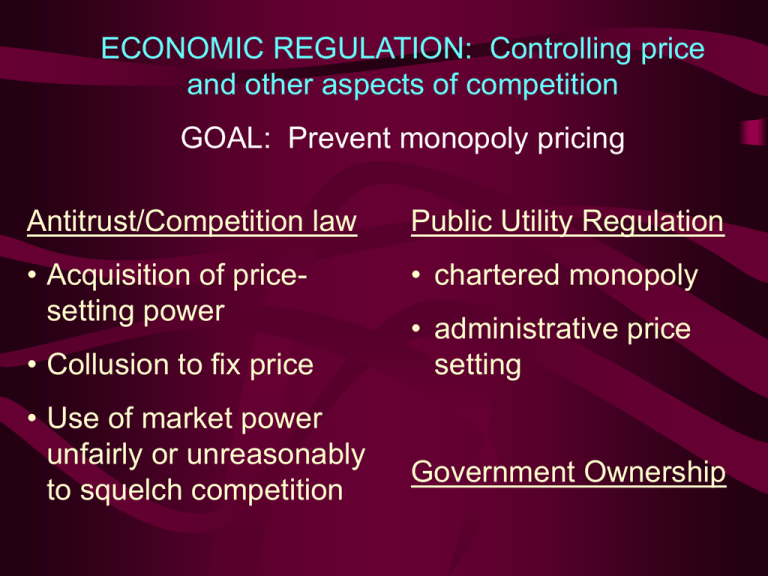

Economic Regulation

advertisement

ECONOMIC REGULATION: Controlling price and other aspects of competition GOAL: Prevent monopoly pricing Antitrust/Competition law Public Utility Regulation • Acquisition of pricesetting power • chartered monopoly • Collusion to fix price • Use of market power unfairly or unreasonably to squelch competition • administrative price setting Government Ownership Economic Regulation: Evolution of Legal Rules 1792 Tripp v. Frank (England) 1837 Charles River Bridge (U.S.) 1859 Edwin Drake struck oil in western Pennsylvania 1865 First natural gas utility opened in Fredonia, NY 1877 Munn v. Illinois 1882 Edison’s Pearl St. Station power plant opened 1887 Interstate Commerce Act 1880s1930s Rise of state utility commissions; passage of federal major antitrust legislation 1930s Federal Power Act; Rural Electrification Act; Public Utilities Holding Co. Act Monopolization • Under §2 of the Sherman Act, it is illegal to monopolize or attempt to monopolize. • To tell if a monopoly is illegal, ask: – What is the market? – Does the company control the market? • No matter what your market shares, you do not have a monopoly unless you can exclude competitors or control prices. Monopolization How did the Standard Oil acquire its dominant share in the oil market? • Originally, Standard Oil professionalized and improved the quality of the oil refining business • This increased the cost of entry • Rockefeller excelled at eliminating waste and minimizing costs while maintaining quality. Monopolization How did the Standard Oil maintain its dominant share in the oil market? • Negotiated “rebates” from railroads. Why rebates? Why not just reduced rates? • Consolidation plan • buyouts +/or • South Improvement Company What exactly was the SIC? How did it work? • Shipping/transportation control • Vertical integration (upstream; downstream) Artifacts of Standard Oil: U.S. antitrust laws prohibit – price fixing / collusion – geographic market divisions – maintenance of a monopoly through “bad acts” – certain forms of price discrimination – certain forms of resale price maintenance – mergers that will create firms with “monopoly power” Antitrust Law Illegal monopolization Illegal restraints of trade Sources of Confusion in Antitrust Law • Changing philosophies over time: – Movement away from presuming harm to consumer (per se violations) and toward requiring government/plaintiff to prove harm (increasing application of rule of reason) – Movement towards greater focus on effect on consumer in the long run – Because these philosophical changes are new, different judges seem to apply different approaches, depending upon whether they subscribe to the old or the new philosophy – DOJ/FTC enforcement policies vary according to the preferences of the presidential administration Economic Regulation: Evolution of Legal Rules 1792 Tripp v. Frank (England) 1837 Charles River Bridge (U.S.) 1859 Edwin Drake struck oil in western Pennsylvania 1865 First natural gas utility opened in Fredonia, NY 1877 Munn v. Illinois 1882 Edison’s Pearl St. Station power plant opened 1887 Interstate Commerce Act 1880s1930s Rise of state utility commissions; passage of federal major antitrust legislation 1930s Federal Power Act; Rural Electrification Act; Public Utilities Holding Co. Act Inefficiency of Monopoly Price PM MC PC MR QM D QC Quantity Commission Regulation COMMISSION FORM: • Plural executive; appointed (feds) or elected (some states) • Rate cases; few rulemakings • “Staff” represents ratepayers CONGRESS Staff COMMISSION Intervenors Regulated Firms PRESIDENT Commission Regulation COMMISSION FORM: • Plural executive; appointed (feds) or elected (some states) • Rate cases; few rulemakings • “Staff” represents ratepayers REGULATORY PRINCIPLES: 1. “Natural” monopoly; certificate of convenience and necessity; duty to serve Commission Regulation COMMISSION FORM: • Plural executive; appointed (feds) or elected (some states) • Rate cases; few rulemakings • “Staff” represents ratepayers REGULATORY PRINCIPLES: 1. “Natural” monopoly; certificate of convenience and necessity; duty to serve 2. Cost-based rate setting; “fair” rate of return for shareholders on “prudent” investments How might this “fair” return be established? PUBLIC POWER MOVEMENT 1. Federal Power Agencies (TVA, BPA) 2. REA 3. Municipal power 4. Federal and municipal preferences 5. California in 2002? Characteristics of modern, regulated public utility: • Monopoly license within service area • Duty to serve all • Regulated rates • Under traditional rate regulation, how are rates set? R = Br + O • What is a rate case? Procedurally, how does a rate case unfold? Who initiates it, and who else is involved? R = Br + O What is “rate base”? • Is all utility capital equipment included? • Once the eligible assets are identified, how is a value assigned to that rate base? • Suppose the state PSC miscalculates the value of a generating plant, overvaluing it by 30%? R = Br + O • What is the rate of return? • What sort of rate of return is the utility entitled to? What policy objectives underlie the requirement of a “fair” return on investment? • How is this standard applied? How is the rate set? R = Br + O • How closely do regulators scrutinize expense claims made by utilities? • What if the expenses were incurred imprudently? • How are expenses calculated? I. TEXAS LIGHT AND POWER: Item Original cost($000) Year Transmission facilities $1000 1995 Coal-fired plant $10K Rarely used solar plant $1000 1995 Cancelled nuclear plant $1000K 1995 Construction on new hydro plant $1000/yr. Railroad spur for coal delivery $100 Assets of env consulting subsidiary $1000 Research into fusion power $1000 PURPA era hydro purchase contracts $100/yr. Executive salaries $1000/yr. Attorney’s fees $1000/yr. Contribution to Ch. of Scientology $100/yr. Contribution to local food bank $100/yr. 1 1965 Since 1995 1995