Document

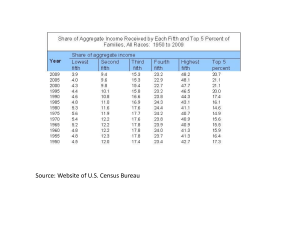

advertisement

Tax, growth and development Richard Parry Head, Global Relations Division, Centre for Tax Policy and Administration OECD Session 8 Mobilizing Tax Revenues: Key Questions • How to raise sufficient tax revenues to finance development? • How to raise revenues in the most efficient (and stable) way possible? • How to raise revenues in an equitable way? • How to raise revenues in a way that reduces administrative costs, enforcement costs and compliance costs? • How to raise revenues in a transparent and reliable way? • How to raise revenues and overcome the political economy obstacles? Rates and the tax Base • Increasing rates might raise revenues, but not Rates necessarily • Broad base – low rate for direct taxes • Broad base – low rate VAT system + excise duties on specific goods as luxury goods, environmentally bad goods, alcohol, cigarettes – Move away from specific indirect taxes to broad VAT base – Is this regressive? – Low VAT rates will reduce tax evasion – Redistribution should not be done by each tax but by considering the entire tax and benefit system Tax and Growth • This section reports the main results of a tax and growth study for OECD countries • The results might not always reflect conditions in African countries but some lessons • Results depend on the starting-point! Main Empirical Questions in the OECD Tax and Economic Growth Project • Does the tax structure, as opposed to the level of taxes, matter for GDP per capita and its rate of growth? • To what extent do different tax provisions affect investment, productivity (TFP) and growth? • Does the industry/firm structure matter for the impact of taxes? 5 Labour utilisation - Employment - Hours worked GDP per capital Labour productivity - physical capital - human capital - Efficiency in the use of inputs (TFP) Taxes - consumption - property - personal income - corporate income Broad Tax Structure • Macro findings suggest a “ranking” of taxes in terms of their negative impact on GDP per capita: recurrent taxes on immovable property < consumption taxes < personal income taxes < corporate income taxes • Broad tax bases and low rates • Tax progressivity seems to reduce GDP per capita 7 Corporate Taxes I • Cutting corporate taxes positively affects investment and productivity growth, especially for larger and older firms but not for firms that are both small and young. • Lowering the corporate tax rate will increase the productivity of firms especially in profitable industries. • Especially dynamic and innovative firms gain from a corporate tax rate reduction. 8 Corporate Taxes II • Also the average effective corporate tax rate has a negative impact on the firm’s productivity. • It is possible that product market regulations and large administrative burdens on firms can make investment decisions less responsive to taxes. • Need to be careful about lowering the corporate rate much below the top personal income tax rate. R&D Tax Credits • Tax and growth study: R&D tax credits increase productivity and therefore stimulate growth but their impact is relatively modest. • Are R&D tax credits better for growth than a standard CIT rate reduction? • Is innovation better supported by targeted spending programmes? Personal Income Taxes • A reduction in labour taxes can have both a substitution effect and an income effect on participation and hours worked • High top personal income tax rates have a negative impact not only on labour utilisation but also on labour productivity reducing risk taking by individuals • Countries with a large share of industries with high rates of enterprise creation (or wishing to move in this direction) may gain from reforming their top marginal tax schedule. However, this could increase inequality. PIT and Total Factor Productivity • The negative impact of top marginal tax rates on TFP is stronger in countries with a high level of the OECD indicator of product market regulation • The PMR indicator includes, among other things, measures of the administrative burden on firms and regulatory barriers for start-ups. • Progress made by African countries Summary of key findings • Recurrent taxes on immovable property are the least distortionary form of property tax, but they are very unpopular • Broadening the base of consumption taxes is better for growth than increasing the rate • There is limited scope to improve growth by using multiple consumption tax rates, and their equity effects are best achieved by other means Broadening the Tax Base and the Informal Sector • What role does the informal sector play? • What inhibits the development of the formal sector? – Excessive regulatory system, inefficiency and corruption – Bureaucracy – Presence of entry costs into the formal economy – Macroeconomic instability – Poor public services • What can be done to encourage greater participation in the formal sector? Tax Administration • Good tax policy depends on good tax administration • Some key reform elements – Integrated tax administrations – Segment and function not tax – Risk management – Integrated communications and information exchange – Staff retention and skilling • International aspects – Integration of international aspects – Tax compliance and good corporate governance Tax and Inequality • Process of growth inevitably tends to create greater inequality in developing countries which are industrialising • Growth is uneven at sector, regional and household level • Implication is that growth and inequality not undesirable per se given result is reduction in overall (absolute) poverty but…….. • Need to ensure that some of the benefits of growth are redistributed to those not directly benefitting • Implication is that tax system should be progressive overall 16 Achieving Successful Tax Reform • Tax reform design and evaluation strategies • Reform and timing • Institutional tax reform implementation strategies • Political economy aspects • Comprehensive versus incremental approaches • Communication and consultation strategies Tax and development project • DRM about resource for development, also about state building • Multi-stakeholder Task Force – engagement of donors in strengthening African tax systems • Focus on capacity building and transparency in international tax areas • Support for G20 work on tax and development To Sum Up • DRM not just a tax issue but tax can affect growth • Key factor is broad based low rate regime, as well as a well functioning tax administration and a balance of taxes • In terms of the mix of taxes – pro-growth elements are focus on recurrent property, or consumption taxes • Importance of extending the formal sector • Inequality often exacerbated by growth. But growth provides the means to deal with inequality. • Need for more analysis in African context Thanks for your attention richard.parry@oecd.org