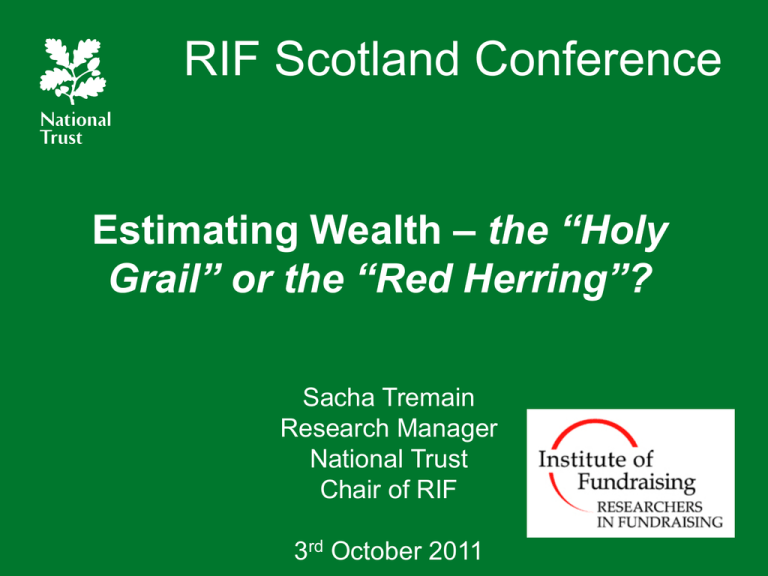

Estimating wealth - Institute of Fundraising

advertisement

RIF Scotland Conference Estimating Wealth – the “Holy Grail” or the “Red Herring”? Sacha Tremain Research Manager National Trust Chair of RIF 3rd October 2011 A bit about me • Chair of Researchers in Fundraising group • Research Manager for the National Trust since 2006 • Manage the Raiser’s Edge database single-handedly • Research individuals with £5k+ giving potential • Monthly Prospect Review and Management meetings • Part of a large team – 25 strong • There’s just me and my assistant • Major Gifts and CT team raises £5m every year • Support at least 3 multi-year £1m+ priority campaigns. • 3 Annual Giving programmes: £250-£5k+ • 2 Lifetime programmes: £10k and £100k • We run a series of events every year at our properties What I’m going to talk about… • Why we need to estimate wealth, or do we? • What to look for and where to find it • How to do it – some common formulas • Is estimating giving capacity more important? • How to estimate giving capacity • What else you have to think about • How to know if you’re getting it right • Questions What’s the fuss about? Why do we need to estimate a prospect’s wealth? • To know what size of gift to ask for • To prioritise and segment your prospect pool • To identify who your most ‘valuable’ prospects are • To help assign a rating and cultivation strategy – A £1k prospect clearly needs a different approach to a £1m prospect According to the latest World Wealth Report, there are 10.9million HNWIs worldwide 103,000 UltraHNWIs 103,000 worldwide That’s a lot of wealthy people in the world waiting to be found by researchers like us!!!! What to look for… What else? Anything else??? Wealth indicators – – – – – – – – – – – – – – – – Property value Income and remuneration – bonuses Title or type of job they do Assets & Investments – owns an island/Art collection Shareholdings and investments, e.g. venture capital trusts or invest in film production companies Company ownership – public or private Philanthropy – publicised donations What they do in their spare time - expensive hobbies Private education – school fees What car they drive Where they go on holiday Previous giving to your cause or other cause Where they shop or ‘hang out’ Who they ‘hang out’ with Where they live Where company is based – offshore – higher-rate taxpayer? …and where to find it Obvious starting point… Various Rich Lists – – – – – – – – The big “Purple Book” (Sunday Times) Sunday Times Forbes Regional, e.g. Business Insider/ Archant Life Industry, e.g. Estates Gazette Wealth Watch (Sunrise Publishers) Asian/Greek Rich List Lists of Rich Lists, incl. Helen Brown group Other places where the work’s already been done for you: • Wealth tags from screening cos – e.g. Prospecting for Gold/ Factary/ Wealth Engine Who’s Who – – – – – – – – – – – – – Who’s Who Debretts People of Today Burkes Peerage & Baronetage Who’s Who in Scotland Power Lists, e.g. Management Today, Elite 100, Business Insider Financial News Top 100 Media Guardian Top 100 Entrepreneurial Exchange Retail Week Power list GlobalScot Institute of Directors, Scotland – list of winners and nominees Who’s who in the City Citywire / CityAM Property… •Your home price • Our Property • Mouseprice • Zoopla Income/Shareholdings • Annual reports/Account – – – – – – Companies House / Company websites for published accounts Onesource, MINT, DASH, ICC, Boardex Average remuneration or highest paid director Dividend payments NED Director’s Fees (£25k/£50k medium-large cos) Stock Options • Digital Look – Director Dealings • Job adverts – similar positions advertised • Salary lists, e.g. Guardian Executive Pay • Salary Surveys, e.g. Michael Page and Robert Walters • The Lawyer Hot 200 • Author book sales • Newspaper articles • Any others? Company ownership • Similar sources as Income/Shares • Private vs Public – – – – – – – – – Liquidity ratios – assets/liabilities Share structures – ownership as a % Compare with similar sized/industry company Accounts type – small company exemptions If not Pre-tax profit, then use Shareholders funds as an indication of profit – 5x Net worth Tax payments Look for stability P:E ratio Markets and company structures confusing? Philanthropy • Donor boards • Donor rolls online or in annual accounts • Sunday Times Giving List • Factary Phi • Charity Commission • Trustfundraising • Company Giving • Hollis Sponsorship • OSCR or Northern Ireland Charity Commission • Jersey charities • Who’s Who in Charities • Guidestar • Newspaper articles • Who else are they giving to? How much? • Any others? Common Formulas Estimated net worth = – Total known direct stock holdings x (1-3) – Total real estate holdings x 5* Working out certain parts of net worth: – Company Value = average profit (over 3 years) x P/E ratio – Hedge Fund – 2/20, i.e. an average hedge fund manager charges a 2% management fee of the fund's net asset value each year and a performance fee of 20% of the fund's profits. – Estimating net worth of a public company, assuming the value of stock holdings represents 20-25% of an individual’s estimated worth – Sale of company: Total Sale price x % stake – 40% deduction for capital gains tax *Real estate, you may want to have bands according to value, i.e. change the multiplier down for lower value real estate If you only know 1/2 things… Source: World Wealth Report 2011 Let’s try it You know: – The value of a person’s property = £1.5m – Annual salary = £250k So… – Add these two figures together = £1.75m – This represents 48% (almost half of their wealth) according to the World Wealth Report (29% income and 19% real estate). – Double it and you get to estimated net wealth of £3.5m – NB: if we’d used - Total real estate holdings x 5 = £7.5m – Which feels right when looking at the whole picture – Doesn’t have to be an exact science!!!! – Wealth Band = £3.5m-£7.5m Calculating Gift Capacity – some more common formulas Source: http://www.thinkcs.org/2009/09/calculating-anindividuals-giving-capacity-deal-or-no-deal/ Even more formulas… – – – – 20 x level of consistent annual giving = giving ability over 5 yrs 10% of annual income = giving ability (over 5 years) 0.5% - 1.5% of liquid assets = giving ability 5% of total known assets (real estate + stock holdings + annual income for 5 years) = giving ability (5 years) – 5%-10% of annual income + bonus over 3-5 years (2-3% in a single gift), i.e. Annual salary + bonus x 0.05 (or 0.10) = gift potential – 2%-5% of net worth – 10% of stock options of $1m+ – 0.5%-5% of net worth of company – HNWI in Europe (assets of $1m) give 4.6% of their wealth to charitable donations (only 6-7% of HNWIs and 10% of UltraHNWIs in Europe give philanthropically) NB: Major gifts usually come from assets, not income My favourites Ones I use most often: – 0.5%-5% of net worth = 5 yr gift capacity – 10% of income / 3 (average no of charities a person supports = 3 yr gift capacity – Total giving to NT / No of years x 10 = 5 yr gift capacity – NB: You can add an inclination rating, i.e. 2 = low and 4 = high to indicate likelihood of giving at a higher level Example: – £3.5m-£7.5m net worth, no previous giving, so… – 0.5% = £17,500-£37,500 over 5 years – But = £3.5k-£7.5k a year, i.e. 0.1% of estimated net worth = single gift Tax Don’t forget tax-effective giving – higher-rate tax payer? How rich they really feel Net worth Definition £1m - £2m The comfortable poor £3m - £4m The comfortably off £5m - £15m The comfortably wealthy £16m - £39m The lesser rich £40m - £74m The comfortably rich £75m - £99m The rich £100m - £199m The seriously rich £200m - £399m The truly rich £400m - £999m The filthy rich Over £1bn The super rich Source: Felix Dennis “How to Get Rich” What else you need to consider… • Who’s asking them to make a gift and how? • Is it the right time for them to make a gift? • Trouble in paradise? – – – – – – – – – – – – – Divorce Children at school/university Trouble at work – job insecurity / fraud Legal proceedings Controversy Tax year / tax owed Death in the family Unwell Holiday Change of job / retiring / selling business Debts – loans / remortgages Gambling addiction? Reputation Top tips Look at the whole picture What does your profile tell you? If someone has met them, find out what they discovered at that meeting Capture the information on the database Use a couple of formulas to test it out What is your gut telling you? Keep it SIMPLE How to know if you’re getting it right Test the formulas on previous donors where you have estimated wealth information – What’s the % for your organisation? – Which wealth band is the most common? – How has the estimate been arrived at? - Property/ assets/ stockholdings… – Were there any fluctuations? What caused them? – Where are the gaps? We were missing donors with ENW of £200m+ – Good worked example of calculating net worth that is right for your organisation: Virgina University Any questions? Sacha Tremain Research Manager National Trust sacha.tremain@nationaltrust.org.uk 01793 817689 Member of RIFUK? E-mail: rifuk-subscribe@yahoogroups.com