Premium Tax Credit Counseling - California Coverage & Health

advertisement

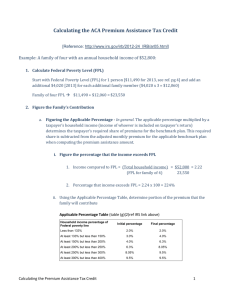

Tara Straw March 4, 2013 What to think about in 2013: ◦ ◦ ◦ ◦ Accurate and complete information Filing requirement Filing status Confronting expectations and preferences What to think about in 2014: ◦ Staying up-to-date on changes in income and family What to think about in 2015: ◦ Dependents ◦ Reconciliation or penalty Premium credits help pay for health plans People can receive the credits in advance but might need to pay back excess at year end Some plans (‘silver’ level plans) have lower costsharing for people with incomes up to 250% of poverty Must have income between 100-400% FPL Cannot have minimum essential coverage ◦ Does job-based plan cost more than 9.5% of household income for single coverage? ◦ Does it meet minimum value? Cannot be eligible for public coverage Must have a valid SSN Must plan to file taxes ◦ People with previous unpaid taxes may be deterred Must file jointly if married ◦ Rules to come re abuse/abandonment Advance credits are based on projected annual income ◦ Reconciliation Is it … The most accurate amount of tax credit today? The most accurate amount of tax credit based on estimates for the entire year? The highest amount of credit? The credit with the lowest risk of repayment? And will client, assistor/navigator, and tax preparer all agree? The starting point on premium credit eligibility are the tax returns being filed right now (2012 income) What has changed between now and open enrollment? And what will change again by December 2014? Initial application burden ◦ Special case: People without a valid social security number Should I take less assistance in advance? What plan should I select, considering benefits, premiums, and cost sharing assistance? What if only some members of my family need coverage? What if electronic data not available or doesn’t match? - Medicaid, CHIP, Basic Health, Premium Tax Credit disputes Anticipate incomplete information on: ◦ Employer offer of coverage & cost of coverage Inconsistencies? ◦ Income Cash income Wages from multiple part-time/part-year jobs ◦ Knowledge of who in the family currently has coverage and how ◦ Presence/absence of wellness incentives How accessible will information be? Filing Requirements: ◦ Single - $9,750 (~87% FPL) ◦ Married Filing Jointly (with no kids) - $19,500 (~129% FPL) ◦ Head of Household (with two kids) - $12,500 (~65% FPL) Generally, people below filing requirement will be Medicaid eligible (in expansion states) Who might fail to file? ◦ IRS (or other) collectible debt ◦ Good news: advanceable premium tax credit won’t be used to offset debt Joint filing requirement No credit if married filing separately ◦ ◦ ◦ ◦ Similar to EITC and other credits Prospective/retrospective problem Marriage/divorce counselor How does someone change the presumption? Exceptions for … ◦ Survivors of domestic violence? (And others?) ◦ When? ◦ How? Reluctance ◦ Perceived value of coverage Skepticism ◦ What’s the catch? Gaming ◦ Due diligence Advanced credit, lump sum or something else? ◦ Lump sum won’t be a viable option for most ◦ Fixed penalty vs risk of repayment Learning from the EITC Barriers toward use of advanceable credits ◦ ◦ ◦ ◦ Lack of awareness Uncertainty Desire for a large refund Perceived inability to save Premium tax credits can be different because: ◦ Infrastructure for accessing them ◦ Penalties for failure to obtain coverage ◦ Inability to collect large refund without incurring large costs Who, what, when of reporting income & family changes, including filing status ◦ Avoid large obligations at the end of the tax year ◦ Affects cost-sharing meanwhile ◦ Duty to counsel on this but it may be a deterrent Changes in the offer of affordable job-based insurance Due diligence with the “silent” exchange ◦ Can I trust the Exchange and my insurance company to make timely and accurate changes based on my information? Loss of coverage Gain dependent Change in immigration status Gain eligibility for tax credit Move QHP violates contract with respect to enrollee Error (sometimes) Exchange-provided exception Filing Status ◦ If Married Filing Separately – exceptions? Potential effects on dependency exemptions ◦ Dependents who are not your school-aged children ◦ “Qualifying relative” Older kids, other relatives, members of your household who are not related to you To claim exemption, must provide more than ½ of person’s support, including health care. Support by the government is not support the taxpayer is providing Reconciliation Income Maximum Repayment (Single/Family) <200% FPL $300/$600 200%-300% FPL $750/$1,500 300%-400% FPL $1,250/$2,500 >400% FPL No Cap Re-enrollment: Was it worth it? Penalty the greater of a flat dollar amount or a percentage of taxable income. ◦ 2014: $95/adult or 1% of taxable income Exemptions if: ◦ ◦ ◦ ◦ ◦ ◦ ◦ No “affordable” coverage (in 2014, costs >8%) Income below the tax filing requirement Uninsured < 3 months Undocumented immigrants Hardship Incarcerated Membership in certain religious sects Motivation or anger? Volunteer Income Tax Assistance (VITA) ◦ Free tax assistance for people with income below $51,000 Tax Counseling for the Elderly (TCE) ◦ Free tax assistance for people age 60 and older Visit irs.gov for a list of programs in your community Develop local partnerships ◦ Work with tax partners and others ◦ Comprehensive public education ◦ Comprehensive training of enrollment staff and volunteers Prepare for the unexpected Expect the unprepared ◦ This is a multi-year effort!