Financial Viability Of ASF Consortium in Doubt

advertisement

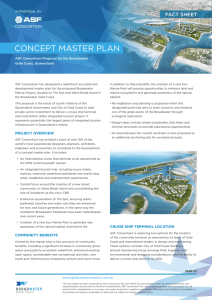

Media Release 3rd march 2015. Financial Viability of ASF Consortium in Doubt. Late last Friday 27th February the ASF Group Ltd, parent company of the ASF Consortium, lodged their half yearly report with ASX and the contents indicate that the financial viability of the Group could be in doubt. The ASF Consortium is the company bidding for the ability to develop the casino based integrated resort development and cruise terminal in the Broadwater. The Report to ASX reveals that the ASF Group, which deals mainly in mining and petroleum activities, had suffered a $7.02 million loss and has drawn comments from its auditors. ASF directors disclosed the group revenue from continuing operations halved to $245,000 in the half year to December 31. The loss attributable to ASF shareholders of $7,020,000 compared with a profit of $987,000 in the previous corresponding period. The auditors, Grant Thornton Auditors Pty Ltd, in their report to members referred to a “material uncertainty” which may cast doubt on the group’s ability to continue as a going concern. Under the heading "Emphasis of Matter” the auditors said: “Without qualifying our opinion, we draw attention to Note 2 in the financial report which indicates that the consolidated entity incurred a net loss of $7,326,000 and had cash outflows from operating and investing activities of $12,316,000 during the half year ended December 31, 2014. “These conditions, along with other matters set forth in Note 2 (to the accounts) indicate the existence of a material uncertainty which may cast significant doubt about the consolidated entity’s ability to continue as a going concern and therefore, the consolidated entity may be unable to realise its assets and discharge its liabilities in the normal course of business, and at the amounts stated in the financial report”. While the Directors in Note 2 of the ASX Report indicate that they believe they can deal with this situation by raising more capital, it surely must cast doubt on the viability of the Broadwater project. In Note 2 to the accounts they (the Directors) pointed out that “The continuing viability of the Group to meet its commitments and to develop its projects or dispose of them for a profit is dependent upon the Group’s ability to continue to raise capital.” “However if planned revenue and capital raisings fell short they would reduce costs.” Lois Levy, Campaign Coordinator of Gecko, said “One might conjecture that if the ASF Group needs to reduce costs to meet their obligations, that the Broadwater project might be the first to go since the financial statements show that spending on the Broadwater casino and cruise ship proposal had exceeded $6.5 million by December 31.” The ASF Consortium over-ambitious plans for the Broadwater and development of Wavebreak Island have never moved past the phase of being possible proponents as far as the public is aware. Lois said, “If any secret deals have been made by the outgoing LNP Government with this ASF Consortium group they may well put the taxpayers at risk, as it would appear from this half yearly report that the Consortium could get into building this monstrous development and then run out of money leaving the public with the mess.” The report failed to mention that change of Government and the promise, made to opponents of the ASF Consortium project, by Premier Palaszczuk on 25th January this year that the project would not go ahead. Lois went on to say, “A final announcement to this effect by the Premier has not yet been made, though statements that all election promises would be met indicate that this should be forthcoming shortly. It must be recognised that the Government has only been in office for two weeks and much of that time saw them dealing with the Category 5 Cyclone Marcia so that details of the complex assessment process for the ASF Consortium proposal have had to wait.” Contact: Lois Levy, Campaign Coordinator advocate@gecko.org.au 0412 724 222.