Click here to the Industry Briefing Powerpoint slides

advertisement

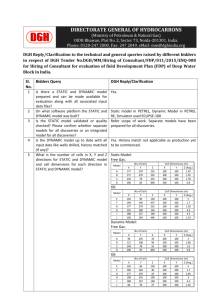

IndII Industry Briefing 14 March 2013 Agenda 1. 2. 3. 4. 5. 6. Overview and Introduction (David Ray) General Issues – Procurement (Jeff Morgan) General Issues – Contract Management (Jeff Morgan) Program Overview – Transport (John Lee) Program Overview – Water and Sanitation (Jim Coucouvinis) Program Overview – Policy and Investment (Lynton Ulrich) 2 Overview and Introduction • 2012: relatively quiet in terms of procurement ─ ─ Focus on planning and design IndII Board meeting – late 2012. IndII required to leave $10 mill space for allocation post June 2013 • 2013: much more activity on the procurement front ─ Of a total TA budget of $67 million approx. $20 mill already contracted by Feb 2013, with approximately $30 - 35 mill new contracts to be issued by the second/third quarter of 2013. • Forward program, key highlights: ─ ─ ─ ─ ─ ─ ─ TA for roll out of existing grant programs: Water Hibah, sAIIGs Design and development of new grant programs: PRIM, IURSP, CBO water, City sewerage investment Large project preparation activities: Solid waste, waste water, PDAM support and possibly a major port Re-engagement in national roads (policy, planning and delivery) Many smaller, but highly strategic TA activities: WSSI, NTB/NTT Water Governance, Road Safety, Aviation, Jakarta urban transport Knowledge sector: AIIRA and IIIDE PPPs as an alternative procurement modality 3 Introduction (cont’d) • Expectations management re activity approvals • IndII governance process requires 3 layers of approvals for activities: ─ Board approval of FRPD (Facility Review and Planning Document). 6 monthly review providing broad program guidance and direction ─ Technical Team approval. GOI approval of activities at the concept stage ─ Activity Design approval. Detailed program design required for final AusAID funding approval. This latter stage of the approval requires the most time and effort. 4 General Issues – Procurement • Procurement categories ─ Direct engagement - <$125,000 ─ Select tender <$500,000 ─ Open tender typically >$500,000 • Follow requirements of EOI / RFT ─ Common problem – excessive number of pages, adhering to requirements 5 General Issues – Contract Management • Style / formatting of deliverables, follow contract, use style guide • Timeliness of deliverables • Invoicing – follow contract, accurate • Adviser Performance Assessment – continued late submission of deliverables, poor invoicing practices = negative assessment • Messaging and communications 6 Program Overview – Water and Sanitation Water Supply • Output based water hibah grant ($90 million) • Grants for community water systems Watsan sector governance • Water and sanitation service index (WSSI) • NTB/NTT water governance program Wastewater • sAIIGs – grants for neighbourhood sewerage • EIAs/DEDs for wastewater (3 cities) • Sewerage investment (1 city) Solid waste • FS for SW facilities (2 cities) 7 Water Supply Water Hibah - $90 million in Grant program • Baseline and verification Consultants – 2 Packages east and west regions approximately $1.8 million each (bids closed) • Impact evaluation of water hibah – (Second semester 2013). Community Based Organisations – Water Supply • Preparation Support – Select Tender $120,000 Q3 2014 • Implementation support - $700,000 - $1,500,000, Q1 2014 8 Watsan Sector Governance Water and Sanitation Service Index • Pilot implementation in 12 local governments – current • Roll out in approximately 100 local governments – Open Tender Q3/Q4 2013; $500,000 Water Governance Program • Preparation of Stage 2 – Second Semester 2013, Consultant Pool $115,000 • Implementation Support – Q4 2013, $700,000 open tender. 9 Wastewater Australia Indonesia Infrastructure Grants for Sanitation – sAIIG • Preparation, Appraisal and Oversight Consultant – 2 packages each $1,600,000 – out to tender • Baseline Consultant – 2 packages $700,000 each – EOI completed, tender in March 2013 • Verification Consultant – One package $800,000, April 2013. • Capacity Building for sAIIG - $594,000, Q3 2013. Sewerage Detailed Design and Procurement Documents • 3 cities, $1,500,000 each; March 2013. Palembang, Cimahi, and Makassar Social and Environmental Safeguards • Wastewater 3 cities including Land Acquisition and Resettlement plans, March 2013 one package $900,000 10 Wastewater / Solid Waste City Sewerage Grant – Construction Management • One package, $2,000,000, Q4 2013. Contract novation provisions post IndII may apply. Solid Waste Feasibility Studies 2 Cities – Support WB Loan $100 million • Feasibility studies for upgrading Municipal solid waste disposal facilities – Manado and DI Yogyakarta (Sleman & Bantul) - $900,000 11 Other External Funding in WSS Water Supply 2nd Pamsimas – very limited T/A input from loan – Procurement by DGHS. USAID – IUWASH, approx. $40 mill program but small T/A components. WSP – Parallel inputs to our CBO program and steady trickle of other T/As. Sewerage ADB $120 million loan for second MSMIP. Technical assistance for Capacity development and implementation oversight – procured by DGHS. JICA – South Central Jakarta Sewerage. $240 million, expected loan in 2013, announcements 2014. Solid Waste World Bang Solid Waste Improvement Program. Project implementation support, Capacity Building, Facility operation contracts. 12 Program Overview - Transport • Multi-Modal Connectivity – Policy & strategic advice to key transport ministries – Corridor-based inter/multi-modal transport planning o National and sub-national • Urban Mobility & Congestion Relief – Policy and strategic advice to MoT and DKI Jakarta – Practical projects in urban corridors/networks o BRT (TransJakarta) in Jakarta o Public transport infrastructure in secondary urban corridors • Life-Cycle Delivery – Transition from input-based delivery to life-cycle, output-based approach – Alternative risk transfer and service delivery options • Safety – Black-spot treatments and EINRIP Road Safety Audits – Safety components in integrated corridor solutions supported by IndII grants – Institutional capacity-building: police, DGH, DGAC, DGLT, DGR, DGST 13 Multi-Modal Connectivity • Policy and strategic planning advice – Support for MoT and MPW through advisory units – Outputs: Policy papers and briefings; RENSTRA assistance; institutional strengthening; knowledge-sharing – Opportunities: None at this stage; RENSTRA advice will generate new opportunities • Multimodal corridor strategy – North Java Corridor Multimodal Transport Study – Outputs: policies/investments to optimize the roles of the respective modes – Opportunities: Follow-up to scoping study ($0.08m); later additions possible ($0.3m budgeted) • Sectoral planning – RENSTRA assistance in DGH, DGST; port master-planning – Outputs: Road corridor priorities; port MP/Pre-FS/PP business case – Opportunities: National Roads Policy ($0.4m) & Planning ($3.2m) (EOI/RFT issued); Makassar New Port MP/pre-FS/PPP business case ($0.85m) • Multi-modal connectivity at the sub-national level – Integrated corridor solutions – Outputs: Pilot programs for AIIG grant funding – Opportunity: See Safety (IURSP under preparation) 14 Urban Mobility & Congestion Relief • Policy and strategic planning advice – Support for MoT and DKI Jakarta through advisory units – Outputs: Policy briefing notes; assistance with RENSTRA; institutional strengthening; knowledge sharing – Opportunity: None at this stage, but some will emerge from RENSTRA and institutional proposals • Jakarta (with World Bank) – Management and operational assistance to TransJakarta; policy/planning advice to DKI Jakarta – Outputs: improved TransJakarta performance; integration of urban transport policies and strategies; dissemination of best practice; BRT infrastructure project/s suitable for World Bank support – Opportunities: Spin-off activities for DKI likely (ITS, ERP etc); TransJakarta investment program (will become clearer mid-2013) • Other cities – Integrated corridor solutions – Outputs: Pilot programs for AIIG grant funding – Opportunity: See Safety (IURSP under preparation) 15 Life-Cycle Delivery • Institutional capacity-building – DGH: Support for BIPRAN, BINTEK and selected balai units o Outputs: corridor plans, asset management tools, capacity-building, training – RTTFs: strengthened role as arm’s-length reviewer of performance (PRIM) – DGST: Support for port administrations – Opportunities: Upgrading DGH standards/manuals (Bintek); PRIM (see below) • Program implementation – DGH: long-life designs; strengthened asset management by balai units o Outputs: upgraded standards, performance-based contracts o Opportunity: National Roads program delivery ($3.0m initially, likely more later) – DGST: preparation of PPP projects in selected ports o Outputs: PPP procurement strategy and transaction plan/s o Opportunity: Makassar New Port MP/pre-FS/PPP business case ($0.85m initially, with PPP transaction to follow) 16 Life-Cycle Delivery (continued) • Alternative delivery model/s – DGH: appropriate risk transfer; life-cycle delivery by private sector – Outputs: pilot project in life-cycle delivery with private finance – Opportunity: Possible pilot project arising from National Roads Policy/Planning (PPP/PFI/PBC component) • Life-cycle management at the sub-national level – Provincial Road Improvement & Maintenance (PRIM) program o Pilot program (in NTB) in strengthening road maintenance with grant support on satisfactory performance – Outputs: better quality roads, replicable model for expansion to other provinces and kabupatens – Opportunity: PMC in DGH, PIUC in NTB (consultants shortlisted); possible later expansion in NTB and other provinces 17 Safety • Road Safety – DGH: RSEU Business Plan; black-spot program; EINRIP RSAs o Possible opportunity: Strengthening of RSEU (DGH); institutionalization of iRAP assessments – INTP: crash investigations and speed control; twinning with VicPol – DGLT: safety components under Integrated Urban Road Safety Program (IURSP) o Corridor-based integration of bus shelters, pedestrian facilities, traffic management and road safety improvements, with grant support for satisfactory performance o Opportunity: IURSP program preparation & implementation (±$1-2m), subject to concept approval • Railway Safety – DGR: scoping study for railway safety regulation – Possible opportunity: Rail Safety Master Plan • Aviation Safety – DGAC: Concept of Operations/Traffic Capacity – Opportunity: Airspace CONOPS study 18 Program Overview – Policy and Investment • Focus on activities related to infrastructure finance and cross-sectoral in nature or cover activities from other sectors. • Object of P&I is for increased investment in infrastructure service delivery through improvement in GOI systems and processes. • Activities for 2013 ─ Financial and governance reforms in selected PDAMs Stage 4 (in procurement) ─ Completion of PDAM reform Stage 3 ─ Completion of MPW Audit Module 1 ─ Gas Master Plan Development ─ Small scale water supply PPP support ─ Knowledge sector activities 19 Activities for 2013 • Financial and governance reforms in selected PDAMs Stage 4 ─ ─ ─ ─ ─ 6 to 9 “healthy” PDAMS to be selected. Prepare Business and Good Governance Plans. Source commercial loans under Perpres 29/2009. Obtain MoF agreement. Opportunities - Non at the moment. Subject to a selective tender process following EOI evaluation. • Completion of PDAM reform Stage 3 ─ Completion of Business and Good Governance Plans for 7 “unhealthy” PDAMs. ─ Obtain MoF approval. ─ Contracts already awarded. • Completion of MPW Audit Module 1 ─ Completion of Action Plans for IACM progress to level 3, Anti-corruption, Procurement, IT development and change management. ─ Package for another donor. ─ Contract already awarded. 20 Activities for 2013 • Gas Master Plan Development ─ Completion of 10 Policy Notes. ─ Completion of Final Report. ─ Contract already awarded. • Small scale water supply PPP support ─ Finalise project selection. ─ Development of follow–on activity with other donors. ─ Opportunities – subject to follow-on development. • Knowledge sector activities ─ Australia-Indonesia Infrastructure Research Awards (AIIRA) program. ─ Feasibility Study for the establishment of The Indonesian Institute for Infrastructure Development Effectiveness (3IDE). ─ Opportunities (3IDE) - None at the moment. Subject to a selective tender process following EOI evaluation. 21