Final presentation - Georgetown University

advertisement

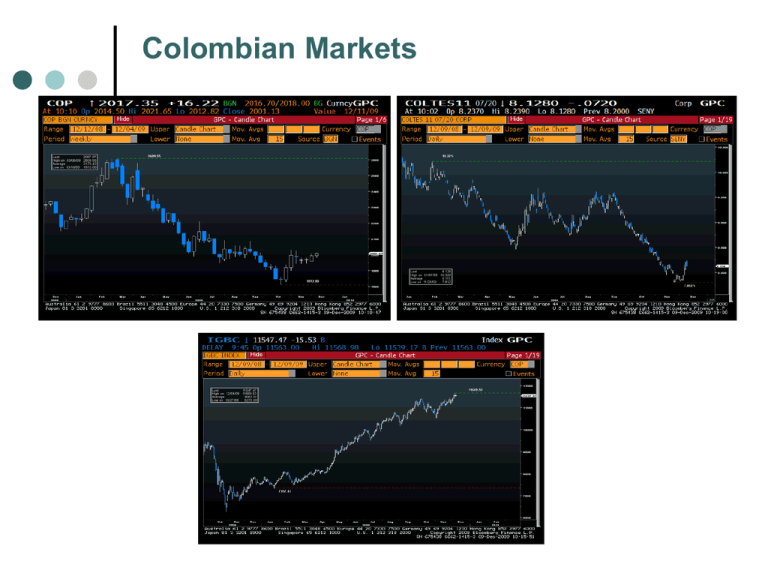

Colombian Markets Invertrust Diego Rodriguez BPE Advanced Communication Skills Georgetown University Dic-16-09 Overview Alternative Investment Business Opportunity Management team Marketing Plan SWOT Analysis Financial Analysis Conclusion Alternative Investment Real Estate Commodities Private Equity – Venture Capital Exchange Traded Funds (ETFs) Hedge Funds Business Opportunity Market focus on traditional investments What kind of investment are you considering to do 10% 20% Alternative market is in its infancy 20% 50% Conservative Moderate Aggressive Combination Historical low fixed rates Management team Why using an Investment Management Company Lower transaction cost Better expected returns Diversification opportunity (less risk) Expert management 0 1 2 3 4 Management team Investment professional managers Diego Rodriguez (CEO) Daniel Arguelles (VP Trading Strategies) Carlos Cortez (Co-VP Trading Strategies) Management team Operation and control members Ivan Ramirez (COF) Staff members Ricardo Urrutia Antonio Vargas Alejandro Olivares Jose Maria De Valenzuela Price Waterhouse Coopers Marketing Plan Product Investment Management company Focus on Alternative Investments First Colombian Hedge Fund Marketing Plan Place (distribution) Money Under Management 60 50 40 30 20 10 0 Pension Funds Trust Securities Insurance Invs mng 100,000 billions total market share Wealthy investors Institutional accounts Marketing Plan Price Management Fee (2% - 3%) Success Fee • Benchmark • Beat It • 30% of the extra profit Marketing Plan Promotion Business Magazines Golf, Tennis, and Polo tournaments Brochures A lot of networking SWOT Analysis Strengths Management team Business model proved overseas Intra - entrepreneur experience Focus on emerging markets Immediate incomes possibilities Opportunities New local business Emerging markets behavior Current Global Financial Crisis Weaknesses Track record New Company Threats Bad performance International competitors Financial Analysis Miles $ M 2010 2011 Money under management 25,000.00 50,000.00 Management fee 2012 2013 2014 300,000.00 500,000.00 1,000,000.00 500.00 1,000.00 6,000.00 10,000.00 20,000.00 Success fee ($) 1,725.00 2,700.00 11,700.00 16,500.00 24,000.00 Total Income 2,225.00 3,700.00 17,700.00 26,500.00 44,000.00 Operating expenses Salaries Management team 480 504.00 529.20 555.66 583.44 Others 397.00 416.85 437.69 459.58 482.56 Total Expenses 877.00 920.85 966.89 1,015.24 1,066.00 Profit before tax 1,348.00 2,779.15 16,733.11 25,484.76 42,934.00 Tax (35%) 471.80 972.70 5,856.59 8,919.67 15,026.90 Net profit 876.20 1,806.45 10,876.52 16,565.10 27,907.10 ROE 44% 90% 544% 663% 558% ROI 19% 17% 14% 13% 11% Conclusion Alternative Investment Business Opportunity Management team Marketing Plan SWOT Analysis Financial Analysis