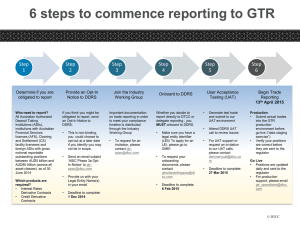

Settlement Roadmap

advertisement

DTC Settlement Strategy and Roadmap Update Bank Depository User Group September 23, 2013 Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC Introduction Settlement Roadmap Paper originally published in December 2012 Strategic objectives are Systemic Risk mitigation and further adherence with CPSS IOSCO recommendations Promotion of Settlement Finality White Paper published to provide customers with information on how multiple initiatives come together over the next 5 years – a “Roadmap” Four Key settlement related initiatives: Settlement Matching CNS Settlement as Delivery Versus Payment (CNS for Value) Money Market Settlement - Structural Changes Shortening the Settlement Cycle “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to thetoFreedom of Information Act. Act.” “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant the Freedom of Information © DTCC 2 Settlement Matching - Background DTC permits receiving participants to “reclaim” processed transactions Certain reclaims are permitted to bypass DTC’s risk controls Reclaims compromise intraday settlement finality Reclaims present credit and liquidity risk to DTC, participants and the system as a whole The value of transactions currently reclaimed is approximately $4 Billion per day but could increase in times of stress Reclaim rates of unaffirmed institutional transactions are MUCH higher than those of affirmed transactions - 5% vs. 0.2% “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 3 Settlement Matching - Proposal Proposal: Require receiving participants to match transactions prior to settlement Non – Institutional Trades The matching requirement will leverage DTC’s Receiver Authorized Delivery (RAD) system All non-ID transactions require RAD approval prior to processing Institutional Trades Will be supported by the trade match – promoting affirmation and STP Custodians will be given the option to pull out obligations for which they have funding or credit issues Supports bank participant demands for the “exception” “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 4 Settlement Matching – Benefits Mitigate systemic risk associated with overriding DTC risk management controls Improve intraday settlement finality for US settling transactions Promote best practice for trade affirmation Leverage trade match to drive settlement – gives teeth to affirmation Position DTC and industry for shortened settlement cycle Effective trade affirmation and settlement matching cited as key enablers “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 5 Settlement Matching - Next Steps Published detailed service description in 1Q/13 Published updated implementation schedule 2Q/13 Publish an important notice in Q4 with additional detail Settlement Matching will be implemented in four phases: Introduce reduced RAD limits in 2Q/13 (Completed in July) Introduce stock loan specific RAD profiles scheduled for October 25 Reduce RAD limits to zero originally targeted for 4Q/13 but moved to 2Q/14 Require receiver matching for institutional transactions originally targeted for 1Q/14 but moved to 3Q/14 Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 6 CNS for Value - Model Continuous Net Settlement (CNS) is a service provided by NSCC to net and novate “street-side” trades CNS obligations will be processed as delivery versus payment (DVP) in DTC instead of free of payment CNS obligations will be subject to DTC’s risk management controls Members with pending receives will be required to fund their DTC accounts to support CNS receive obligations in DTC “Confidential “Confidential Treatment Treatment Requested Requested by DTCC, by DTCC, [DTC, [DTC, NSCC, NSCC, FICC, FICC, WTC]WTC] Pursuant Pursuant to thetoFreedom the Freedom of Information of Information Act. Act.” © DTCC 7 CNS for Value - Benefits Enabler for multiple intraday settlement slices Provides participants with intraday liquidity benefits, i.e., ability to use NSCC credits to offset DTC debits Alerts DTCC to potential default situations earlier in the day Reduces affiliate risk Eliminates cross-guaranty Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act.” © DTCC 8 CNS for Value – Milestones Published Industry White Paper - 2011 Solicited member feedback on the proposal - 2012 Modeled potential collateral monitor and debit cap blockage - 2012 Model intraday impact to NSCC Clearing Fund - 2013 Target dates as follows: Detailed Business Case Q3 2013 Detailed Service Description Q4 2013 Impact Studies and Build Q1 2013 - 2015 Testing Available Q3 2015 Implementation Q3 2016 (Deferred) Project is being deferred due to resource contention “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act.” © DTCC 9 MMI Processing - Background DTC processes approximately $250 billion worth of transactions in Money Market Instruments (MMIs) per day A large portion of maturing MMI securities are funded through the issuance of new MMI securities Net maturing MMI positions require issuer funding MMI issuer Paying Agents can instruct DTC to reverse processed transactions if unfunded by the issuer “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 10 MMI Processing Risk If an MMI Paying Agent isn’t paid by the issuer by 3:00 PM ET, the Paying Agent can Refusal to Pay (RTP) the issuer’s obligation When notified of a RTP by an MMI Paying Agent, DTC will: Reverse all completed transactions for the respective MMI issue Permit the MMI reversal transactions to bypass DTC’s risk management controls MMI reversals compromise intraday settlement finality MMI reversals present credit and liquidity risk to DTC, participants and the system as a whole Today, DTC withholds the two largest credits a participant has in MMI securities (LPNC) in case they are reversed The objective of MMI optimization is to eliminate the credit and liquidity risk associated with reversals of completed transactions related to an issuer failure and to eliminate the need to withhold credits via LPNC “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 11 MMI Optimization All MMI issuances and deliver orders (DOs) will continue to be presented to DTC’s Receiver Authorized Delivery (RAD) system for approval All approved MMI transactions, along with that day’s maturity presentments, will be “held” in a pending status until the issuer has “funded” its maturities in one of two ways: – When the settlement value of approved issuances exceeds the value of the applicable maturing obligations and/or, – When the IPA has indicated via a screen or automated message that it has received issuer funding Once funded, DTC will simultaneously check all transactions for an issuer, i.e., issuances, DOs and maturities, against each participant’s DTC position and risk controls – If able to complete, these transactions will be processed and final, i.e., no reclaims or reversals – If unable to complete no transactions for the relevant issuer will be processed “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 12 MMI Optimization Periodically throughout the day the transactions associated with acronyms that have been funded and not completed will be attempted for processing with other pending MMI “units” and staged to the “new MMI Optimization” process MMI Optimization will attempt to maximize the settlement of transactions by looking at the net effects of transactions across multiple issuers on the receiving and delivering participants’ position and risk controls Once the optimal combination of transactions is amassed, the transactions will be processed and then settled. – Participants will continue to be required to fund their accounts intraday when they have debits that will exceed their net debit caps or if there is a collateral shortfall “”Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act.” © DTCC 13 MMI Processing Benefits Eliminates DTC credit and liquidity risk associated with issuer failure reversals that override controls Increases intraday settlement finality Enhances intraday liquidity recycling at DTC through the elimination of the 2 Largest Provisional Net Credits (2LPNC) control since MMI transactions will no longer be eligible for reversal Preserves the IPA’s ability to notify DTC of an issuer default Minimizes participant technology changes “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 14 MMI Optimization – Key Dates DTCC published an industry whitepaper in December, 2012 “Reducing Risk and Enhancing Intraday Finality in the Settlement of Money Market Instruments” www.DTCC.com - Thought Leadership, White Papers The Detailed Service Description will provide a timeline for targeted dates as follows: Publish a Detailed Service Description Solicit Industry Feedback Begin Simulations of the Model Submit Rule Filing (tentative) Participant Testing Available Implementation Q4 2013 Q1 2014 Q2 2014 Q4 2014 Q2 2015 Q4 2015 “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 15 Shortening the Settlement Cycle (SSC) Originally proposed in 2000 Industry analysis performed Decision made to focus on improving industry processing efficiently 10 building blocks identified Significant progress in many of these areas In 2011, DTCC and Industry agreed the time was right for another industry study In spring of 2012, DTCC issues Request for Proposal for new cost benefit analysis Boston Consulting Group (BCG) selected to conduct analysis Conducted approximately 100 stakeholder interviews “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 16 SSC - Enablers Enablers For T+2 and T+1 Migration to institutional trade date matching Mandated Settlement Matching at the depository Cross-industry Settlement Instructions solution Continue to dematerialize physicals Extend "access equals delivery" for all products Compress timeframes / rule changes Increase penalties for fails Additional Enablers for T+1 Build infrastructure for near-real time processing Transform securities lending processes Transform foreign buyer processes Accelerated retail funding “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 17 SSC – Cost / Benefits Reduce risk for both the individual investor and the industry at large including Enable firms to optimize capital by reducing collateral required and liquidity need for NSCC NSCC estimates its line of credit could be reduced by 20-25% in T+2 and 40-50% in T+1, thus reducing line costs by $5MM- $7MM and $10MM to $15MM, for T+2 and T+1, respectively. Reduce operational risk and expenses through implementation of building blocks Align settlement cycle across geographies BCG Estimated T+2 total investment at $550M with $170M in annual cost savings T+1 total investment at $1,770M with $175M to $370M in annual cost savings Next Steps DTCC currently consulting with Industry representatives and Regulators and expects to publish a position paper in the next few weeks “Confidential Treatment Requested by DTCC, [DTC, NSCC, FICC, WTC] Pursuant to the Freedom of Information Act. © DTCC 18