View this presentation

advertisement

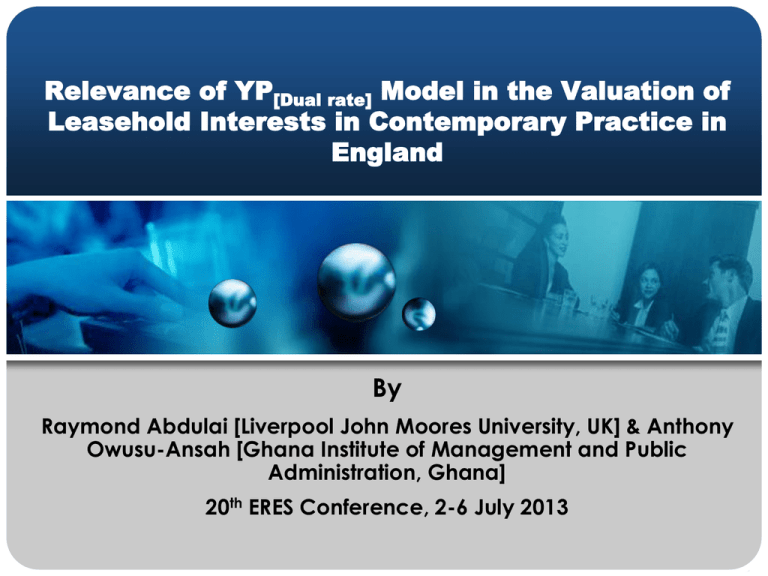

Relevance of YP[Dual rate] Model in the Valuation of Leasehold Interests in Contemporary Practice in England By Raymond Abdulai [Liverpool John Moores University, UK] & Anthony Owusu-Ansah [Ghana Institute of Management and Public Administration, Ghana] 20th ERES Conference, 2-6 July 2013 Structure of Presentation Introduction Research methodology Brief history of YP[Single rate] & YP[Dual rate] models Results Conclusion 2 Introduction Real estate (RE) valuation required for various purposes including: Purchase and disposal of RE Mortgage valuation Insurance Compulsory purchase & compensation Taxation/rating Six main methods of valuation exist: Comparative, Investment/income, Cost, Profits and residual approaches [traditional methods] Hedonic pricing [contemporary approach] 3 Introduction (cont.) Investment/income approach: YP[Single rate] model used to value freehold (FH) YP[Dual rate] model used to value leasehold interests (LH) Rationale - FH is a wasting asset & ASF needs to be set up Debate over the use of YP[Dual rate] model Not used in most countries, e.g.- Australia and US (Whipple, 2006; Fisher and Martin, 2004) In the UK, YP[Dual rate] is used One school of thought supports its use Another school of thought does not support its use 4 Introduction (cont.) Arguments for & against the use of YP[Dual rate] tend to the be theoretical Limited empirical studies Objectives To empirically examine the extent to which the use of the model actually reflects market conditions in practice To determine whether or not it actually matters if it is the YP[Dual rate] model or the YP[Single rate] model that is used to value LHs 5 Research methodology Qualitative research methodology adopted using a neighbourhood in Liverpool as a case study 105 LH purchasers purposively selected and semistructured interviews conducted in 2012 One in-depth interview with an official of Homes & Communities Agency (HCA) QSR NVIVO 10 used to aid data analysis 6 Brief history on the use of YP[Single rate] & YP[Dual rate] 1853 - YP [Single rate] used to value LH and FH (Cox, 1853) Single rate model well established in the C19th and rolled into C20th (Mackmin, 2008) Support for the use of YP[Dual rate] emerged in C20th 1909 - Webb argues for its use Since then there have been arguments for & against the use of YP[Dual rate] Debate closed in some countries Debate still rages on in the UK 7 Results Types of LH Ownership Sole Ownership Unmarried males Unmarried females Married males No 12 5 10 Married females 3 30 Total Joint Ownership Married couples [male & female] % [of 30] % [of 105] 40.0 11.4 16.7 4.8 33.3 9.5 10.0 100 No 75 2.9 28.6 % [of 105] 71.4 8 Results (cont.) Types of mortgage markets RE procured via loans from banks Repayment period: 25-30 years Two mortgage markets Open market – LTV: 70-90%; equity: 10-30% 85 (81%) of respondents participated in this market Government scheme: HomeBuy Direct 20 (19%) of respondents participated in this market Ground rent: £200-750 pa with a term of 999 years Price range: £125,000-253,000 9 Results (cont.) Use of ASF to Recoup Initial Capital Awareness of ASF No % 2 1.9 Unaware of ASF method 103 98.1 Total [N] 105 100 Not concerned about the future 6 5.7 Not concerned about the future & use of debt capital in the future 4 3.8 Use of debt capital in the future 95 90.5 Use of ASF method 0 0 105 100 Aware of ASF method Method adopted to make provision for future expense Total [N] 10 Results (cont.) Using the YP[Dual rate] model implicitly assumes every LH purchaser automatically uses ASF method Empirical evidence does not support it Concentration is on only ASF when other methods can be adopted Use of debt capital [common method] PV£1 concept A leasehold purchaser could hold a portfolio of investment vehicles 11 Results (cont.) Impact of using YP[Dual rate] on LH Valuations Appropriate YP factors [RoC – 7%; ASF rate – 2.5%; tax – 40%] Term 10 25 50 100 150 200 250 350 400 450 500 Perp. YP [Perp.] 14.29 YP[SR] 7.02 11.65 13.80 14.27 14.29 14.29 14.29 14.29 14.29 14.29 14.29 - YP[DR] 6.28 10.07 12.46 13.83 14.16 14.25 14.28 14.28 14.29 14.29 14.29 - YP[DR adjusted for tax] 4.57 8.42 11.48 13.54 14.07 14.22 14.27 14.28 14.29 14.29 14.29 12 Conclusion The YP[Dual rate] model has been empirically examined Bidders, in practice, do not use the ASF It undervalues properties significantly in short leases Focus is on only the ASF method when other methods exist Risks associated with wasting assets taken into account YP[Dual rate] could be considered when ASF is encountered in practice 13