- Money Advice Scotland

advertisement

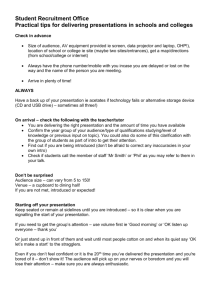

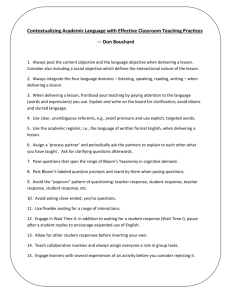

Delivering money advice – are we getting it right? Pat Sproul Money Advice Senior The Highland Council The stakes Debt has a profound effect on the individual; both on psychological and physical health. It leads to guilt, low self-esteem and depression, which in turn leads to an inability to cope with other life stressors. A Highland GP Aims of workshop To enable attendees to: • put the client’s needs at the heart of money advice and amend policies and practice accordingly • understand why having a robust procedural framework supports: • high quality advice provision and • efficient and effective money advice delivery Delivering Money Advice Delivery must be: • supported by a robust infrastructure of policies, procedures and systems • tailored to external conditions e.g. The Highland Council team delivers money advice to a mix of supersparse and urban households – across an area the size of Belgium • efficient • ‘fit for purpose’ - meeting the actual needs of clients and not the perceived needs Delivering Money Advice The Highland Council: • serves a third of the land area of Scotland – including the most remote and sparsely populated parts of the UK • has the seventh highest population of the 32 authorities in Scotland. • The total land area including all islands at low water is 26,484 square kilometres. • This is 33% of Scotland and 11.4% of Great Britain. • It is 10 times larger than Luxembourg, 20% larger than Wales, and nearly the size of Belgium. Delivering Money Advice The Highland Council Money Advice team: • 12 team members located in 5 offices in the Highlands • Virtual team using networked systems to ensure consistency of service delivery • Scottish National Standards accredited • 3 team members funded by the Scottish Legal Aid Board funding stream ‘Making Advice Work’ • Relies on IT to support service provision Delivering Money Advice Scottish National Standards for Information & Advice Providers Standard 2.4 All services must produce an annual service plan that seeks to ensure the best match between the needs of service users and the resources available to provide the service. Delivering Money Advice • The HC Money Advice team produces a Business Plan each year and this takes into account, amongst other factors, the changing environment • Due to the geography of the area, most of the HC Money Advice first interviews are made by phone and this works well in many cases • In the last couple of years however, the team has moved back from telephone 1st contacts where clients are at risk of eviction and piloted ‘on tap’ , intensive money advice, linked to Housing pre court or pre eviction interviews for high rent arrears cases Delivering Money Advice • This pilot for face to face interviews for certain client groups gave rise to The Highland Council Money Advice team’s successful bid to the Scottish Legal Aid Board ‘Making Advice Work’ funding stream • The HC project, ‘Reaching the Unreached’ uses texts as one of the main ‘channels’ when delivering money advice to these clients Delivering Money Advice Standard 4.5 Type II and Type III services must have a casework procedure that can be applied consistently to all service users. • The ‘Reaching the Unreached’ project required new procedures to be created, given that there were some differences of approach • The procedures are growing and being amended as we learn from the new initiative New age? Money advice has always faced changes e.g. legislative changes, financial pressures, but things are moving quickly now and the sector has to keep up. Today, we are going to look at some upcoming challenges and discuss how your organisation is changing, or not, to meet the client’s needs OVER TO YOU……..