I4D-presentation-City

advertisement

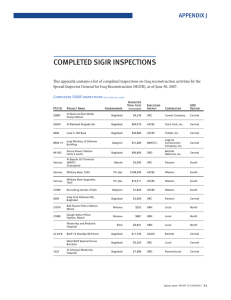

I4D Investors for Development: Presentation “We need the commitment, the creativity and the innovation of businesses to help us to tackle the challenges that confront us” Prime Minister David Cameron, on business and the ‘Big Society’ Investors for Development I4D 1 Investors for Development An initiative led by the United Kingdom’s leading investors to secure a commitment from the City of London to allocate 0.7% of AUM to investments in developing countries that generate significant financial and social returns. 2 I4D in Context The opportunity The Opportunity The power of finance as an investor in, and catalyst for, social value and betterment A $1 trillion business opportunity over the next decade for ‘impact’ investments in poor countries, with potential profits of $600 billion [Source: GIIN] An opportunity for the City of London to demonstrate that it is at the forefront mobilising the positive power of capital and investment in partnership with government Investors for Development I4D 3 I4D in Context The Current Climate Increasing pressure to reverse the perception that finance and investment produce either neutral or negative social returns A growing expectation that business and finance must play a role in addressing pressing social challenges A $500 billion funding gap for official aid over the next decade Increasing criticism of the current aid model Investors for Development (I4D) 4 I4D in Context The Challenges Lack of intermediation, little understanding of the opportunities for investment and partnership Existing and potential regulatory obstacles Lack of clarity about government’s potential role in co- financing and product development Need for product innovation, particularly in creating ‘blended value’ investment vehicles Investors for Development (I4D) 5 How I4D can meet the challenge By providing leadership and co-ordination within the investment community Publicly demonstrating the City’s commitment to long term values of sustainability and responsibility Creating a platform to assist government with regulatory obstacles and support co-financing Improving collaboration between commercial investors, philanthropic foundations and social investors on ‘blended value’ investment vehicles Investors for Development I4D 6 The returns from leading I4D 1 2 3 4 Social ROI Reputational ROI Political ROI Business ROI Global Development The City Government/ Taxpayers Investors/ Businesses Investors for Development I4D 7 Benefits for Global Development Increasing the sources available for financing development and social investment Enhancing the UK’s positioning as an innovator in business solutions for development Investors for Development I4D 8 Benefits for the City A response to the public’s demands for more socially- responsible investment Providing the City with new investment opportunities in high-growth emerging and frontier markets New investment products to meet client needs beyond passive ESG investment screening “The interests of profit and responsibility are in no way opposed.” Vince Cable MP, Secretary of State, Department Business Innovation and Skills Investors for Development I4D 9 Benefits for Government An inclusive strategy which supports greater participation in the ‘Big Society’ from the private sector Demonstrating the UK’s leadership within the G20 on innovative models in leveraging private capital for poverty reduction and private sector development Leveraging public sector resources with private sector capital, particularly in this constrained fiscal environment Creating opportunities for business development within the UK generated by growing trade and investment links with high-growth, emerging economies “It is wealth creation above all which will help poor people to lift themselves out of poverty.” Andrew Mitchell MP, Secretary of State, Department for International Development Investors for Development (I4D) 10 I4D: Initial products and I4D projects Development Impact Bond: building on the successful launch of the UK’s Social Impact Bond, this mechanism has the potential to lever private financing for up-front investments in development Blended Value Development Investment Fund: concessional or ‘patient’ capital that is able to absorb some of the risks of investing in emerging and frontier markets Social Enterprise Limited Liability (SELL) Partnership: to remove obstacles to blending philanthropic with private capital Impact Assessment of Development Investment on UK trade, investment, jobs and growth Pension Fund Reform: Reform of the regulatory environment, facilitating pension fund allocations to opportunities in impact investment Investors for Development (I4D) 11 I4D will bring together Visionaries Founding Founding Members Members Exemplars Exemplars International International Advisory Advisory Group Group Partners Sir Ronald Cohen Stephen Dawson OBE Sir Richard Branson Shell Foundation Barclays Stanley Fink Tidjane Thiam CIFF Coca Cola Unilever Astra Zeneca WPP Diageo Social Finance Portland Trust 8 Miles Fund Jacana Capital Queen Rania Mo Ibrahim Patrice Motsepe DFID GIIN CGI Rianta Capital Omidyar Network Kenyan Equity Bank Lord Malloch Brown Prime Ministers Commonwealth Oxfam Care Investors for Development (I4D) 12 Milestones to June 2012 • Agree founding sponsors, partners Phase 1 to June 2011 Phase 2 to June 2012 Investors for Development (I4D) and int’l advisory board •Define work plan and projects •Recruit skeleton staff, service providers (research, consultancies, etc) •London Launch •Product suite launched •Partnerships and projects underway •Advocacy strategy underway •New York CGI global launch •Financial sustainability plan in place 13