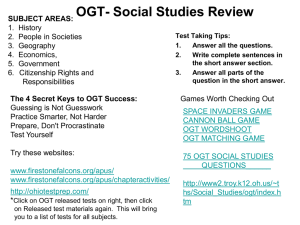

Economic Systems - Canton Local Schools

advertisement

Economic Systems Benchmark: Compare how different economic systems answer the fundamental economic questions of what goods and services to produce, how to produce them, and who will consume them. I. Trade, Specialization, and Interdependence • A. International Trade – 1. US sells goods to other nations – 2. US buys goods from other nations Question: Why doesn’t the US just make and sell to our own country??? Answer: Other countries have goods that we don’t have. Ex: coffee, tea, bananas, chocolate • B. Cost and Specialization – 1. Opportunity cost: the value of the next best alternative when a choice is made – Ex: If you make $120/day and you decide to go fishing instead of work, the opportunity cost is $120 – 2. Trade involves opportunity cost – Ex: US business buys goods from other nations because they are cheaper to produce there • 3. Absolute Advantage: when a country is able to produce more of a particular good, due to increased efficiency or cheaper labor costs. – a. specialization: when a country specializes in the making of a good • C. Interdependence: The US depends on trade with other countries in order to stay competitive and profitable – a. results: • Negative: move plants to foreign countries, loss of US jobs • Positive: cheaper prices for goods, greater choice of products • D. Global Organization: The WTO – 1. World Trade Organization • • • • • a. b. c. d. e. US is a member enforces standing trade agreements encourages trade talks between countries attempts to settle disputes tries to help developing nations • E. Regional Organization: NAFTA – 1. North Atlantic Free Trade Agreement • a. signed in 1994 (Clinton), but was an idea of the Bush administration • b. free trade zone that includes US, Mexico, and Canada • c. abolished tariffs between the 3 countries • d. established 1 big market II. Labor Unions, Business Organizations, and Farm Organizations • A. In terms of the economy, what are pros and cons of labor unions and farm organizations in the United States? The U.S. Government and the Economy • Explain how the U.S. government provides public services, redistributes income, regulates economic activity, and promotes economic growth and stability. I. Effects of Governmental Actions on Individuals and Business • A. Gov. has played an important role in our economy – 1. gov. action or lack of action Examples: a. Interstate Commerce Commission: regulates trade within US and makes it fair b. passes laws against tainted food, impure drugs, air and water pollution, and unsafe autos 2. US gov. is one of largest consumers in our economy (armed forces) ** Throughout history, the US gov. has become increasingly involved in our economy II. Taxes • A. Gov. must levy taxes – 1. pay employees – 2. buy equipment – 3. provide assistance to those in need B. Tax increase 1. less money for businesses to research 2. less money for individuals to buy things Types of Taxes • A. Income Tax: Tax on income earned at a job – 1. individuals – 2. businesses – 3. Income taxes are progressive: the more you make, the more you are taxed B. Excise Tax: Tax on the manufacture or sale of certain items (Ex: gas and airline tickets) 1. Excise (or sales) taxes are regressive: they are the same, but it hurts those who make less money more than someone who makes a lot of money Ex: If Person A makes $50K/year and pays $5K in excise tax, that is 10% of his earnings. If Person B makes $100K/year and pays $5K in excise tax, that is 5% of his earnings. C. “sin” tax: taxes on cigarettes and alcohol III. Government Regulation of Business • A. laws the encourage competition • B. regulate monopolies • C. Antitrust Legislation (prevent monopolies) – 1. Interstate Commerce Act: passed in 1887 to regulate railroads prices and interstate trade – 2. Sherman Antitrust Act: broke up many industrial monopolies (Standard Oil). President Teddy Roosevelt enforced this law – 3. Others: Clayton Antitrust Act, Federal Trade Commission, Meat Inspection Act, Securities and Exchange Act, Truth in Packaging Act IV. The Federal Reserve System • The Fed: the central bank of the United States • a network of 12 banking districts in major cities around the United States • established in 1913 • managed by a board of governors • Fed’s decisions do NOT have to be approved by the President Federal Reserve’s Responsibilities • A. to set the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices • B. to supervise and regulate banking institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers • C. to maintain the stability of the financial system and contain risk that may arise in financial markets • D. to provide certain financial services to the U.S. government, to the public, to financial institutions, and to foreign official institutions, including playing a major role in operating the nation’s payments systems Federal Reserve System and the Economy • To help when the economy is bad, the Fed will: – a. lower the reserve requirements that banks must hold, therefore…….. – b. interest rates will decrease, therefore…… – c. banks will lend out more money, therefore……….. – d. there will be more money in the economy, therefore………. – e. more items are being bought, therefore….. – f. the economy becomes better, because people now have jobs and are spending more money • To help when inflation is high, the Fed will: – a. raise the reserve requirements that banks must hold, therefore…….. – b. interest rates will increase, therefore……. – c. banks will lend out less money, therefore……….. – d. there will be less money in the economy, therefore………. – e. less items are being bought, therefore….. – f. the economy slows down, and prices of items stay the same or decrease 1. OGT Multiple Choice • (Blue Book 2007) Which of the following is a “progressive” tax? • A. excise tax • B. state income tax • C. sales tax on an automobile • D. “sin” tax on tobacco 2. OGT Multiple Choice • (Blue Book 2007) Why did many people in the late 1800’s and early 1900’s want the government to break up monopolies? • A. Monopolies created excessive competition. • B. Monopolies decreased dividends for their shareholders • C. Monopolies advocated an increase in labor union membership • D. Monopolies decreased competition and fixed prices 3. OGT Multiple Choice • (Blue Book 2007) Which of the following would result in the Fed increasing interest rates? • A. The Fed buys securities on the open market • B. The Fed keeps the reserve requirment the same • C. The Fed lowers the reserve requirement • D. The Fed raises the reserve requirement 4. OGT Multiple Choice • (Orange OGT Study Guide 2007) A business in Country A has a productive capacity that outstrips consumer demand in its country. The best economic decision for that business would be to • A. reduce the product’s price so more consumers in Country A could purchase • B. store the product in warehouses until more consumers in Country A could purchase it • C. reduce its workforce so it produces less of its products • D. sell its products to consumers in other countries in addition to Country A 5. OGT Multiple Choice • (Orange OGT Study Guide 2007) Which of the following is most likely to contribute to international trade between two countries. • A. High unemployment in both countries • B. Equal distribution of natural resources • C. Production of specialized goods in each country • D. Different economic systems in each country 6. OGT Multiple Choice • (Orange OGT Study Guide 2007) Generally when two parties trade with each other there should be a rise in their standard of living because • A. each is gaining access to a wider variety of products • B. each is limiting choices for its consumers • C. one side will benefit to the detriment of the other • D. both sides will see a loss of consumer confidence 7. OGT Multiple Choice • (Orange OGT Study Guide 2007) What is one major change countries participating in international trade may see in their economic infrastructure? • A. A greater variety of products being produced in their country • B. Increased production of goods for which the country has a comparative advantage • C. Higher prices for all manufactured goods produced in the country • D. The elimination of all goods for which the country has the absolute advantage 8. OGT Multiple Choice • (Orange OGT Study Guide 2007) Which of the following statements best describes trade by people in the United States with people in other nations. • A. The US has not traded at all with other nations • B. The US has always traded at all with other nations • C. The US has reduced its trade with other nations • D. The US has increased its trade with other nations 9. OGT Multiple Choice • (Orange OGT Study Guide 2007) Labor unions in the U.S. have been interested in all of the following except • A. higher wages • B. longer work week • C. safer working conditions • D. shorter work week 10. OGT Short Answer • (Orange OGT Study Guide 2007) Saudi Arabia is one of the world’s largest produces of oil. However, it does not produce many manufactured goods. On the other hand, Japan does not have much oil as a natural resource but does produce a large number of manufactured goods. Explain why it would be beneficial for these two countries to trade with each other (2 points). 11. OGT Extended Response • (BASE TEST 2006) One way the Federal Reserve System • seeks to influence the U.S. economy is by raising or lowering the rate of interest (discount rate) that member banks must pay to borrow money from the Federal Reserve. • Considering that the inflation rate rose significantly from 1976 to 1980, identify the change (increase or decrease) the Federal Reserve System could have made in the discount rate to reverse that trend. • Describe the expected impact this change in the discount rate would have had on: consumer spending business spending • Explain why this change in the discount rate would produce the desired effects on spending.