ppt

advertisement

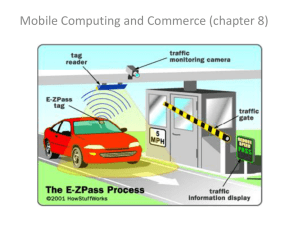

COMP7880: E-Business Strategies Mobile Commerce Dickson K.W. Chiu PhD, SMIEEE, SMACM, Life MHKCS Jelassi & Enders: Chapter 12 1 Our Roadmap Mobile e-commerce strategy E-business strategy Strategy Strategy formulation implementation 12 Strategic analysis 3 External analysis 9 5 Internal organisation Strategy options Opportunities/ threats Strengths/ weaknesses 4 Internal analysis 6 Sustaining competitive advantage 8 7 Exploring new market spaces Creating and capturing value 10 13 Interaction with suppliers Implementation 11 Interaction with users/customers COMP7880-IC-2 Defining m-commerce (Elliott, Phillips, 2004 ) Mobile commerce (M-commerce) is concerned with the use, application and integration of wireless telecommunication technology and wireless devices within the business systems domain. Location independent connectivity Mobile Internet Mobile E-commerce Mobile phone, Mobile device (PDA, wireless vending machines, wireless LAN,…) Ramifications for wireless design: ’E’ ‘M’ (Venkatesh, eds., 2003) M-Commere Strategy 3 The M-commerce Systems Environment (Elliott, Phillips, 2004 ) Wireless Vending Devices (M-Wallet capable) Voice, Picture, SMS, And Data M-Commere Strategy 4 1G: Analog Communication (Elliott, Phillips, 2004 ) Only in certain environments, particularly in government agencies and the military 1946 AT&T Bell introduced the first commercial mobile phone 1960s AT&T Bell developed the IMTS (Improved Mobile Telephone Services) Late 1970s and early 1980s, microprocessor technology and improvements in cellular network infrastructure led to the birth of 1G, wireless telecommunications systems 1980s Nokia in Finland Ericsson in Sweden Motorola in USA Sweden, Japan, and USA developed their own standard Roaming was extremely difficult M-Commere Strategy 5 2G: Based on Digital Technology (Elliott, Phillips, 2004 ) 1G, lack of security and the proliferation of different wireless network standards 2G occurred in early 1990s GSM (Global System for Mobile Communication) More global compatible telecommunication network European-Centric development Less costly Roaming was possible Fully specify the complete network structure As well as voice communications, 2G mobile phone can send and receive message SMS (Short Messaging Services) Mobile Internet Browsing, via the WAP (Wireless Applications Protocol) M-Commere Strategy 6 2G Phone connection to the Mobile Internet Source: Kavassalis et al., 2003 M-Commere Strategy 7 2.5G: Digital With Package Switched (Elliott, Phillips, 2004 ) One significant drawback to 2G GSM network – primarily voice-centric with limited data transmission characteristics GPRS (General Packet Radio Service) Developed in late 1990s and early 2000s Higher transmission rates and always-on connectivity E-mail can be received on a mobile phone handset without the need to dial-up WAP content can be accessed at a quicker rate M-Commere Strategy 8 3G: Third generation wireless communication (Elliott, Phillips, 2004 ) 3G technology is aimed at providing a wide variety of services and capability in addition to voice communication, such as Multimedia data transfer, video streaming, video telephony, and full, unabridged Internet access Providing Data Centric Services with enhanced voices and multimedia capabilities UMTS (Universal Mobile Telephony Systems ) A new Network service replacement for the GSM 3G is to provide an economically viable and technologyenhanced PCS portal First introduced to Japan in 2001, and spread to Europe and USA in 2002 Life Style Portal Location dependent information M-Commere Strategy 9 3G: Third generation wireless communication source form: 3GPP TS 23.228, 24.228, 23.102 M-Commere Strategy 10 from: http://www.medialab.sonera.fi 4G M-Commere Strategy 11 Current Development iB3G 4G Pervasive Computing M-Commere Strategy 12 iB3G: Combining the best of both dual-mode handset Cellular Source form: 余孝先, 2004 Coverage Mobility Billing System Roaming Widespread 2G/2.5G, HS,3G, B3G WLAN M-Commere Strategy Bandwidth Cost Multimedia Services Always Connected Easy to Setup 802.11a,802.11b, 802.11g 13 4G: 4th Generation Wireless System source from: BWN Lab, http://users.ece.gatech.edu/~jxie/4G Reasons to Have 4G Support interactive multimedia Wider bandwidth, higher bit rates Global mobility and service portability Low cost Scalability of mobile networks What’s New in 4G Entirely packetswitched networks All network elements are digital Higher bandwidth and lower cost (up 100Mbps) Tight network security M-Commere Strategy 14 Pervasive Computing source from: IBM Web Site Pervasive Computing Enabling information access anywhere, anytime, on demand Pervasive Computing delivers mobile access to business information without limits- from any device, over any network, using any style of interaction. It give people control over the time and the place, on demand. M-Commere Strategy 15 Pervasive Computing for a Nomadic Lifestyle Lessons Learned from MIT’s Project Oxygen, Zue 2004. Some System-Level Challenges Pervasive: Be available everywhere, at anytime, for anybody Nomadic: Allow people and devices to move around freely Embedded: Live in our world, sensing and affecting it Human-centered: Understand and respond to human intent; solve real problems Non-intrusive: Preserve privacy while ensure security Adaptable: Provide flexibility in response to change Eternal: Must never shut down or reboot Organic: Allow applications and services to be added easily … Question: What are the opportunities? M-Commere Strategy 16 Integrated multimedia nature of 3G domainthe PCS (Personal Communications Service) (Elliott, Phillips, 2004 ) M-Commere Strategy 17 M- Commerce Applications Delineating the effects of M-commerce: A space-time matrix M-Commerce applications are categorized along three dimensions: Location sensitive Time critical Controlled by information receiver or provider EC vs. MC M-Commere Strategy 18 Delineating the effects of M-commerce: A space- time matrix Balasubramanian et al. 2002 M-Commere Strategy 19 Delineating the effects of M-commerce: A space- time matrix Balasubramanian et al. 2002 M-Commere Strategy 20 Taxonomy of M- Commerce Applications Balasubramanian et al. 2002 The extent to which the applications is location sensitive The extent to which the applications is time critical The extent to which the applications is controlled by the information receivers or by the providers Dimension 3: Controlled by the Information Receivers Dimension 2: or by the Providers Time Critical M-Commere Strategy Dimension 1: Location Sensitive 21 Mobile information assets: location sensitive Rao, Minakakis, 2003 ;Balasubramanian et al. 2002 Deploy Mobile Internet services based on the various benefits of mobility Information that is provided on a geographical locations Information that tracks an individual user (via their mobile phone) to determine their specific geographical location anywhere in the world GPS (Geographical Positioning Systems) Support location-based services (LBS) Location-tracking services are encouraged by both business and national government e911 in USA: 999 in UK; 119 in Taiwan M-Commere Strategy 22 Locations Assets (Elliott, Phillips, 2004 ) Location-based services information Location-based product Retailing Location-based Products Location-based Access Location-based Maps (directions) M-Commere Strategy 23 Time Critical Applications vary along the dimension in terms of the degree to which they are time critical Flight departure Information that quickly depreciates in value Participation in a virtual auction (+) Mobile access to digital libraries (–) It will involve the exchange of information related to a scheduled Balasubramanian et al. 2002 A stock price Information that is required to address some emergence A roadside assistance M-Commere Strategy 24 Controlled by the information receivers or by the providers Balasubramanian et al. 2002 Applications controlled by an information receiver Relates to more random, unforeseen needs A call for service after an automobile breakdown Applications controlled by an information provider Tend to be marketing “broadcast” activities Coupon announcement Maintain on an ongoing basis by service providers or coordinators Monitoring of truck fleets using on board sensors M-Commere Strategy 25 M-commerce vs. E-commerce (Elliott, Phillips, 2004 ) E-Commerce is concerned with data and information transfer, and with Internet access, via wired technology M-Commerce is concerned with data and information transmission, and Internet access, via wireless technologies and various portable devices M-Commere Strategy 26 Comparison between E-commerce and Mcommerce (Elliott, Phillips, 2004 ) Factor E-Commerce M-Commerce Product or service focus Product focus Service focus Product or service provision Wired Global access Wireless Global access Product or service assets Static information and data Dynamic locationbased data Product or service attraction Fixed non-timeconstrained access Mobility and Portability of access M-Commere Strategy 27 Comparison between E-commerce and Mcommerce Barnes And Huff, 2003; Elliott, Phillips, 2004 Factor E-Commerce M-Commerce Personal Devices PC: Medium Mobile phone : High Network Operators can determine the services No Yes, like a gatekeeper Usage and Applications will charge No standard way to charge; PC is essentially free Users seem prepared to pay a ‘mobility premium’ User’s Location Hard to find Network Operator know who you are, where you are, can direct you to the portal of choice, and can charge you money Reverse Billing No Yes, in which services are charged directly to the user’s phone bill Display Screen Size and Medium Memory Small Click through rates for banner AD and e-Mail (i-mode) 3.6%; 24% PC Less than 0.5% M-Commere Strategy 28 M-Commerce Value Chain Emerging Industry Structure (Bane, Bradley, and Collis (1998)) Phone Television Computer Shopping Voice Video Digital Wormhole Data Terminal Shop at home Facilitating Technologies Entertainment Transactions Education Pornography Gambling Hardware Fileservers CPU Software Computing Algorithms Digital Signal Processing General Magic ATM Publications Transmission Manipulation Packaging Content = Industry size (relative) M-Commere Strategy 29 M-Commerce Value Chain European Commission 1996 (Barnes, Stuart J. 2002) M-Commere Strategy 30 European Mobile Portal & Media Value Chain Source: http://www.medialab.sonera.fi/workspace/JukkaHelin3GinJapanOct2002.pdf M-Commere Strategy 31 i-mode and Media Value Chain Source: http://www.medialab.sonera.fi/workspace/JukkaHelin3GinJapanOct2002.pdf M-Commere Strategy 32 MacDonald, 2003 M-Commere Strategy 33 M- Commerce Business Models MacDonald, 2003 Brand Building or Media Mix Customer Relationship Management Online Retail Premium Content Aggregation B2B Advertising M-Commere Strategy 34 MacDonald, 2003 9% M-Commere Strategy 35 Sources from: http://www.medialab.sonera.fi M-Commere Strategy 36 Sources form: http://www.medialab.sonera.fi M-Commere Strategy 37 Sources form: http://www.medialab.sonera.fi M-Commere Strategy 38 Obstacles to M-commerce (Elliott, Phillips, 2004 ) Efficient and fast wireless telecommunications services are often focused within specific area West Europe,the USA, Japan Not available in low population area Many developing countries has led these countries to adopt wireless telecommunications Wireless Mobile Internet access more costly than wired Internet access 3G technologies and devices often deliver data content that are indistinguishable form those available on the wired Internet Mobile Internet users are accustomed to paying for Internet and correspondingly expect to pay for certain levels service and reliability M-Commere Strategy 39 Obstacles to M-commerce (2) (Elliott, Phillips, 2004 ) Concerns over privacy and security still pervade the wireless data transmission world 3G technology is inherently more secure than 2G Many government and business organizations banned the use of 2G mobile phone for private or secure conversations Many individuals and organizations still harbor concerns over the health issues of wireless technology With regard to microwave radiation emission levels Up to the year 2000 the studies remain inconclusive Many government are requiring mobile phone devices manufacturer to publish health evidence M-Commere Strategy 40 The development of M-commerce In Europe and Japan Focus on delivering to the customer technology, such as internet –enable mobile phones, and the provision of Mobile Internet services Europe view: Lifestyle consideration In USA Focus on the use of palm computers, other mobile devices (e.g. the BlackBerry mobile E-mail devices), and other wireless technology to improve the effectiveness of business systems process USA view: Support mobile working M-Commere Strategy 41 The growth of spread of M-commerce (Elliott, Phillips, 2004 ) Innovations: Adoption: Developments in mobile wireless application and technologies Proliferation and use wireless technologies by (potential) customers Increased competition: Desired by organizations to expand markets and added value to products and services M-Commere Strategy 42 Mobile e-commerce value network outlines the key players Provider of enabling technologies Infrastructure equipment vendor Content provider Service area Source: Adapted from F. Müller-Veerse et al. (2001), p. 23. Portal provider Mobile device manufacturer Application area Technology area End Consumers Mobile network operator Application developer/provider m-Commerce consumer services and applications Information Communication News m-Advertising Weather m-Health Catalogues SMS/MMS ... … Transaction Entertainment m-Banking m-Games m-Tailing m-Gambling m-Payment m-Music ... ... Source: Adapted from F. Müller-Veerse et al. (2001), p. 80. M-SCM M-CRM m-Inventory m-Tracking ... m-Services m-Sales ... Internal External m-Commerce business services and applications Source: Adapted from F. Müller-Veerse et al. (2001), p. 80. m-Workforce m-Office m-Fleet tracking ... Characteristics of m-commerce Ubiquity This characteristic means that users are able to use their device at any time and in any location. Ubiquity increases the immediacy of communication and is equally valued in consumer and business markets. Convenience Mobile content is inferior to other media in terms of screen size and downloading speed. However, it is superior to other media in terms of convenience and ease of use. Localisation Localisation of devices and their users is based on the portability of wireless devices and the knowledge about a person’s location. It enables location-based services. Personalization in mobile is higher than in wired ecommerce. When calling a mobile phone, users call the number of a person and not the number of a location as in the case of a fixed-line phone. Personalization Privacy and security Device and network limitations Source: See also D. Steinbock (2005). Privacy and security are decisive prerequisites for all wireless transactions. Users need to be in control of their data, especially if it comprises information about their geographical location. Due to slow transfer rates, limited connectivity, small screens and tiny keyboards of the handset, a user’s wireless Internet experience can be very restricted. Impact of wireless technologies on the value chain Firm Infrastructure • Mobile financial and ERP systems, incl. legal and government information • Mobile investor relations (e.g. information dissemination, broadcast conference calls, alerts) • Voice-to-data conversions: mobile forms-based applications, multimedia cellular and wireless broadcast • Mobile services: rich voice (image, video), Internet (intra/extranet), messaging (SMS, MMS, LBS) and content • Mobile access to e-mails, personal information management Human resource management • Mobile activities in recruiting, hiring, training, development and compensation • Mobile self-service personnel and benefits administration, incl. mobile time and expense reporting • Mobile sharing and dissemination of company information • Mobile services via HRM: voice guidance, messaging (SMS, MMS, LBS push or pull), internet and infotainment Technology development • Mobile teams, distributed collaborative product design across locations and among multiple value-system participants • Knowledge directories accessible from any location • Real-time access by R&D to mobile sales and service information Procurement • Mobile demand planning and fulfilment • Other mobile linkage of purchase, inventory, and forecasting systems with suppliers and/or buyers • Mobile direct and indirect procurement via marketplaces, exchanges, auctions, and buyer/seller matching Mobile SCM Source: Adapted from Dan Steinbock (2005), p. 260. Mobile CRM Impact of wireless technologies on the value chain Operations Inbound Logistics Mobile activities Mobile activities in associated with receiving, storing and transforming inputs disseminating inputs to into final products/services products/services Outbound Logistics Marketing and sales Mobile activities Mobile activities with associated with collecting,means for buyers to storing and distributing purchase products/ products/services to services and inducing buyers them to do so, incl. advertising, promotion, • Mobile scheduling, • Mobile • Mobile order sales force, channels, shipping, information processing and pricing warehouse/demand exchange, scheduling management and scheduling and • Mobile delivery vehicle • Mobile sales channels, planning and decision making operation e.g. websites, scheduling across in in-house • Mobile marketplaces the company and plants, contract customer/channel • Mobile access to its suppliers assemblers, and access to product customer information, • Mobile distribution components development and product catalogues, across the suppliers distribution status order entry company of real• Mobile • Mobile channel • Mobile product/service time inbound and available-tomanagement, incl. configurators in-progress promise information exchange, • Mobile push/pull inventory data information to warranty claims, advertising sales force and contract management • Mobile surveys, optchannels (versioning, process in/opt-out marketing, control) and promotion response tracking Mobile SCM Source: Adapted from Dan Steinbock (2005), p. 260. After-sales service Mobile activities associated with providing service to enhance or maintain the value of product/services • Mobile support of customer service reps (incl. voice guidance, SMS, MMS, LBS, e-mail, billing, co-browse, chat, VoIP, video streaming) • Mobile customer self-service via portals and mobile service request processing, billing, shipping etc. • Mobile field service access to customer account review Mobile CRM Impact of wireless technologies on the industry’s five forces Barriers to entry Bargaining power of suppliers (+/–) Procurement using mobility tends to raise bargaining power over suppliers (e.g. Wal-mart and RFID), though it can also give suppliers access to more customers (+/–) Mobility provides a channel for suppliers to reach end users, reducing the leverage of intervening companies, but it may also provide a direct channel to industry rivals and thus disintermediate channels (+/–) Mobile procurement and mobile markets tend to give all companies equal access to suppliers, but they can also be used to create privileged access to some firms (+/–) Mobility can gravitate procurement to standardised products that reduce differentiation, but it can also be deployed to diversify products/services, which increases differentiation Source: Adapted from Dan Steinbock (2005), p. 266. Rivalry among existing competitors (+) Increases barriers to entry by eliminating waste and contributing to efficiencies (+/–) Mobile applications are difficult to keep proprietary from new entrants, but consolidation favours incumbents (–) A flood of new entrants has come into many new industries Bargaining power of channels and end users (–/+) Reduces differences among competitors as offerings are (+) Complements (–) Shifts powerful bargaining difficult to keep proprietary, but increases channels and power to the potential for efficiencies can improve end consumers (–/+) Migrates competition to price, but can bargaining (+/–) increase potential for differentiation Increases/decreases (–) Widens the geographic market, power over switching increasing the number of competitors traditional costs channels (–) Lowers variable cost relative to fixed cost, increasing pressure for price discounting (+) By making the overall industry more efficient, Mobility can expand the size of the market Threat of substitute (+) The proliferation of mobility approaches products or services creates complementary opportunities, rather than substitution threats