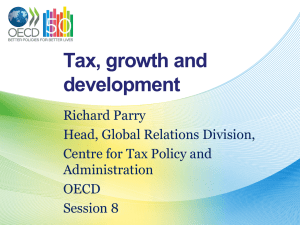

THE CORPORATE INCOME TAX: INTERNATIONAL TRENDS AND

advertisement

TAX COMPETITION: THEORY AND EMPIRICAL EVIDENCE Michael P. Devereux Centre for Business Taxation University of Oxford copyright rests with the author Plan • A brief introduction to the theory – should we expect competition? – should we expect a “race to the bottom”? – can we distinguish “beneficial” and “harmful” tax competition • Evidence of tax competition – Trends in tax rates and revenues – Econometric evidence • Conclusions Basic tax competition theory • • • Capital mobile across countries, but labour immobile Governments provide a public good paid for by a source-based tax on the return to capital They choose a tax rate to reflect (a) benefits of higher public good provision (b) loss of capital abroad • Tax rate lower than in a closed economy Questionable assumptions • Labour not mobile? • No other taxes available to governments? • Labour income tax • VAT • Residence-based capital income tax • No imperfect competition, economic rent, discrete choices • No publicly-provided goods for production Incidence & Some Implications • Taxes on capital (in small open economy) cannot reduce the post-tax rate of return to owners • So are effectively borne by domestic residents • Better to tax them directly and avoid distortion to location of capital – ie. better NOT to tax capital income Extensions to model (1) Competition over discrete location choices, where firms earn economic profit 1. If firms want to locate near market, large countries attract investment, though they may have to pay a subsidy 2. If firms want to locate away from their competitors, governments can raise (some) tax without distorting investment Extensions to model (2) • 3 levels of decision: – Where to locate a new facility – depends on average tax rate – How much to invest – depend son marginal tax rate – How much profit to shift to lower-taxed countries – depends on statutory tax rate • Governments could compete over any of these 3 tax rates – should depend on mobility of firms v capital v profit Is competition harmful or beneficial? (1) Compared to what ? – Closed economy ? – Partially co-ordinated group of countries ? • eg. in capital taxes, but not labour taxes – Fully co-ordinated group of countries ? – Countries globally co-ordinated ? Is competition harmful or beneficial? (2) • Competition may be generally good, but – taxes not like ordinary markets; and governments provide goods that the private sector cannot – Is competition over environmental pollution beneficial? – Competition over only some taxes distort choice of instruments • Is a distinction based on competition for firms & capital as opposed to competition for profit ? Is competition harmful or beneficial? (3) • All competition acts as a constraint in national policy setting • If governments act in national interest then real harm is where other countries hurt, eg. – global pollution – preventing other countries raising taxes on capital ? • But should we tax source-based profit anyway? – arguably not on efficiency grounds; and can use other instruments for equity ? Empirical Evidence Do governments compete? Some possible sources of evidence: 1. Trends in tax rates, and tax reforms 2. Evidence of impact of taxes on business 3. Evidence of impact of foreign taxes on domestic taxes 2004 2003 2002 2001 2000 1999 1998 1997 median 1996 1995 1994 1993 1992 1991 1990 1989 1988 25% 1987 1986 1985 1984 1983 1982 Average OECD Statutory Corporation Tax Rates 55% 50% 45% 40% 35% 30% unweighted mean 20% Statutory corporation tax rates: Old and new member states, 1995-2005 40.0 38.0 36.0 34.0 32.0 30.0 28.0 26.0 24.0 22.0 20.0 1995 1997 1999 15 old member states 2001 2003 10 new member states 2005 Corporation Tax Rate Reductions in EU, 2003-5 Reduction (%) Year of reform Austria 34 to 25 2005 Belgium 39 to 33 2003 Cyprus 25 to 15 2003 31 to 28 to 26 2004, 05 Estonia 26 to 24 2005 France 35.4 to 33.8 2005 Greece 35 to 32 2005 Hungary 18 to 16 2004 Italy 36 to 34 to 33 2003, 04 Latvia 22 to 19 to 15 2003, 04 34.5 to 31.5 2005 28 to 27 to 19 2003, 04 Portugal 30 to 25 2004 Slovakia 25 to 19 2004 Czech Republic Netherlands Poland d ark Denm Finla n en gal Swed Portu e Germ a ny It aly Malt a n ium Spai Belg Fran c d Kin gdom Luxe mbou rg Net h erlan ds Gree ce Unite nia publi c Slove h Re Czec Aust ria Lat vi a Lit hu ania Hung ary Pola nd Slova kia Esto nia Irelan d us Cypr EU Statutory corporation tax rates, 2005 45 40 35 30 25 20 15 10 5 0 But do trends tell us anything ? • An implicit hypothesis that (a) globalisation and hence (b) competition have been increasing, but – also requires evidence of pattern of increased mobility – theory says little about competition with imperfect mobility – tax rates may have moved for other reasons – tax revenues tell a different story Outward FDI: US and UK 250 2000 $bn 200 150 100 50 0 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 Year UK US But do trends tell us anything ? • An implicit hypothesis that (a) globalisation and hence (b) competition have been increasing, but – also requires evidence of pattern of increased mobility – theory says little about competition with imperfect mobility – tax rates may have moved for other reasons – tax revenues tell a different story 1.0% 0.0% 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 OECD Corporation Tax Revenues as % of GDP 1965-2004 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% GDP weighted average unweighted average 0.5% Implicit Tax Rates in Capital: Old and New Member States 1995 - 2003 35 % 30 25 20 15 10 1995 1996 1997 1998 1999 15 old member states 2000 2001 2002 10 new member states 2003 2. Evidence of impact of taxes on business behaviour (1) • Plenty of empirical evidence of effect of taxes, affecting – location of firms – direct flows of capital • Studies use a variety of measures of both capital and tax rates – and hence estimates of elasticities vary widely 2. Evidence of impact of taxes on business behaviour (2) • Also evidence of effects of tax on the location of profit, eg: – Repatriation of dividends to parent companies – Use of debt in high-tax subsidiaries – Transfer prices – Comparison of profit across countries Corporate Taxable Income as % GDP, relative to Statutory Tax Rates, 2004 Corporate Taxable Income as % of GDP 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 10 15 20 25 30 Statutory Tax Rate 35 40 But evidence of tax competition ? One more stage required before governments should respond to concerns of effects of tax: • What are the welfare consequences of the induced behaviour of firms? eg: – Is the aggregate capital stock lower? – Are productivity and wages lower? • Relatively little research on these issues 3. Evidence of impact of foreign taxes on domestic taxes Direct examination of relationship between tax rates • very little research • difficulty in identifying appropriate tax rates – eg. implicit rates (or revenue/GDP) may show common movements due to correlation in economic cycle across countries One study Devereux, Lockwood & Redoano (2005) • examine effective marginal tax rate and statutory tax rate in OECD countries • find a significant effect on the statutory rate of statutory rate in other countries – Consistent with competition for firms (via the effective average tax rate) – Consistent with competition for profit • Overall, results suggest significant competition, which more than explains reforms up to 2000 Conclusions (1) Governments do compete in statutory corporation tax rates • EU statutory rates of corporation tax have fallen steadily, and go on falling – new member states increasing competition • But revenues have remained buoyant; can this continue? Conclusions (2) Does it matter? • Depends on what is the “optimal” rate of source-based corporation tax – arguably it is zero anyway – harmonisation of CT may lead to competition in public services used in production – if harmonisation were possible, why not consider residence-based tax within the EU? Or are political considerations paramount? Conclusions (3) • Longer term issues arise with increasing labour mobility – less easy to rely on taxes on residents if they are more mobile – may eventually imply need to restrict labour mobility, or agreement on income tax rates