Conference and Business Tourism: Scope, Value, Trends, Issues

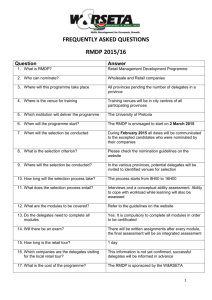

advertisement

CONFERENCE AND BUSINESS TOURISM: SCOPE, VALUE, TRENDS, ISSUES AND OPPORTUNITIES Tony Rogers TERMINOLOGY • • • • • Business tourism Business visits and (live) events MICE CI/CIT www.keepbritaintalking.co.uk • www.businessvisitsandeventspartnership.com SEGMENTS AND VALUE • • • • • • • Conferences & meetings £7.2 billion Exhibitions & trade shows £9.3 billion Incentive travel £1.2 billion Corporate hospitality £1.1 billion Outdoor events £1 billion Individual business travel £7 billion + Discretionary v. non-discretionary SCALE OF INVESTMENT • Harrogate International Centre’s expansion £13m • NEC £25m refurbishment programme • Major £500m expansion of the Scottish Exhibition & Conference Centre, Glasgow • ICC London ExCel - £165m • New convention centres planned for Brighton, Cardiff, Blackpool, Leeds, Newcastle/Gateshead • Cautious hotel investors? UK VENUES • Hotels • Conf./Training Centres 9% • Academic 6% • Multi Purpose Venues 12% • Purpose Built 2% • Unusual Venues 18% (universe of 3,500 venues) 53% MARKET SHARE Market share - no. of events C on/training centre 12% Purpose built centre 1% University 5% Unusual 20% Hotel 61% Based on 3 year average (2006/08) Source: UKEMTS 2009 WHO IS BUYING? Type of organisation Govt / public sector 36% Corporate 46% Association 18% Based on 3 year average Source: UKEMTS 2009 CONFERENCE SIZE All events1 % 8 – 20 delegates 42 21 – 50 delegates 24 51 – 100 delegates 20 101 – 200 delegates 8 201 – 500 delegates 5 501 – 1000 delegates 1 1001 – 2000 delegates * Over 2000 delegates * Average event size 51 delegates Based on three year average (2006/8) * = less than 0.5% Source: UKEMTS 2009 RESIDENTIAL v. NON-RESIDENTIAL Levels of residential / non-residential business (All venues) 61 62 65 67 28 29 26 23 9 9 9 10 2005 2006 2007 2008 Overnight in the destination Overnight at venue Not overnight Source: UKEMTS 2009 BILLION POUND INDUSTRY Source: UKEMTS 2009 ORIGIN OF BUSINESS Origin of event business Overseas 3% UK 27% Regional 70% Source: UKEMTS 2009 The British Meetings and Events Industry Survey 2009 Number of events, Year from July 2008 to June 2009 70 61% 60 52% 50 40 30 20 Corporate 33% Association 23% 15% 16% 10 0 More Less Same The British Meetings and Events Industry Survey 2009 Mean budgeted delegate rates inc VAT Associations Corporates Daily £43 £54 24 hour £123 £146 The British Meetings and Events Industry Survey 2009 Annual budget for events Associations Corporates Last year Change Forecast £180,466 £209,730 +0.5% -1.9% +0.1% -0.1% The British Meetings and Events Industry Survey 2009 Top ten UK destinations 1. London 2. Birmingham 3. Manchester 4. Edinburgh 5. Leeds The British Meetings and Events Industry Survey 2009 Top ten UK destinations 6. Glasgow 7. Cardiff 8. NewcastleGateshead 9. Nottingham 10. Harrogate The British Meetings and Events Industry Survey 2009 Key factors influencing venue selection 1. Location 2. Price 3. Access 4. Quality of service 5. Quality of conference facilities The British Meetings and Events Industry Survey 2009 Issues of most concern for the next twelve months 1. 2. 3. 4. 5. Reduced budgets/pressure to reduce costs Venues’ cancellation policy Producing interesting events relevant to audience Economic climate affecting organisation Terms and conditions for venues and suppliers The British Meetings and Events Industry Survey 2009 Issues contributing most to a successful event Corporates Associations Content relevant to work and daily life 66% 65% Inspiring and original presentations 52% 48% Networking with peers/colleagues 48% 51% Ease of access and travel 41% 49% The (quality of) venue 35% 41% TRENDS & IMPLICATIONS • Proliferation of e-communications generating increased need for face-toface meetings • Shorter, more intensive events • Interactive meetings • Need for dedicated facilities at venues – continuous investment TRENDS, CHALLENGES, OPPORTUNITIES • • • • • Procurement ROI Legislation Terrorism, risk, health & safety Economy: – greater spread of events across UK CASE STUDIES • NORTH WEST CONFERENCE RESEARCH UNIT • ROTARY INTERNATIONAL CONVENTION 2009 – BIRMINGHAM • BOURNEMOUTH…