Mark Bastorous

advertisement

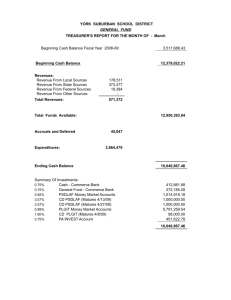

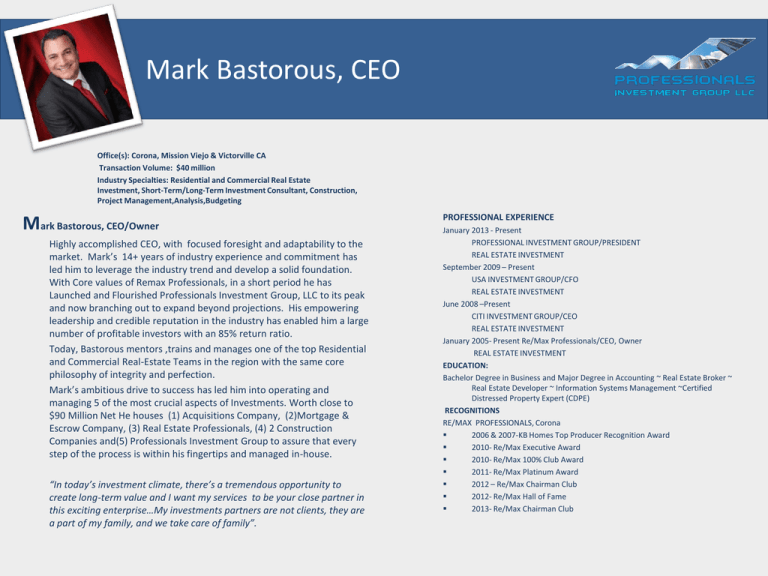

Mark Bastorous, CEO Office(s): Corona, Mission Viejo & Victorville CA Transaction Volume: $40 million Industry Specialties: Residential and Commercial Real Estate Investment, Short-Term/Long-Term Investment Consultant, Construction, Project Management,Analysis,Budgeting Mark Bastorous, CEO/Owner Highly accomplished CEO, with focused foresight and adaptability to the market. Mark’s 14+ years of industry experience and commitment has led him to leverage the industry trend and develop a solid foundation. With Core values of Remax Professionals, in a short period he has Launched and Flourished Professionals Investment Group, LLC to its peak and now branching out to expand beyond projections. His empowering leadership and credible reputation in the industry has enabled him a large number of profitable investors with an 85% return ratio. Today, Bastorous mentors ,trains and manages one of the top Residential and Commercial Real-Estate Teams in the region with the same core philosophy of integrity and perfection. Mark’s ambitious drive to success has led him into operating and managing 5 of the most crucial aspects of Investments. Worth close to $90 Million Net He houses (1) Acquisitions Company, (2)Mortgage & Escrow Company, (3) Real Estate Professionals, (4) 2 Construction Companies and(5) Professionals Investment Group to assure that every step of the process is within his fingertips and managed in-house. “In today’s investment climate, there’s a tremendous opportunity to create long-term value and I want my services to be your close partner in this exciting enterprise…My investments partners are not clients, they are a part of my family, and we take care of family”. PROFESSIONAL EXPERIENCE January 2013 - Present PROFESSIONAL INVESTMENT GROUP/PRESIDENT REAL ESTATE INVESTMENT September 2009 – Present USA INVESTMENT GROUP/CFO REAL ESTATE INVESTMENT June 2008 –Present CITI INVESTMENT GROUP/CEO REAL ESTATE INVESTMENT January 2005- Present Re/Max Professionals/CEO, Owner REAL ESTATE INVESTMENT EDUCATION: Bachelor Degree in Business and Major Degree in Accounting ~ Real Estate Broker ~ Real Estate Developer ~ Information Systems Management ~Certified Distressed Property Expert (CDPE) RECOGNITIONS RE/MAX PROFESSIONALS, Corona 2006 & 2007-KB Homes Top Producer Recognition Award 2010- Re/Max Executive Award 2010- Re/Max 100% Club Award 2011- Re/Max Platinum Award 2012 – Re/Max Chairman Club 2012- Re/Max Hall of Fame 2013- Re/Max Chairman Club Mark Bastorous, CEO Companies and Net Worth Volume Remax Professionals ® Franchise of one of the World’s top Real-Estate companies with 40+ Years of global real estate network, with more than 90,000 Sales Associates 25+ Licensed Agents 20+ monthly properties across Southern California Annual Sales Volume of Mark Bastorous $8,009,288.00 Annual Sales Volume Remax Professionals $72,581,793.00 Escrow Division Generating an average of $240,000 Annually Property Management Professionals Investment Group, LLC® Real Estate Development and Investment Management Company prioritizing on continues growth through relationships with key stakeholders, joint venture partners, investors, Clients and other business affiliates Current Residential Net Worth Overall $48 Million Current Commercial Developments Net Worth of over $21 Million A large list of High Caliber Investors 80-90% Investor Return Ratios Average 27 % Return of Investment AMI Construction® Construction project Management Company to complete each project at the highest quality yet maintain the lowest cost on time Commercial and Residential Project Management $3.7 Million in Annual Project Revenue ATT& T, Shell, Valero, Steak n Shake, Wienerschnizel, Arco SoCal Steak n Shake® California’s first Steak n Shake ® of a well established chain of 512 established US locations. We have opened one in Victorville and in process of opening more to come… Projected over $1.75 Million in Sales Projected over $700,000 Net Profit First location open In Victorville Future location to start construction in 2014 3B Solutions, Inc® Construction and Construction Project Management Company to develop new residential and commercial properties cradle to grave Medical and non Medical development $1.5-$2.0 Million in Annual Project Revenue High-End Single Family Homes, Spec Homes, Additions Shopping Centers & Industrial Building Residential Properties/Flips Property Name Cost of Acquisition Cost of Rehab Sold Price Company Profit $555,000 $110,000 $790,000 $85,000 $700,000 $80,230 $800,000 -$20,230 $430,000 $75,000 $630,000 $93,500 13687 Winewood Victorville CA $90,000 $4,500 $161,500 $67,000 13136 Four Hills Victorville CA $207,500 $15,500 $298,000 $61,100 25053 Mulholland Calabasas CA $720,000 $220,000 $1,325,000 $318,750 59 Sparrowhawk Irvine CA 11221 Wallingsford Los Alamitos CA 2024 North Schaffer Orange CA New Construction Developments Land Cost Projected Construction Cost Commission and Closing Cost Total Investment Cost Estimated Sales Value Investment Profit 22266 Ave San Luis Woodland Hills ,CA $250,000 $374,000 $39,950 $580,000 $799,000 $109,500 920 Crescent Heights Los Angles ,CA $875,000 $875,000 $62,000 $1,873,500 $2,720,000 $846,500 607 Radcliffe Avenue Pacific Palisades, CA $1,485,000 $1,100,000 $118,500 $2,703,500 $3,900,000 $1,196,500 15 Collumnar Ladera Ranch ,CA $550,000 $960,000 $83,000 $1,845,250 $2,800,000 $954,750 0 Talcey Terrace Riverside, CA $250,000 $1,312,500 $110,000 $1,672,500 $2,500,000 $152,197 Property Address Commercial Projects Gas Stations Shell, Valero & Arco Ontario Valero Gas Station Downy Arco Gas Station • • • • • • • Purchase Price Projected Rehab Cost Closing Cost Potential Revenue loss during construction Permit Fees Contingency Projected Project Cost $3,655,000 $2,450,000 $950,000 $75,000 $90,000 $40,000 $50,000 • • • • • • • Purchase Price Projected Rehab Cost Closing Cost Potential Revenue loss during construction Permit Fees Contingency Projected Project Cost $2,236,000 $1,700,000 $90,000 $75,000 $22,000 $50,000 $100,000 • • • Projected Sale Price Closing Cost Broker Fees $4,950,000 $75,000 $99,000 • • • Projected Sale Price Closing Cost Broker Fees $3,500,000 $9,000 $175,000 • Projected Profit $1,121,000 • Projected Profit • • Funds Needed for Project Return on investment in 2 years $2,250,000 $1,195,000 • • Funds Needed for Project Return on investment in 2 years $1,080,000 $1,046,000 %103 Commercial Project Steak ‘n Shake Residential New Developments Commercial Developments