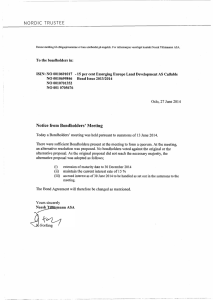

Liens subordination risk Risk

advertisement

Bond Covenants Key risk areas 2 Key risk areas in high-yield bonds Today we’ll will cover 4 areas in depth with obvious ratings implications » 1. Distributions / value transfers to other parties » Risky investments » 2. Debt incurrence / leveraging » Change of control (covered in Pt. I) » 3. Liens subordination risk » 4. Structural subordination risk » Long-term bond value All 4 will, where relevant, show examples of: » Investor friendly, conservatively structure » Average – “Market norm” » Issuer friendly, loosely structured, LBO structure etc. HY covenant packages in Europe and Americas are substantially the same But beware of “covenant-lite” bonds 3 Distributions / Value Transfers To Other Parties 4 Restricted payments covenant Risk » Management has incentive to extract cash and other forms of value to distribute to SHs and affiliates » It can do this through various avenues in the corporate structure » Bondholders are concerned if cash / value transfers at a time when such distributions decrease the issuer’s debt-servicing capacity Restricted payments covenant » Purpose / structure. A company should be able to pay dividends but only if its cash flow permits after making adequate provision for debt servicing » Like most negative covenants, the covenant has a three-fold structure: – (1) Prohibitory paragraph – (2) Financial ratio tests that are an exception to the prohibitory paragraph – (3) List of carve-outs » See RP covenant diagram (handout) 5 Debt Incurrence / Leveraging 6 Overview Risk » Increased leverage can negatively impact bondholders by reducing the cushion of cash flow, increasing default risk in downturns as well as increasing mgt’s incentive to engage in shareholder-friendly actions » In liquidation, additional debt ranking equally with the notes dilutes bondholders’ claims against a company’s assets Key covenants & provisions » Debt incurrence covenant » EBITDA add-backs » Debt re-classification clause » Mergers / “all or substantially all” asset conveyance covenant » Debt retirement through asset sales proceeds 7 Liens subordination risk 8 Liens subordination risk Risk » Unsecured and secured bondholders do not want other creditors to have prior claims on assets should the issuer become insolvent » Additional liens subordination also negatively impacts the market value of their bonds Key covenants and provisions mitigating this risk » Negative pledge/limitation on liens » Sale/leaseback covenant Secured bonds » Many permutations in the capital structure involving secured bonds exist » As to the same collateral, holders are subject to – dilution risk as to their specific lien position on that collateral – subordination risk on that collateral, which can occur through a subordinated lien position or through a “first-out” feature in the proceeds waterfall in favor of another creditor, typically credit facility lenders » May be pari passu but “not equal”: enforcement/ control mechanisms can put secured bondholders at a disadvantage 9 Structural subordination risk 10 Structural subordination risk comes in many forms Risk » Cash flow: bondholders want a direct claim on issuer’s cash flow and its restricted subs » Assets: in an insolvency, unsecured bondholders do not want to compete with other unsecured creditors for assets » Bondholders don’t want more creditors to get ahead of them than they bargained for Structural subordination can take many forms » Other claimants get control over the free flow of cash within the restricted group, restrictions on dividends and superior claims by creditors of subsidiaries Key covenant & provisions mitigating structural subordination risk » Debt incurrence ratio test » Subsidiary guarantee provision » Refinancing provision » Application of asset sales proceeds » Limitation on restriction of dividends by restricted subsidiaries » Limitations on sale of stock of restricted subsidiaries 11