Deconstructing the Value Proposition of Captives

advertisement

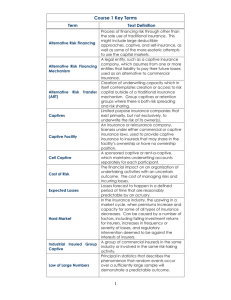

Deconstructing the Value Proposition of Captives Charlie Woodman, CPA, CGMA Risk Finance & Analytics Willis Construction Practice Craig A. Ream Program Administrator - CS Insurance Ltd. Willis Captive Practice 20th Annual Willis Construction Risk Management Conference Marriott Legacy Town Center – San Jacinto Room Tuesday, September 16, 2014 Economics of Insurance: The Stage Profits & Losses 55 -75% • Components of Traditional Insurance: Expected loss and ALAE Taxes and regulatory fees Overhead and administration Insurer selling and distribution expense Reinsurance and Intermediary charges Risk Margins Surplus charges Risk Based Capital offsets Fixed (25%-35%) Insurance Company Overhead, Taxes, Reinsurance Cost, Commissions Profits & Investment Income Underwriting Profit and Investment Income Accrued by Insurance Company 1 The Continuum of Risk Finance HIGH Integrated Risk • Traditional Hazard lines (property, Casualty, EPL) • Integrated layers at specified layers Qualified Self Insurance w/ Risk Funding • State Qualified Self Insured • Insured is legal insurer Group Captives • Formed to insure member owners (shared risks/assets) • Replication of insurance and group purchase of excess Large Deductible Policy • Significant/complete risk assumption in exchange for deductible credit Loss Sensitive or Retro Policy • Assumption of limited risk in exchange for potential return premium • Deferred “pay-in” premium Guaranteed Cost • Complete transfer of risk • Commercial insurance with no deductible LOW Assumption of Risk HIGH Program Selection Drivers are Risk Appetite Financial Protection Asset and Revenue Protection Performance Certainty Liquidity and Cash Certainty / Cost of Short-term Finance Statutory or Counter-party Requirements Revenue / Expense Matching Safety & Loss Containment Services and Acquired Disciplines Control Negotiation & Leverage Catastrophic Protection Taxation Market Opportunity Captive Insurance Company - Defined An Insurance Company, typically owned by non-insurance parent(s), insuring the risks or interests of its owner(s) Incorporated, Regulated, Capitalized and Individually Accountable May be fairly transparent May or May not be a replacement for insurance. Depends on Form (ownership and insured relationship) Emphasizes the ‘Insurance Transaction’ Insurance Company Operations: Insurance Accounting and Financial Metrics Must Always Maintain Positive Capital and Surplus (Unrestricted Net Worth I.e., Marketable Assets > Liabilities) Typically administered by professional third-parties Captive Mgt / Legal / Audit / Actuarial / etc. 4 Forms of Captives Single-owner or Pure Group – Homogeneous or Heterogeneous Association Insurer Controlled Agency / Sponsored Rent-a-captive Segregated account (cell) captives Captive pools Risk retention groups Trusts Special Purpose (Re)insurer Etc… Feasibility Prerecorded Lecture/ 5 5 Boil It Down – Two Real Types Single Parent Wholly-owned (and can include Rent-A-Captive “Cells” & Trusts) Emphasis on Risk Funding and Cost / Funding Efficiencies Underwrites ‘related’ risks to single economic interest as insureds are commonly parental operations Will consolidate operating and financial position with publicly-held parent; may deconsolidate under certain circumstances in closely-held. Group Owned No common ownership among insured participants Group, Association Captive, Risk Retention Group Emphasis on Risk Transfer as an insurance market alternative Will pool certain retention layers among participant insureds Common services and emphasis on the health of the group as a whole. 6 Primary Focuses of Single Parent Captive Programs Cost Savings Long Term - “Seasoning” of a Property & Casualty Insurance Company: Platform and enhance the placement of insurance coverage, terms and conditions Access or contract with alternative markets or reinsurers Effect optimal balance of risk retention and transfer, glean greater control over risk process Projected performance is difficult to quantify Short Term - “Business Case” / Cash Flow Efficiencies: Highly Quantitative / Heavy Tax Risk Management / Program Facilitation Provide rapid liquidity Buy Down Deductibles of Subsidiaries or Operating units Stabilize or enable allocations and budgeting / contracting processes Business Enhancement: “Profit Center” Controlled Insurance Programs Sub Contractor Default Insurance Extended Warranty / Service Contracts Asset Facilitation / Wealth Strategies – Closely-helds 7 Business Case: Assessment and Short-term Viability NPV - Short Term Business Case cost Savings Accelerated Tax Benefits State Tax Arbitrage Operating Costs WACC / Opportunity Cost of Capital Other Quantitative & Qualitative Capital Commitment / Operating Cost Internal Costs & Resource Commitment Recognitions and Materiality Corporate Culture 8 Group Captive Value Proposition Control over insurance “destiny” Unbundled service providers Retain underwriting profits and earn investment income Disciplined loss funding in a tax favorable structure Access to capacity and economies of scale Group Captive Value Proposition Reduce and stabilize costs Improve risk management through accountability Customized and focused loss control services Improved long term premium stability Best in class coverage Captive benefits on shared platform – reduced expense Group Captives Unbundling the Insurance Transaction How do they do it? Assumption of a high level of risk Cost of risk transfer significantly reduced Insurance market volatility minimized Proven risk sharing structure Reduces volatility in claims experience for participants Provides needed risk shifting and distribution Volume purchase #61 on ENR top 400 - $900M in combined revenues Shock claims are diluted How do they do it? Investment income Enhanced loss prevention and claims management Avoid exposure to cat risks Member selection - “Best in Class” controlled growth Assures health of program over time Reduces cost of risk transfer Enhances peer group best practices exchange Construction Solutions Case Study Construction Solutions Construction Solutions Contractors Group Captive Established in 2001 100% Member Owned and Controlled Domiciled - Cayman Islands Prospective Members: Moderate/High hazard contractors generating between $500,000 and $3,000,000 in combined WC, GL and Auto Standard Premium Contractors with a strong senior management commitment to safety Contractors with loss and incident rates superior to average for class Contractors with a formal loss control and safety program Contractors with solid financials Construction Solutions Common January 1st renewal date $136,000,000 of payroll insured 1,700 power units insured $10,000,000 in annualized captive premium Renewals presented in October and bound in November Strict loss control covenants and annual CORR analysis Bi-Annual Loss Control Meetings: September 15, 2014 May, 2015 Dallas Pittsburgh Bi-Annual Board & Shareholder Meetings: October 19-21, 2014 May 17-19, 2015 Toronto Cayman Construction Solutions Insured Coverage Workers’ Compensation Statutory Coverage & 1M Employers Liability General Liability 1M per occurrence 2M aggregate per project/per location aggregate Automobile 1M Liability Physical Damage Construction Solutions Current Membership 2 Masonry Construction 2 Commercial Roofing & Sheet Metal Fabrication 1 Machinery Installation, Rigging, and Transportation 1 Road/Street Construction and Paving 1 Road/Street & Bridge Construction 2 Asphalt Distribution and Paving 1 Aggregates and Precast Concrete Products 1 Pipeline Construction Construction Solutions Current Members Peckham Industries – White Plains, NY The Hamlin Companies – Garner, NC Franco Associates – Pittsburgh, PA Cost Company – Pittsburgh, PA Energy Services of America (ESA) – Huntington, WV Valley Group – Fishersville, VA Suit-Kote – Cortland, NY Economy Paving – Cortland, NY Diamond Materials – Wilmington, DE Greenwood Industries – Millbury, MA LC Whitford – Waterville, NY Construction Solutions Internal Structure One Time Capitalization: $ 30,000 Share Purchase Experience Adjustment Assessment equal to one times A Fund In a multi coverage occurrence the total clash retention is $ 500,000. $ 1,000,000/Unlimited (WC) Reinsurance – Arch Excess of $ 500,000 $ 500,000 Severity Fund B $ 375,000 XS $ 125,000 $ 125,000 Frequency Fund A First Dollar to $ 125,000 General Liability Workers Compensation Auto Construction Solutions Premium Distribution Example: Captive Expenses $ 345,900 Loss Funding $ 654,100 Total Premium $1,000,000 Construction Solutions Premium Distribution Example: A Fund $ 490,575 B Fund $ 163,525 Loss Funding Allocation $ 654,100 Construction Solutions Conceptual Annual Program Pricing ABC Construction WC 49.06% 16.35% 65.41% 18.98% 5.72% 3.50% 1.30% 2.09% 3.00% 34.59% A Fund - $0 - $125,000 $ B Fund - $125,000 - $500,000 $ Total Loss Funds $ Excess & Aggregate Charge Front Administrative Charge Taxes/Boards & Bureaus Charge Loss Control Funding Claims Admin Funding Captive Expense Funding Subtotal Total Estimated Subject Premium Estimated Composite Rate Auto Total 269,816 $ 147,173 $ 73,586 $ 490,575 89,939 $ 49,058 $ 24,529 $ 163,525 359,755 $ 196,230 $ 98,115 $ 654,100 $ 104,390 $ 56,940 $ 28,470 $ 189,800 $ 31,460 $ 17,160 $ 8,580 $ 57,200 $ 19,250 $ 10,500 $ 5,250 $ 35,000 $ 7,150 $ 3,900 $ 1,950 $ 13,000 $ 11,495 $ 6,270 $ 3,135 $ 20,900 $ 16,500 $ 9,000 $ 4,500 $ 30,000 $ 190,245 $ 103,770 $ 51,885 $ 345,900 $ Estimated Exposure GL $ 550,000 $ 15,000,000 $ 3.67 300,000 $ 15,000,000 $ 1,000,000 140 2.00 $ Share Purchase Retail Brokerage Fee Assessment Exposure Collateral Required 150,000 1,071 $ (A Fund) (2/3 A Fund) $ $ 30,000 TBD 490,575 326,723 Construction Solutions ABC Construction Policy Term 2013 2012 2011 2010 2009 2008 $ $ $ $ $ $ TOTALS $ All Lines to include General Liability, Auto Liability and Workers Compensation $0 - $125,000 $125,001 - $500,000 $500,001+ 200,000 $ - $ - $ 650,000 $ - $ - $ 325,000 $ 100,000 $ - $ 325,000 $ 300,000 $ - $ 325,000 $ 375,000 $ 500,000 $ 125,000 $ 375,000 $ 1,500,000 $ 1,950,000 $ 1,150,000 $ 2,000,000 $ Total Incurred 200,000 650,000 425,000 625,000 1,200,000 2,000,000 5,100,000 Construction Solutions ABC Construction Gross Subject Premium Losses Incurred (Paid+Reserved) Losses Excess of $500,000 Reinsured: $ $ $ A FUND Net Premium Losses Incurred (Paid+Reserved) $ $ Profit/(Loss) $ Transfer to B $ A Fund Assessment $ Sub-Total: $ Deficit Reallocation (Risk Share) $ Final A Fund Balance $ B FUND Net Premium Losses Incurred (Paid+Reserved) $ $ Profit/(Loss) $ Transfer from A $ Deficit Reallocation (Risk Share) $ Final B Fund Balance $ Loss Equity Balance*: $ 2013 2012 1,000,000 $ 200,000 $ $ 1,000,000 $ 650,000 $ $ 2011 2010 1,000,000 $ 425,000 $ $ 2009 1,000,000 $ 625,000 $ $ 2008 1,000,000 $ 700,000 $ 500,000 $ Total 1,000,000 $ 500,000 $ 1,500,000 $ 6,000,000 3,100,000 2,000,000 490,575 200,000 290,575 290,575 290,575 $ $ $ $ $ $ $ $ 490,575 650,000 (159,425) 159,425 - $ $ $ $ $ $ $ $ 490,575 325,000 165,575 165,575 165,575 $ $ $ $ $ $ $ $ 490,575 325,000 165,575 (136,475) 29,100 29,100 $ $ $ $ $ $ $ $ 490,575 325,000 165,575 (165,575) - $ $ $ $ $ $ $ $ 490,575 125,000 365,575 (211,475) 154,100 154,100 $ $ $ $ $ $ $ $ 2,943,450 1,950,000 993,450 (513,525) 159,425 639,350 639,350 163,525 163,525 163,525 $ $ $ $ $ $ 163,525 163,525 163,525 $ $ $ $ $ $ 163,525 100,000 63,525 63,525 $ $ $ $ $ $ 163,525 300,000 (136,475) 136,475 - $ $ $ $ $ $ 163,525 375,000 (211,475) 165,575 45,900 - $ $ $ $ $ $ 163,525 375,000 (211,475) 211,475 - $ $ $ $ $ $ 981,150 1,150,000 (168,850) 513,525 45,900 390,575 154,100 $ 15.4% 1,029,925 17.2% 454,100 $ 45.4% 163,525 $ 16.4% 229,100 $ 22.9% 29,100 $ 2.9% $ 0.0% Construction Solutions Maximum Cost: $ 1,482,510 Premium + Assessment Minimum: $ 356,654 Captive “Fixed” Expenses Less - Investment Income Plus - Shared Losses Construction Solutions Hypothetical Collateral Requirements (Assume A Fund $482,510 Each Year) 1st Year 2/3 of A Fund = $321,673 2nd Year 2/3 of A Fund = $321,673 $643,346 combined 3rd Year 2/3 of A Fund = $ 321,673 $965,019 combined No Additional Collateral required at 4th renewal!! 4th Year Caps at 2/3 of 3 Year Total = $965,019 Construction Solutions Service Providers Front and Reinsurance - Arch Insurance Program Administration – Willis Onshore Legal Counsel – Kerr, Russell & Weber, LLP Captive Manager – SRS (Cayman) Investment Manager – PRP Performa Ltd. Auditor – KPMG Actuarial – Milliman Claims Administration – Gallagher Bassett Loss Control – Willis Captive Flow Underwriting Profits! Insured CS Retail Broker Arch Insurance Company CS INSURANCE LTD. Willis, SRS, KR&W, Milliman, KPMG, GB Construction Solutions Policy Issuance Financial Protection Specific and Aggregate Excess Coverage Statutory Coverage Meets Legal Regulatory and Customer Requirements Underwriting Expertise Loss Control Resources Claims Administration – Gallagher Bassett Why Construction Solutions? Construction specific focus – coverage and services Size of program Enhanced input and control of captive operations Active peer group - culture of constant improvement High average member premium size - $885,000 Low average risk sharing – 3.5% Minimal assessments Why Construction Solutions? Enhanced and focused risk control Exceptional historical results – loss ratio 33% $81 MM Premium - $22 MM paid & $3.5 MM reserves Program Structure – flexible retention, ALAE, clash, aggregate No automatic close-out policy Excellent distribution history $10 MM in distributions to date Policy years closed – net cost was 70% of original premium Construction Solutions Questions?