Changes to the ACCA Qualification

advertisement

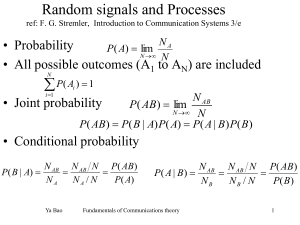

What are the changes to the ACCA Qualification? FUNDAMENTALS : Knowledge F1, F2, F3 FUNDAMENTALS PROFESSIONAL Knowledge Skills Essentials Options F1 F2 F3 F4 F5 F6 F7 F8 F9 P1 P2 P3 P4 P5 P6 P7 FUNDAMENTALS : Knowledge F1, F2, F3 New exam style Amended syllabuses F3 - one version MAIN SYLLABUS DIFFERENCES F1 Sections slightly reordered, contains more on accounting information and reports. Focuses more on fraud, accounting systems, money laundering and ethics, including conflict resolution. F2 More focus on planning, control and performance measurement, such as budgeting and standard costing. Amended to better underpin F5. F3 More emphasis on the regulatory framework, drafting accounts and on reporting business transactions and the accounts of unincorporated business. This syllabus also includes more on basic consolidations of accounts and interpretation. Better underpins F7 in syllabus and question type as 15 mark questions introduced in CBE and paper exams. FUNDAMENTALS : Knowledge F1, F2, F3 Paper F1, Accounting in Business Section A • 16 x one-mark short objective test questions and 30 x two-mark short objective test questions Section B • 6 x four-mark longer version objective test questions, one taken from each of the six sections of the syllabus FUNDAMENTALS : Knowledge F1, F2, F3 Paper F2, Management Accounting Section A • 35 x two-mark short objective test questions Section B • 3 x 10-mark longer version objective test questions – one taken from each of the budgeting, standard costing and performance measurement sections of the syllabus FUNDAMENTALS : Knowledge F1, F2, F3 Paper F3, Financial Accounting Section A • 35 x two-mark short objective test questions Section B • 2 x 15 mark longer version objective test questions with one question based on group accounts and the other on preparation of financial statements FUNDAMENTALS : Skills F4, F5, F6, F7, F8, F9 FUNDAMENTALS PROFESSIONAL Knowledge Skills Essentials Options F1 F2 F3 F4 F5 F6 F7 F8 F9 P1 P2 P3 P4 P5 P6 P7 FUNDAMENTALS : Skills F4, F5, F6, F7, F8, F9 F4 - no changes F5 - decisionmaking, environmental accounting F6 (UK) - IHT, overseas transactions for VAT FUNDAMENTALS : Skills F4, F5, F6, F7, F8, F9 F7 - legal / regulatory info, UK based on IFRS F8 - updated syllabus F9 - Islamic finance PROFESSIONAL : Essentials P1, P2, P3 FUNDAMENTALS PROFESSIONAL Knowledge Skills Essentials Options F1 F2 F3 F4 F5 F6 F7 F8 F9 P1 P2 P3 P4 P5 P6 P7 PROFESSIONAL : Essentials P1, P2, P3 P1 - business risk Governance, Risk Professional and Ethics Accountant PROFESSIONAL : Essentials P1, P2, P3 P2 - SMEs, consolidated accounts, entity reconstructions P3 –management accounting added PROFESSIONAL : Options P4, P5, P6, P7 FUNDAMENTALS PROFESSIONAL Knowledge Skills Essentials Options F1 F2 F3 F4 F5 F6 F7 F8 F9 P1 P2 P3 P4 P5 P6 P7 PROFESSIONAL : Options P4, P5, P6, P7 P4 - syllabus rearranged P5 - remove overlap with F5 and P3 P6 (UK) - June 2013 - basic IHT removed PROFESSIONAL : Options P4, P5, P6, P7 P7 - internal audit amended, practice management, assignments and reporting removed Changes to style of questions in Section A to integrate requirements and make more “real life”