IP Direct – new features

• Combats fraud from employees and

counterfeit notes

• Evaluating enhancements based on customer feedback:

• Sage integration (50 and 200)

• Direct Debit Manager

Mini Cash in Transit Pick Up

• Regional customer pilot conducted of Bank Branch alternative

• Proposition under assessment for potential full delivery

• Bank provides small CIT vans collect notes/coin from customer

premises (£3k - £10k)

• Bureau module

Mobile Channel

• Assessing Mobile Channel opportunities

• Potential prototypes being worked on:

• SME E-invoicing prototype on handheld

and iPAD

• Order coin to be delivered with collections

• Business cheques also collected

• Quick apps - “bookshelf” and “expenses”

• Mobile app for iPhone and Blackberry

users linked to Bankline

• Mobile wallets/Payment options

RBS00000

18

Summary

Definition of ‘Innovation’

The act of starting something for the first time

Introducing something new

A new method of doing something

“If at first the idea is not absurd, then there will be no hope for it.” (A. Einstein).

RBS00000

19

No representation, warranty, or assurance of any kind, express or implied, is made as to the accuracy or completeness of the information contained in this document and RBS accepts no obligation to any

recipient to update or correct any information contained herein. The information in this document is published for information purposes only. Views expressed herein are not intended to be and should not

be viewed as advice or as a recommendation. You should take independent advice on issues that are of concern to you. This document does not purport to be all inclusive or constitute any form of

recommendation and is not to be taken as a substitute for the recipient exercising his own judgement and seeking his own advice. This document is for your private information only and does not

constitute an analysis of all potentially material issues nor does it constitute an offer to buy or sell any investment. Prior to entering into any transaction, you should consider the relevance of the

information contained herein to your decision given your own investment objectives, experience, financial and operational resources and any other relevant circumstances. Neither RBS nor other persons

shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this communication.

The products and services described in this document may be provided by The Royal Bank of Scotland plc, The Royal Bank of Scotland N.V. or both.

The Royal Bank of Scotland plc. Registered in Scotland No. 90312. Registered Office: 36 St Andrew Square, Edinburgh EH2 2YB. The Royal Bank of Scotland plc is authorised and regulated in the

United Kingdom by the Financial Services Authority. The Royal Bank of Scotland N.V. is authorised by De Nederlandsche Bank and regulated by the Autoriteit Financiele Markten (AFM) for the conduct

of business in the Netherlands.

The Royal Bank of Scotland plc is in certain jurisdictions an authorised agent of The Royal Bank of Scotland N.V. and The Royal Bank of Scotland N.V. is in certain jurisdictions an authorised agent of

The Royal Bank of Scotland plc.

Copyright 2012 RBS. All rights reserved. This communication is for the use of intended recipients only and the contents may not be reproduced, redistributed, or copied in whole or in part for any purpose

without RBS’s prior express consent.

RBS00000

20