Research into Manufacturing and Engineering

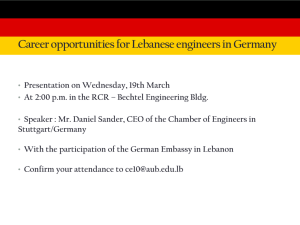

advertisement

Research into Advanced Manufacturing and Engineering Services Skill Needs Image copyright of DEL Agenda • Terms of Reference and Methodology • Size of Advanced Manufacturing and Engineering Sector/ Importance to NI Economy • Current Workforce • Supply of Skills • Demand for Skills • Best Practice Interventions • Areas for Development Terms of Reference • The overall research objectives are to: – – – – – – – – – Define the sectoral footprint and size of the advanced manufacturing and engineering services sector; highlight the economic and statistical value of the sector and its importance to the Northern Ireland economy; assess the current skills profile of the current workforce (by qualifications) for the sector and highlight the current demand of these skills; analyse regional salary information across the advanced manufacturing/engineering services footprint in UK and Ireland including a review of salary information by skill level, particularly at the level of graduate and post graduate; assess the supply of skills (lower, intermediate and higher levels) for the sector from our schools, Further Education and Higher Education; determine the future skill requirements for the workforce in the sector in Northern Ireland; highlight any skill imbalances which currently exist or are forecast to exist; identify what actions are needed to ensure that the supply of these skills in Northern Ireland is sufficient for the sector; and provide an evidence base for the development of an Action Plan for the advanced manufacturing and engineering sector. Methodology • • • • • • Stage 1: Project Planning and Initiation; Stage 2: Secondary Research – Desk Research and Literature Review; Stage 3: Consultations and Interviews with Key Stakeholders; Stage 4: Survey; Stage 5: Additional Stakeholder Interviews; Stage 6: Modelling/Forecasting of Future Requirements for Skills and Recommendations; and • Stage 7: Reporting and Dissemination of Findings. Importance of Advanced Manufacturing and Engineering to Northern Ireland Economy • The advanced manufacturing and engineering sector employs approx. 79,580 people in Northern Ireland (2013). • The Northern Ireland Manufacturing Sales & Exports Survey 2011/12, DETI (2012) estimated total sales by manufacturing companies in Northern Ireland at £16.6 b. Exports £4.2b. • Forecasts show that the sector is expected to marginally contract up to 2020 with 78,624 jobs forecast . Aerospace, agri-food and sustainable energy expected to expand significantly. Manufacture of electrical equipment (SIC code 27.0), water, sewerage and waste management (SIC codes 36.0, 37.0 and 38.0) and manufacture of machinery and equipment n.e.c. (SIC code 28.0) also to expand. Drivers Technical Change Competition and globalisation Demographic change BUSINESS DRIVERS Firms’ strategic choices Environmental change Consumer demand Literature Review – UK research • UKCES 2012 noted that the number of STEM graduates has been rising across UK. There were 285,000 science graduates and 46,000 engineering graduates in 2010/11, an increase of 14% and 28% respectively, since 2006/07- across the UK • However 40% of STEM graduates are not working in STEM roles, but instead go into Financial Services, Medicine and other roles. • The Royal Academy of Engineering has estimated that there will be a shortfall of over 1,000 STEM graduates per annum (2010-2020) across the UK. • UKCES highlight Skills Gaps for managers in particular regarding strategic thinking/ leading and managing change. Graduate skills gaps also identified (life experience, technical or job-specific skills and poor motivation) • 82% of Manufacturing companies have increased their investment in training. Department of Quantitative Social Science at the Institute of Education in 2011(LFS data) The report concluded that many qualifications, but not all, have an increased value for the individual (i.e. increased wages) and for the labour market, if they are in a STEM subject area, and more so in engineering. It highlights the fact that it is not enough to encourage young people to study in a STEM area; they must also understand that some STEM qualifications have additional value in the labour market over others; engineering related qualifications are valued more than science related qualifications Science, Engineering and Technology Technicians in the UK Economy, Gatsby Trust (2012) • The SET workforce is ageing and therefore fuelling high replacement demand levels • Number of graduates in SET technician employment has increased in the past with 27% of associate professionals and 16% of skilled trades having a degree qualification. • Case study evidence and employer interviews suggested that employers are reevaluating the mix of graduate and intermediate level personnel in technician jobs. • HR policies starting to show changes to reflect the need to focus on retaining existing experienced employees as well as recruiting talent Literature Review – Key Findings • The Department of Business, Innovation and Skills (2012) provided evidence on the benefit of apprenticeships, via the conduction of 79 employer case studies across eight sectors. • They state that, while the cost of apprenticeships must be met by employers, this investment can gradually be recouped over an average of three years and seven months in the engineering sector. • Benefits of training an apprentice include the means of attracting the highest quality of recruits as the result of training which concludes in the acquisition of a widely recognised qualification. Employer Ownership of Skills: Building the Momentum, UKCES (2013) • UK Commission for Employment and Skills highlights the importance of building employer ownership into designing any upskilling programme. It is based on the learnings from 37 pilot projects set up in 2011 which found that: – Employer ownership and responsibility drives jobs and growth – Being customer focused and outcome driven ensures that businesses and people are at the heart of how the skills system operates – Routing the public contribution through the employer will create a single market for skills where supply responds to genuine demand and public investment leverages greater private investment Low skills equilibrium and the Importance of Innovation, University of Warwick (2008) • University of Warwick reviewed the different approaches used by companies to skills development and investment in the Manufacturing Sector. They developed the term Low Skills Equilibrium (LSEq) to describe a situation in which companies are involved in a vicious circle of producing low value add goods and services with low profit margins and there is insufficient cash to train the employees to move out of the situation. • In order to break out of the LSEq it is necessary to raise employers’ demand for skills. The report states that government policy is critical to supporting development of clusters and promoting innovation in order to help organisations adopt business strategies that involve moving up the value chain. Manufacturing in the UK: An economic analysis of the sector, BIS (2010) • Found evidence of the upskilling of individuals across all occupational groups. • Evidence of companies in a collaborative arrangements benefiting from one partner hiring skilled workers, or the “poaching” of highly skilled workers from one firm to another may cause R&D knowledge spill overs. Therefore benefits to the wider economy from investment in skills may exceed private benefits to individuals and firms • The unpredictability of modern manufacturing, meant it was difficult for employers to forecast future employment opportunities that will arise in future. This uncertainty has discouraged some employers from investing in skills and training. Supply • The analysis of the supply of young people into the sector shows mixed results. The number of A-level entries to Mathematics and Design and Technology has increased by 13.7% over the last three years. However the number of entries in STEM related GCSE subjects has decreased 2.5% over the same period. • There were 2,640 graduates in courses relevant to advanced manufacturing and engineering from Higher Education Institutions (HEIs) in Northern Ireland over the last three years equating to an average of 880 people graduating per year. • The numbers enrolling in STEM related FE courses have declined by 15.5% over the last three years and now stand at 17,053 enrolments in 2011/12. Data on the number of FE students coming from STEM related courses going into advanced manufacturing and engineering occupations is not available • The 2013 ApprenticeshipsNI figures show there were 996 participants in 2013 for STEM related apprenticeships, which indicates a 12.2% increase in total participants since 2009. • Department for Employment and Learning Statistical Bulletin: Professional and Technical Enrolments in the Northern Ireland Further Education Sector for 2012/13. Demand- Working Futures Model • The Working Futures model projects the demand for skills as measured by occupations and qualifications. • This database has been developed over many years and is as consistent as possible with all the official published sources upon which it is based. This database was extended to cover 79 SIC2-digit categories in order to meet the requirements specified in the Working Futures 2012-2017. • Sources such as the Labour Force Survey, Office for National Statistics and BIS are used to construct the database. Demand for Skills for the Sector – Expansion, Replacement and Net Replacement • The bulk of the jobs in Advanced Manufacturing and Engineering are due to replacement (ie people retiring or leaving the sector) rather than additional ( new jobs) • The Working Futures Model identifies that there will be a need for 3,000 net additional jobs approx for NI over the next 7 years- for All industries.. • 1,300 per annum are needed to work in Advanced Manufacturing and Engineering Sector in NI • The others are expected to work in a range of roles including teaching, public sector, sales/ customer service etc. RSM Survey of Advanced Manufacturing companies • Survey designed to cover all areas of the Terms of Reference. Some Steering Group members involved in the design of the questionnaire • Sent out to SEMTA data base of Members and to Advanced Manufacturing companies who have worked with FE colleges and Economic Development Officers to access as wide as audience as possible. • 88 responses received and analysed Skills Gaps • Evidence from the survey respondents identified Skilled Trades as being the only occupation as difficult to fill at present- but 47.8% of respondents noted they had difficulties, recruiting: – – – – – – – – – Systems design engineers and stress engineers; CNC programmers/ engineers; R&D Engineers; Production managers/ engineers, Plant Engineers, Project Managers; Manufacturing Systems Engineers ; Electrical technicians; Fitters; Welders; and Skilled fabricators. Company Feedback Reasons given as to why companies were not satisfied with the skills: • Apprenticeships – Young people immature when starting apprenticeship. Trouble with behaviour, timekeeping, work ethic; and – Apprentices lack hands on experience, good at book learning, but practical experience is virtually non-existent. • Further Education colleges – Education must be designed to be jobs and work focused; and – Not enough practical experience, any practical skills were general, not specific enough. • Higher Education institutions – Lacking industrial experience; and – Coming in with degree, but lacking in understanding of consultation and problem solving. RSM Survey- Upskilling • Respondents were most aware of DEL’s ApprenticeshipsNI programme (83.9%) and with 45.5% stating that they had used it. • Companies were least aware of DEL’s Assured skills and Skills Solutions programmes (36.8% and 43.6% being aware of them respectively). • ApprenticeshipsNI was the most commonly used support (45.5% of respondents). • Other programmes that have been used were the YES Scheme and Invest NI’s BITP programme. Respondents were asked what actions need to be taken • Majority of responses focused on: – Increasing the quality of engineering training at HE and apprenticeship training sites (with more practical training needed); – Providing more financial support to make recruitment of apprentices more viable i.e. fund the salaries for apprentices and not just training; – Providing more incentives to businesses to run properly funded graduate schemes; – Promoting career opportunities in advanced manufacturing and engineering to children and young people at schools. Ensuring that careers teachers understand what opportunities exist in manufacturing; and – Promoting the STEM subjects among females and promoting work experience to young people in schools and colleges. Summary- Supply and Demand • There are sufficient numbers of young people coming through the education/training systems but there is a mismatch between the skills and experience required by employers and what is being produced. • The skills mismatch relates to insufficient numbers of people coming through with professional, associate professional, skilled trades and managerial skills. Best Practice Supports Getting STEM students to stay and work in the sector- is a problem in other parts of the world. Actions being taken include: • Increasing Awareness of the Sector in order to get more Science Technology students staying in the Sector: STEPS to engineering – introduced in ROI- to encourage primary school students to get interested in science and engineering. It is part of the Engineers Ireland- Promoting the Profession. • Pathway Models being used in the States to demonstrate to new recruits the different routes they can take in engineering and advanced manufacturing and where they can end up. • Overall promotion of sector starting earlier in school life, involving parents and bringing in more women Regional Salary Information • The basic median pay of those in clerical and technical roles is £19,677, (13% below the average UK basic median pay); • The basic median pay of those in manual roles is £17,901, (7% below the average UK basic median pay). • Considering management roles only, the basic median pay is totalled at £43,014, with the total median pay at £49,560. There is no variance between these figures and the UK average basic median pay. Note: NI figures based on a small sample and need to be treated with caution • Median pay is lower in NI than in ROI for most engineering occupations. Process Engineers 66% lower. • Significant variation in salaries between subsectors and between companies • Universities now required to publish salary information on leavers. RECOMMENDATIONS Increase attractiveness of the Sector Actions: • The sector should work with primary schools to increase awareness and interest in engineering as part of the STEM activities. Primary Schools could be provided with kits/activities that teachers can use to excite children about engineering design and production. • Sector Skills Councils, FE and HE with employers need to tackle the image of ‘engineering’ held by many parents/guardians. They should include information on the education pathways needed to pursue the different type of careers in engineering and they should highlight the importance of gaining practical experience as well as academic qualifications. Parents have questions on apprenticeships that Careers teachers are not up to date on, and these should be incorporated into the sessions. Build Attractiveness of Sector to Parents and Young People • Primary School- kits/activities that teachers can use to excite children about engineering design and production. • Inform parents/guardians on careers. • Promote engineering from the first year of second level school, rather than waiting until students are aged 14 or over. • Expand the UK Aerospace Youth Rocketry Challenge. • More businesses to regularly invite and showcase their industry to primary, secondary and grammar school pupils and their teachers (focus on changing the sceptical perceptions of manufacturing). Build Attractiveness of Sector to Parents and Young People cont/d.. • Sentinus should consider expanding their short workplace engineering activities e.g. Insight into Engineering and make it available to pupils in the summer before they choose their GCSE subjects. • Industry fact sheets already provide the facts on the whole life earnings. This needs to be used more in sessions with parents and young people to allow comparison with other professions.. • School Careers Teachers should have access through W5 (Provider of the STEMNET contract) to the STEM ambassadors from advanced manufacturing/ engineering businesses that are available in their local area. Actions needed to build skills of potential entrants to the sector to meet needs of businesses • Central information source should be set up to detail the different education/career pathways that can be taken by students pursuing engineering careers. • Apprenticeship training needs to meet the requirements of business and this should be actioned through the implementation of the recommendations which will come out of the Ministerial Review of ApprenticeshipsNI. • The Foundation Degree should be evaluated at the end of its first year to assess whether it has addressed employers’ needs. • Pilot Actions needed to build skills of potential entrants to the sector to meet needs of businesses cont/d.. • The business community and education providers (further and higher education) should investigate the possibility of establishing a curriculum group (specifically for advanced manufacturing and engineering) which would regularly meet to ensure that courses and qualifications remain relevant to business needs. • Consideration should be given to expediting the process which it takes to develop and fund specific courses relevant to growing the manufacturing and engineering sector. Actions needed to ensure that sufficient skilled resources are retained in NI to support the sector • Invest NI to provide top up salary support to SMEs that are unable to afford to pay market rates for engineers in key positions within the companies that have the potential to contribute more to the economy. Key positions are those that require specialist technical skills to help the company develop new products/new markets and to increase their exporting levels. • Northern Ireland companies should prepare for the potential risk of engineers being attracted to positions outside of Northern Ireland and develop plans for ensuring they have sufficient resources coming through from HE/FE to meet their needs. Actions needed to ensure that sufficient skilled resources are retained in NI to support the sector cont/d.. • Companies should consider setting up scholarships, bursaries and summer placements to attract top talent from HE/FE to them. • Universities should provide companies seeking to employ graduates, information on the salaries being paid to graduates • Companies should use the market salary information for graduates to inform their pay strategies for these positions. It is important that companies seek to recruit the best talent for the local economy. Actions needed to Upskill the Sector • DEL/Invest NI should increase awareness of their training supports to client companies in the advanced manufacturing and engineering services sector, highlighting the need to build capacity within both existing managers and those likely to take up management positions in the future. • Management succession programmes should be encouraged within those companies with a cadre of junior managers. These programmes will require the identification of employees with the talent and ambition to be future leaders within the company. These employees should be provided with the development needed to ensure they will have the required skills and competencies to manage and lead the companies in the future. Actions needed to Upskill the Sector • DEL/Invest NI should work with businesses/training providers to ensure that the management training provided is tailored to the advanced manufacturing/engineering services sector. • DEL/Invest NI should work with advanced manufacturing companies operating with low profit margins to provide access to strategic support that will help them identify value add opportunities which will allow the companies to grow profitably. This could be actioned through the provision of international advanced manufacturing/engineering mentors, working with local companies, to help them develop strategically. Actions needed to Upskill the Sector • The approach taken to CNC machining should be reviewed within a year and if it is has delivered on industry needs then it is an approach which should be taken to dealing with the shortages in skilled welders/design engineers. • The skills actions set out in the strategies for Aerospace, Agri-Food and Sustainable Energy should be implemented. The delivery of these supports should be business-led and employers should be incentivised to work with FE/HE as required to deliver higher quality vocational learning. • Larger employers should consider the opportunity to involve trainees from their SME supply chains, in any training programmes they have established to provide apprenticeships, thereby reducing the time/ cost to the SMEs. Actions needed to retain skills within the Sector • Invest NI should provide advice and guidance to companies on how to retain talent through the development of relevant HR policies and procedures. • SMEs need external support to identify the training needs within their companies. Given that a high proportion of SMEs do not feel they need training, it is important this assessment is carried out independently, but by specialists who understand the sector.