Group Captive & Actuarial 101

advertisement

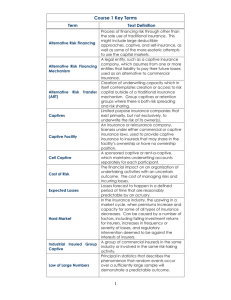

Group Captive & Actuarial 101 Chad Kunkel Artex Risk Solutions Division Executive Vice President Joe Herbers Pinnacle Actuarial Resources, Inc. Managing Principal TC Leshikar KPMG Director, Tax What is a Captive? • A licensed insurance company formed to insure the risks of its owners • Regulated by the Country or State the company is licensed in • Captives are not all the same Why form a Captive? • • • • • • • • • Ability to retain underwriting profits Underwriting flexibility Lower insurance costs over the long term Control over claims Opportunity to receive investment income Direct access to reinsurance and carriers Incentives for loss control Tax advantages Insure coverage gaps Types of Captives • Single Parent Captives – Pure captives insuring only their own risks or affiliates • • • • • Rent-A-Captives Agency Captives Association Captives RRG – Risk Retention Groups Group Captives Single Parent Captive Types of Captives • Single Parent Captives • Rent-A-Captives – Captive “rents” its facility to an outside organization • Agency Captives – Insures risks of its customers • Association Captives • Group Captives Rent-A-Captive or Cell Captive Captive Cell 2 Cell 1 Cell 4 Cell 3 Cell 5 Cell 8 Cell 6 Cell 7 Types of Captives • • • • Single Parent Captives Rent-A-Captives Agency Captives Association Captives – Insures risk of the members of its association • Group Captives – Insures risk of its members or shareholders Group Captive Group Premiums Business 1 Business 5 Business 2 Business 6 Business 3 Business 7 Business 4 Insurance Policies Captive Group Captive Considerations • • • • • • • Reason for the Group Captive Need for Critical Mass Historical Data Capital and Carrier LOC requirements Retentions of the Captive Sharing Risk Captive Structure Reason for forming a Group Captive • Myth – taking risk does not always equal cheaper insurance • Need for long term approach • Hard and soft market cycle consideration Critical Mass • • • • • Important for viability of Group Premium volume typically equals lower costs Need for Reinsurance/Carrier support Law of large numbers Need to overcome start up costs Historical Data • • • • • • • Important to determine feasibility Historical Losses by Line of Coverage Historical Exposures Historical Premium information Projected Exposures Need for Carrier/Reinsurance Support Need for Actuarial Study Capital Requirements • Captive will need Capital in addition to Premium paid in • If Fronted Program – Carrier Collateral considerations need to be contemplated Captive Retentions • • • • • Risk appetite of group needs to be contemplated High retentions could create concern for new insureds Low retentions could prevent carrier support Lower retentions can help with stability in early years Can increase retentions over time to assist in lower costs Sharing Risk • Number of ways to share risk – Pooling or Quota Share – Sharing occurs after premiums exhausted – Layer Approach • Reduces Sharing of Risk • Holds Insureds more accountable Captive Structure • Stock or Mutual Company • Ownership – 1 Vote Per Insured – Based on Premium or Capital • Return of Premium Considerations • Tax Captive Process Captive Feasibitliy Studies - Outline • • • • • What is a Captive Feasibility Study What are Actuaries? Actuarial Involvement in Captive Feasibility Study Dealing with Uncertainty Predicting the Future Captive Feasibitliy Studies • • • • • • • • • • Data Analysis Loss Estimates Capitalization Requirements Domicile Tax Issues Coverage, Retentions, Limits Expenses Reinsurance Costs Regulatory Issues Pro forma Financials Actuaries & Captive Feasibitliy Studies • Projecting the future in regards to: – – – – Premiums Losses Loss Adjustment Expenses Captive expenses • Acquisition, general, taxes • Reinsurance costs • Capitalization Requirements • Investment Returns What is an Actuary? • Insurance professional skilled in measuring and quantifying risk • Typically a math or statistics major in college • Schooled in all aspects of insurance operations – – – – Claims Underwriting Marketing Legal - Accounting - Ratemaking - Reinsurance - Systems/IT What does an Actuary do? • Quite simply – Predict the Future • Ratemaking – Figure out what premiums to charge for a variety of coverages, limits and deductibles • Loss Funding Studies – Projecting future costs so insurer or self – insured entity can budget costs • Loss and loss adjustment expense reserve accruals for financial reporting purposes • Retention Level Analysis • Exposure Modeling (CAT) • Risk Transfer in Reinsurance Essential Background Information • Business Plan • Historical premium, losses, claim counts & exposures for entity being considered • Domicile, Service Providers being considered Captive Business Plan • Key management of enterprise – Owner(s), officers, roles • • • • • Nature of underlying business being insured Coverages Retentions – both per occurrence and aggregate Limits Services Providers Data Analytsis • Projecting Ultimate Losses – Start with current reported incurred losses • • • • Adjust for retentions Adjust for expected future loss development Adjust for future trend Adjust for changes in statutory benefit levels (WC) – Use multiple methods to project ultimate losses – Rely on a point estimate or reasonable range of ultimate losses • Project Ultimate Loss Ratio Lags Property/Casualty insurance business is characterized by lags (which give rise to need for IBNR) Uncertainty in Projecting Ultimate Losses • • • • • Changes in rate of claim payments Changes in case reserving practices Changes in mix of exposure Changes in retention limits Changes in claim reporting procedures Data Analysis • Projecting Expenses – – – – – – – – Commissions/Brokerage Fronting Taxes, Licenses & Fees General (audit, actuarial, legal) Claims Handling Reinsurance Loss Control Federal Excise Tax Usually stated as % of either WP or EP Data Analysis • Underwriting Profit • Investment Returns – Investment Income • Mix of investments by type (stocks, bonds, cash, other) • Expected returns by type – Realized Capital Gains/Losses • FIT • Dividends Pro Forma Financials Run Pessimistic, Base and Optimistic scenarios • Underwriting Exhibit – – – – – Projected premiums (direct / ceded / net) Projected losses (premium x loss ratio) Projected expenses Dividends Underwriting profit (by subtraction) • Balance Sheet – Assets, Liabilities & Surplus Pro Forma Financials Run Pessimistic, Base and Optimistic scenarios • Income Statement – Underwriting Income, Investment Income, Other Income – Changes in Surplus • • • • • Beginning Surplus Capital Paid In Net Income Change in unrealized gains Stockholder dividends • Cash Flow Statement – Beginning Cash – Inflows (premiums, investment income, paid-in capital) – Outflows (losses, expenses, taxes, dividends) Consideration of Uncertainty • Reliance on actual data versus benchmarks and/or external data – less uncertainty in we have reliable data for entity being studied • Nature of historical data (# of years, consistency between years) • Examine reasonable range versus point estimate Predicting the Future • We know our projections will not be absolutely correct • Objective is to have projections “in the right neighborhood” close to reality • Systematic pessimism or optimism in not good • With feasibility studies, we provide a range from pessimistic to optimistic TAX • From the insured’s perspective - Are the Premiums Deductible? - Are there any Premium Taxes? Domicile, U.S. Federal Excise Tax, State Premium Taxes etc. • From the owners’ perspective – If Non-U.S. domiciled, are the owners subject to tax annually or only when distributions are made? – Is there any “unrelated business taxable income” for the tax-exempt owners TAX • From the captive’s perspective – Is it considered an “insurance” company for U.S. tax purposes (i.e. can it deduct loss reserves, are the premiums paid by the insureds deductible)? – If Non-U.S., is it a controlled foreign corporation (“CFC”)? – If Non-U.S., is it eligible to make the Section 953(d) election to be taxed as a U.S. Corporation? – Is it eligible to make the Section 831(b) election? – If Non-U.S., are there withholding taxes on its income? – If Non-U.S., does it intend to “conduct a U.S. trade or business”? TAX • Items to Consider – Taxable and tax-exempt organizations may have different tax motivations – Some uncertainty in the area of U.S. Tax of Captives. Should be part of Owners/insureds’ risk tolerance assessment – Determine upfront, how the Captive will be treated for U.S. Tax purposes. – Make sure all stakeholders’ tax advisors are involved at formation and all on same page – Document the business reasons for captive formation as support in case of future audit – Include tax calculations in proformas and projections Formation Process • • • • • Creation of Business Plan Identification of Services Providers Insurance Manager forwards Business Plan to CIMA Meeting with CIMA License Application submitted to CIMA – Pro forma Projections, Actuarial projections, Business Plan, Identification of service providers along with director applications • “Approval-In-Principle received – 6 Weeks • Company incorporated and capital put in place • License Issued Get Started • • • • • • • Board of Directors Appointment of Officers Appoint and Engage Service Providers Insurance Arrangements Creation and approve operating budget Creation of Committees You are up and running! On Going • Board Meetting – Determine how often • • • • • • Shareholder/Member Involvement Committees Signing Authority Financial Statement Review Investment Policy Review of Goals/Establish new ones Long Term • • • • • • • Retention of Membership Long Term Approach Adequate pricing and capitalization Risk Management Return of Premiums/Dividends Monitor Service Providers Review of Structure/Retentions Questions & Answers