Ch 5 Outline

advertisement

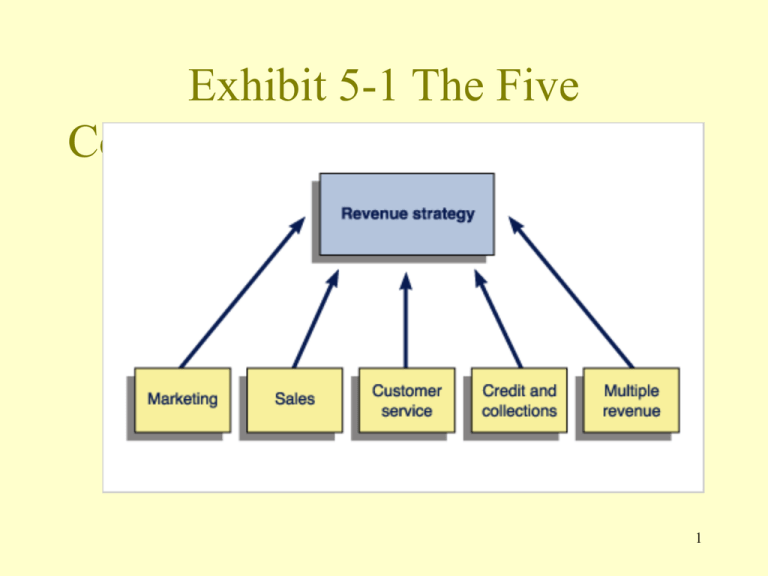

Exhibit 5-1 The Five Components of Revenue Strategy 1 Ch 5 Outline 1. Introduction 2. What is Revenue Strategy? a. Marketing b. Sales c. Customer Service d. Credit and Collection Policies e. Multiple Revenue Streams 2 5-2 What Is Revenue Strategy? • Providing a valuable product or service to customers is the primary means by which businesses produce revenue. – The entrepreneur has three rules for success: • Focus on the customer • Keep turnaround times short • Always give the customer what they want – In most businesses, the CEO coordinates the interaction among marketing, sales, and customer service functions—functioning as the vice president of revenue. • Functional divisions and the communication and execution gaps that develop among them, are some of the major challenges that large organizations face. 3 5-2 What Is Revenue Strategy? (cont.) • The entrepreneur must integrate the five components of revenue strategy into a coherent whole that focuses on delivering value to customers. • Most large companies tend to gauge their success in terms of quarterly profit increases. – Most traditional companies focus on profit improvement more than revenue growth. – The entrepreneurial venture, most focus on revenue growth. – Revenue growth in entrepreneurial companies is achieved through an intense focus on customers. – Acquiring customers begins with the marketing message. 4 Exhibit 5-3 How an SCA Provides Competitive Advantage 5 Sources or Platforms for competitive advantage include: ► Price/value--Frank Bozin sells high-quality, goodtasting water at a bargain price. ► Unique service features—Katherine Barchetti offers men’s suits and women’s shoes based on her knowledge of specific consumers’ needs. ► Notable product attributes—Vincent Yost sells his “smart” parking meters at a premium price. ► Customer experience—New PIG Corporation sells industrial clean-up services, but in such a way that customers “experience” each contact with the firm. ► Customer convenience—Bobby Thigpen’s American Fast Lube services cars at the customer’s home or 6 office. Marketing: • The primary objective of a venture’s marketing efforts from the perspective of revenue strategy is to develop a sustainable competitive advantage (SCA). • Another way that marketing contributes to revenue strategy is through analysis of consumer behavior and projections about future tastes and buying habits. 7 5-2a Marketing (cont.) • Knowing the company’s products and services and the factors that govern customer decision making—important requirements of successful marketing. – The extent and amount of marketing conducted by a company—function of its budget. • In the early phases of an entrepreneurial venture, marketing budgets are usually limited. To maximize revenue: – – – Entrepreneurs target a market, develop a persuasive message and use communication channels that routinely reach the target market. Entrepreneurs also leverage their contacts to generate low-cost marketing opportunities. Entrepreneurs observe the competition closely. 8 5-2b Sales • Selling is the business activity that is most directly related to a company’s revenue. – Inside sales—employed by the venture. • Salespeople can be an expensive investment. • Most salespeople prefer to earn through commissions. – – Commission structure is an important source of motivation or de-motivation to the sales force. Sales compensation is complicated and must be fully integrated with the revenue strategy. • Guidelines for entrepreneurs to follow: – – – Remember sales compensation is for employees responsible for persuading the customer to act. Realize that the company is going to change as it grows and compensation has to change as well. Understand difference between sales compensation and total compensation. 9 Four Types of Outside Sales 1. 2. 3. 4. Direct Selling E-Commerce Party Plans Multi-level Marketing 10 5-2b Sales (cont.) – Outside Sales—not employed by the venture • Direct Selling: Independent contractors who represent and sell products for one or more clients. • E-commerce: Enable customers to learn about the company’s products or services and to purchase them online. • Party plan selling: Simplified distribution channel— manufactured products are sold directly to customers. • Multilevel marketing (MLM): Network marketing—direct-selling process is duplicated by salespeople who sponsor and train others. 11 5-2c Customer Service • Many inexperienced entrepreneurs think of customer service as a necessary evil. – Because customer service is an after-sale expense, it constitutes non-revenue-generating overhead. – Although customer service is often an after-sale business function, it impacts revenue in two ways: • Dissatisfied customers may elect to return their purchases— resulting in lost revenue. • Satisfied customers may tell others about their positive customer service experiences—resulting in new revenue for the venture. 12 5-2c Customer Service (cont.) – Customer service strategies can become a source of competitive advantage for entrepreneurial ventures to determine a way to offer a service that competitors either don’t offer or don’t perform effectively. – Identify a challenging customer service problem in an industry and be the first business to find and offer an effective solution. – Emphasize pre-sale customer service as a means of acquiring paying customers. – Customer service can also produce revenue through the sale of warranties. – Customer service strategy includes the selection and implementation of appropriate technologies. • Customer relationship management (CRM) software 13 5-2d Credit and Collection Policies • Venture must develop credit and collection policies, execute policies consistently to maximize revenue. – Credit is based on the assumption that the customers will pay later, usually with an interest charge. • The longer the customer has to pay back the loan and the lower the interest rate charged by the lender, the greater will be the effect on sales volume. • Increased sales volume is the primary objective of both the marketing and sales activities. – If managers responsible for these activities determine the venture’s credit policy, the outcome is predictable—they would tend to keep interest rates low and payback terms long. 14 5-2d Credit and Collection Policies (cont.) – The venture must develop credit and collection policies and execute them consistently to maximize revenue. – Granting credit without an established collection policy has ruined many businesses. – The company’s collection policy is the system used for collecting from customers who do not pay on time. – Accounts receivable refers to payments due from customers. • A company with receivables is loaning its cash to customers instead of collecting it. • The average actual collection period is known as days receivable and can be calculated as follows: – Days receivable = actual accounts receivable / sales per day 15 5-2d Credit and Collection Policies (cont.) – When days receivables is greater than the venture’s credit terms—age accounts receivable by multiples of the credit terms. – Entrepreneur needs understands the concept of days receivable and aging, and other aspects of collection. • The longer an account goes unpaid, the more difficult it becomes to collect. • A pre-collect notice is sent by a collection agency to the debtor. • Collection agencies focus on collecting past due accounts for businesses. – One law they must follow is the Fair Debt Collection Practices Act, or FDCPA. 16 5-2d Credit and Collection Policies (cont.) – A new venture may occasionally need to take action to motivate a customer to pay, but customer retention is always important. • Retaining customers is important because it often costs a lot of money to acquire them. • Customer acquisition costs—the time, resources, and marketing collateral that are required to add a single customer to the firm’s customer list. 17