CPPP Slides for Texas CHIP Coalition 8/23/2013

advertisement

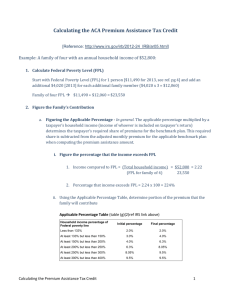

CPPP Slides for Texas CHIP Coalition Click to edit Master title style 8/23/2013: Deeper Dive into New Marketplace Anne Dunkelberg, Associate Director – dunkelberg@cppp.org Click to edit Master subtitle style CPPP.org 2 2014: ACA Provides Public Support Fitted to Income >$89,400 for a family of four; >400% of FPL Family Income $67,100-$89,400; 300-400% of FPL $44,700-$67,100; 200-300% of FPL Job-based coverage, or Full-cost coverage in the exchange Job-based coverage, or Subsidized exchange coverage: premiums capped at 9.5% of income Job-based coverage, or Subsidized exchange coverage: premiums capped at 6.3 – 9.5% of income CHIP • Job-based coverage, or • Subsidized exchange coverage: premiums capped at 3% - 6.3% of income Medicaid ???Medicaid??? $29,700-$44,700; 133-200% of FPL <$29,700 for a family of four; < 133% FPL Children Family income based on 2011 federal poverty income levels for a family of four Adults (non-disabled adults, not eligible for Medicare) 3 Coverage Level Options in the Exchange All plans will cover essential benefits: hospital, ER, mental health, maternity, Rx, preventive care, chronic disease management and more. % enrollee cost share % covered by plan 90% Platinum Gold 80% 70% Silver 4 standard levels, (plus a 5th catastrophic plan for people under age 30 or if no other coverage is affordable) Bronze 0% 20% 60% 40% 60% 10% 20% 30% 40% 80% 100% Options vary by % of covered benefits paid by the plan on average vs % covered through out-of-pocket enrollee cost sharing 4 Center on Budget and Policy Priorities What Kind of Coverage Can People Buy? Plan Tier Actuarial Value Platinum 90% Gold 80% Silver 70% Benchmark Bronze 60% Lower premiums, higher enrollee cost-sharing Higher premiums, lower enrollee cost-sharing cbpp.org The Affordability Puzzle 1) Premium Credits 2) Help with Health Care Costs Preventive Services Out-of-Pocket Caps Cost-Sharing Subsidies Out-of-Pocket Caps: Key Points All new health insurance plans will have OOP caps beginning in 2014 Caps apply only to covered services % of FPL 100-200% 200-300% 300-400% 400%+ Annual Out- individual $2,017 $3,025 $4,033 $6,050 of-pocket family $4,033 $6,050 $8,067 $12,100 Maximum Premium Credits: Eligibility Primary Group: Individuals and families between 133* and 400 percent of poverty Two additional groups: 1) Legally present people below 133%* of poverty who are not Medicaid eligible 2) People who would have to spend more than 9.5% of income to participate in employer plan or whose employer plan has less coverage than the “bronze” exchange plan Premium Credits: Key Points Sliding scale relative to income (premiums capped at 2-9.5% of income) Must be used to purchase coverage in exchange Value of credit linked to second lowest-cost silver level plan (the “silver reference plan”) People can choose any level of plan (e.g. bronze, silver, etc), but MUST select a silver plan to get cost-sharing subsidy Center on Budget and Policy Priorities How Is the Amount of the Tax Credit Determined? Credit amount = Cost of benchmark plan – Expected premium contribution Credit amount affected by: • Individual or family’s expected contribution based on their income • Premium cost for benchmark plan cbpp.org Center on Budget and Policy Priorities John: Age: 24 Plan Cost: $5,000 Example 1: 200% FPL Example 2: 300% FPL Income: $22,980 Income: $34,470 Expected Contribution: • Share of income: 6.3% • Amount: $1,448 Expected Contribution: • Share of income: 9.5% • Amount: $3,275 Premium Credit: $3,552 Premium Credit: $1,725 6000 Expected Contribution Federal Premium Credit 5000 $1,725 4000 3000 $3,552 2000 $3,275 1000 $1,448 0 200% FPL 300% FPL cbpp.org Center on Budget and Policy Priorities Example: Single Individual John: • 24 years old • Income of 22,980 (200% FPL) • Expected contribution: 6.3% or $1,448 3 Lowest Cost Silver Plans Covering John: • Plan A: $4,800 • Plan B: $5,000 • Plan C: $5,200 Benchmark Premium Credit: $5,000 - $1,448 = $3,552 cbpp.org Cost-Sharing Subsidies: Key Points Families under 250% FPL receive extra help with cost-sharing – lower deductibles and copays Actuarial values increased to: - 94% for families 100-150% FPL 87% for families 150-200% FPL 73% for families 200-250% FPL Must select a silver-level plan to qualify Center on Budget and Policy Priorities John: Example 1: Silver Plan Example 2: Bronze Plan Age: 24 Total Premium: $5,000 Total Premium: $3,000 John’s Premium Contribution: $121/month John’s Premium Contribution: $0 / month Plan AV with CSR: 87% Plan AV without CSR: 60% Sample Silver-CSR Plan (enrollee pays) Sample Bronze Plan (enrollee pays) Deductible $250 $3,000 Maximum OOP limit $2,000 $6,350 Inpatient hospital $250 / admission 50% of the charge $15 $35 Premium Credit: $3,552 Income: $22,980 Office visit cbpp.org Center on Budget and Policy Priorities What Happens When Estimated Income for the Year is Different from Actual Income? • Final amount of credit based on actual income • At tax filing time, advance payments received are reconciled with actual credit amount – If income increases, may have to repay – If income decreases, may get more credit at tax time • To avoid repayment, can reduce the amount of advance payment received during the year cbpp.org Center on Budget and Policy Priorities Cap on Amount of Advance Credits that Must Be Paid Back Income as Annual income percentage of for an individual poverty line (2013 $) Under 200% At least 200% but less than 300% At least 300% but less than 400% 400% and above Single taxpayers Annual income Married for a family of taxpayers filing four jointly (2013 $) Under $22,980 $300 Under $47,100 $600 $22,980 $34,470 $750 $47,100 $70,650 $1,500 $34,470 $45,960 $1,250 $70,650 $94,200 $2,500 $45,960 and higher Full reconciliation $94,200 and higher Full reconciliation cbpp.org Center on Budget and Policy Priorities What if an Individual’s Tax Liability is Less than the Credit Amount? • Credit is refundable, so people with little or no tax liability can still get the credit John: • Income of 22,980 (200% FPL) • Eligible for credit of $3,552 • Tax liability of $1,500 Credit ($3,552) will offset tax liability ($1,500), and John will still get remaining credit ($2,052) cbpp.org FAMILY BUDGETS Use of This Presentation The Center for Public Policy Priorities encourages you to reproduce and distribute these slides, which were developed for use in making public presentations. If you reproduce these slides, please give appropriate credit to CPPP. The data presented here may become outdated. For the most recent information or to sign up for our email updates, visit our website. © CPPP Center for Public Policy Priorities 7020 Easy Wind Drive, Suite 200 Austin, TX 78752 P 512.320.0222 F 512.320.0227 Methodist Healthcare Ministries 4507 Medical Drive San Antonio, TX 78229 Toll-Free: 800.959.6673 P 210.692.0234 F 210.614.7563 www.MHM.org CPPP.org 18