Class10a - Sprott School of Business

advertisement

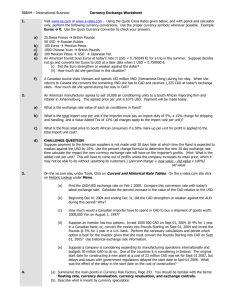

Chapter 21 International Financial Management Introduction The world has become smaller due to Advances in communication & transportation International flows of capital and technology Cooperation between different countries As a result, firms become MNCs Today’s agenda Multinational Corporation (MNC) Foreign Exchange Rates Managing Foreign Exchange Risk Financing International Business Operations Multinational Corporations MNCs are firms doing business in more than one country (home country) 4 basic forms of MNCs - Exporter - Licensing or Franchising - Joint Venture - Foreign Subsidiary Reasons for investment aboard Fear of import tariffs (e.g.Toyota) Lower production costs in foreign country Tax advantages Proximity to market International diversification (the overall risk of the MNC is reduced when foreign and domestic operations are not correlated) Following competitor International vs Domestic Environment In addition to normal business risks, the MNC is faced with foreign exchange risk and political risk Higher risk, higher return. So MNC is more profitable Int’l vs Domestic Environment cont’ International environment is more complex Different from the domestic market in: - Inflation rates - Tax rules - Structure and operation of financial institution - Financial policies and practices Foreign Exchange Rates Exchange rate is the price of one currency in terms of another Rates are determined by the supply and demand for each currency Factors affecting exchange rates: relative inflation/interest rates, balance of payments, government policies, confidence in future economic performance Making money through the FX rates Assume today’s exchange rate between USD/CAD is 1 to 1.5 and the bank saving rates in the States and Canada are 3% and 4% respectively US investors are attracted to the high saving rate in Canada They convert USD1000 into CAD 1500 and save it in Canadian bank Making money through the FX rates cont’ One year later, they get CAD 1500 (1+4%) = CAD 1560 Assume the exchange rate by that time is 1 to 1.48, the US investor will convert the CAD 1560 back to USD (1560/1.48) i.e. USD 1054 The rate of return is USD (10541000)/1000 = 5.4% (compare with domestic return of 3%) Reminder The US investor is lucky and makes a gain in the saving rate as well as the foreign exchange rate However, the movement of large sums of money between borders would cause the exchange rates and available saving rates to adjust (e.g. Canadian bank may lower the saving rate due to large amount of deposits) Foreign Exchange Rates cont’ Two types of exchange rates Spot rate – exchange rate between currencies for immediate delivery Forward rate – exchange rate that is established for future delivery Forward rate may be used to reduce the foreign exchange risk Using forward rate to reduce FX risk Using the previous example, once the US investor has converted USD1000 into CAD1500 and deposits it in Canadian bank, he/she may afraid that CAD will depreciate after a year (i.e. exchange rate a year later may be 1USD/1.55CAD, then the return to US investor is [(1560/1.55)-1000]/1000 = 0.65%; much lower than the domestic return of 3%) Using forward rate to reduce FX risk cont’ To remove the FX risk, the US investor may lock in a one-year forward exchange rate of say 1USD/1.51CAD (sell CAD in advance) By doing so, the investor is sure that the return will be [(1560/1.51)-1000]/1000 = 3.3%; a bit higher than the domestic return Normally the forward exchange rate will move in a direction to prevent arbitrage (making profit without taking risk) Who will buy at the forward rate? Example: A US importer issue a purchase order to buy 1 M CAD raw material from a Canadian supplier. The goods will be shipped to US a year later. Once the goods are shipped, the US importer has to pay 1 M CAD to the Canadian supplier. The spot rate is 1 USD to 1.50 CAD. The one-year forward rate is 1 USD to 1.51 CAD. Fearing that the CAD may appreciate against USD on the shipment date, the firm decides to buy CAD at the forward rate now Managing FX Risk Other than using forward exchange rate, US investor may reduce FX risk by Hedging in the currency futures market – buying or selling standardize forward contract Hedging in the currency options market – similar to currency futures but with an option not to exercise the future contract ( a premium is required in advance) Financing International Business Operations - - - Eurodollar loans – major source of shortterm loans for MNCs The borrowing costs are lower because Smaller overhead costs for lending banks given the huge size of transactions High credit of borrowers (MNCs) Absence of reserve or capital requirement by the local government Financing Int’l Bus. Operations cont’ Eurobond market – long-term bonds sold throughout the world but are denominated primarily in USD, DEM, SFC and YEN Advantages of Eurobonds: - Less stringent disclosure requirement - Lower registration fees - Some tax advantages exist Summary The birth of MNCs - their risks and benefits Exchange rate – spot and forward rates Managing FX risk – through forward/future/option contracts Additional sources of finance for MNCs – Eurodollar and Eurobond markets Summary of this course Through out this course, we have been learning how to raise capital for a company and how to invest the capital raised That is, make use of share/bondholders’ money to create more value for the firm Personal Application Start saving as early as possible Make use of other’s money to create more money for yourself (leverage) Meaningful Life It is more important to share with people what we have for we are in the same boat Life Journey Meaningful Life cont’ Unless life is lived for others, it is not worthwhile (Mother Theresa) We are borne not to fight against each other but to help each other (Johnny Tong)