Safety of Municipal Funds - New Hampshire Government Finance

advertisement

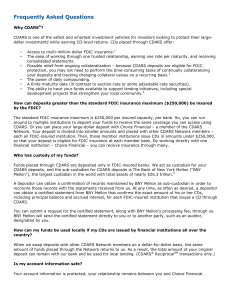

Hosted by: New Hampshire Government Finance Officers Association Sponsored by: Local Government Center May 5, 2011 3:30 – 5:00pm Presented by: Glenn Rowley Joyce Baldassare Tammy L. Buchanan Safety of Municipal Funds By Glenn Rowley, SVP Government Banking 603-634-7164 Glenn.Rowley@citizensbank.com NHGFOA 5/5/11 2 Citizens Financial Group is a commercial bank holding company and a wholly owned subsidiary of The Royal Bank of Scotland Group. Headquartered in Providence, RI U.S. ranked 12th in Assets at $130 billion and $92 billion in Deposits 1,500 branches with 495 in New England Long-Term Credit Ratings (as of Feb. 2011) Fitch A+ Moody’s A2 Standard & Poor’s A- Tier 1 Capital Ratio 13.16% (CFG as of Feb. 2011) NHGFOA 5/5/11 3 BANK FINANCIALS Know who you are banking with and understand the bank’s financials RATIOs Liquidity Loans to Deposit Liquidity Ratio Asset Quality Capital Tier 1 Capital Risk Based Capital Earnings NHGFOA Non performing Loans to Total Loans Loan Reserve to Total Loans Return on Assets Return on Equity 5/5/11 4 Bank Rating Services Highline Financial Veribanc IDC Bankrate Bauer Financials Rating Agencies Standard & Poor’s Moody’s Fitch NHGFOA 5/5/11 5 Collateralization – things to look for Third party involvement Automation Mark to Market Daily Program approved by Bank Board Contract Notices, confirms, online information Underlying securities Third Party Should be impartial They are a service provider, the credit quality pertains to the securities pledge to the deposit NHGFOA 5/5/11 6 Costs Most banks are compensated through rate spreads Costs can be between 25 to 50 basis points (bps) Citizens Banks Collateral Program Third Party Program through Bank of NY Mellon Daily Mark to Market Online access Automated daily feed FIRREA Compliant NHGFOA 5/5/11 7 Dodd-Frank Signed into law July 21, 2010 Most significant remake of the U.S. Financial Services sector since the Great Depression Impacts every segment of the Financial Services Industry Dodd Frank requires 243 New Regulations 67 Studies Will it prevent future financial disasters? Panic of 1907 Crash of 1929 S & L Crisis of 1989 Crash of 2008 Gave Gave Gave Gave Us Us Us Us NHGFOA Federal Reserve 1913 SEC, FDIC, Glass Steagall FIRREA Dodd Frank 5/5/11 8 Sixteen Provisions of the Act Deriviative Regulation Systematic Risk Bank Regulatory and Supervisory Framework Insurance Investor Credit Rating Agencies Broker Dealers Disclosure Deposit Insurance Consumer Protection What this means to you Regulation Q Repeal FDIC Unlimited Coverage on DDA through 2012 NHGFOA 5/5/11 9 Collateral Presentation By Joyce Baldassare SVP/Chief Deposit Officer 603 606 4714 direct line NHGFOA 5/5/11 10 Centrix Bank was founded in 1998 to provide commercial banking services to small- to medium-sized businesses and professionals in New Hampshire. Unique in its goal and successful in the execution of its business model, Centrix is one of the fastest-growing banks in the Granite State. Centrix offers a full-range of banking services to commercial entities, professionals, not-for-profits and municipalities. A New Hampshire State-chartered, FDIC-insured bank, Centrix is comprised of professionals who contribute greatly to the diversity and experience necessary to serve its niche. Our customer service philosophy is to serve our customers through uncompromised focus on customer satisfaction. NHGFOA 5/5/11 11 Centrix Bank is headquartered in Bedford, New Hampshire with branches located in Concord, Dover, Manchester, Milford, and Portsmouth and a loan production office in Nashua. Centrix Bank continues to grow at a steady pace, while maintaining strong asset quality with our total equity to asset ratio greater than 7.1%. At the conclusion of Q4 2010, Centrix Bank’s assets and loans grew 16% and 10% year-over-year, respectively. Centrix Bank is quoted on the OTCBB under the symbol “CXBT”. SNL Financial LC listing of Centrix Bank at #58 out of 1147 banks in the Best 100 Performing U.S. Community Banks with assets between $500 million and $5 billion. NHGFOA 5/5/11 12 Repurchase Agreements - Pledged collateral typically Fannie Mae and Freddie Mac Mortgage Backed Securities (MBS). Collateralized Deposits - Pledged collateral typically Fannie Mae and Freddie Mac Mortgage Backed Securities (MBS). CDARS or Certificate of Account Registry Service ICS or Insured Cash Sweep No extra cost for collateral since the cost is built into the rate. NHGFOA 5/5/11 13 Promontory Interfinancial Network developed and started CDARS in 2003. The founders and board member of this network include former regulators of the FDIC and the former Treasury Deputy. Additional information about Promontory and CDARS can be found at www.promnetwork.com. The most popular products offered by Promontory for Public Funds investment are CDARS and ICS. CDARS or Certificate of Deposit Account Registry Service invests funds in Certificates of Deposit, and ICS or Insured Cash Sweep invests in Money Market accounts. Each bank in the Promontory network can invest multi-million dollars in both CDARS and ICS. NHGFOA 5/5/11 14 Forego the hassle of: Tracking and “marking to market” changing collateral values on an ongoing basis. Having uninsured investments to footnote in financial statements. GASB 40 issues1 Opening accounts at different banks and/or under different insurable capacities. Manually consolidating account statements. Calculating blended rates and manually consolidating interest disbursements on a recurring basis. [1] CDs issued to governments through CDARS should not be regarded as being exposed to custodial credit risk or requiring an adverse 5/5/11 NHGFOA disclosure on the government's financial reports. 15 Highlights of CDARS Full FDIC coverage of all the funds placed in the network in increments of less than $250,000 deposited in Certificates of Deposit in approved banks throughout the country. Certificates of Deposit range in term from four weeks to three years, allowing you to manage your liquidity. Municipalities would receive one statement, one 1099 tax form, and one rate for each Certificate of Deposit term. NHGFOA 5/5/11 16 Benefits of CDARS Municipalities would receive full protection on their deposits with FDIC insurance. The rate and return on the money is significantly higher than US Treasuries and similar other low-risk investment instruments. The money invested in CDARS is maintained in the local economy. NHGFOA 5/5/11 17 1. Sign a CDARS Deposit Placement Agreement and deposit money with Centrix Bank. 2. Your funds are placed using the CDARS service. 3. Provide list to Centrix Bank of where Municipality has other monies in order for Promontory to exclude those banks from your funds placement. 4. Your CDs are issued by banks in the CDARS Network. 5. The Municipality will receive confirmation from your bank of our CDs. 6. The Municipality will receive consolidated interest payments and statements. NHGFOA 5/5/11 18 ICS is a semi-liquid investment product with the funds deposited into Money Markets within the Promontory network. With ICS service you can: Earn interest with one interest rate on each account. Access funds with withdrawals up to six times per month. Have the security of full FDIC insurance. Unlimited deposits into the ICS account. Online access to view where your funds are at all times. NHGFOA 5/5/11 19 1. Identify an existing account or establish a new checking with Centrix Bank to be used with ICS. 2. Sign an ICS Deposit Placement Agreement and a custodial agreement. 3. Provide list to Centrix Bank of where Municipality has other monies in order for Promontory to exclude those banks from your funds placement. 4. Have your deposited funds placed into money market deposit accounts at other banks using ICS. 5. See where your funds are at all times through online tools specially developed for ICS. 6. Receive one monthly statement from Centrix Bank detailing your account activity and balances across all institutions. NHGFOA 5/5/11 20 How safe are your deposits? In 2010, the NH State Treasurer specified approved use of CDARS by municipalities for investment of public funds. This program has been endorsed by the American Bankers Association. The FDIC has stated and recognized that all money deposited through this program is covered under FDIC guidelines. The media, both print and television, have featured this program as a safe and wise investment. Additional supportive information including videos and newspaper clippings can be found by visiting www.cdars.com. NHGFOA 5/5/11 21 COLLATERALIZATION THROUGH FHLBB Tammy L. Buchanan, AVP Government Banking (603) 762-1876 Tammy.Buchanan@Peoples.com NHGFOA 5/5/11 22 43rd largest financial institution in the U.S. $25 billion in assets $1.5 billion in excess capital Largest New England-based Bank with 340 branches and 491 ATMs from New York to Maine. Formerly known as Ocean Bank 169 years in business; 32 recessions; 0 bailouts Established $60 million community foundation in 2007 in support of local nonprofits 100% publicly-owned stock form holding company regulated by the U.S. Office of Thrift Supervision (OTS) NASDAQ ticker - PBCT NHGFOA 5/5/11 23 FHLBB is a Government-sponsored, privately-owned wholesale bank. It’s mission is to support the lending activities of its member financial institutions throughout the six New England states. All FHLBB stock is owned by its member banks. As a member, People’s United Bank utilized FHLBB’s resources which enables us to deliver competitively priced financial products, services and expertise. FHLBB consistently receives the highest possible agency ratings. The Bank is rated Aaa by Moody's Investors Service and AAA by Standard & Poor's Corporation. NHGFOA 5/5/11 24 Letter of Credit (LOC) is used to secure deposits made by state governments, municipalities and other public agencies Benefits of an LOC over traditional collateral: Customer has full deposit relationship protected up to the maximum credit amount determined by the municipal entity and the relationship manager Customer has less paper, less reporting and less reconciliation Customer is owner of the account; Bank cannot terminate or change the LOC without the agreement of the customer Same-day payout of funds should the Bank default NHGFOA 5/5/11 25 Less paperwork Fast and easy set-up Easy to manage Cost effective for both Bank and Customer NHGFOA 5/5/11 26 Member (People’s United Bank) applies to the FHLBB for the LOC; the Member is the applicant while the municipality is the beneficiary FHLBB issues the LOC on behalf of the applicant in the name of the municipality LOC must have an expiry date and can only be changed or cancelled with the municipality’s consent In the event of a bank default, the municipality prepares and delivers to FHLBB a sight draft and letter of request to draw funds against the LOC. (If these documents are received by 11:00 AM, funds are disbursed by wire transfer on the same business day.) NHGFOA 5/5/11 27 What is the cost to the Municipality? What is the cost to the Bank? NHGFOA 5/5/11 28 The Comprehensive Implementation Guide, issued by the Governmental Accounting Standards Board, states that an Irrevocable Letter of Credit can be considered a form of insurance if the Bank or the Bank’s affiliate did not issue it and provides a scope of coverage substantially the same as that provided by Federal deposit insurance. Thus, the Irrevocable Standby Letter of Credit issued by the Federal Home Loan Bank is not exposed to custodial credit risk, and deposits should be considered Category 1. NHGFOA 5/5/11 29 Q&A NHGFOA 5/5/11 30