History of Money - Athlone Credit Union Limited

advertisement

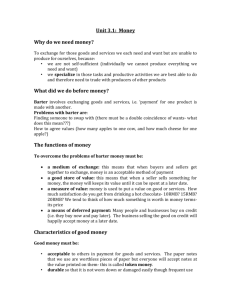

Unit 3 Understanding Money Unit 3 Learning Outcomes At the end of this unit, students should be able to: Understand the history of money Describe the form that money takes in today’s society Understand saving Understand compound interest and how it works Unit 3 Barter Barter preceded the use of money System for exchanging goods Number of issues Inefficient Items many not have similar value Coincidence of wants – if nobody wants what you have to barter = no deal History of Money 1000 BC – China began to manufacture copper cowrie shells 600 BC - First minted coins – Lydia (not western Turkey). Made from electrum (mixture of silver and gold) 118 BC – Leather money used in China – believed to be early form of banknote History of Money 30 BC – Cesar Augustus reformed the Roman monetary system. Issued gold, silver, brass and copper coins 800 AD – China started using paper money Easier to carry and could not use metals for making essential objects Called 'fei qian‘ - 'flying money' 1200 AD – The Florin, minted in Florence, Italy became a widely accepted currency in Europe History of Money 17th Century – Paper money was first used when Sweden began printing own paper monetary certificates Move to paper helped to increase and facilitate international trade Ireland – Notes and Coins Ireland introduced first notes and coins in 1928 Original notes featured Lady Lavery Coins featured Irish animals and fish ‘Pegged’ to sterling until 1979 when one-to-one exchange rate was finally broken History of Money January 1999 – Eurozone came into existence 11 Member states signed up UK opted to retain sterling currency Exchange rate IR£1 = €1.27 Euro Notes and Coins officially introduced on 1st January 2002 How do we use Money? Irish people – heavy users of cash and cheques Average 36 withdrawals from ATMs each year – 50% higher than EU average Cheque usage declining but still very high 2013- National Payments Plan aims to increase usage of electronic payments Estimated that Irish economy could save €1bn if switch from paper to electronic New Developments Bitcoin introduced in 2009 Virtual Currency No central authority – controversial Peer-to-peer payments Future? The Euro Legal tender in 18 countries (2014) Notes – 7 denominations Coins – 8 denominations. Coins have common side and national side What is Money? “Money is anything that is generally accepted as payment for goods and services and repayment of debts…” What forms are available? Can you think of a few examples… What are Savings? “Savings are the process of setting aside money until a future date instead of spending it today. The goal of saving is provide funds for emergencies, short term goals and investments” OR “A fund of money put as a reserve for the future” Uses of Money Students understand 4 main uses on money from communion to birthday presents: 1. 2. 3. 4. Saving (10%) Giving (10%) Investing (10%) Spending (70%) Example: allowance €/£ 10 per week but put €/£1 in savings for Christmas, holidays, birthdays, college, debs etc. How do savings work? 1. 2. 3. 4. 5. A customer deposits savings in a bank / credit union. Added to the pool of savings held The bank / credit union uses these funds to fund loans to other customers. The bank / credit union gets income from the interest that customers pay on their loan. This income is used to run the bank / credit union and it is also given back to customers in the form of interest on their savings. How do savings work? A depositor / investor will look at the options on how interest is calculated and credited? He / she will assess the A.E.R. ( Annualised Equivalent Rate of Return) Compound Interest This is the interest added to the principal so you get interest on interest. The COMPOUND ANNUAL RATE ( c.a.r.) is the rate you get when calculating your interest. Example: how much will you receive if you invest €/£500 @ 4% per annum for two years?