Class16

advertisement

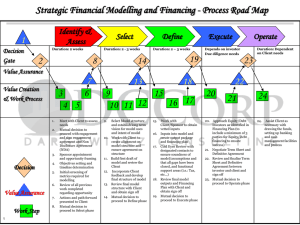

Welcome to Class 16 Research: Financial Domain & Case Studies – Part 1 Chapter 8 Financial Domain of Corporate Performance Assessment of corporate financial performance requires: 1. The integration of BOTH accounting and finance knowledge. 2. The ability to interpret Annual Report data. It involves an investigation of changes in a firm’s: Revenue Profitability Cash flow Liquidity Asset utilization Financial leverage Operating leverage Return on stockholder investment Stock value, and more Natural Limitations of Performance Assessment Performance is a matter of opinion Terminology is often inconsistent Variations of Opinion Variation of Opinion Mathematical achievements by a firm can be interpreted from different perspectives. Thus, a 5% increase in revenue may be considered “good” performance by one analyst BUT Insufficient, disappointing, and “bad.” by another analyst. Each analyst may be comparing the firm’s achievements to a different set of performance benchmarks. Or, they may be assigning different value to individual performance components. In other words, precise performance is a matter of “OPINION.” Variations in Terminology Technicate A “terminologist” is one who studies, uses, or assigns words or phrases to "technicate" terms in order to convey a particular thought or idea. Every profession has multiple terminologists. The result is "terminological incongruity" which has many negative effects. It increases the probability of miscommunications and it is a nemesis to students and others trying to enter a new profession. “Technicate” is an original word created to demonstrate what terminologists do in creating or redefining words to describe thoughts or ideas. Communication is enhanced when terminology used – is defined and clarified. Thus, we define how the following term will be used for analysis purposes: “INVESTED CAPITAL” Invested Capital For clarification purposes, in the context of this analysis environment, Invested Capital will represent the total of all funds contributed by both the creditors and the shareholders. Invested Capital Invested Capital = Creditor Capital + Equity Capital [IC] = [CC] + [EC] or Creditor Capital + Equity Capital = Invested Capital [CC] + [EC] = [IC] Accounting Equation Assets = Liabilities + Equity [A] = [L] + [E] or Liabilities + Equity = Assets [L] + [E] = [A] Think about it… Creditor Capital Equity Capital Liabilities Invested Capital Invested Capital Equity Assets Assets A closer look at Assets, Liabilities, & Equity Assets, Liabilities, & Equity The broad categories of assets, liabilities, and equity are divided into segments to enhance the understanding of crucial balance sheet relationships. For example: Assets are divided into those that are "current" and “noncurrent." Liabilities are separated in a similar fashion. Equity is divided into "paid in" and "earned." Invested capital, is divided into "borrowed" and "equity." Businesses engaged in financial services or related activities as their primary source of revenue generally do not divide their assets and liabilities into current and noncurrent. These organizations include S & Ls, banks, investment houses, etc. Assets: (1) Current Assets (assist with required payments) (2) Noncurrent Assets (enable the firm to conduct its business) [facilities, equipment, property, long-term investments, intangibles, etc.] Liabilities (Borrowed Capital): (1) Current Liabilities or near-term debt (due within 1 yr. or the operating cycle) (2) Long-term debt (all the other debt) Shareholder Equity (Equity Capital): (1) Earned Capital (accumulated earnings that have been retained in the business) (2) Paid-in Capital (money paid by stockholders to purchase stock) Invested Capital: (1) Borrowed Capital (credit extended by suppliers, (2) Equity Capital (investments by stockholders) banks, and note and bondholders, etc.) Understanding the relationship between the different classes of accounts is fundamentally important to financial analyses. These are highlighted in the Financial Position Model Financial Position Model Important relationship between CA & CL Assets Claims on Assets Current Assets Current Liabilities Stockholder Equity Help pay bills Are Debts generally due within the next year (1) Paid-in (2) Earnings Noncurrent Assets Long-term Debt Items such as buildings & equipment that support business operations (Also, long-term investments, etc.) Provides operating capital for the purchase of Noncurrent Assets and provides some assistance with current liquidity Important relationship A thorough understanding of the Financial Position Model is crucial to Financial Decision-Making The Financial decision-making domain includes: 1. Internal Financing Decisions 2. Asset/Debt Decisions 3. Debt/Equity Decisions Internal Financing Financing Decisions Debt/Equity Asset/Debt 1. Internal Financing Decisions: Tactical and Strategic Internal financing decisions fall into two main categories: (1) Short-term focus Tactical financing decisions (2) Long-term focus Strategic financing decisions Internal Financing Decisions: TACTICAL (1) Tactical financing decisions center on maximizing internal funding by suggesting operating changes. For example, directing staff to consider ► SPEEDING the turnover of accounts receivable (ACP) ► Using JIT (just-in-time) inventory techniques Objective: Improve performance by improving current system Internal Financing Decisions: STRATEGIC (2) Strategic financing decisions center on completely changing the way of specific functions within the firm are conducted for improved efficiency and enhanced cash flow Significant changes in corporate operations, such as: ► OUTSOURCING customer service, or ► SUBCONTRACTING major manufacturing (e.g. NIKE) Objective: Improve performance by completely changing system 2. Asset and Debt Management Decisions Asset and Debt decisions include consideration of how to maximize utilization of high-ticket assets such as property, facilities, equipment, intangibles, etc. These decisions are also directed at maintaining an optimum balance between: 1. current assets and current liabilities 2. current and noncurrent debt 3. current and noncurrent assets Capital budgeting: Decisions about whether to buy or sell property, plant, & equipment are part of this domain 3. Debt/Equity Decisions Debt and Equity decisions are primarily concerned with: 1. The use and extent of long-term financing 2. The optimum level and configuration of equity 3. The appropriate balance between total debt and total equity. Decision-making in this domain involves considering issues such as: 1. How much money is needed to sustain growth 2. How should the company acquire those funds (For example, should the corporation issue bonds, issue common stock, issue preferred stock, or borrow from other sources?) Important Financial questions: How much short-term cash is necessary and what is the best strategy to ensure that cash is available when necessary? What is the best long-term strategy for investment in this company? What is the optimum financial leverage? What are the most appropriate sources of cash in-flow? What is the optimum relationship between equity and debt financing? Special note on Proxy Statements…. THEY ARE VERY IMPORTANT!!! They include: 1. Invitation to the annual meeting 2. Legal rights and administrative details available to the shareholders 3. Biographies of all directors (most with pictures) 4. Board committees & board compensation 5. Executive compensation 6. Shareholder proposals 7. Information on salaries and bonuses 8. Information on stock options and other significant declarations by the TMT End, Research: Financial Domain & Case Studies – Part 1 Re-read Chapters 8