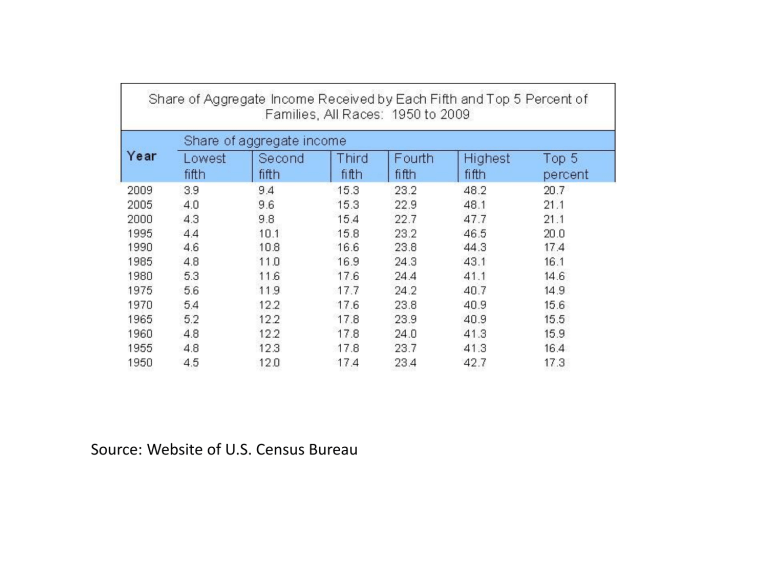

Taxing the Rich Figures

Source: Website of U.S. Census Bureau

Daniel Baneman and Jim Nunns, "Income Tax Paid at Each Tax Rate, 1958-2009," Tax Policy Center,

October 2011. http://www.taxpolicycenter.org/UploadedPDF/901456-Tax-Paid-Each-Rate.pdf

“Taxation is most progressively distributed in the United States, probably reflecting the greater role played there by refundable tax credits, such as the Earned Income Tax Credit and the Child Tax Credit. ... Based on the concentration coefficient of household taxes, the United States has the most progressive tax system and collects the largest share of taxes from the richest 10% of the population. However, the richest decile in the

United States has one of the highest shares of market income of any

OECD country.After standardising for this underlying inequality ...

Australia and the United States collect the most tax from people in the top decile relative to the share of market income that they earn."

OECD. "Growing Unequal: Income Distribution and Poverty in OECD Countries,

2008, pp. 104-106.

"

Benefits had a much stronger impact on inequality than the other main instruments of cash distribution -- social contributions or taxes.

... The most important benefit-related determining factor in overall distribution, however, was not benefit levels but the number of people entitled to transfers."

OECD “Divided We Stand: Why Inequality Keeps Rising,” 2011.

Congressional Budget Office Report. "Trends in the Distribution of

Household Income Between 1979 and 2007." 2011.

The "Overview" of the OECD report states: "However, redistribution strategies based on government transfers and taxes alone would be neither effective nor financially sustainable. First, there may be counterproductive disincentive effects if benefit and tax reforms are not well designed. Second, most OECD countries currently operate under a reduced fiscal space which exerts strong pressure to curb public social spending and raise taxes. Growing employment may contribute to sustainable cuts in income inequality, provided the employment gains occur in jobs that offer career prospects. Policies for more and better jobs are more important than ever."

OECD “Divided We Stand: Why Inequality Keeps Rising,” 2011.

"The case for drastic progression in taxation must be rested on the case against inequality -- on the ethical or aesthetic judgement that the prevailing distribution of wealth and income reveals a degree (and/or kind) of inequality which is distinctly evil or unlovely."

Henry Simons Personal Income Taxation, 1938.