Fundamentals and contagion in the euro area sovereign bond markets

advertisement

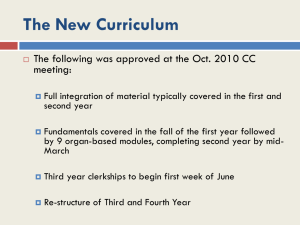

Fundamentals and contagion mechanisms in the euro area sovereign bonds markets Econometric Clinic TT3 meeting 2012/06/14 G. Amisano and O. Tristani DG-Research European Central Bank PRELIMINARY 1 Motivation: euro area spreads GR spread FR spread 20 0.8 15 0.6 10 0.4 5 0.2 0 2000 2002 2004 2006 2008 2010 2012 2000 2002 2004 IR spread 2006 2008 2010 2012 2008 2010 2012 2008 2010 2012 IT spread 8 3 6 2 4 1 2 0 2000 2002 2004 2006 2008 2010 2012 2000 2002 2004 PT spread 2006 SP spread 3 8 6 2 4 1 2 0 2000 2002 2004 2006 2008 2010 2012 0 2000 2002 2004 2006 2 Motivation • Facts: – very large swings hardly compatible with linear models – relatively small parallel changes in fiscal fundamentals – Strong comovements across countries • Obvious questions: – What determines these movements? – To what extent are they justified by the evolution of fiscal fundamentals in each country? – Can we disentangle the role of common factors and contagion effects? 3 Our approach • Starting point: debt crises can be self-fulfilling. They are more likely at relatively high levels of debt [and shorter maturity structure] (Cole and Kehoe, 2000) • Our approach: – define the “crisis” as a regime (different from “normal”) – explicitly allow for probability of crisis regime to depend on fiscal fundamentals ... – … but also allow for exogenous changes in investors’ risk aversion (a common factor) – … and cross-country contagion (the occurrence of the crisis regime in another country) 4 Our approach • Advantages: – Good empirical fit – Allows for nonlinear effects: difference between fluctuations within a regime and transitions between normal and crisis regimes – Ability to identify a certain form of cross-country contagion • Drawbacks: – Reduced form model – Lacks strong theoretical restrictions – No policy implications 5 The model (I) • Spreads of EA countries bonds at different maturities with respect to German bonds returns: yit • Each of the country spreads is modelled as VAR: Panel VAR framework • Each country VAR has level and volatility affected by a discrete regime variable: Markov Switching panel VAR • Common parameters (pooled) and country specific parameters • Transition probabilities not constant in time • Amisano and Fagan (2012), Amisano, Bragoli, Colavecchio and Fagan (2012). 6 The model (II) • Each country (i=1,2,..m) vector yit (n x 1) of spreads modelled as VAR with regime shifts: y it c sit A sit y it 1 Σ1i ,/s2 v it , i 1,2,...,m it • Note that all coefficients can be allowed to vary across regimes: – Intercept (level) – Autoregressive coefficients (persistence) – Covariance matrix (volatilities/correlations) 7 The model (III) • Transition probabilities across regimes depend on – – – – Country specific fundamentals Common observable factors Persistence of own regime Other countries regime dynamics (contagion) 8 The model (IV) • Transition probs as a probit function: p( sit 1 | s t 1 , z it 1 ) ( i1 i 2 sit 1 i 3 ( sit 1 ) β´z it 1 it ) ( ) 1 1 2 exp z dz 2 2 I s jt 0 (t ype1 contagion) sit 1 j i s jt (t ype2 contagion) j i it ~ NID(0,1) Cov(it , j ) 0, i j , t , 9 The model (V) 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 -2.5 contagion no contagion -2 -1.5 -1 -0.5 0 0.5 1 1.5 2 2.5 10 The model (V) • Some comments on transition probabilities – When b = 0 and i3 = 0, we have time homogeneous Markov Switching process with each country evolving independently – When i3 ≠ 0 we have contagion from other countries • Type 1 mechanism: operates when at least one other country is in crisis regime • Type 2 mechanism: more other countries in distress exert a stronger pull towards crisis. – Shocks it and variations in fundamentals (Dzit) have nonlinear effects 11 The model (VII) • • Parameters in the country specific VAR can be either pooled, country specific or partially pooled (random effects) Parameters in the transition probabilities (the gammas): – Slope parameters (b) pooled – Other parameters are country specific (i1, i2 , i3) or (partially) pooled 12 Potential drivers of transitions • • • • Global risk appetite. BAA-AAA spread Business cycle variables (IP): not relevant Fiscal fundamentals (govt net lending as % GDP) Monthly data from 2001:m1 to 2011:m10 for 6 countries: FR, GR, IT, IE, PT, SP 13 Potential drivers of transitions Attitude with respect to risk (BAA-AAA spread) 3 2.5 2 1.5 1 2000 2002 2004 2006 2008 2010 2012 14 Potential drivers of transitions Fiscal fundamentals FR z2 GR z2 -5 -2 -4 -10 -6 -8 2000 -15 2002 2004 2006 2008 2010 2012 2000 2002 2004 IR z2 2006 2008 2010 2012 2008 2010 2012 2008 2010 2012 IT z2 0 -1 -10 -2 -3 -20 -4 -30 -5 -40 2000 2002 2004 2006 2008 2010 2012 2000 2002 2004 PT z2 2006 SP z2 -4 0 -6 -5 -8 -10 -10 2000 2002 2004 2006 2008 2010 2012 2000 2002 2004 2006 15 Preliminary results: summary • • • • • Cross-country analysis: FR, GR, IE, IT, PT, SP 3 factors: net Gov. lending (in % of GDP); risk aversion; lagged cross-country “contagion” All countries have 2 regimes, RA and fiscal fundamentals very relevant Lagged other country regimes relevant 16 Preliminary results: summary prior type prior mean prior std posterior mean posterior std gamma(1,i) intercept Gaussian -1.5 1 -2.17 0.16 gamma(2,i) lag own state Gaussian 3 1 2.47 0.26 gamma(3,i) lag other countries Gaussian 0.5 1 1.28 0.22 beta(1) RA Gaussian 0 1 0.06 0.1 beta(2) Fiscal Gaussian 0 1 -0.33 0.15 17 What drives changes in regimes? The case for Italy: contagion (I) • Probs to move into crisis regime 0.3 NO CONTAGION 0.25 ACTUAL 0.2 0.15 0.1 0.05 0 2006 2007 2008 2009 2010 2011 18 What drives changes in regimes? The case for Italy: fundamentals (II) • Probs to move into crisis regime 0.3 0.25 0.2 0.15 0.1 SAMPLE MEAN 0.05 RISK_AVERSION FISCAL 0 2006 2007 2008 2009 2010 2011 19