Managing Risks in the Project Pipeline

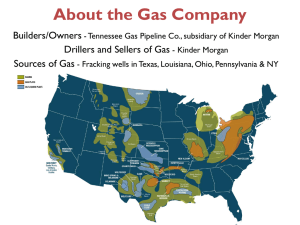

advertisement

Managing Risks in the Project Pipeline Minimizing the Impacts of Highway Funding Uncertainties Larry Redd, P.E. Tim McDowell, WYDOT, P.E. Larry Redd LLC Uncertainties Can Ruin Your Asset Management Plans Best Laid Plans • Optimized project selection • Intended performance benefits • Assumed revenue by year Unplanned Outcomes • Actual Revenue? • Missed deliveries • Holding Costs • Obsolete projects • “Hurry-up” projects • Low performance STIP— ”Project Pipeline” Project Deliveries Project Programming 2017+ Larry Redd, P.E. 970-219-4732 larryredd@earthlink.net Larry Redd LLC 2017 2016 2015 2014 2013 2012 Pipeline Uncertainties • Scope growth and project cost • Labor and Materials price volatility • Environmental or ROW issues • Unplanned political priorities • Construction cost inflation • Uncertain or variable revenue Non-Optimum Project Pipeline Costs Costs Costs of “Being Too Lean”--Loss of Stimulus Funds, Block Grants, Special Legislative Funds -”Hurry-up” design and devel. costs -Non-optimum advanced const. “Optimum” Range Holding Costs – -“PE 10 yr Limit List” $Millions at risk, and $Billions in projects may not get done -Lost permit costs -ROW and EA costs -Development costs -Obsolete projects -Redesign costs Amount of Projects “On-the-Shelf” Ready to Go Objectives • Identify cost elements (holding and hurry-up costs) and uncertainty factors to reduce or trade off or mitigate. • Identify controllable factors to optimize (examples) – – How to operate the pipeline (loading, project mix, draining, etc.) – Cost factors to reduce (holding, hurry up) – Reduce time delays in getting projects onto the shelf • Bottom line – Determine how to deliver intended projects, with expected performance, on time; in the midst of uncertain and/or variable funding • Not “Business as usual…” – Instead, using low impact solutions/methods to manage risks and uncertainties Uncertainty Factors • • • • • • • • • Scope growth Political priorities Material price volatility Labor costs Other construction cost escalation Legal issues Environmental or regulatory issues Right-of-way issues Funding issues Simulation Cartoon Higher Risk if delayed. 3R4R Project Loading Rate Lower Risk if delayed. 1R2R Project Loading Rate 3Rs and 4Rs in Design 3Rs and 4Rs “On-the-Shelf” 3R4R Design Completion Rate 1Rs and 2Rs in Design 3R4Rs Paved 3R4R Paving Rate 1Rs and 2Rs “On-the-Shelf” 1R2R Design Completion Rate 1R2Rs Paved 1R2R Paving Rate Available Funding – WYDOT Scenario Available Funding dollars/yr 300,000,000 250,000,000 200,000,000 150,000,000 Jan 01, 2012 Jan 01, 2022 Sensitivity of Losses to Key Parameters Parameter Initial Value Sensitivity Value Reduction in Losses Design Time for 3R4Rs 5 yrs 3 yrs Up to 22% or more Pipeline (Shelf) Draining Logic Proportional based “Keep the Critical on intended Mix Projects Moving” Up to 16 % or more Holding Cost factor (per year) 5% for 3R4Rs and 2% for 1R2Rs 2.5% for 3R4Rs and 1% for 1R2Rs 20 to 30% Hurry Up Inefficiency 40% inefficiency 20% inefficiency 25% or more Use of Projected Revenue No Projections used Projected two years out Up to 30 % or much more “Smoothness” of Funding “Bumpy” or “Blocky” funding Smoothed or flattened funding Ideally this would eliminate losses Observations and Conclusions • Latest results verify that total Project Pipeline losses can be about 3% per year or more (off-nominal cost assumptions). – A 3 percent savings is representative based on the findings of the analysis. This would amount to a total savings of $90 million,for example, for a budget of 3 billion dollars over a 10-year period. • Multiple methods have been shown to be effective in cutting these losses: – Using (accurate) forward projections of available revenue, or reducing design times in the pipeline (especially for 3R4R projects) – Reducing the values of the factors of Hurry Up and Holding Costs – The “Critical Project Method” of stabilizing the flow of major projects has proven effective. Don’t delay the largest and more complex projects. • Questions?????