Food Security through the Commercialization of Agriculture

advertisement

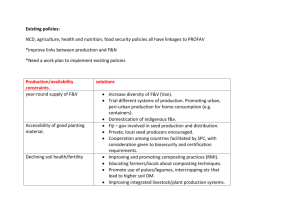

Value Chain and Business Model Approaches Improved Food Security through the Commercialization of Agriculture FAO contribution to Value Chains Methodology -------------------------Heiko Bammann, Enterprise Development Officer, AGS FAO Rome check: http://www.fao.org/ag/ags/index_en.html Sequence of presentation: Value Chains – basic introduction Inclusive Business Models FAO support to VC development Activities and tools supported Initial lessons learned Value Chain Approach A value chain is the full range of activities which are required to bring a product or service from conception, through the different phases of production, transformations, and delivery to final consumers and final disposal after use It is made up of a series of actors from inputs suppliers to producers and processors to exporters and buyers Aim: to elevate the value chain to ” higher level” Improve profits Critical Dimensions of a Value Chain Inputs Production Processing Product Flow Financial Flow Information Flow Incentives and Governance Retailing Five Typical Action Areas/Steps Selection of sector or product, key issues and entry point 2. Value chain mapping 3. Participatory value chain analysis 4. Value chain action planning (draft upgrading strategy) 5. Stakeholder validation and planning workshops => Develop a VC upgrading strategy! 1. Producer-Buyer linkages in VC Institutional environment (laws, regulations, etc.) Financial and Information flows Inputs Production Buyer Processor Distribution Physical flows Supporting services Consumption Inclusive Business Models Small farmers are increasingly tied to markets and agro-industries through business linkages and alliances with each other and with other value chain stakeholders. There are many models of business linkages, but three are relevant for small farmers: producer organisation model buyer driven model intermediary model Typical organisation of smallholder production Type Producer driven Buyer driven Driver Small-scale producers themselves, through FO’s: ECTAD, CPGC new markets higher market prices stabilize market position Large farmers extra supply volumes Processors (Hot Mama, BEL) Exporters (GUY) Retailers (Super J, SLU) assure supply supply more discerning customers ‘make markets work for the poor’ regional development Traders, wholesalers and other traditional market actors Intermediary driven Objective NGO’s and other support agencies National and local Governments i.e. NAMDEVCO, GMC, NWC Must Be a Business Case for Working with Small Farmers Business Reasons Smallholders’ comparative advantage (premium quality) Securing supply Access subsidized inputs Corporate responsibility Community goodwill Politics Costs and Risks Product quantity, quality, consistency, safety Traceability & compliance with standards Loyalty and fulfilment of commitments Negotiation, coordination and communication Foundations of Sustainable Models Organized & empowered farmers Facilitating policy sector Receptive business sector Partnership facilitator Rationale for supporting Business Models Reduce over reliance on multi-stakeholder participatory approaches Focus first on key VC problems Empower real development drivers Enhance reliability of raw material supply Enhance competitiveness of agribusiness buyer Business managers know their markets SMAEs create value, buy products, generate jobs Mainstream business thinking FAO – AGS* supported projects EU All ACP Agricultural Commodities Programme (EU AAACP) – (E) check: www.euacpcommodities.eu/en http://www.fao.org/ag/ags/ivc/en/ The Phase II of the CARICOM/CARIFORUM Programme for Food Security - (I) check: http://www.rlc.fao.org/progesp/pesa/caricom2/ * FAO Rural Infrastructure and Agri-Industries Division For the Caribbean Focus on one product (group) and improved value creation Activities to achieve improved business linkages, production, post-harvest handling, value addition and marketing to local, regional or international markets Focus on farmers and agribusiness organizations Countries, Value Chains, and ‘Businesses’ supported BAR – Onion VC – BAS (I) BEL – Hot Pepper – Hot Mama + (I) DOM – Pineapples – NIPPA (I) GRN – Roots and Tubers – NEFO (E) GUY – Eddoes – GAPA (E) JAM – Ackee – PO’s (I) JAM – R&T – CPGC (E) SLU – Fruits – BVFO, etc. (I) SVG – R&T – ECTAD (E) CARICOM – Services - CaFAN (E/I) Overview of the business model approach What are differences? Business models for improved producer-buyer linkages (steps) Identification of the key driver Analysis/Characterisation of the current business model Identification of the critical success factors for buyers Preparation of an upgrading business model and financing plan Identify sub-set of activities that project can support without distorting viability, unduly subsidizing, undermining sustainability Characterization of Business Model 1. 2. 3. 4. 5. 6. 7. 8. Product: products sold, differentiation Product flow and distribution Clients: clients, numbers, why buy Resources and capacities base Activities: production, transformation, etc. Key partners and collaboration Costs and revenue Expectations Activities and tools supported 1 - Business to Business Coordination Addressing sources of uncertainty Implementing contractual arrangements (formal and informal) Promoting trust, transparency and collaboration 1 - Business to Business Coordination Possible tools: Information mechanisms to improve transparency Workshops to identify bottlenecks and better understand on each other’s role Strategic plans for management of the chains operations Training in negotiating skills and developing contracts 2 - Respond to Customer Needs Ensuring processes and products respond to customers’ needs Synchronize product delivery and logistics Improve information on customer requirements Implement quality and safety standards 2 - Respond to Customer Needs Possible tools: Market appraisal and surveys Train in good agriculture practices and postharvest and handling Train in agro-processing and value addition Train in standards and certification processes Develop product quality and safety grading systems 3 - Add Value by Managing Processes Identify and address logistics constraints Appraising business to business processes Developing organizational innovations that improve delivery times Reducing waste and protect the environment from harmful production and processing 3 - Add Value by Managing Processes Possible tools: Mapping exercises and workshops to understand the flows Appraise financial institutions and support loan applications Train in bulk buying and collective marketing Introduce switch to re-usable items Training in business, financial management and marketing skills Relevance of this approach for the Caribbean? 1. 2. 3. 4. Comparative advantage in production Import substitution Ability to absorb external price shocks Receptive value chain actors -> contribution to Food Security through the Commercialization of Agriculture Initial lessons learned Change of mindset for agricultural development required (define roles) Good management practices are critical!!! Transparency, accountability and trust Business development services rather new in the agriculture sector expensive for small number of beneficiaries Time dimension private sector vs public sector business success requires time learn from failures look for successes and learn from champions Involve regional partners from the start (CARDI, CaFAN, CABA, etc) Thank You !