Power Point

advertisement

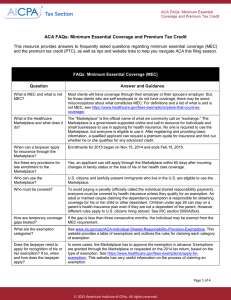

Affordable Care Act Premium Tax Credit 1 Definitions • Affordable Care Act o A combination of laws passed to expand health care coverage options while lowering the cost of health care and requiring many Americans to obtain health insurance. • The Marketplace o Online or over the phone 1. health coverage options 2. compare health insurance plans based 3. choose a plan; and purchase coverage. 2 Step 1 • Intake and Interview Form • Did the Taxpayer, Spouse, and all dependents have Minimum Essential Coverage (MEC)? • The Taxpayer answers: o Yes: Check yes on line 61 of the 1040, move to step 6 o No: Move on to step 2 In TaxWise 3 Wait, What is MEC? 4 MEC Does Not Include 5 Step 2 • Is this tax payer exempt from coverage gap fees? 6 More Exemptions 7 TaxWise Form 8965 • Part 1 = Exemptions obtained through the marketplace • Part 2= Everyone will answer 8 TaxWise Form 8965 Cont. • Part 3 = All other exemptions. 9 Step 3 Shared Responsibility Payment • The greater of: o 1% of household income above the filing threshold, or o Flat dollar amount • $95 per adult, $47.5 per child • Max of $285 for a family o But capped at the cost of the national average premium for a bronze level health plan available through the marketplace. 10 Filing Thresholds Filing Status Age Must file if gross income exceeds Single Under 65 $10,150 65+ $11,700 Under 65 $13,050 65+ $14,600 Under 65 (both spouses) $20,300 65+ (one spouse) $21,500 65+ (both spouses) $22,700 Married Filing Separately Any age $3,950 Qualifying Widow(er) Under 65 $16,350 65+ $17,550 Head of Household Married Filing Jointly 11 Shared Responsibility Payment • The greater of: o 1% of household income above the filing threshold, or o Flat dollar amount • $95 per adult, $47.5 per child • Max of $28 o But capped at the cost of the national average premium for a bronze level health plan available through the marketplace. • Example: o Joy is single with no dependents. Joy’s household income is $30,450. Her filing threshold is $10,150. 1. $30,450-10,150 = $20,300 2. $20,300 * 1% = $203 12 2014 National Average Bronze Plan Premium Number of months without MEC or exemption Family Size 1 2 3 4 5+ 1 204 408 612 816 1,020 2 408 816 1,224 1,836 2,448 3 612 1,224 1,836 2,448 3,060 4 816 1,632 2,448 3,264 4,080 5 1,020 2,040 3,060 4,080 5,100 6 1,224 2,448 3,672 4,896 6,120 7 1,428 2,856 4,284 5,712 7,140 8 1,632 3,264 4,896 6,528 8,160 9 1,836 3,672 5,508 7,344 9,180 10 2,040 4,080 6,120 8,160 10,200 11 2,244 4,488 6,732 8,976 11,220 12 2,448 4,896 7,344 9,792 12,240 13 Shared Responsibility Payment • The greater of: o 1% of household income above the filing threshold, or o Flat dollar amount • $95 per adult, $47.5 per child • Max of $28 o But capped at the cost of the national average premium for a bronze level health plan available through the marketplace. • Example: o Joy is single with no dependents. o Her flat dollar fee is $95, her 1% of household income fee is $203. o Her annual national average premium for bronze level coverage for 2014 is $2,448 14 Step 4 Back to Taxpayers with Coverage • Did the taxpayer purchase MEC through the marketplace? o Yes – figure the premium tax credit o No – you are done • Premium Tax Credit (PTC) o Helps pay for coverage purchased through the marketplace in the form of a refundable tax credit. o Must file a joint return if married o Must be between 100%-400% of the federal poverty level o Taxpayer claiming PTC cannot be a dependent • Advanced Premium Tax Credit (APTC) o When health insurance was purchased, a projection of 2014 family size and income was made and the APTC was paid in advance to the health insurance company. o This helps lower the taxpayers monthly payment 15 Federal Poverty Lines • Use the taxpayers Modified adjusted gross income (MAGI) to determine eligibility 16 MAGI • Modified adjusted gross income is adjusted gross income (AGI) excluded foreign income nontaxable social security tax-exempt interest MAGI + + + + 17 Form 8962 in TaxWise 18 APTC • If there is no advancement of the PTC or only part of the PTC is claimed in advance, the remainder can be claimed as a refund on the tax return. • If excess PTC is claimed in advance, it must be paid back. APTC Repayment Limits Income (as % of Fed Poverty Line) Single filing status All other filings statuses Less than 200% $300 $600 200% to 299% $750 $1,500 300% to 399% $1,250 $2,500 400% and above No limit No limit 19 Form 8962 Cont. 20 Outline of Steps 1. Do you have full year MEC? 1. 2. Yes – Move to step 4 No – Move to step 2 2. Are you exempt from purchasing coverage? 1. 2. Yes – complete form 8965 No – Move to step 3 3. Figure the Shared Responsibility Payment 1. That is the last step for taxpayers without coverage 4. Did the taxpayer purchase MEC through the Marketplace? 1. 2. Yes – Move to step 5 No – Done 5. Figure the Premium Tax Credit – Form 8962 1. That is the last step for taxpayers with MEC 21 For more training • http://eitcoutreach.org/aca/webinar 22