The Political Economy of Decentralization in the Philippines

advertisement

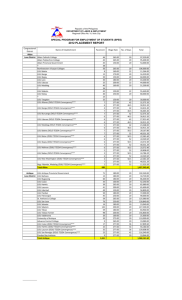

The Political Economy of Decentralization in the Philippines A overview of the impact of fiscal decentralization to the development of Local Government in the Philippines By Alfredo S Sureta Jr. San Sebastian College-Recoletos Constitutional and legal basis of Fiscal decentralization in the Philippines • Political decentralization always goes hand in hand with fiscal decentralization. • There can be no meaningful decentralization if the central government still retains direct supervision and control over the disbursement of public funds. • Hence a meaningful decentralization project should not only deepen political accountability but foster efficiency in the delivery of public service. • Effective decentralization also allows for “the diffusing of social and political tension and ensuring local and political economy • Under the Article X, sections 5, 6 and 7 of the 1987 constitution “Each local government unit shall have the power to create its own sources of revenues and to levy taxes, fees, and charges subject to such guidelines and limitations as the Congress may provide, consistent with the basic policy of local autonomy. • Such taxes, fees, and charges shall accrue exclusively to the local governments. • In addition Section 6. Local government units shall have a just share, as determined by law, in the national taxes which shall be automatically released to them. • Section 7, Local governments shall be entitled to an equitable share in the proceeds of the utilization and development of the national wealth within their respective areas, in the manner provided by law, including sharing the same with the inhabitants by way of direct benefits”. LGC provisions Basis for the computation of the funds under the LGC Distribution of the share of the fund among the LGUs Section 284 ,285 and 286 (a) Provinces - Twenty-three percent (23%); (b) Cities - Twenty-three percent (23%); (c) Municipalities - Thirty-four percent (34%); and (d) Barangays - Twenty percent (20%) Transitory Provisions on the IRA (a) On the first year of the effectivity of this Code, thirty percent (30%); (b) On the second year, thirty-five percent (35%); and (c) On the third year and thereafter, forty percent (40%). Provided, That in the event that the national government incurs an unmanageable public sector deficit, the President of the Philippines is hereby authorized, upon the recommendation of Secretary of Finance, Secretary of Interior and Local Government and Secretary of Budget and Management, and subject to consultation with the presiding officers of both Houses of Congress and the presidents of the "liga", to make the necessary adjustments in the internal revenue allotment of local government units but in no case shall the allotment be less than thirty percent (30%) of the collection of national internal revenue taxes of the third fiscal year preceding the current fiscal year: Provided, further, That in the first year of the effectivity of this Code, the local government units shall, in addition to the thirty percent (30%) internal revenue allotment which shall include the cost of devolved functions for essential public services, be entitled to receive the amount equivalent to the cost of devolved personal services (a) Population - Fifty percent (50%); (b) Land Area - Twenty-five percent (25%); and 131 (c) Equal sharing - Twenty-five percent (25%) Provided, further, That the share of each barangay with a population of not less than one hundred (100) inhabitants shall not be less than Eighty thousand (P80,000.00) per annum chargeable against the twenty percent (20%) share of the barangay from the internal revenue allotment, and the balance to be allocated on the basis of the following formula: (a) On the first year of the effectivity of this Code: (1) Population - Forty percent (40%); and (2) Equal sharing - Sixty percent (60%) (b) On the second year: (1) Population - Fifty percent (50%); and (2) Equal sharing - Fifty percent (50%) (c) On the third year and thereafter: (1) Population - Sixty percent (60%); and (2) Equal sharing - Forty percent (40%). Provided, finally, That the financial requirements of barangays created by local government units after the effectivity of this Code shall be the responsibility of the local government unit concerned. The IRA (a) The share of each local government unit shall be released, without need of any further action, directly to the provincial, city, municipal or barangay treasurer, as the case may be, on a quarterly basis within five (5) days after the end of each quarter, and which shall not be subject to any lien or holdback that may be imposed by the national government for whatever purpose. 70,000,000,000 60,000,000,000 50,000,000,000 40,000,000,000 30,000,000,000 Internal Revenue Allotment Total Non-Tax Revenue 20,000,000,000 Total Tax Revenue 10,000,000,000 0 F.Y.2008 F.Y.2007 F.Y.2006 F.Y.2005 F.Y.2004 F.Y.2003 F.Y.2002 F.Y. 2001 • The table illustrates the accumulated income total of LGUs in the Philippines from 2001 up to 2008. It represents the overview on how the LGUs generated their both from external and internal sources. And the most remarkable overall view of LGUs fiscal situation is the dependency of the LGUs from the internal revenue allotment of the national government. • This income pattern is consistently observed from 2001 to 2008. Despite relative increase in the pattern of local tax collection which includes real property tax, business tax and other non-tax revenue. The pattern remains virtually unchanged with the IRA allotment taking most of the share in terms of the resources LGUs need to maintain its day to day operation. 100% 99% 98% 97% 96% Loans & Borrowings 95% 94% F.Y.2008 F.Y.2007 F.Y.2006 F.Y.2005 F.Y.2004 F.Y.2003 F.Y.2002 F.Y. 2001 Internal Revenue Allotment • The number of IRA dependent LGUs outweighs the aggregate total of fiscally strong LGUs. In addition to external funding provided by the IRA, the code also provides that LGU’s can avail of funds from the capital market. According to the DILG study “despite the availability of financing facilities in government financial institutions (GFIs) LGUs borrowings remain low. Local income vs. IRA(2001-2008) 16% Total Local Sources Internal Revenue Allotment 84% • Based on the data collected by the BLGF, the locally generated revenue for the LGU’s has remained low. While there is an increase in the type of revenue an LGU can collect according to the items enumerated in LGC. • The collection has remained very low compared to the percentage share of IRA provided to the LGU’s. Even though there have been cases of fiscally productive LGU’s. The overall picture has remained unchanged. Below is a summary of LGU revenue sources as compared to the IRA allotment. 60,000,000,000 50,000,000,000 Real Property Tax 40,000,000,000 Business Tax Other Taxes Regulatory Fees Service/User Charges 30,000,000,000 Receipts from Economic Enterprise Toll Fees Other Receipts Internal Revenue Allotment 20,000,000,000 Linear (Regulatory Fees) 10,000,000,000 0 F.Y.2008 F.Y.2007 F.Y.2006 F.Y.2005 F.Y.2004 F.Y.2003 F.Y.2002 F.Y. 2001 Total Tax Revenue Real Property Tax Business Tax Other Taxes 60,000,000,000 Total Non-Tax Revenue Regulatory Fees Service/User Charges 50,000,000,000 Receipts from Economic Enterprise Toll Fees Other Receipts Internal Revenue Allotment 40,000,000,000 Other Shares Extraordinary Receipts/Aids Loans & Borrowings 30,000,000,000 Inter-Local Transfers General Public Services Education, Culture & Sports/ Manpower Development Health, Nutrition & Population Control 20,000,000,000 Labor and Employment Housing and Community Development Social Security /Social Services & Welfare 10,000,000,000 Economic Services Debt Service Other Purposes Excess (deficit) of Income over Expenditures 0 F.Y.2008 F.Y.2007 F.Y.2006 F.Y.2005 F.Y.2004 F.Y.2003 F.Y.2002 F.Y. 2001 Linear (Internal Revenue Allotment) Linear (General Public Services) General Public Services Education, Culture & Sports/ Manpower Development Health, Nutrition & Population Control Labor and Employment Housing and Community Development Social Security /Social Services & Welfare Economic Services Debt Service Other Purposes Excess (deficit) of Income over Expenditures 30,000,000,000 25,000,000,000 In Millions of pesos 20,000,000,000 15,000,000,000 10,000,000,000 5,000,000,000 0 2000 2002 2004 2006 2008 2010 • Consequently there are attempts to correct this under spending by the LGU’s. Among them are attempts to enhance the capacity of the LGU’s to utilize the resources they have. • Training programs initiated by the DILG, Local government Academy and the Local Government Development Foundation tries to capacitate LGU’s staff on development planning and financial management. • Another program started by the DILG together with World Bank is the creation of a “Performance Enhancement Fund” which provides additional funding to LGU’s on top of their regular IRA allotment. • The fund can be accessed when an LGU posses specific criteria that will allow effective use of the fund. But even if the LGU’s access this fund several challenges remain to be solved. • First there is a lack of serious financial accountability on the utilization of LGU’s resources. Until today national government agencies such as the Department of Finance and the DILG have not imposed strict accountability rules on the utilization of the funds provided to the LGU’s. • Other government agencies such as the Department of Health and the Department of Social Welfare utilize different indicators to measure service delivery by the LGU’s. But the lack of a comprehensive standard to measure LGU performance hampers any effort to exact fiscal accountability from the LGU. • Secondly, despite the devolution of health, social services, and agriculture the same national government agencies continue to receive increased appropriation from the national budget. Contradicting the goal of fiscal decentralization embodied in the code. • And finally the difference in the capacity of different LGU’s in terms of implementing their devolved function. Resulting in an uneven delivery of public service where LGU’s that are financially autonomous are able to function effectively making them less dependent on the IRA. While less developed LGU’s have to rely more on the IRA to function. • But since these IRA dependent LGU’s cannot function without it, they cannot get out of the cycle of IRA dependency. Hence making it difficult for these LGU’s to become fiscally autonomous from the national government. Even though there has been numerous best practices by highly effective LGU’s all over the country (see table 4). These LGU’s remain simply as island of governance.