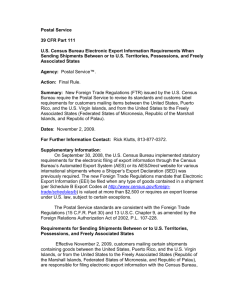

Foreign Trade Statistics Regulations & AES

advertisement

Foreign Trade Statistics Regulations U.S. Census Bureau Foreign Trade Division Regulations, Outreach and Education Branch 1 Today’s Topics • • • • • • • • Legal Requirements Filing Requirements U.S. Principal Party In Interest (USPPI) Types of Transactions Exemptions Automated Export System (AES) Compliance Penalties 2 Legal Requirements Census Bureau Foreign Trade Statistics Regulations (FTSR) • 15 CFR, Part 30 Section 30.1-30.99 Bureau of Industry and Security (BIS) Export Administration Regulations (EAR) • 15 CFR, Parts 700-799 3 What is an SED Shipment? An SED shipment is: • Merchandise shipped from One USPPI to One Consignee • On the Same Flight/Vessel • To the Same Country • On the Same Day • Valued Over $2,500 per Schedule B Number or License Required 4 When is the SED Required? For virtually all shipments: . • To Foreign Countries • Between the U.S. and Puerto Rico • From Puerto Rico to Foreign Countries • From Puerto Rico to U.S. Virgin Islands • From the U.S. to the U.S. Virgin Islands 5 U.S. Principal Party in Interest The U.S. Principal Party in Interest is the: • U.S. Person or Entity • Primary Benefactor (Monetary, or Otherwise) Generally that Person can be the: • • • • U.S. Seller: (Wholesaler or Distributor) U.S. Manufacturer U.S. Order Party Foreign Entity (If in U.S. at time goods purchased or obtained) 6 Two Types of Transactions Export Transaction (Standard): USPPI files the AES record or appoints an authorized U.S. agent to file the export information. Routed Export Transaction: Foreign Principal Party in Interest (FPPI) appoints an authorized U.S. agent to file the export information. 7 Export Transaction USPPI Responsibilities: • Files the export information or appoints authorized U.S. agent • Provides POA to the authorized U.S. agent • Responsible for license determination Authorized U.S. Agent Responsibilities: • Obtains a POA from the USPPI • Provides transportation data • Files accurate and complete export information 8 Routed Export Transaction USPPI Responsibilities: • Must provide the FPPI’s agent with commodity data & licensing information • Upon request be provided with their portion of the SED upon completion by authorized U.S. agent Authorized U.S. Agent Responsibilities: • Obtain a POA from the FPPI • Provide transportation data • Files accurate and complete export information 9 Shipments Exempt from Filing • $2,500 or less per Schedule B Number • Intangible exports of software & technology • Tools of Trade: hand carried, personal or company use, not for sale, returned within 1 year • Country of ultimate destination is Canada 10 Exemptions Do Not Apply • Commerce (BIS) Licenses • State Department Licenses • License Shipments from Other Government Agencies • OFAC Prohibited Countries 11 Record Retention For the Census Bureau: • Retain documents verifying the shipment for 5 years from the date of export Other Government Agencies: • Retention periods may differ 12 Automated Export System The Automated Export System is the electronic filing of: • Shipper’s Export Declaration AES Filers can be: • U.S. Principal Parties in Interest • U.S. Authorized Agents 13 AES Filing Methods • Direct connection to the CBP mainframe • Self-developed Software • Certified Vendor Software • Certified Service Center • AESDirect • Interactive Filing • AESPcLink • Batch Filing (EDI Upload) • AESWebLink 14 AESDirect • Census Bureau’s FREE Internet based system for filing SEDs with AES • www.aesdirect.gov • On-line help facility • Help Desk / Tech Support 7am-7pm EST, 7days a week • Data Security through encryption, user authentication and password maintenance 15 Staying Compliant with AES • Filings are monitored for quality, timeliness and coverage • Census will take the appropriate action to correct non-compliance • AES filers can be penalized for: • Failure to File • Late Filing • Providing false or misleading information 16 Compliance Review Program Goals • Identify and Develop Best Practices • Offer Assistance and Guidance with AES Filings • Help you Avoid Costly Encounters with Government Enforcement Agencies 17 Compliance Review Process • Notification letter sent prior to meeting • Compliance Team will visit companies • Attendees, Managers, Compliance Officers, Forwarders, and/or staff with AES responsibilities • 90 days to achieve compliance • Referrals to OEE and/or CBP 18 Penalty Provisions Delegation of Authority – Enforcement Criminal Penalty Civil Penalty Voluntary Self Disclosure 19 Criminal Penalties USPPI or Authorized Agent who knowingly: Fails to file • Files false and misleading information • Continues to participate in illegal activities Fines: • Up to $10,000 per violation • Imprisonment for not more than five years • Both 20 Civil Penalties USPPI or Authorized Agent or Carrier: Late Filings Up to $1,100 per each day delinquency or up to a maximum of $10,000 per violation Other Violations Up to $10,000 per violation Penalties may be Mitigated 21 Voluntary Self Disclosure Reflects due diligence in preventing, detecting, and correcting violations. Letter should include the following information: Nature of the problem Mitigating Factors (I.e. training) Number and value of shipments affected Corrective Actions Taken Exhibits/Attachments (I.e. ITNs, AES Records Contact information A VSD should not be used to report a correction to a record 22 For More Information • FTD Call Center: 1-800-549-0595 • Choose 1 – AES Assistance • Choose 2 – Commodity Classification Assistance • Choose 3 – Regulations Assistance • Fax: 301-763-6638 or 301-763-4670 • Secure Fax: 301-763-8835 • Email: ASKAES@census.gov FTDREGS @census.gov • www.census.gov/trade 23