Finance act 2013 – FINAL 9 June 13 CA Sanjeev Lalan

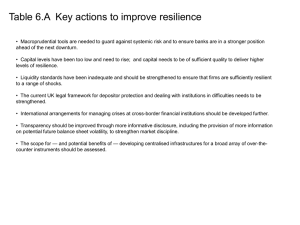

advertisement