Need Analysis & Professional Judgment

advertisement

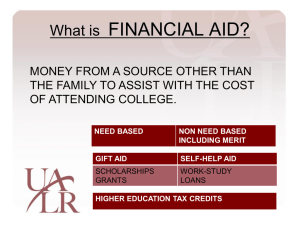

Need Analysis & Professional Judgment Understanding the EFC What you will learn Definition of need analysis Factors that make up the EFC calculation and why they are important Understand the 3 Federal Formulas Learn what is Professional Judgment Understand various types of professional judgment decisions and how they are related to the EFC and Needs Analysis What is need analysis? Definition: The process of determining the student's Expected Family Contribution (EFC) based on the formula established by Congress. Also known as Federal Need Analysis Methodology and Federal Methodology. Guiding Principles • Primary responsibility to pay for education rests with the student and parents/family • Family is expected to contribute to the extent it is able • Families must be evaluated in an equitable manner Expected Family Contribution Definition: Measure of how much the student and his or her family can be expected to contribute to the cost of the students education for the year. The EFC is calculated according to a formula specified in the law. What Comprises the EFC? EFC Federal Formula AGI Eligible to file a 1040A or EZ Federal Means Test Dislocated Worker Income Protection: Taxes Paid House Hold Size Number in college State and other Tax allowance Worksheets A, B, and C Dependent Independent w/no dependent(s) Independent with dependent(s) Protection of Assets Age of Student (if independent) Age of Older Parent Total Income AGI Wages Earned Untaxed Income Additional Financial Information What’s so important about the EFC? EFC is Needed to Calculate Need Cost of Attendance (minus)EFC Need The EFC determines: Pell eligibility Room for need versus non-need-based aid Three EFC Worksheets Worksheet A Worksheet B For dependent students For independent students without dependents (other than a spouse) Worksheet C For independent students with dependents other than a spouse For 11-12 EFC worksheets, go to IFAP: http://ifap.ed.gov/fsahandbook/attachments/1112AVGCh3.pdf (pages 51-77) The EFC Formulas There are 3 different EFC formulas Regular Formula: Takes BOTH income & assets into account Simplified Needs Test (SNT):Takes only income into account Auto-Zero EFC: Student’s EFC is automatically zero Simplified Needs Test How does a student qualify for SNT? Must have income (AGI/wages) of $49,999 or less AND Answer Yes to one of the following: 1. Be eligible to file a 1040A or 1040EZ 2. Qualify for a federal means test benefit 3. Be a dislocated worker Auto-Zero EFC How does a student qualify for Auto-Zero? Must have income (AGI/wages) of $23,000 or less AND Answer Yes to one of the following: 1. Be eligible to file a 1040A or 1040EZ 2. Qualify for a federal means test benefit 3. Be a dislocated worker Only dependent students or independent students with child or dependents other than a spouse qualify for an auto-zero EFC. (EFC Formula Worksheets A &C only) Federal Means Test Benefits Supplemental Security Income (SSI) Temporary Assistance for Needy Families (TANF) Special Supplemental Nutritional Program for Women, Infants & Children (WIC) Food Stamps Free Reduced-Priced School Lunches What is a Dislocated Worker? Was terminated or laid off from employment or received a notice of termination or layoff; Is unlikely to return to a previous occupation; and Is eligible for or has exhausted unemployment compensation, or is not eligible for compensation because, even though employed long enough to demonstrate attachment to the workforce, he or she had insufficient earnings or performed services for an employer that weren’t covered under a state’s unemployment compensation law; or Was terminated or laid off from employment or received a notice of termination or layoff as a result of any permanent closure of, or any substantial layoff at, a plant, facility, or enterprise; Is employed at a facility at which the employer made a general announcement that it will close; Was self-employed but is now unemployed due to economic conditions or natural disaster; or Is a displaced homemaker Is the Applicant Eligible to File a 1040A or 1040EZ? Required to file a long form (1040) if $100K or more of wages (line 7) Alimony received (line 11) Business (line 12) Capital gain or loss (line 13 only if schedule D is required) Rental property (line 17) Farm (line 18) Itemized deductions (line 40) Homebuyers credit (line 67) Eligible to file a 1040A or EZ If there are capital gains/losses but a Schedule D isn’t required, then a 1040A is fine Apply your knowledge! Which EFC Formula? Income Protection Allowance Ed automatically protects a set amount of income varied by household size and number in college (called IPA) Food 30% Housing 22% Transportation 9% Clothing/Personal Care 16% Medical 11% Other consumption 12% US Taxes Paid Also considers state & other taxes IPA Worksheets This example is from Worksheet A (dependent students) Asset Protection Allowance Asset Protection: Dept of Ed automatically protects a set amount of assets based on Independent Student or Parents’ Age of a Dependent Student The older the student or parent, the greater the amount of assets protected – due to anticipated retirement Asset Protection Table Note: Dependent students have no protection of assets. Apply your knowledge! Matching Exercise of EFC Terms Final Thoughts on Need Analysis A myriad of elements go into the EFC! You can’t “guesstimate” what someone’s EFC would be just by asking income information Having a strong foundation of the EFC will assist with your understanding of the following: Professional Judgment Verification Elements Apply your knowledge! 2012-2013 Manual EFC Calculation Professional Judgment It’s Your Decision! What is Professional Judgment? Section 479A in the HEA authorizes us to use PJ Examples of PJ Situations Adjusting EFC data elements Losses of Income Additional Expenses Performing a Dependency Override Parent Refusal to complete a FAFSA and refuses to provide financial support Adjusting Cost of Attendance components EFC Elements that CAN be Adjusted AGI Wages Earned Taxes Paid Number in household Number in College Additional Financial Information Untaxed Income Asset information Dislocated Worker Status Dependency Status Only for dependent to independent First Rule of PJ is… DOCUMENT! A school must exercise PJ on correct applicant data before processing PJ to ensure accuracy A school must wait until a corrected ISIR returns before processing PJ only for students who were selected for verification and processor determined a correction is needed Types of Documentation Types of documents you may wish to collect Tax returns W2s Last pay stubs 3rd party documents Legal documents Letter from employers Losses of Income & Additional Expenses Examples Types of Losses of Income Losses of Income Unemployment or income reduction Death of parent/spouse Divorce of parent/student Loss of child support One-time lump sum payout Additional Expenses Extended family support See GEN-09-04 Such as nursing home expenses Unusual medical/dental expenses that exceed 11% of the IPA Unusual non-discretionary debt that exceeds 12% of the IPA Private school costs for children in elementary or high school How could some of these factors affect a student’s EFC? Medical Expenses Example Let’s say you have a dependent student whose parents experienced an annual medical expense totaling $5,000. After reviewing the ISIR you notice the following: HHS: 4 Number in College: 1 EFC = $2972 AGI : $59,123 IPA: $25,210 How much of the $5,000 exceeds 11% of the IPA? Dependency Overrides & Unsubsidized Stafford Eligibility Examples Authority given for dependency overrides HEA Section 480(d) Dependency Overrides Any student who answers no to all the dependency questions are dependent even if student is self-supporting Students who have extenuating circumstances can request an FAA to consider a dependency override Per CCRAA, Schools have the authority to accept the dependency override that was performed and approved by another school without additional documentation. Dependency Overrides Requires documentation to the validity of the extenuating circumstances Personal statement Letters from professionals Factors to consider Documented, prolonged estrangement Unable to locate a parent after reasonable attempts Situations of abuse Remember: DOCUMENT, DOCUMENT, DOCUMENT! Dependency Overrides None of the following examples merit a dependency override: 1. 2. 3. 4. Parents refuse to contribute to the student's education Parents are unwilling to provide information on the FAFSA or for verification Parents do not claim student as a dependent for income tax purposes Student demonstrates total self-sufficiency You be the Judge… Laura is a first-time freshman living with her grandparents. She is not under legal guardianship, but she has been living with her grandparents since she was 5 when her father left the country. Her mother died when she was 2. She has had no contact with her father since she was 5 and neither has her grandparents, although he sent a check out of the blue when she turned 18 for $5,000. Would you consider Laura independent? Why or why not? Unsubsidized Stafford Eligibility FAAs may use professional judgment to determine if a dependent student may be offered unsubsidized Stafford loans without parental data on the FAFSA To do this, FAAs must verify: Parent no longer provides financial support Parent refuses to file the FAFSA FAA must collect a signed statement from the parent affirming that the above while also certifying that they will not provide support in the future You be the Judge… Hector is about to be a freshman at Best Ever Community College in the city of Fairview. Hector lives at home with parents in Fairview. Hector’s parents charge him room and board for living in their home. Hector’s parents do not carry him on their health and auto insurance policies. Hector asks his parents to complete the parental part of the FAFSA and they refuse. Cost of Attendance Adjustments Budgets, budgets, budgets! Standard COA Components 1. 2. 3. 4. 5. Tuition & Fees Books & Supplies Room & Board Transportation Personal Expenses Types of Adjustments to Consider Additional mortgage/rent charges Unusual car repair or transportation costs Dependent care costs Computer/Laptop expenses Unusual medical/dental expenses not covered by insurance Unusual Debt Stafford loan fees (if applicable) Nursing Home Expenses Elementary/Secondary Private Tuition What you Cannot Do in a PJ A PJ is award year specific and cannot carry forward from year to year unless subsequent request & documentation is received You cannot directly change an EFC You cannot make changes to the EFC formula You may not establish automatic categories of special circumstances. All PJ must be conducted on a case by case basis. PJ cannot be used to circumvent the law PJ cannot be used to waive student eligibility requirements PJ cannot make an Independent student dependent Test your knowledge! Match that PJ & Case Studies! Wrapping Up Understanding the complexity of the EFC makes you that much more effective of an FAA! You have the authority to use professional judgment so use it (with proper documentation) Resources 2012-2013 EFC Formula Guide http://ifap.ed.gov/ifap/byAwardYear.jsp?type=efcformulaguide 2012-2013 FSA Handbook, Application Verification Guide, Chapter 5, Special Cases DCL: GEN-09-04, GEN-09-05, GEN-11-04, GEN-11-15 NASFAA 2010: Electronic Handout: Special Populations: Tips for Completing the FAFSA NASFAA 2009: Q&A from Dependency Status: It’s not the Riddle of the Sphinx Webinar Comments/Questions? Erika Cox & April Gonzales, University of Texas at San Antonio