JSE Equity Market 2012 A New Era for JSE Trading

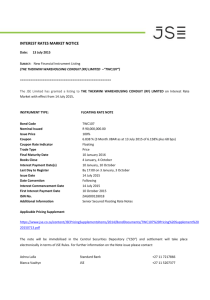

advertisement

JSE Equity Market – A New Era for JSE Trading 1 JSE Focus 2012 Regulation and Market Credibility Cost Understanding and Focus Technology Delivery Integrated trading Integrated Clearing and Settlement Innovative products and services 2 Market Infrastructure Fully integrated vertical and horizontal market structure SETTLEMENT CLEARING Equity Derivatives Commodity Derivatives Equities Interest Rate TRADING LISTING 3 Market Surveillance Information Products JSE Business Model • SRO and listed company • Listing, Trading, Clearing and Surveillance across 4 Markets − Equities – Main Board (ETFs, ETNs, DRs), AltX, BEE Board − Equity Derivatives – SSF, index derivatives, can-do options − Commodity Derivatives – maize, wheat, soya, sunflowers, and CME-referenced corn, crude oil, gold, and platinum − Interest Rate Products - currency futures spot bonds, FRAs/SWAPs • Clearing and risk management services • Settlement − Own just under 45% of STRATE − Guarantee of equity trades • Information product sales • Technology services 4 JSE Products Wide range of products: Equities Equity Derivatives Commodity Derivatives Currency Derivatives Interest Rate Market Ordinary & preference shares Can-Do futures & options Grain futures & options Currency futures Spot bonds (cash) Exchange traded funds & Exchange traded notes Single stock futures Chicago corn futures & options Currency options Bond indices (cash) Warrants Dividend futures Crude oil futures & options Maxi currency futures Contract Bond futures Depositary receipts Index futures Silver & copper futures Rand index Options on bond futures Property unit trust (PUT) and Property Loan Stock (PLS) ; Share Installments & Nil Paid Letters International Derivatives (IDX) CBOT Soybean complex futures & options Jibar futures Debentures Equity options Gold & platinum futures & options Index futures Bonds White maize futures 5 JSE in the global context 300% NASDAQ OMX Liquidity 250% Shenzhen SE 200% Istanbul SE 150% NYSE Group Shanghai SE Tokyo SE Group Deutsche Börse 100% OMX Nordic Hong Kong Exchanges Australian SE Egyptian SE 50% Bursa Malaysia National Stock Exchange India JSE TSX Group London SE Group Bombay SE No. of listed companies 0% 0 6 1,000 2,000 3,000 4,000 5,000 6,000 JSE International Achievements World Economic Forum ranking (SA position out of 142 countries) Category 2011 2010 Regulation of Securities Exchanges 1 1 Strength in accounting and auditing standards 1 1 Protection of minority rights 3 6 Soundness of banks 2 6 Financing through local equity markets 4 7 Availability of financial services 3 7 (Source: WEF Global Competitiveness Report 2011) 7 Revenue drivers - H1 2012 Issuer Regulation 5% 8% Equity Market 11% 4% 1% 26% 3% Back-office services (BDA) and Equities risk management Equity Derivatives Interest Rate Products Currency Derivatives 9% Commodity Derivatives Data Sales 33% 8 Funds management fees Equity Market summary– July 2012 9 Companies Listed & Market Cap– July 2012 10 WFE Rankings– July 2012 11 Equity Market Activity Timeline 12 Equity Market – Trading Technology Equity Market Trading Technology change • JSE migrated from JSE TradElect™ to Millennium IT trading software (400 x faster), on 2 July 2012. • Average Latency on the Native Trading Gateway @ 349 microseconds. o 1 million microseconds in a second - orders are matched in 0.000349 seconds. o JSE TradElect™ averaged between 200 and 400 milliseconds due to the system being in London • Fast Facts “Pre Go Live” o Dress Rehearsal Pass Rate - 5 May: 63%,19 May: 97%, 2 June: 91%, 23 June: 100% o Average Trade to Order ratio: 70% o Highest orders per second: 1333/s o Traders that attended training : 776 o Total Hours of Conceptual Training: 152 Hours 13 Equity Market – International Access Points and Connectivity Strategy JSE Point of Presence (PoP) in UK • On 15 December 2011 the JSE and Fixnetix announced that the JSE chose Fixnetix as the Managed Service Provider (MSP) of the JSE’s PoP in London at the Equinix Data Centre, LD4, Slough (LD4) • Initially, access to the JSE’s Equity Market Customer Testing Service and real time data services will be available via the JSE PoP provided by Fixnetix • The UK PoP will be extended to include trading of JSE equities and this agreement could be expanded to include access to other JSE markets Co-location Services • The JSE has been involved in detailed discussions with co-location experts and is in the process of working on the details of this offering • The JSE has also given notice to current tenants of the intended co-location data centre space so that this space can be vacated mid next year 14 Equity Market – Billing Equity Billing Model Review • A new hybrid value based billing model was implemented on 1 March 2010 • Current model parameters are: 0.0055% on value of trade with R4 floor and R20 ceiling, with R15bn discount threshold (per month) and 20%discount rate • The JSE continuously refines the new billing parameters where the intention is to widen the gap between the floor and ceiling charges in order to: o Improve predictability for clients by moving toward a pure value based billing methodology for transaction charges; and o Ensure minimal impact for clients already faced with increased overall trading costs over the past 2 years due to the increased number of hits per trade • Investigations into models to enhance predictability, e.g. a pure value based model and a model based on the total value executed per order are underway 15 Equity Market Products Focus Expand product base • Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), Structured Products, Share Installments, Warrants & South African Depository Receipts (SADRs) • Product issuer forums, New Products Committee submissions/regulator discussions (where applicable), new products/structures research, new/changed listing rules, listing/trading fees review, new/changed trading/industry segments & dedicated Client Liaison officer Public education Initiatives • We are constantly educating the public on the basics of investing as well as equity market products 16 Equity Market Products Focus (2B UPDATED…) Exchange Traded Funds (ETFs) Growth • As at end August 2012 there were 38 ETFs (YoY listings growth 19%) listed on the JSE with a market capitalisation of R36 billion Exchange Traded Notes (ETNs) Growth • As at end March 2012 there were 20 ETNs (YoY listings growth 33%) listed with a market capitalisation of R3,9 Billion Structured Products Growth • YoY market capitalisation decreased 15% & value traded growth 304% Warrants Growth • 17 YoY market capitalisation increased 84% & value traded growth 51% Africa Focus JSE Africa Board has been integrated into the overall JSE trading spectrum • The exchange already offers trade in a wide range of investment instruments focused on Africa outside of South Africa. • To enhance this, the JSE’s Africa strategy will now include companies listed directly on the Main Board and AltX as well as offering depository receipts and a broader range of exchange traded funds and debt instruments African market exposure opportunities: • 12 listed Companies, 4 Bond issuers, 1 Exchange Traded Note, 2 Africa Indices 2012 Focus: SADRs on African shares • DRs will provide a way for African companies to raise capital on the JSE without requiring a secondary listing 18 BRICSMART A joint initiative to expose investors to the BRICS economies, through cross-listing products • The Initial, 1st phase offering, now gives investors access to derivatives on Brazil’s IBOVESPA, Russia’s MICEX Index, India’s SENSEX Index, China’s Hang Seng and Hang Seng China Enterprises Indices and South Africa’s FTSE/JSE Top40 Index • Apart from cross-listing products, other opportunities will be explored to promote greater development and understanding amongst the respective markets 19 Equity Market Growth Initiatives Retail Broker and Investor Strategy • In collaboration with retail brokers and ETF issuers, the Equity Market will drive out a retail focussed campaign with ETFs offered as the low cost entry level product • The campaign entails various educational interactions, showcases and an expo High Frequency Trading (HFT) Strategy • JSE has seen increased HFT trading and will formulate a strategy in relation to this International Customer Strategy – BRICS alliance and beyond • The team continuously focuses on: • Increasingly giving the JSE exposure globally to ensure increased trading activity • Identifying other business development or growth opportunities (including new product listings and additional JSE service offering opportunities) 20 Equity Market Growth Initiatives Equity Market Membership Structure review • Strategic review of the equity membership model and its associated impact on clearing, risk management, regulation, settlement, etc. Equity Market Structure review • Equity Market Trading Structure Workshop o Central Order Book trading and Reported o Various market/trading models and sessions - liquidity provider/market making programs and admittance for trading platform o Transaction billing model o Global & local regulatory impacts on market e.g. HFT and OTC trading on market o Lit versus dark trading 21 Questions Equity Market Business Development EquityMarketBusinessDevelopment@jse.co.za +27 11 520 7000 22